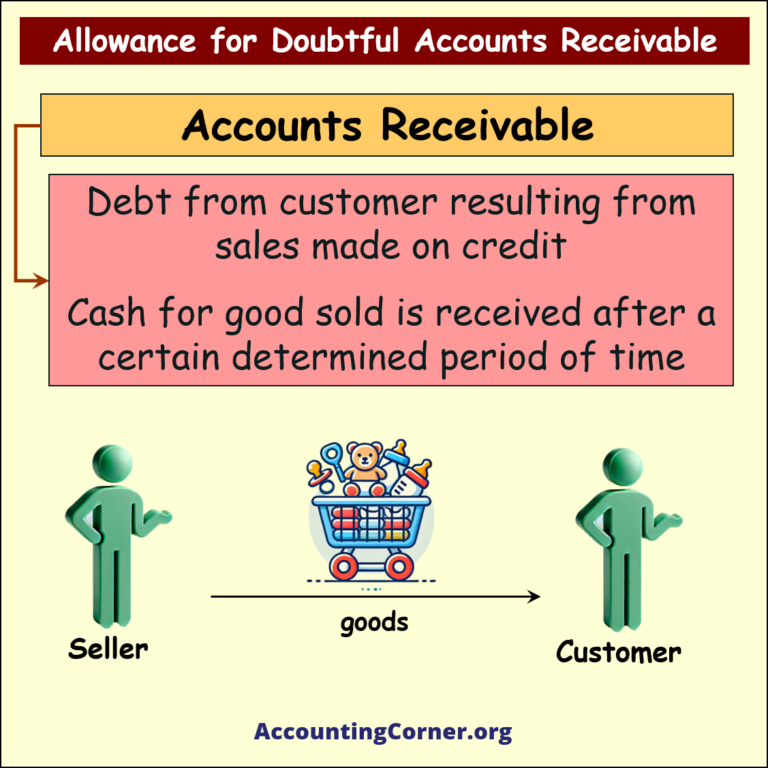

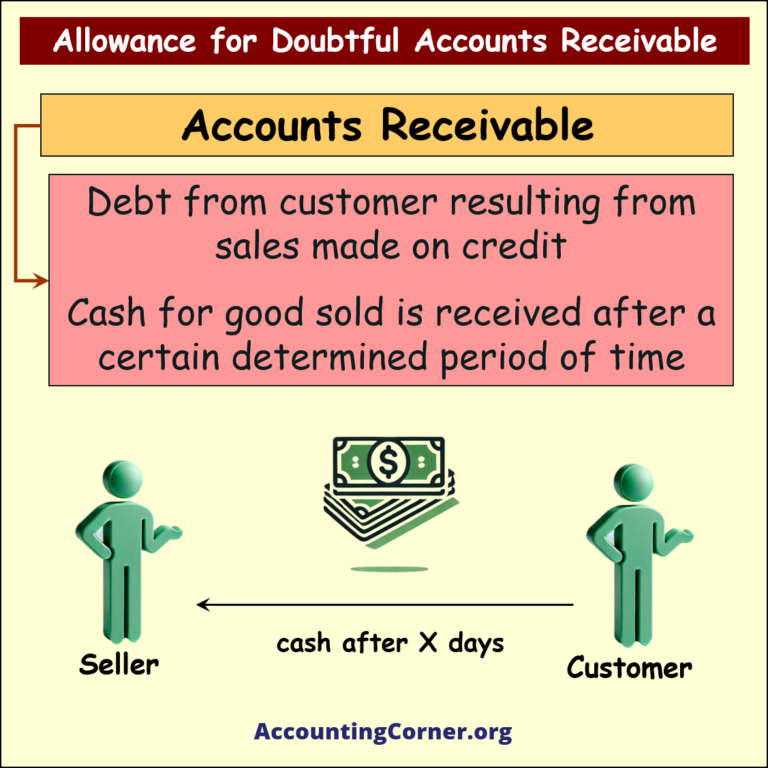

Introduction to Allowance for Doubtful Accounts

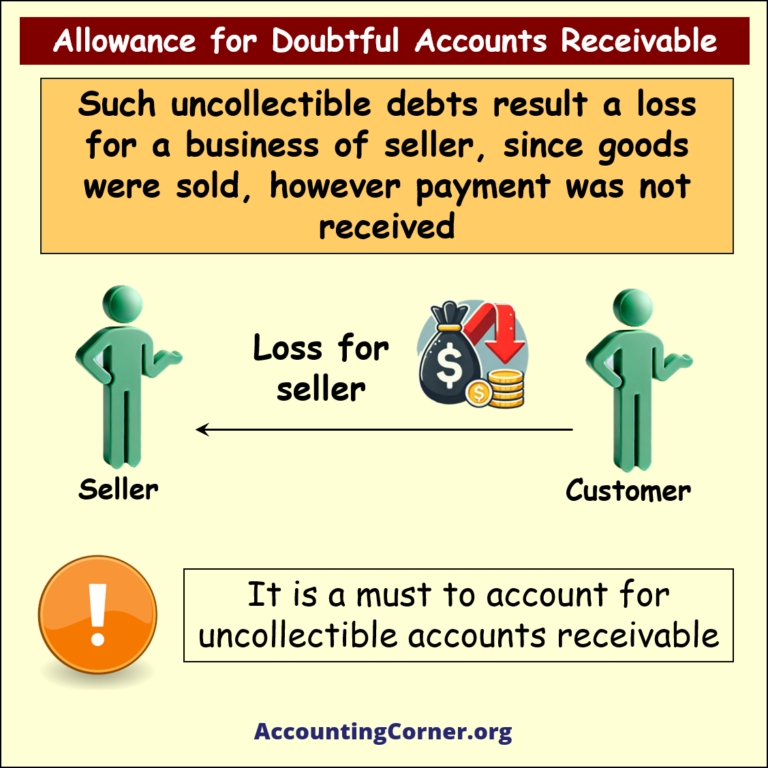

In business, not all customers who purchase goods or services on credit are able to fulfill their payment obligations. To prepare for such situations, businesses create an Allowance for Doubtful Accounts. This allowance estimates the portion of accounts receivable (AR) that may not be collected. By accounting for potential losses in advance, businesses ensure their financial statements reflect a more accurate and conservative view of their receivables and future cash flows.

What is the Allowance for Doubtful Accounts?

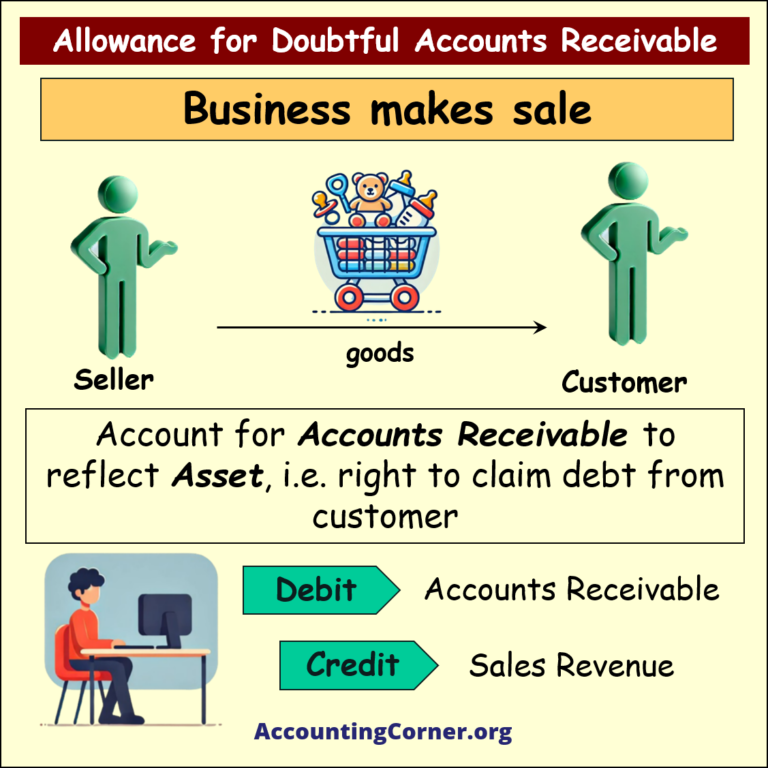

The Allowance for Doubtful Accounts (ADA) is a contra-asset account linked to Accounts Receivable. It represents an estimate of the amount of AR that a company does not expect to collect due to customer defaults. This approach aligns with the matching principle in accounting, where expenses (in this case, bad debts) are recognized in the same period as the revenues they helped generate.

Key Points:

- ADA reflects the company’s anticipation of uncollectible debts.

- It is recorded as an expense in the Income Statement (bad debt expense) and reduces the total AR in the Balance Sheet.

Valuation of Accounts Receivable

Receivables are classified and valued on the balance sheet. Classification involves determining if the receivables are current (collected within a year) or noncurrent (collected beyond a year). Short-term receivables are valued at their net realizable value—the amount the company expects to collect in cash. This valuation requires estimating uncollectible receivables and any returns or allowances.

Process of Estimating Doubtful Accounts

There are two primary methods used to estimate the allowance for doubtful accounts:

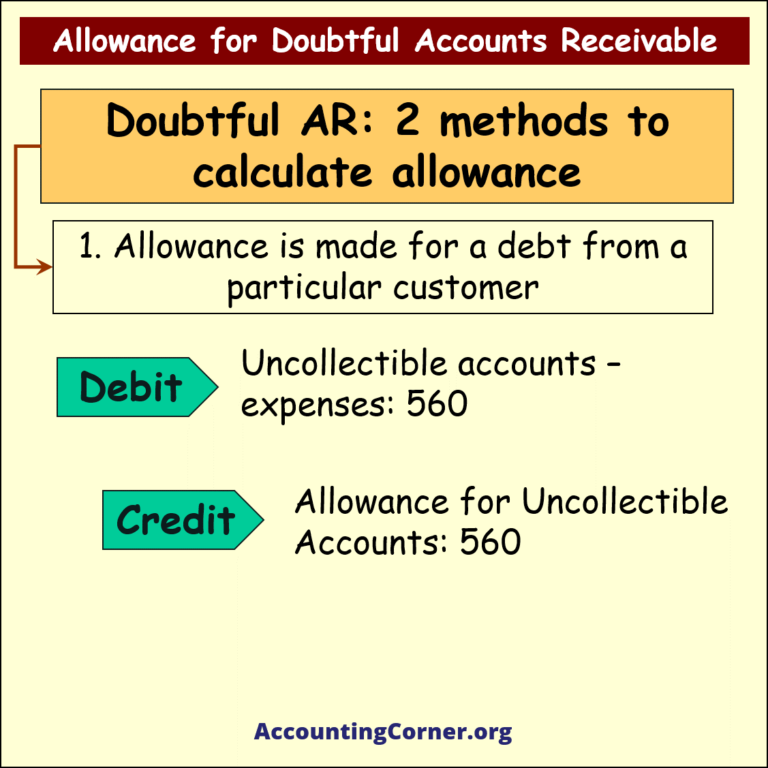

- Specific Identification Method

- In this method, a company makes an allowance for debts from specific customers whom it believes may not be able to pay. This approach is typically used when the company has concrete knowledge about a customer’s financial difficulties or disputes.

Example Accounting Entry:

- Debit: Uncollectible Accounts – Expenses $560

- Credit: Allowance for Uncollectible Accounts $560

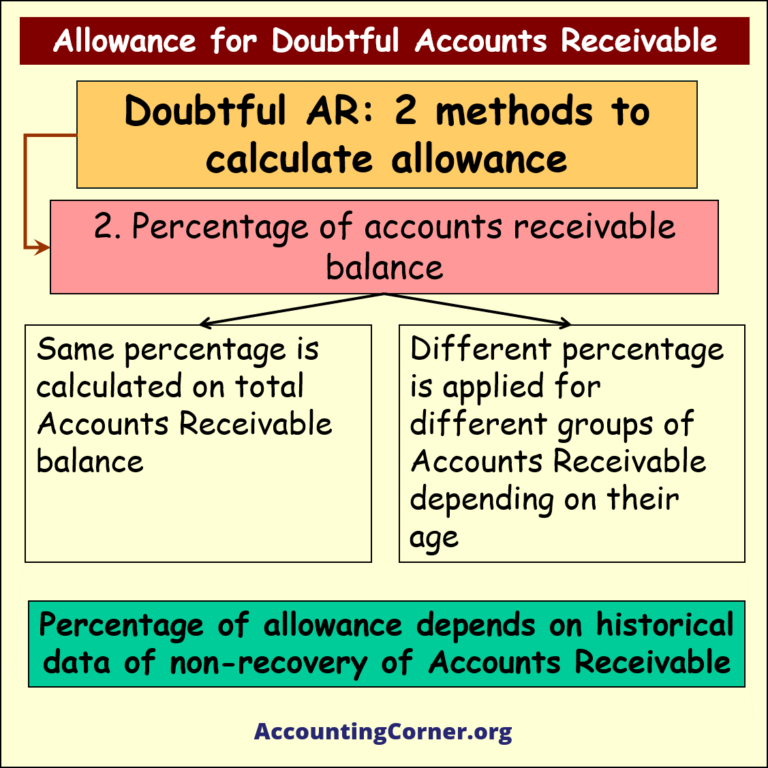

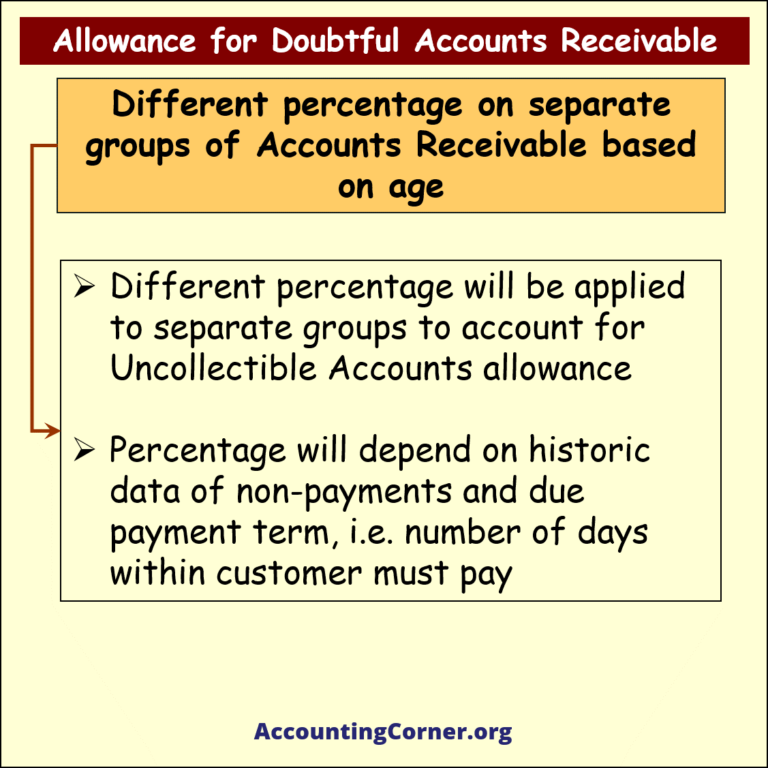

- Percentage of Accounts Receivable Method

- Here, the company applies a percentage to its total AR balance to estimate the allowance. The percentage is often based on historical data regarding bad debts. This method can be refined by dividing AR into age groups (aging analysis) and applying different percentages to each group depending on how long the debts have been outstanding.

Example:

- Accounts Receivable: $6,228

- Doubtful Debt Allowance (2%): $125

- Total Doubtful Debts: $4,056 (calculated by applying different percentages based on the age of the debt)

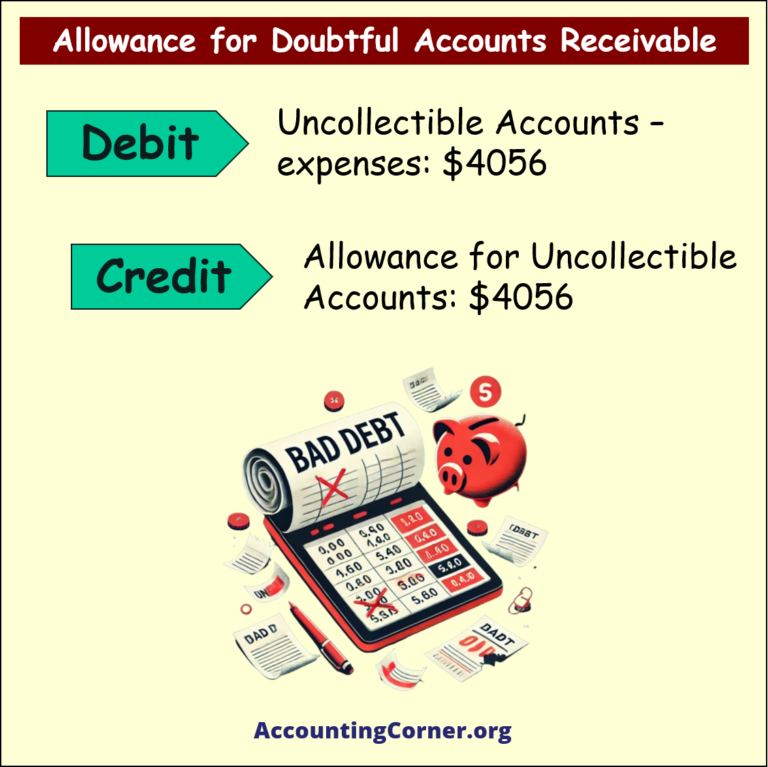

Accounting Entry:

- Debit: Uncollectible Accounts – Expenses $4,056

- Credit: Allowance for Uncollectible Accounts $4,056

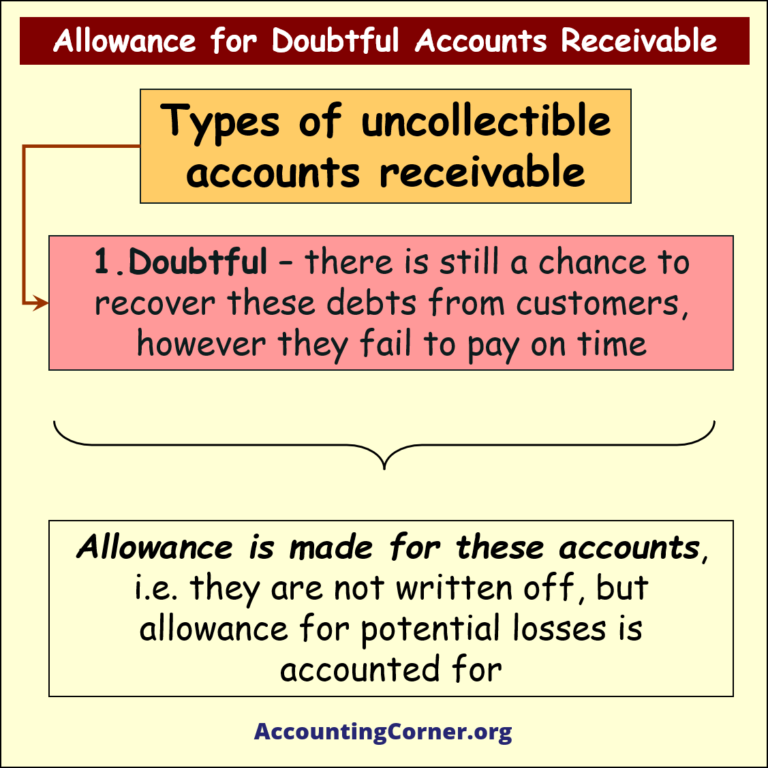

Types of Uncollectible Accounts

- Doubtful Accounts:

- These accounts have a chance of recovery, but the customer has failed to pay on time. An allowance is made for these accounts, but they are not written off immediately.

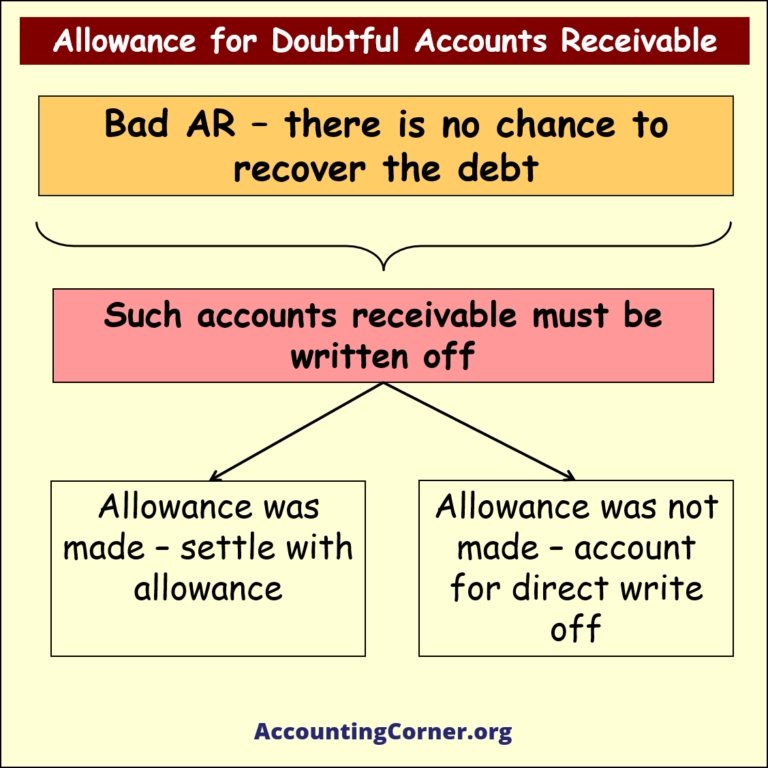

- Bad Accounts:

- These are accounts where recovery is deemed impossible, often due to bankruptcy or permanent financial distress. Such accounts are written off from AR, either against the ADA if an allowance was made or through a direct write-off if no prior allowance was set.

Accounting for Bad Debts and Write-Offs

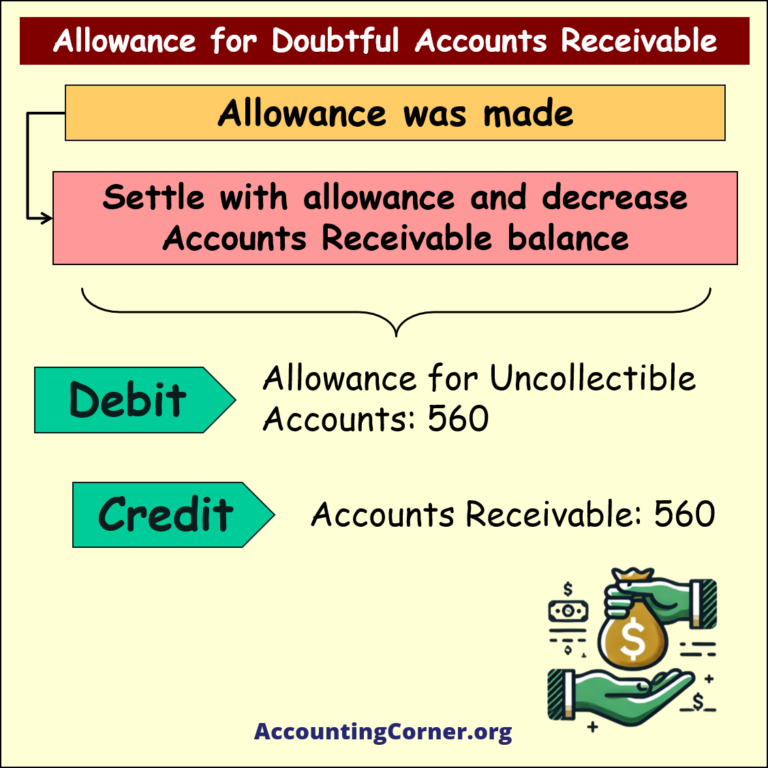

When an account is deemed uncollectible, it must be written off from AR. If an allowance was previously created for the debt, the company settles the amount with the allowance, reducing both AR and the allowance.

- If Allowance was Made:

- Debit: Allowance for Uncollectible Accounts

- Credit: Accounts Receivable

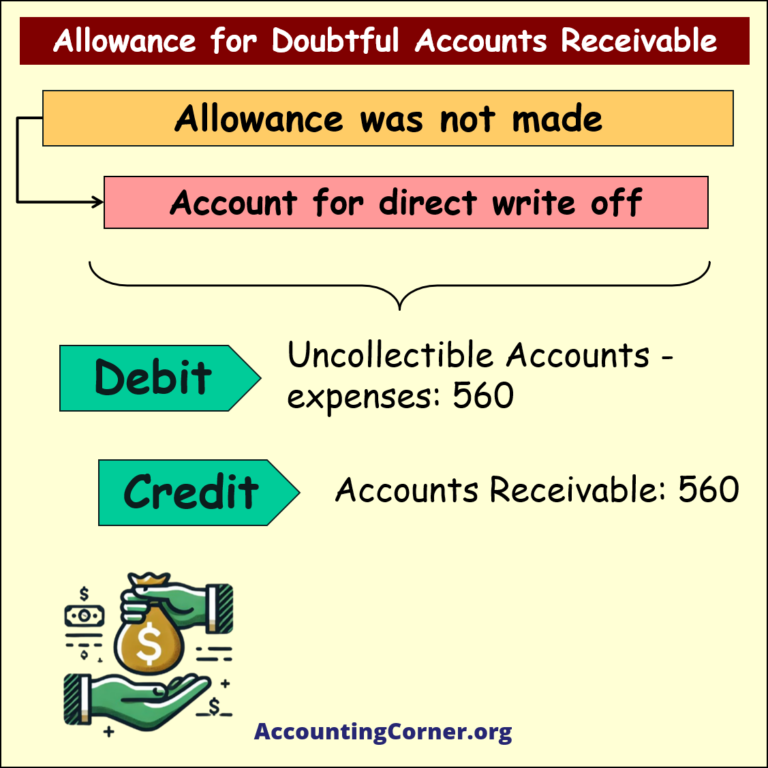

- If Allowance was Not Made (Direct Write-Off Method):

- Debit: Uncollectible Accounts – Expenses

- Credit: Accounts Receivable

Methods of Accounting for Uncollectible Accounts

There are two main methods for accounting for uncollectible accounts:

- Direct Write-Off Method

- Under this method, companies only recognize bad debt expense when specific accounts are deemed uncollectible. Although straightforward, this method does not align with GAAP for financial reporting since it can distort income figures.

- Allowance Method

- This method estimates uncollectible accounts at the end of each period, ensuring that AR is reported at net realizable value. This is a GAAP-compliant approach, often involving either a percentage-of-sales or percentage-of-receivables basis. In this method, bad debt expense is matched with the revenue it helped generate, creating a more accurate depiction of financial health.

Allowance Method Features:

- Companies estimate uncollectibles and match them with revenues.

- They debit Bad Debt Expense and credit Allowance for Doubtful Accounts periodically.

- Specific accounts are written off by debiting the allowance and crediting Accounts Receivable.

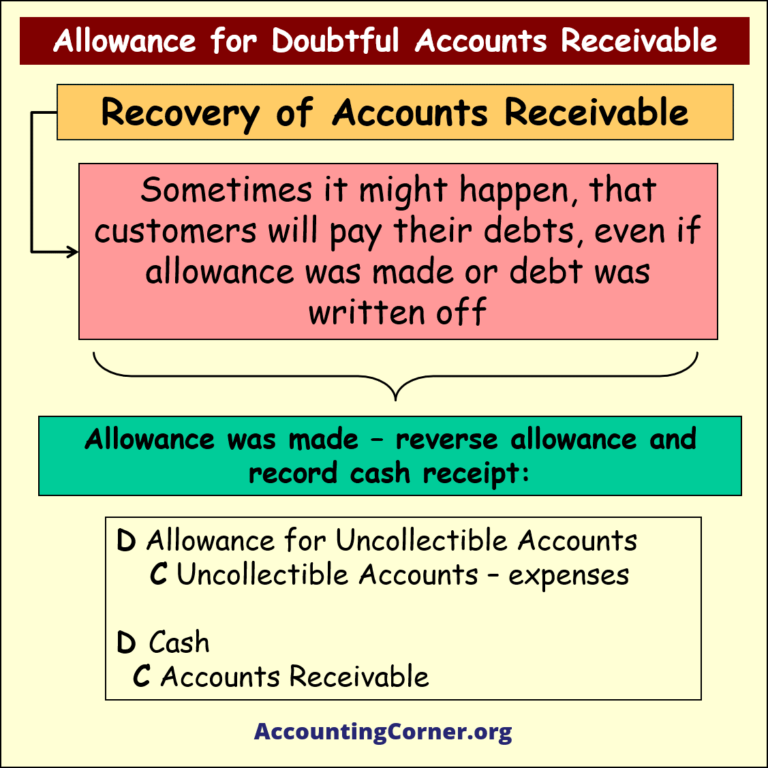

Recovery of Accounts Receivable

If a customer pays a debt that was previously written off, the company reverses the write-off and records the cash receipt:

- If Allowance was Made:

- Reverse the allowance:

- Debit: Allowance for Uncollectible Accounts

- Credit: Uncollectible Accounts – Expenses

- Record the cash receipt:

- Debit: Cash

- Credit: Accounts Receivable

- Reverse the allowance:

- If Allowance was Not Made:

- Record the cash receipt as revenue:

- Debit: Cash

- Credit: Uncollectible Accounts – Revenue

- Record the cash receipt as revenue:

Bases Used for Allowance Method

Two bases are commonly used to estimate uncollectibles:

- Percentage of Sales (Income Statement Approach):

- In this approach, companies estimate uncollectibles as a percentage of credit sales. This method aligns with the income statement by emphasizing expense recognition.

- Percentage of Receivables (Balance Sheet Approach):

- Using past experience, a percentage is applied to outstanding receivables to estimate uncollectibles, focusing on net realizable value on the balance sheet. Companies may apply an aging schedule, categorizing receivables based on how long they’ve been overdue, which helps determine the estimated uncollectibles for each category.

Importance of Allowance for Doubtful Accounts

The Allowance for Doubtful Accounts ensures that a company’s financial statements provide a realistic view of its financial health by accounting for potential losses on credit sales. Key benefits include:

- Accurate Financial Reporting: ADA aligns expenses with revenues, enhancing profitability reporting.

- Risk Management: The allowance protects against overestimating assets and underestimating potential losses.

- Better Decision-Making: A realistic view of uncollectible AR enables informed credit and cash flow decisions.

Conclusion: Managing the Allowance for Doubtful Accounts

The Allowance for Doubtful Accounts is essential for businesses offering credit. Proper management helps balance credit extension with receivables oversight, minimizing significant losses. Using estimation methods like specific identification or aging analysis, companies can manage AR efficiently, preparing for potential defaults while maintaining financial accuracy.

Summary Points:

- Definition: An estimate of the portion of AR expected to go uncollected.

- Methods: Specific identification or percentage-based.

- Impact: Adjusts financial statements to reflect potential credit losses.

- Write-Offs: Accounts can be written off or recovered if paid later.

- Importance: Ensures accurate reporting, risk management, and informed decision-making.

Understanding and managing the allowance for doubtful accounts is crucial for any credit-granting business. Proper handling secures financial stability, precise reporting, and preparation for bad debts.

Allowance for Doubtful Accounts – Visuals

Allowance for Doubtful Accounts – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Allowance for Doubtful Accounts Receivable to AccountingCorner.org