In order to learn what is Gross Profit and explore Gross Profit definition, it is essential to understand that we can identify Gross Profit from two perspectives: financial and cost accounting.

In both perspectives Gross Profit is the difference between sales and Cost of Goods Sold, however composition and details of Cost of Goods Sold is different in these two views. In cost accounting, which will not be presented in very details here, cost of goods sold is usually divided into variable, fixed and overhead costs, which compose cost of goods sold.

In financial accounting Gross Profit, can be also called Sales Profit is calculated as follows – this is Gross Profit Formula:

Net Sales Revenue-Cost of Goods Sold=Gross Profit

To get Net Sales Revenue, we need to use the following formula:

Sales Revenue-Sales Discounts- Sales Returns & Allowances=Net Sales Revenue

In the process of understanding how to calculate Gross Profit, remember that Cost of Goods Sold represents all costs incurred by the business to produce those goods, which were sold during the accounting period. It is essential to understand that Cost of Goods Sold should include only those costs, which are related to sold goods. Cost of those goods, which were produced, but not yet sold, remains in the Balance Sheet under inventory category.

In case of the business which provides services cost of goods sold is replaced by cost of services provided with the calculation formula remaining the same as for manufacturing or trading business.

Cost of goods sold or services provide usually represent those costs, which can quite precisely attributed to this activity. This category of costs does not include general operating or selling expenses.

In financial accounting in case when Multiple Step Income Statement is being used, Gross Profit is reported separately in the Income Statement. It represents whether the main activity of the business is profitable and also serves as indication how efficiently business is able to perform its main activities.

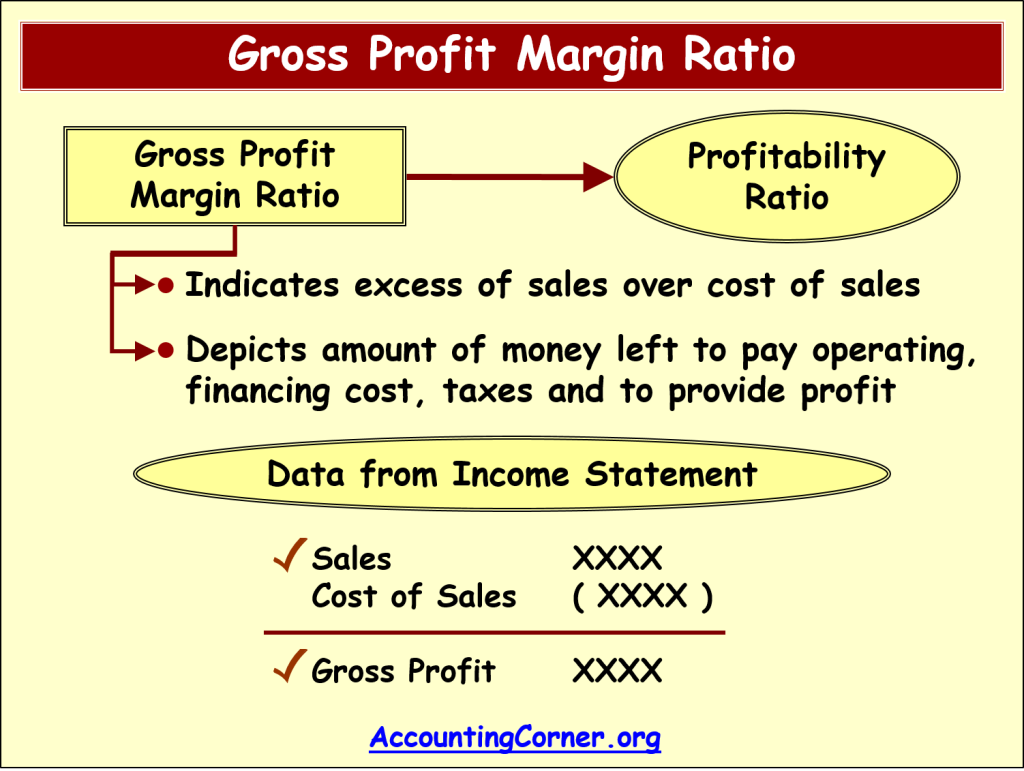

Gross Profit Margin or Gross Profit Percentage is the ration between Gross Profit and Net Sales Revenue. This ratio indicates excess of Net Sales over Cost of Goods Sold or Service Provided and depicts the amount of money which is left for the business to cover sales, operating and other costs, pay taxes and arrive not Net Profit.

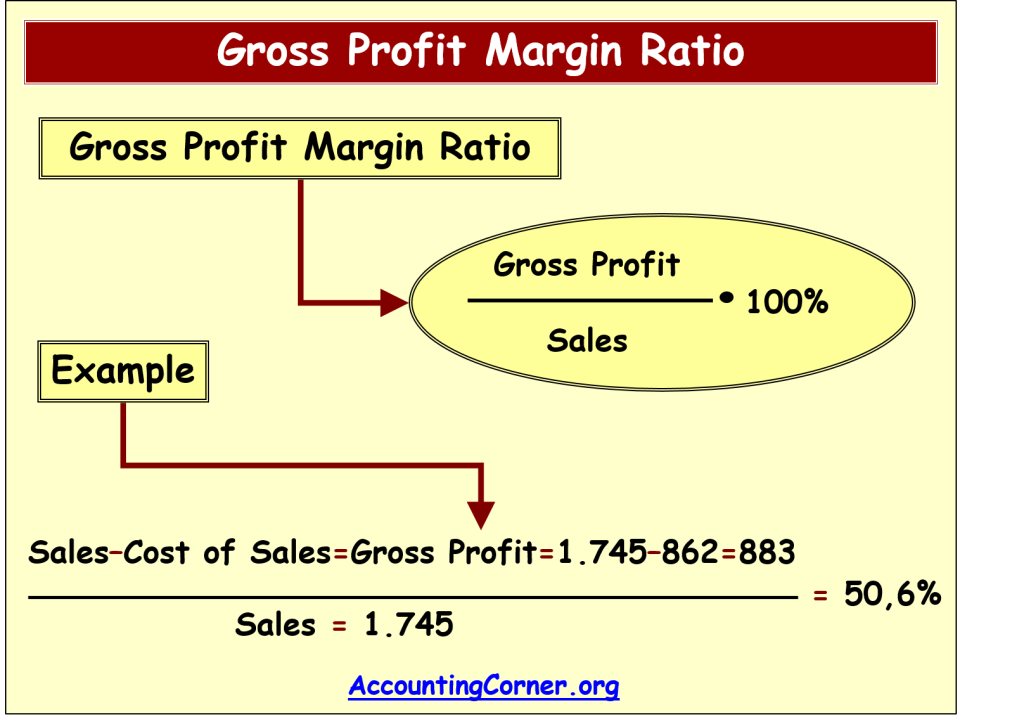

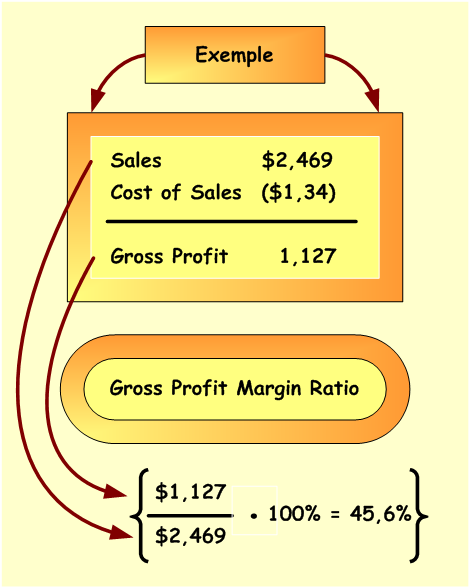

From the picture below you can see Gross Profit Ratio formula, i.e.:

- First we need to calculate Gross Profit, which is (as mentioned above) the difference between Sales (this amount should include Net Sales) and Cost of Goods Sold.

2. Second we use Gross Profit Margin Formula, i.e. we deduct Gross Profit by Net Sales Revenue and multiply by 100% and we get the percentage:

2. Second we use Gross Profit Margin Formula, i.e. we deduct Gross Profit by Net Sales Revenue and multiply by 100% and we get the percentage:

In this picture you can an example how the calculation is done.

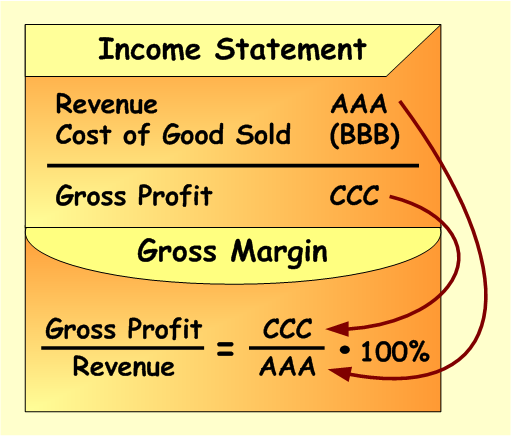

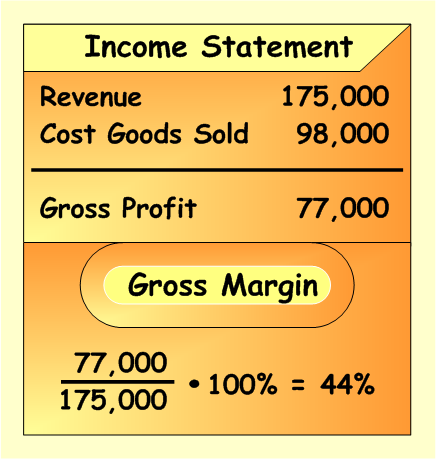

In the picture below you can also find how the calculation looks like if we use data from the Income Statement directly:

In order to understand this ratio better, find below couple of examples on how to find Gross Profit Margin, which can help you understand the concept. Please also note that it is recommended to compare this ratio for a particular business from period to period in order to understand the trend and estimate how good the business is able to perform its main activities. Also comparison can be done via comparing this ratio for similar businesses operating in the same area/ industry. This comparisons can provide the users of financial statement good information how well does the business perform comparing to the peers in the same industry and across the same comparable periods of time

Gross Profit Percentage Calculation Example 1

Gross Profit Margin Calculation Example 2

On some websites online you can also find Gross Profit Margin calculators, please use some of the below links: