Here you can explore the concept of Accounting Equation.

Assets

Any business performing business activities owns properties, which are used to perform these activities. These properties can be material, immaterial or monetary and they are called Assets.

Any business performing business activities owns properties, which are used to perform these activities. These properties can be material, immaterial or monetary and they are called Assets.

Equity

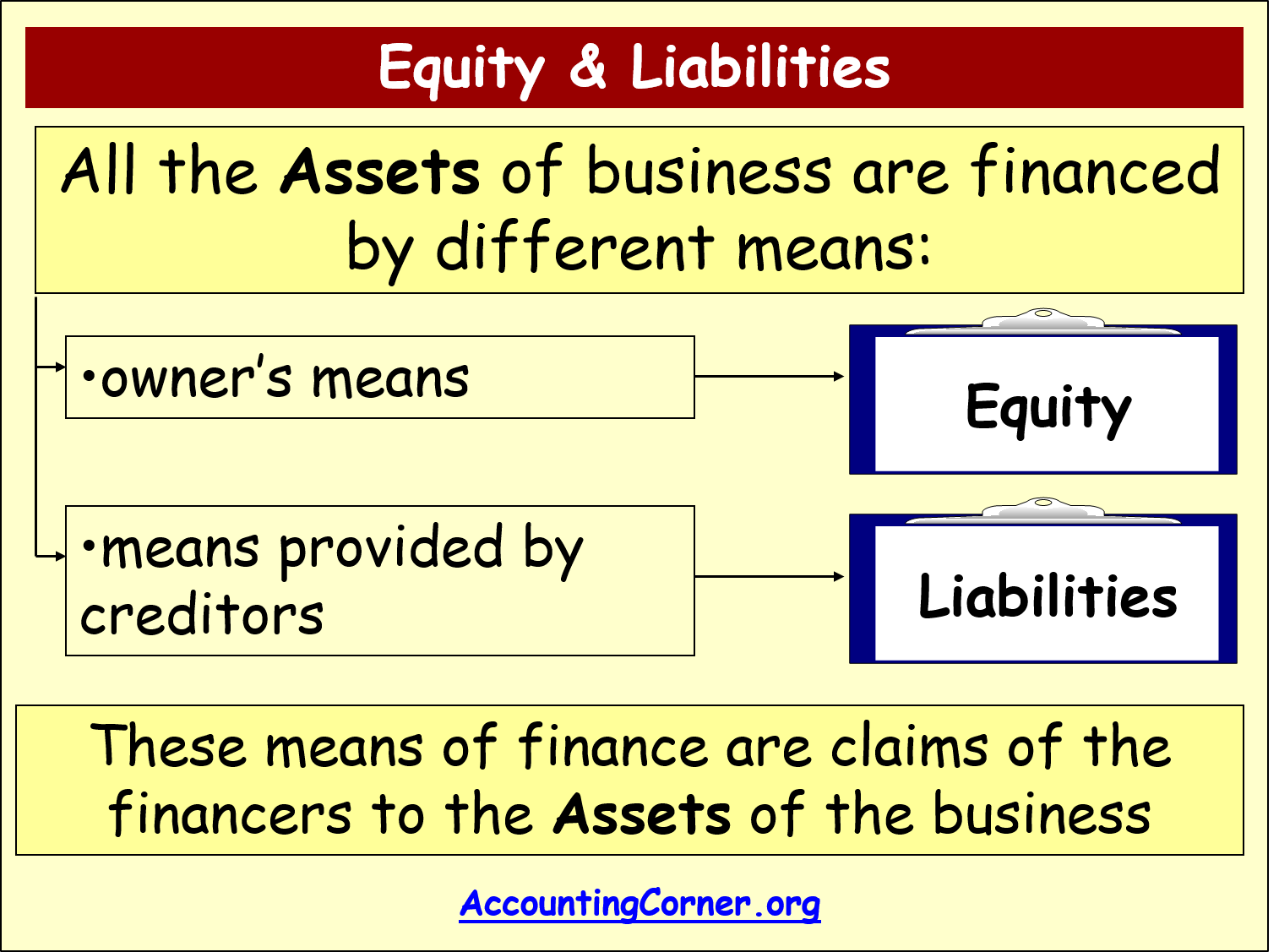

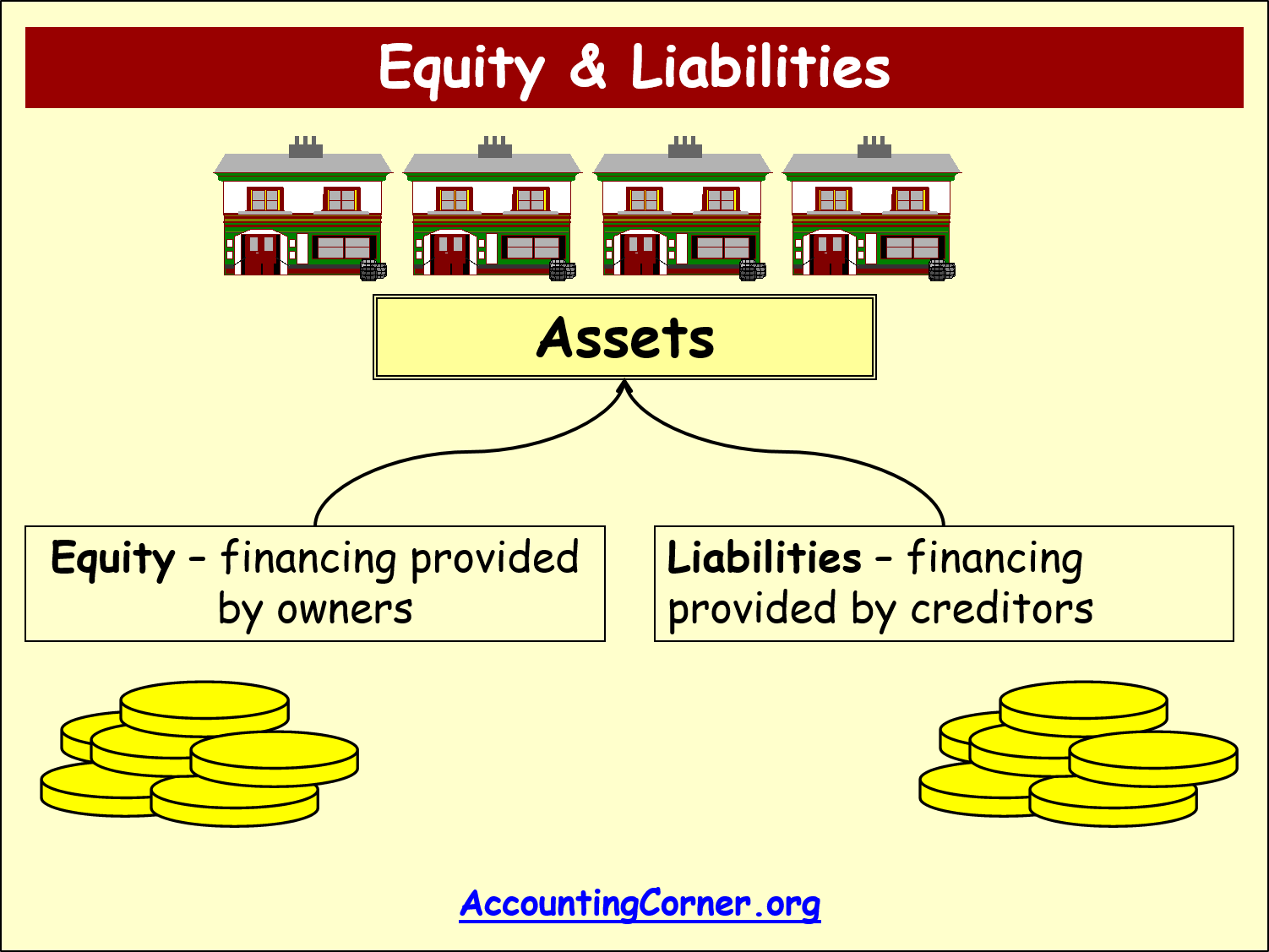

In order to acquire the assets business needs to get financing. Financing can be provided by the owners of the business. This financing represents Equity.

In order to acquire the assets business needs to get financing. Financing can be provided by the owners of the business. This financing represents Equity.

While comparing Liabilities and Equity, Equity it does not have maturity date. These are the financial means provided by the owners, investors, who invest money into the business for an indefinite period of time. They expect getting dividends, which is a remuneration for the provision on the financing means to the business.

Also investors expect that the value of the investments will grow over time and they will be able to sell those investments for the price higher that the initial investment amount.

Liabilities

Financing to the business can be provided by creditors. Such financing is called Liabilities.

Financing to the business can be provided by creditors. Such financing is called Liabilities.

Liabilities is the type of financing provided by creditors. It has maturity date, which means that creditors want their money back on the certain date. Also they want to get interest as a remuneration for the period, when the financing was provided to the business.

Both these categories represent rights for the owners and creditors respectively claiming back their money.

It does not necessarily mean that they have a right to get cash back, return of the assets can be executed in the form of other types of assets.

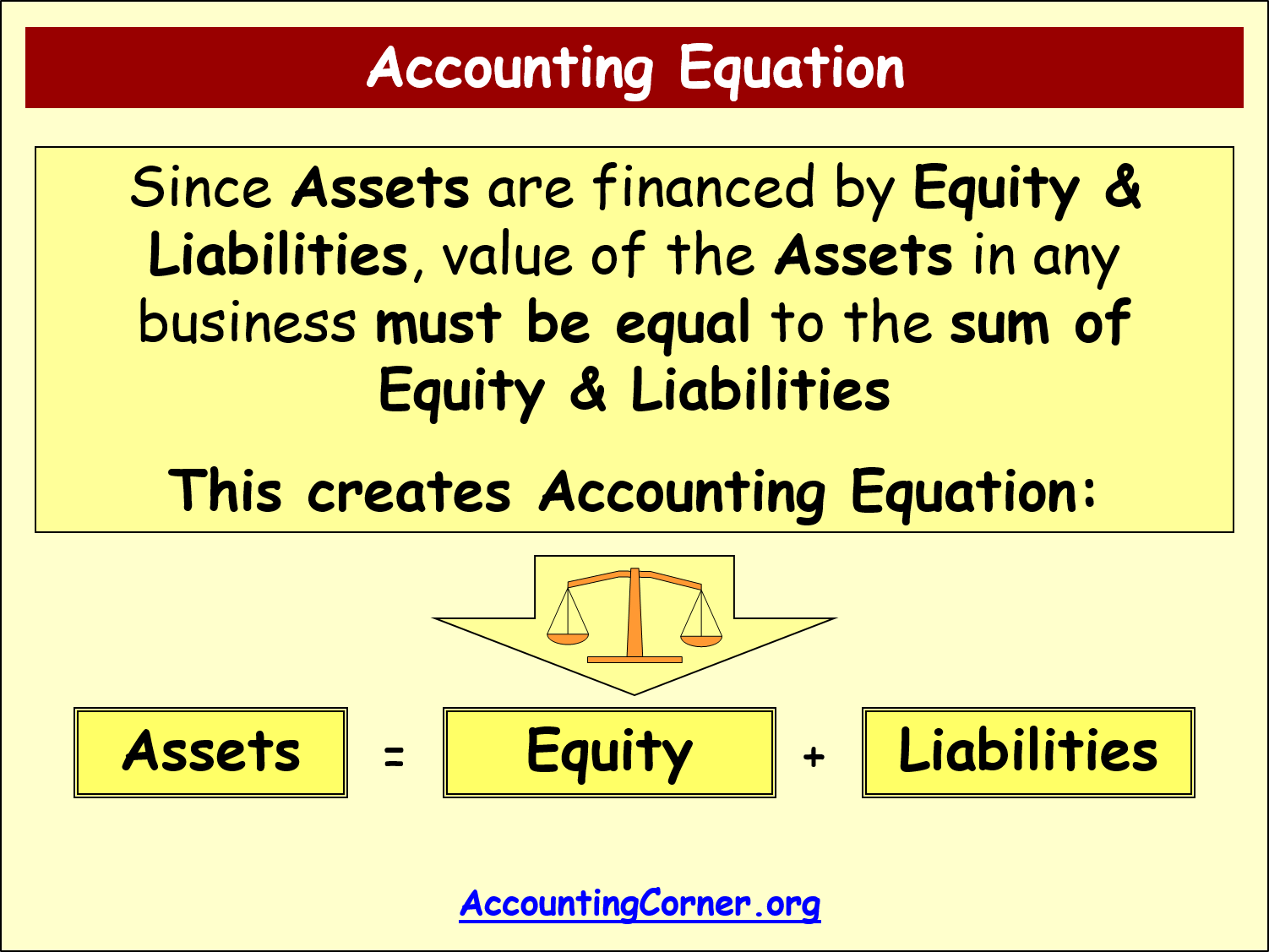

Since there are two categories of the financing, by which the assets are being financed, it leads to the conclusion, that:

total value of assets equals to total value of equity plus total value of liabilities.

total value of assets equals to total value of equity plus total value of liabilities.

This is an Accounting Equation:

Assets=Liabilities+Equity

On the left side there are Assets and on the right side there is a structure of financing means.

It shows Equity and Liabilities, which do indicate how the business finances its Assets.

Assets are financed either by money provided by the owners of the business, or by liabilities, i.e. money provided by creditors.

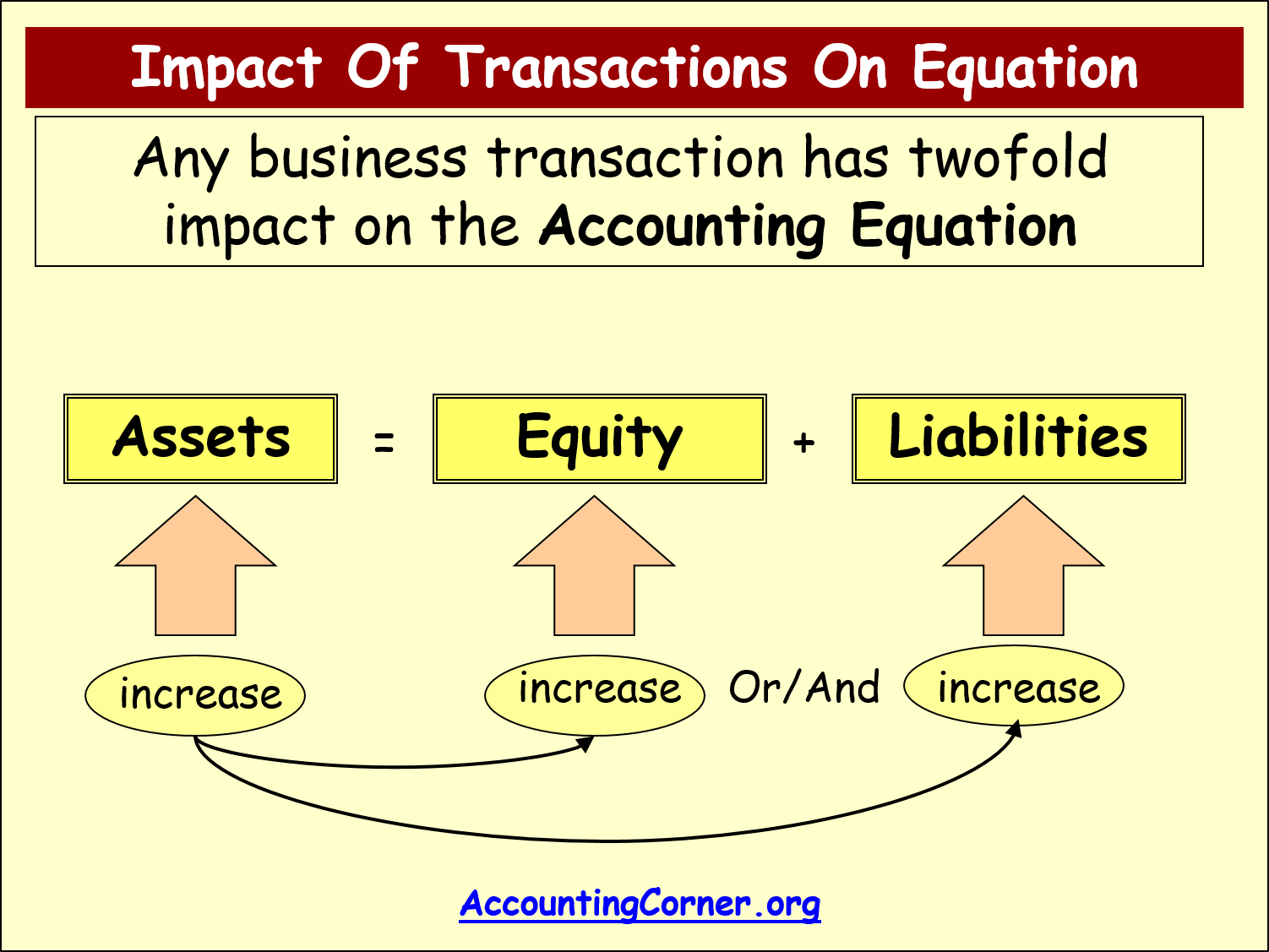

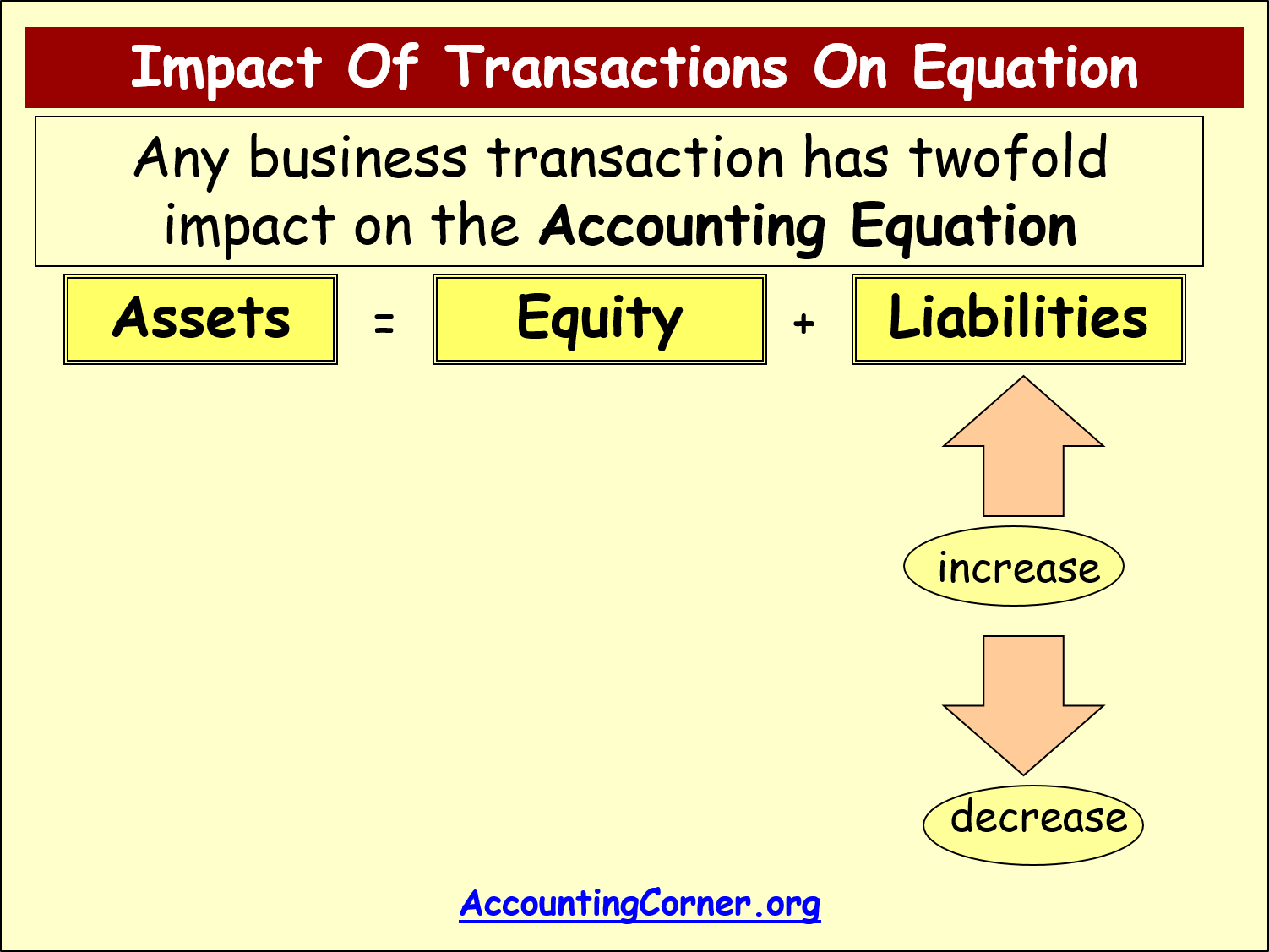

Analyzing the Accounting equation in more details in order to identify, how business transactions impact this equation, the rule is as follows:

An example can be increase in Assets

An example can be increase in Assets

If there is an increase in Assets, in order to have an equation on the other side of the equation there should be an increase in either Equity, or Liabilities, or both of them.

Such rule leads to the equation between asses and sum of equity and liabilities, and also reflects a change in the structure of the financing means.

Examples can be:

- an establishment of business and investment of cash into the business provided by shareholders

- getting a loan from the bank in the form of cash

In both of these examples there will be an increase in Assets on the left side of the equation.

On the right side of the equation in the first option (cash provided by shareholders) there will be an increase in Equity, in the second option (cash provided in the form of the loan) there will be an increase in Liabilities.

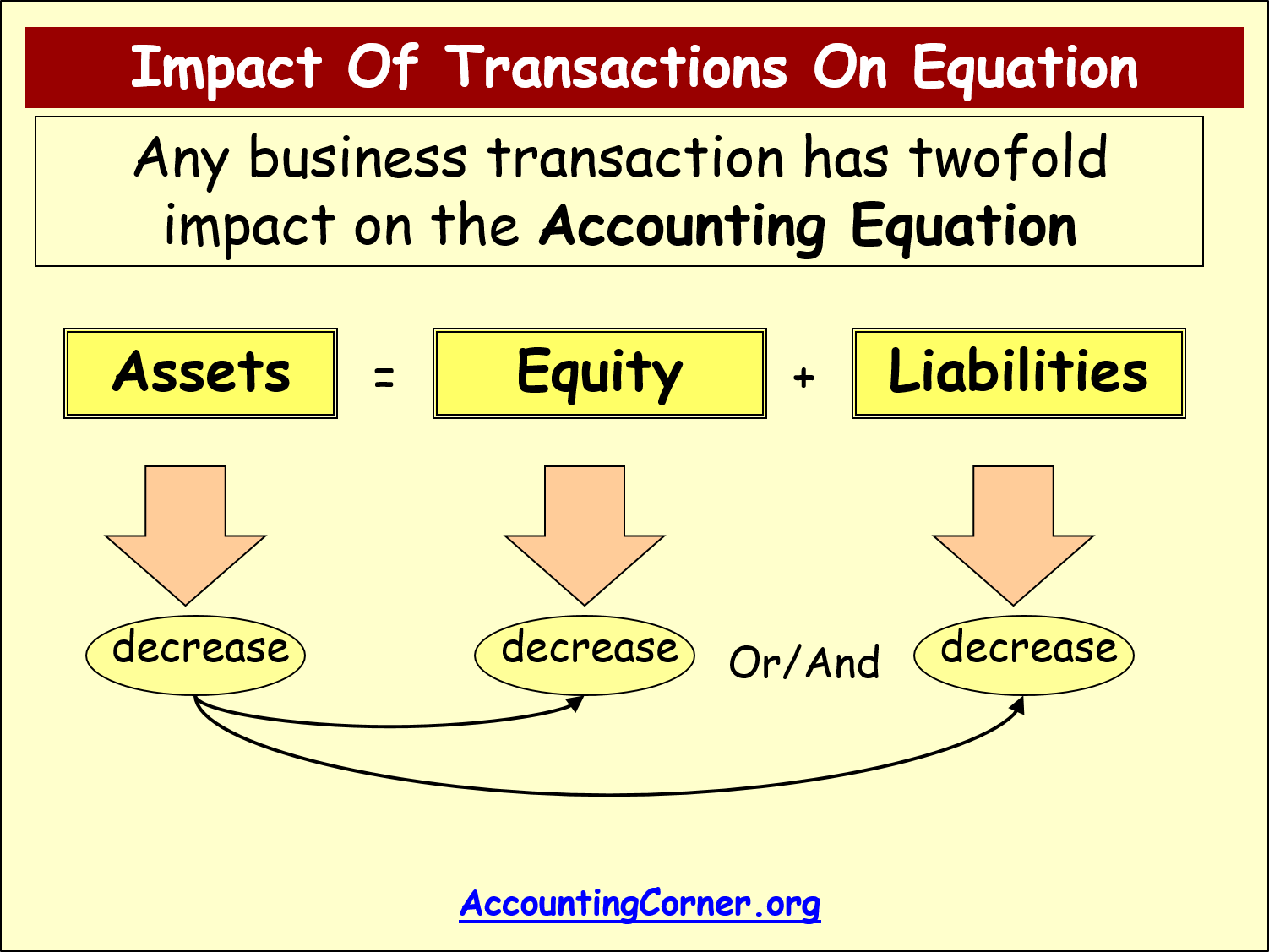

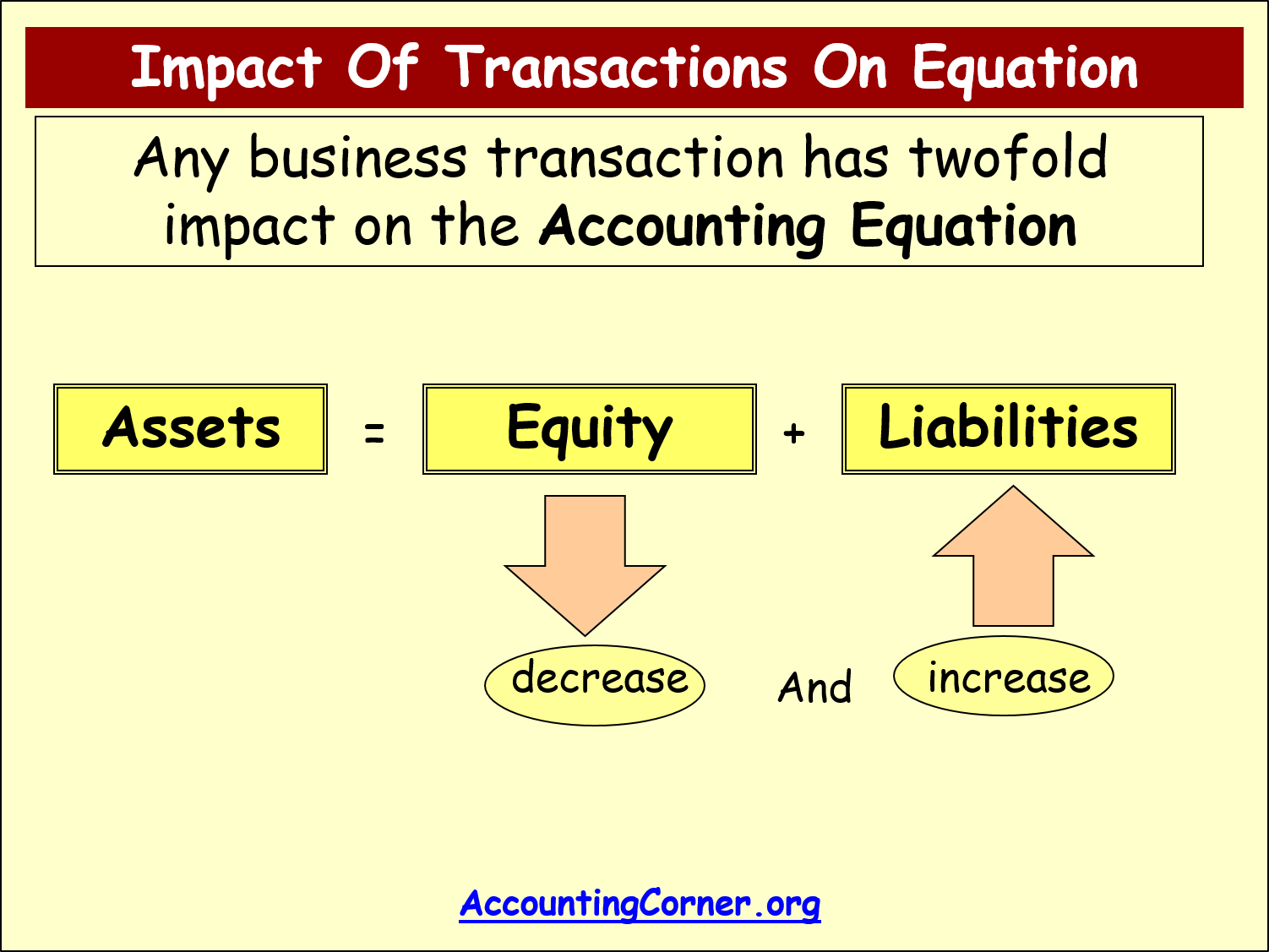

Another example on how transactions impact the Accounting Equation is decrease in Assets and decreased in Equity or Liabilities, or both on them.

Another example on how transactions impact the Accounting Equation is decrease in Assets and decreased in Equity or Liabilities, or both on them.

Practical example can be:

- repayment of the loan to the bank, or

- return of the money invested to the shareholders

In this example Assets will decrease, and there will be a decrease in Equity, or Liabilities, depending on whether Equity or Liabilities were returned back.

After the reflection of this transaction, there will still be an equation between total value of Assets and sum of Liabilities & Equity.

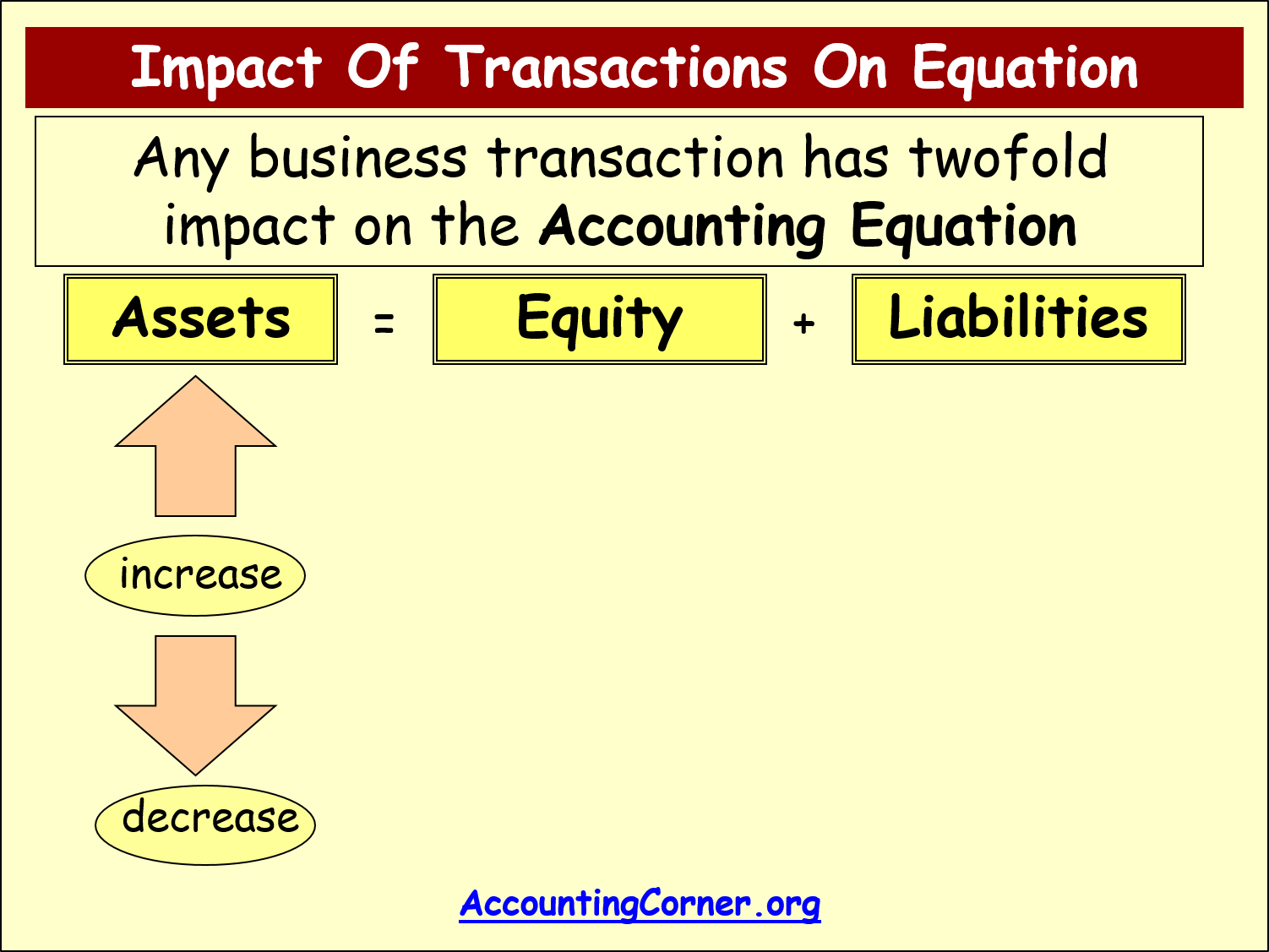

Only Change in Assets

Also, it can happen that a particular transaction has a two-fold impact on the Accounting Equation, however only one side of it will be impacted.

For example, there might be an increase in one category of the Assets and at the same time there is a decrease in another category of the Assets.

This means that there is an exchange between different types of assets, i.e. one type if the assets is being exchanged into another type of the assets.

This means that there is an exchange between different types of assets, i.e. one type if the assets is being exchanged into another type of the assets.

For example, inventory is acquired for cash.

In such case the business gets more inventory and less cash. There is no change on the right side of the Accounting equation since financing structure has not changed.

Only left side of the Accounting Equation was impacted by the exchange between different types of assets.

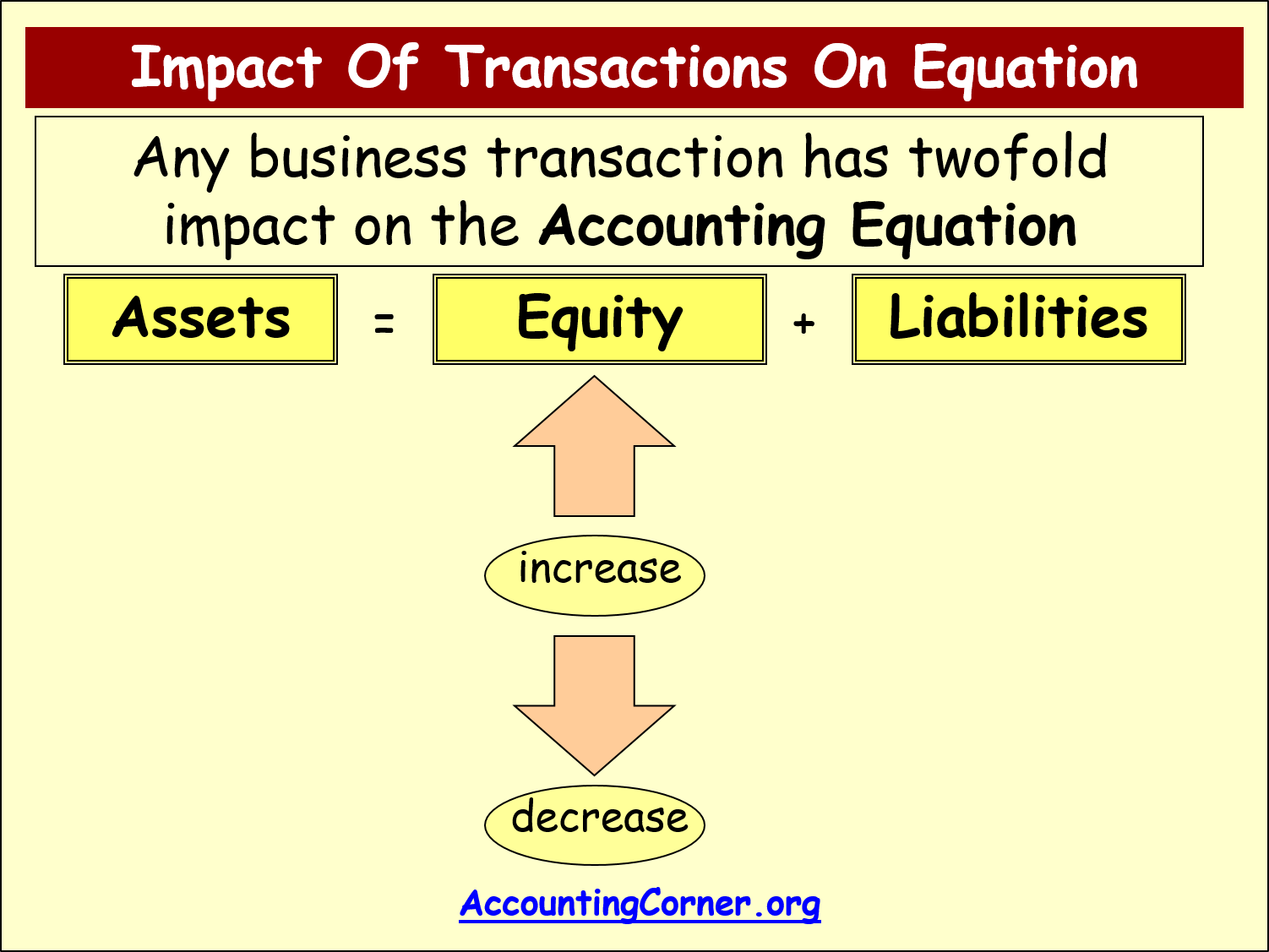

Only Change in Equity

Another example is an increase in one type of Equity and decrease in another type of Equity, which will impact the right side of the Accounting equation and only Equity part.

The practical example which is quite rare can be as follows:

The practical example which is quite rare can be as follows:

accumulated profit is converted into the share capital, i.e. there will be a decrease in accumulated profit, and increase in share capital.

The owners of the business can decide that the accumulated profit should not be distributed to the shareholders in the form of dividends, but to be used to increase share capital. In such case the investors will get additional shares instead of dividends.

Only Change in Liabilities

Another example when transaction impacts only one side of the Accounting Equation is exchanging of one of type of Liabilities into another type of Liabilities.

In practice it happens quite rare, i.e. the business can agree with one creditor to take over the liability from another creditor.

For example, if the business has an agreement with one bank for a short term loan, there might be an agreement with another bank to refinance that short term loan and provide long term loan.

For example, if the business has an agreement with one bank for a short term loan, there might be an agreement with another bank to refinance that short term loan and provide long term loan.

This would mean that on the Accounting Equation there will be an increase in long term financing and decrease in short term financing, if the above agreement with banks is reached.

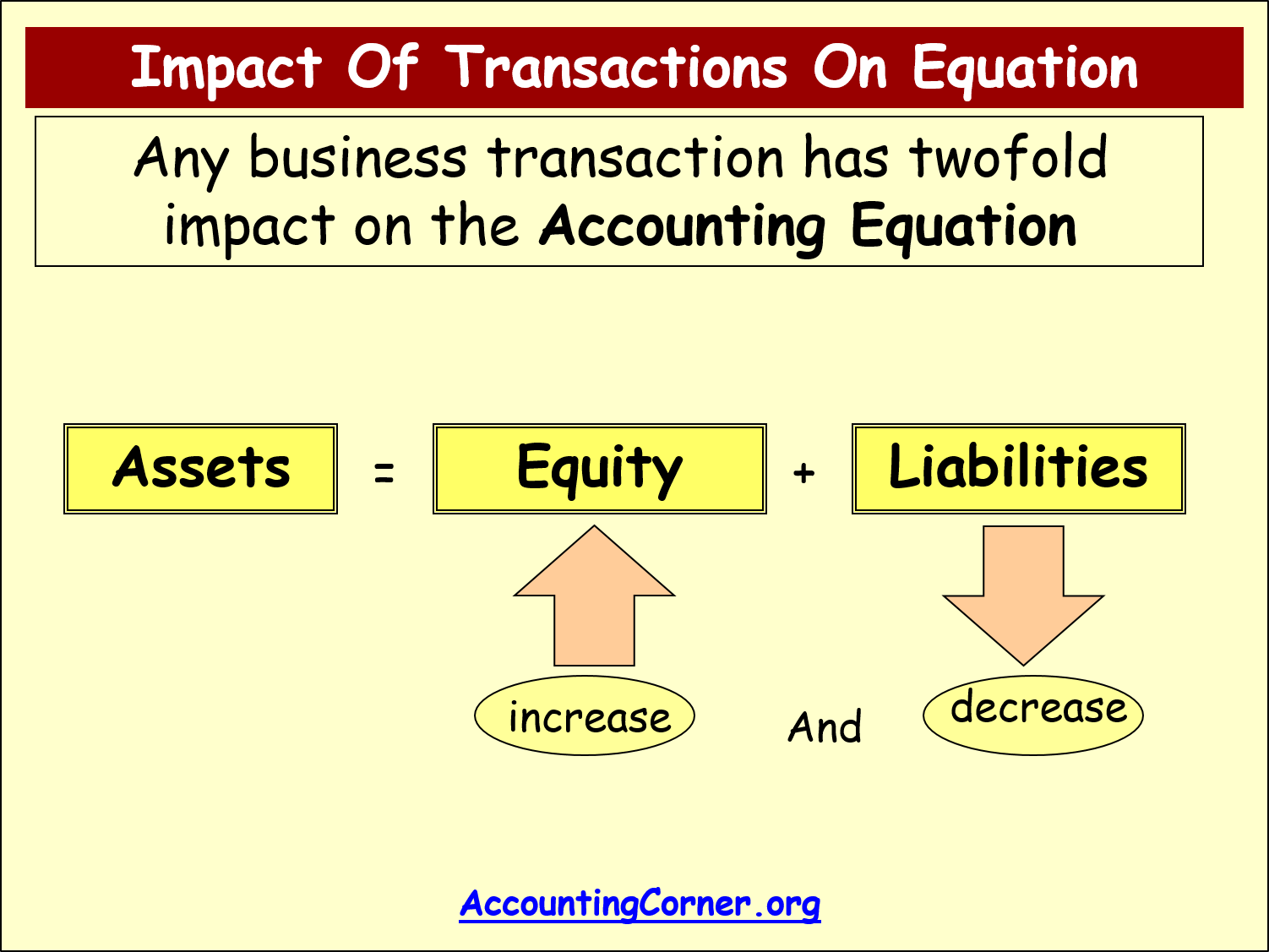

Change in Liabilities & Equity

Another example is a decrease in Equity and increase in Liabilities.

Another example is a decrease in Equity and increase in Liabilities.

This is quite rare and in practice and might not even. There might be a decrease in share capital and the business can get a loan from the bank to repay money back to investors.

Another example is contrary to the previous one, i.e. is a decrease in Liability and increase in Equity.

Another example is contrary to the previous one, i.e. is a decrease in Liability and increase in Equity.

This is not again very often case which happens in practice, i.e. there might be an agreement with the creditor to convert liability to share capital – the creditor will get shares of the business in exchange to liability of the business to this creditor.

The impact of such transaction on the Accounting Equation will be an increase in Equity and decrease in Liabilities.

How to Reflect Impact of Transactions on the Accounting Equation

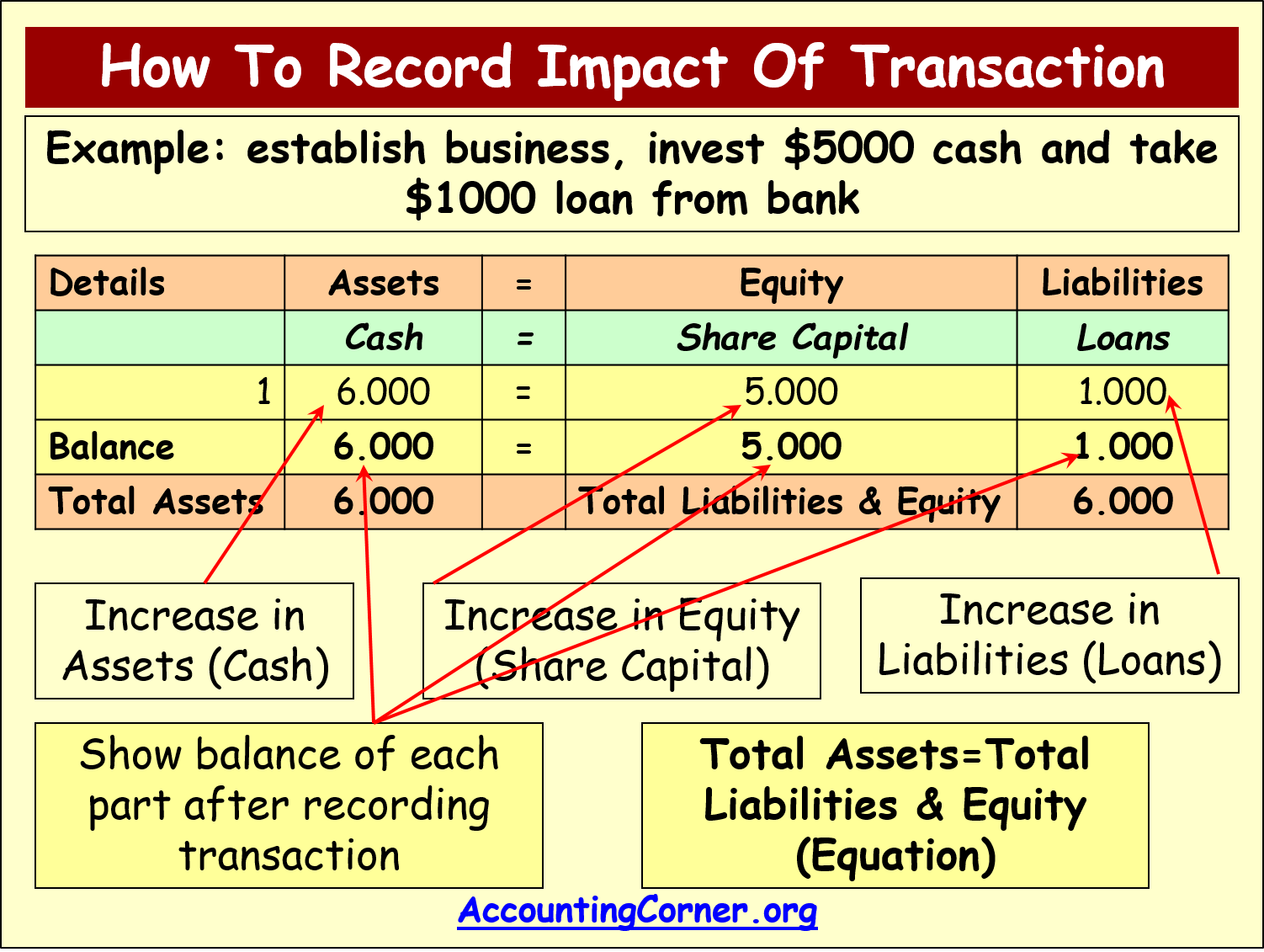

The below example will provide an explanation how an impact of the business transaction in reflected on the Accounting Equation.

Assume that the new business is established and shareholders invested $5,000 in cash, in addition a loan from the bank was taken in the amount of $1,000.

Assume that the new business is established and shareholders invested $5,000 in cash, in addition a loan from the bank was taken in the amount of $1,000.

In the picture below there is an Accounting Equation and how the impact of this transaction was recorded.

On the left side there are Assets and on the right side there is Equity and Liabilities.

The Accounting Equation indicates different categories. Therefore the Assets, Equity and Liabilities, i.e. Assets – Cash, Equity – Share Capital and Liabilities – Loans. These categories are impacted by the transaction analyzed.

On the left side there is an increase in cash by $6,000. This cash was provided to the business in the following forms of financing:

- $5,000 invested by shareholders as share capital – on the right side of the equation there is an increase in Equity – share capital by $5,000

- $1,000 provided by creditors as a loan – on the right side of the equation there is an increase in liabilities – Loans by $1,000

Total value of assets ($6,000) equals to the sum of Liabilities ($1,000) and equity ($5,000), i.e. $6,000.

Total value of assets ($6,000) equals to the sum of Liabilities ($1,000) and equity ($5,000), i.e. $6,000.

After the transaction was recorded, it is necessary to test whether this was done properly. Therefore total value of Assets and total sum of Equity and Liabilities has to be calculated and checked whether there is an equation.

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Accounting Equation to AccountingCorner.org home