Exercise Condition: Beginning inventory, purchases and sales data for cell phones for March are: Inventory: March 1 1,000 units at $40 Purchases: March 5 500 units at $42 March 20 450 units at $44 Sales: March 8 700 units March 14 600 units March 31 300 … [Read more...]

Inventory Exercise 4

Exercise Condition: Hayes Sales had the following transaction for T-shirts for 2008, its first year of operations had the following transactions: January 20 Purchase 450 units @ $6 April 21 Purchased 200 units @ $8 July 25 Purchased 150 units @ $10 Sept. 19 … [Read more...]

Inventory Exercise 3

Exercise Condition: The company produces a product with the following costs as of July 1, 2009: Material: $6 Labor: $4 Overhead: $2 Beginning inventory at these costs on July 1 was 5,000 units. From July1 to Dec.1, Convex produced 15,000 units. These units … [Read more...]

Inventory Exercise 2

Exercise Condition: The units of an item available for sale during the year were as follows: Jan 1 Inventory 27 units at $120 Feb 17 Purchase 54 units at $138 July 21 Purchase 63 units at $156 Nov 23 Purchase 36 units at $165 There are 50 units of the item in the … [Read more...]

Inventory Exercise 1

Exercise Condition: Balance of inventory on hand is the following (acquisition date, quantity and unit price are indicated): Dec. 7 - 10 units @ $6 cost; Dec 14 - 20 units @ $12 cost; Dec. 21 - 15 units @ $14 cost. Trader sells … [Read more...]

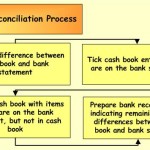

Bank Reconciliation Process

Here we will be exploring bank reconciliation process. Bank Reconciliation Process Steps There are certain steps which need to be followed to make a bank reconciliation, i.e.: identify total difference between cash book and bank statement compare cash book … [Read more...]

What Is Bank Reconciliation?

First step to understanding what is bank reconciliation is to explore the definition of this accounting term. Bank reconciliation - comparison of accounting records of the cash in bank with the actual cash held per bank statement and clarification of any differences. The result … [Read more...]

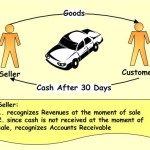

Accounts Receivable Accounting – When Accounts Receivable Is Created?

Here we will be covering the topic: When Is An Accounts Receivable Created and also other questions related to the basics of the accounting for Accounts Receivable. For major part of entities being involved in business either selling goods, or providing services, significant … [Read more...]

What Is Accounting?

If you are just starting to learn accounting, it is essential to understand what it is. Let us think about the business, which performs certain business transactions. In respect of business, we can say that accounting is a system, the purpose of which is to provide information … [Read more...]

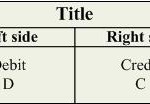

Accounting Cycle Step 1 – Analyze & Journalize Transactions

The purpose of accounting is to record each item, which appears in the financial statements separately in order to be able to trace it back if required. Type of record used for the purpose of recording individual transactions is called an account. Simplest form of account … [Read more...]