![]() Maturity date – date on which a financial instrument or investment reaches the end of its term and the principal amount is due to be repaid to the investor.

Maturity date – date on which a financial instrument or investment reaches the end of its term and the principal amount is due to be repaid to the investor.

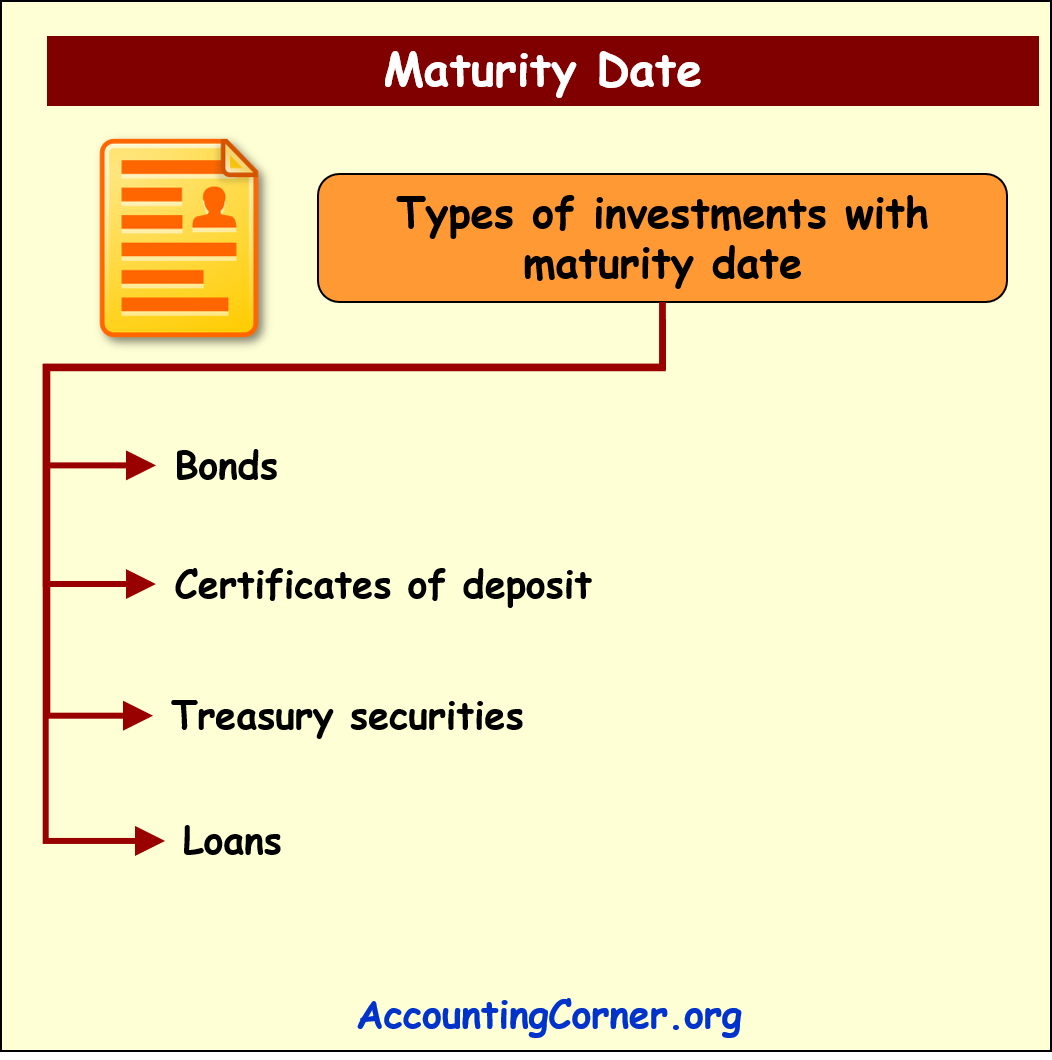

Examples of investments with maturity date:

- Bond: the maturity date is the date on which the issuer of the bond must repay the face value of the bond to the bondholder

- Certificate of deposit: the maturity date is the date on which the certificate of deposit reaches the end of its term and the principal amount, plus any accrued interest, is paid to the investor.

The maturity date is an important consideration for investors when evaluating investment options, as it can affect the level of risk and return associated with the investment.

The maturity date is an important consideration for investors when evaluating investment options, as it can affect the level of risk and return associated with the investment.

The maturity date of a financial instrument or investment can typically be determined by reviewing the terms of the investment agreement or prospectus. The specific steps to determine the maturity date may vary depending on the type of investment.

Here are some general guidelines for determining maturity date for some common types of investments:

- Bonds: The maturity date of a bond is usually specified in the bond agreement or prospectus. It is the date on which the issuer of the bond is obligated to repay the face value of the bond to the bondholder.

- Certificates of Deposit: The maturity date of a CD is typically specified in the agreement or account documentation provided by the bank or financial institution that issued the CD. It is the date on which the CD reaches the end of its term and the principal amount, plus any accrued interest, is paid to the investor.

- Treasury Securities: The maturity date of Treasury securities can be found on the U.S. Department of the Treasury website. The maturity date varies depending on the type of Treasury security, such as Treasury bills, notes, and bonds.

- Loans: The maturity date of a loan is usually specified in the loan agreement. It is the date on which the borrower is obligated to repay the principal amount of the loan to the lender.

In general, the maturity date is an important consideration when evaluating investment options, as it can affect the level of risk and return associated with the investment. It’s important to review the terms of the investment agreement or prospectus carefully to determine the maturity date and other key terms before making an investment decision.

In general, the maturity date is an important consideration when evaluating investment options, as it can affect the level of risk and return associated with the investment. It’s important to review the terms of the investment agreement or prospectus carefully to determine the maturity date and other key terms before making an investment decision.

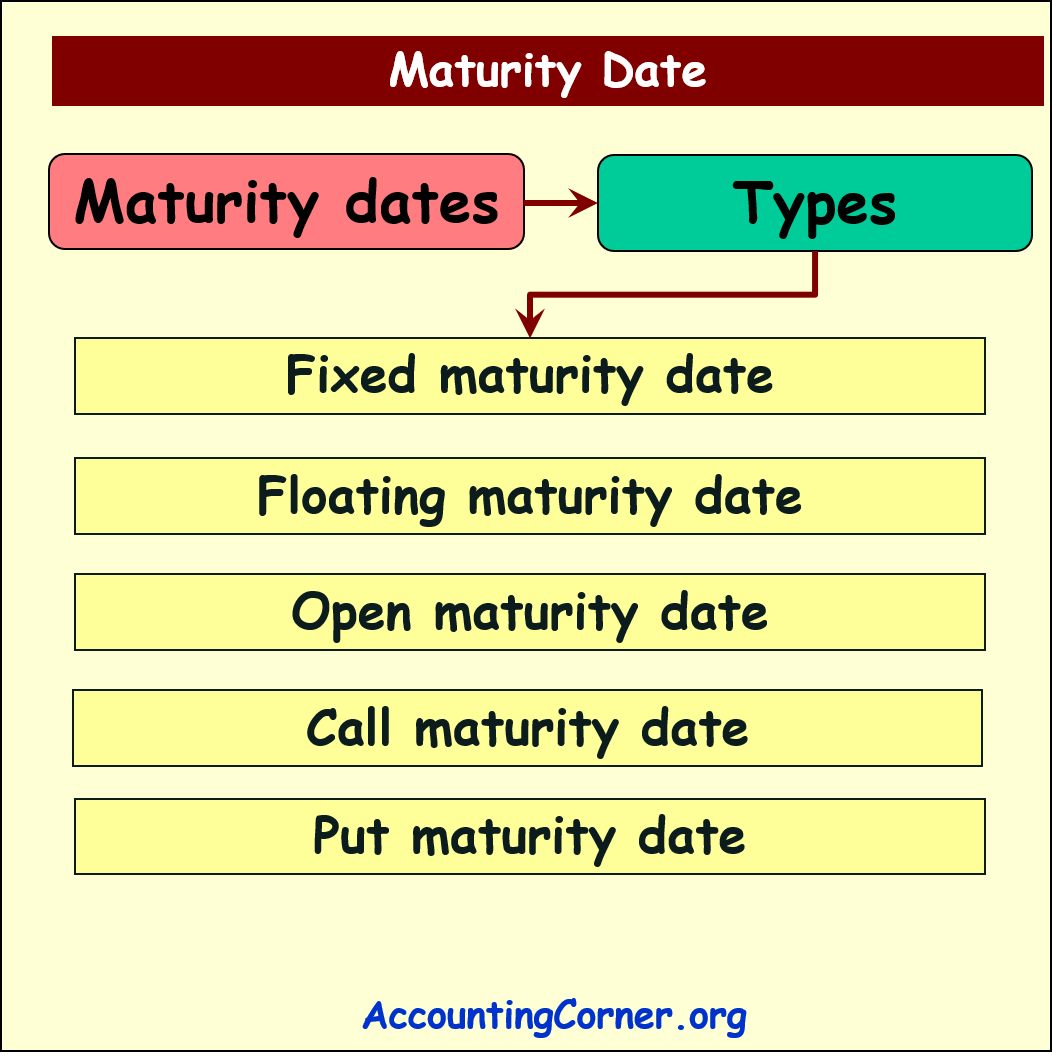

Types of Maturity Dates

The types of maturity date can vary depending on the type of financial instrument or investment. Here are some common types of maturity dates:

- Fixed Maturity Date: This is the most common type of maturity date, where the exact date on which the principal amount is due to be repaid is specified in the investment agreement. For example, in the case of a bond, the issuer will specify the exact date on which the bond will mature and the principal amount will be repaid to the bondholder.

- Floating Maturity Date: In some cases, the maturity date may be tied to a variable or floating rate. For example, in the case of an adjustable rate mortgage (ARM), the maturity date may be tied to changes in the interest rate over time.

- Open Maturity Date: In some cases, the maturity date may not be specified or may be open-ended. For example, in the case of a revolving line of credit, there may not be a specific maturity date, as the borrower can continue to borrow and repay funds as needed.

- Call Maturity Date: Some investments may have a call provision that allows the issuer to repay the principal amount before the stated maturity date. This can be beneficial for the issuer if interest rates have declined since the investment was issued.

- Put Maturity Date: Some investments may have a put provision that allows the investor to sell the investment back to the issuer before the stated maturity date. This can be beneficial for the investor if interest rates have risen since the investment was issued.

It’s important to carefully review the terms of the investment agreement or prospectus to determine the type of maturity date and any other key terms before making an investment decision.

It’s important to carefully review the terms of the investment agreement or prospectus to determine the type of maturity date and any other key terms before making an investment decision.

Maturity date vs Expiration Date

The maturity date and the expiration date are similar concepts, but they are not always the same.

The maturity date is the date on which a financial instrument or investment reaches the end of its term and the principal amount is due to be repaid to the investor. For example, in the case of a bond, the maturity date is the date on which the issuer of the bond must repay the face value of the bond to the bondholder. In the case of a certificate of deposit (CD), the maturity date is the date on which the CD reaches the end of its term and the principal amount, plus any accrued interest, is paid to the investor.

On the other hand, the expiration date typically refers to the date on which an option contract or futures contract expires. For example, in the case of a stock option contract, the expiration date is the last day on which the option can be exercised. In the case of a futures contract, the expiration date is the date on which the underlying asset must be delivered or settled in cash.

While both the maturity date and the expiration date represent the end of an investment or contract, they are not always the same. It’s important to carefully review the terms of an investment or contract to determine the specific dates and any other key terms before making an investment decision.

The final maturity date is the last possible date on which a financial instrument or investment can mature or reach the end of its term. This date is typically specified in the investment agreement or prospectus.

For example, in the case of a bond, the final maturity date is the date on which the bond reaches the end of its term and the issuer is obligated to repay the face value of the bond to the bondholder. In the case of a mortgage loan, the final maturity date is the date on which the borrower is obligated to repay the principal balance in full.

The final maturity date is an important consideration for investors and borrowers because it represents the ultimate deadline for repayment. It’s important to carefully review the terms of an investment or loan agreement to determine the final maturity date and any other key terms before making an investment or borrowing decision.

Return from Maturity Date to AccountingCorner.org