Here we continue to analyze how transactions impact the Accounting Equation and we are coming back to our company called Zeta and its transactions monthly transactions.

Under the 3rd transaction Zeta acquired inventory on credit for $4,500 and also stationary was acquired for $670, which was paid by cash.

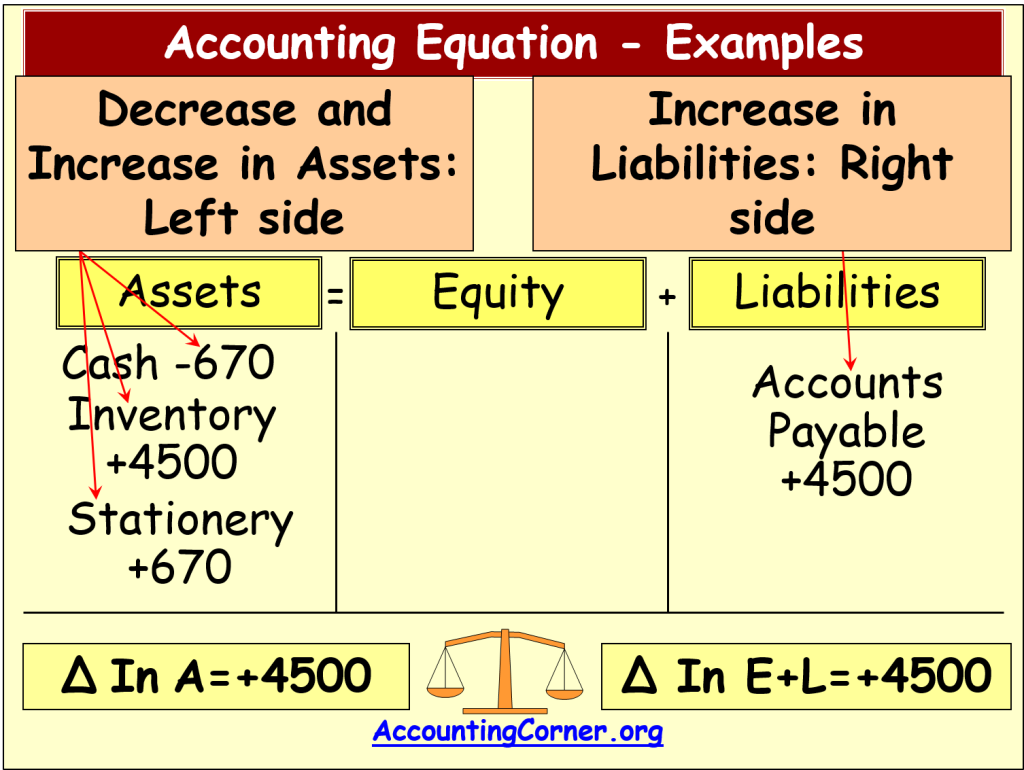

First of all we record the impact of the transaction and the accounting equation. Afterwards we will see how the equation looks like after all the three transactions are recorded.

As a result of this transaction on the left side of the accounting equation there is an exchange of one type of assets into another and also there is an increase in certain assets, as the transaction covered the acquisition of inventory on credit and the acquisition of stationary, which was paid by cash.

On the left side there are the following items:

- Decrease in cash by $670, which was caused by the cash payment for stationery acquired

- Increase in stationery by $670, which is resulted by its acquisition and exchange of cash for stationery

- Increase in inventory by $4,500, which represents acquisition of inventory

On the right side there is the following item:

- Increase in Accounts Payable by $4,500, which is resulted by the acquisition of inventory on credit, i.e. the payment for inventory was not done by cash, but inventory was acquired on credit. These accounts payable will have to be paid when due date comes

And after these items are recorded we must check whether the impact of this transaction on the accounting equation was recorded properly. For this purpose we calculate total change in assets, getting increase by $4,500. On the right side of the equation we calculate total change in equity and liabilities, getting increase by $4,500. As there is an equality, this does indicate that the transaction was recorded properly.

View on Accounting Equation After All 3 Transactions

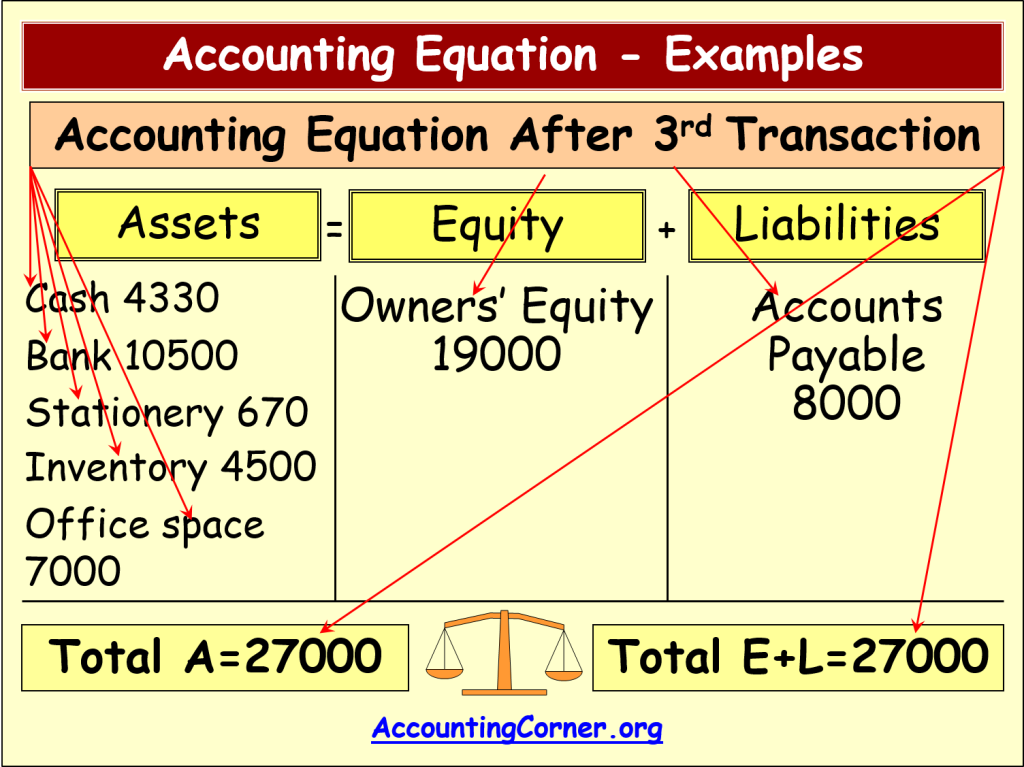

The next step the particular transaction was recorded is to check the view of the accounting equation after all transactions were recorded. The purpose is to check whether total value of assets equals to total sum of equity and liabilities. In the picture below it is presented how the accounting equation looks like after the third transaction was recorded.

Comparing to the result after the 2nd transaction there is lower balance of cash, since stationary was acquired during the 3rd transaction. Also there are stationery and inventory balances which were acquired during the 3rd transaction.

In addition from the previous transactions there is office space, the cost of which is $7,000 cash in bank amounting to $10500, which also has not changed, since in the 3rd transaction there were not payments from bank.

On the right side of the accounting equation there is an equity of $19 000, which remained unchanged. Also there is an increase in accounts payable by $4 500 (caused by the acquisition of inventory on credit) and total accounts payable balance is $8,000 after the third transaction was recorded.

Next total value of assets and total value of equity plus liabilities have to be calculated in order to check whether there is an equation and whether all the previous transactions including 3rd transaction were recorded properly and correctly.

Total value of assets is $27,000 and equity plus liability is also $27,000. There is an equation, which means that all tree transactions were recorded properly.

Next step is for transaction and here it is then with zeta from petty cash paid for office space insurance it was $1,900 and the period of insurance is half a year. So let’s see how this transaction impacts accounting equation. On the left side we have decreasing cash since it was paid by cash the insurance was paid by cash so we have a decrease in cash by $1,900 and we have an increase in prepaid insurance. We account it as prepaid insurance as it relates to the future periods, to the future half of the year or when those expenses will be incurred so we have an increase in another type of assets.

We exchange cash into prepaid insurance and the random change in seeing equity or liabilities since the was no increase or decrease in equity we were not acquiring additional capital to acquire prepaid insurance and we also we are not acquiring the prepaid insurance on credit so we paid by cash and total change in assets is zero since we have exchange one type of assets into another and change in equity and liabilities is also zero since there was no impact on equity and liabilities and what happened next you remember that we need to check how the accounting equation looks like after the fourth transaction we need to calculate assets, equity and liabilities and to check whether there is an equation.

In order to be sure that all the four transactions were recorded correctly so here we have cash and cash decreased by value of prepaid insurance since we have paid in the fourth transaction by cash for that insurance we have cash in bank which was not changing after the fourth transaction was recorded we have prepaid insurance it is $1,900 and this is impacted by the 4th transaction when we have acquired for cash. We have stationary. We have inventory and we have office space and these items they have not changed off to the 4th transactions since they were not impacted by that.

On the right side we also calculate total value of equity after the fourth transaction it remains unchanged and total value of liabilities which also remains unchanged since there was no impact on this part of the equation after during the 4th transaction and we calculate total value of assets and total value of liabilities and you can see that we have an equation which means that all four transactions were recorded properly.