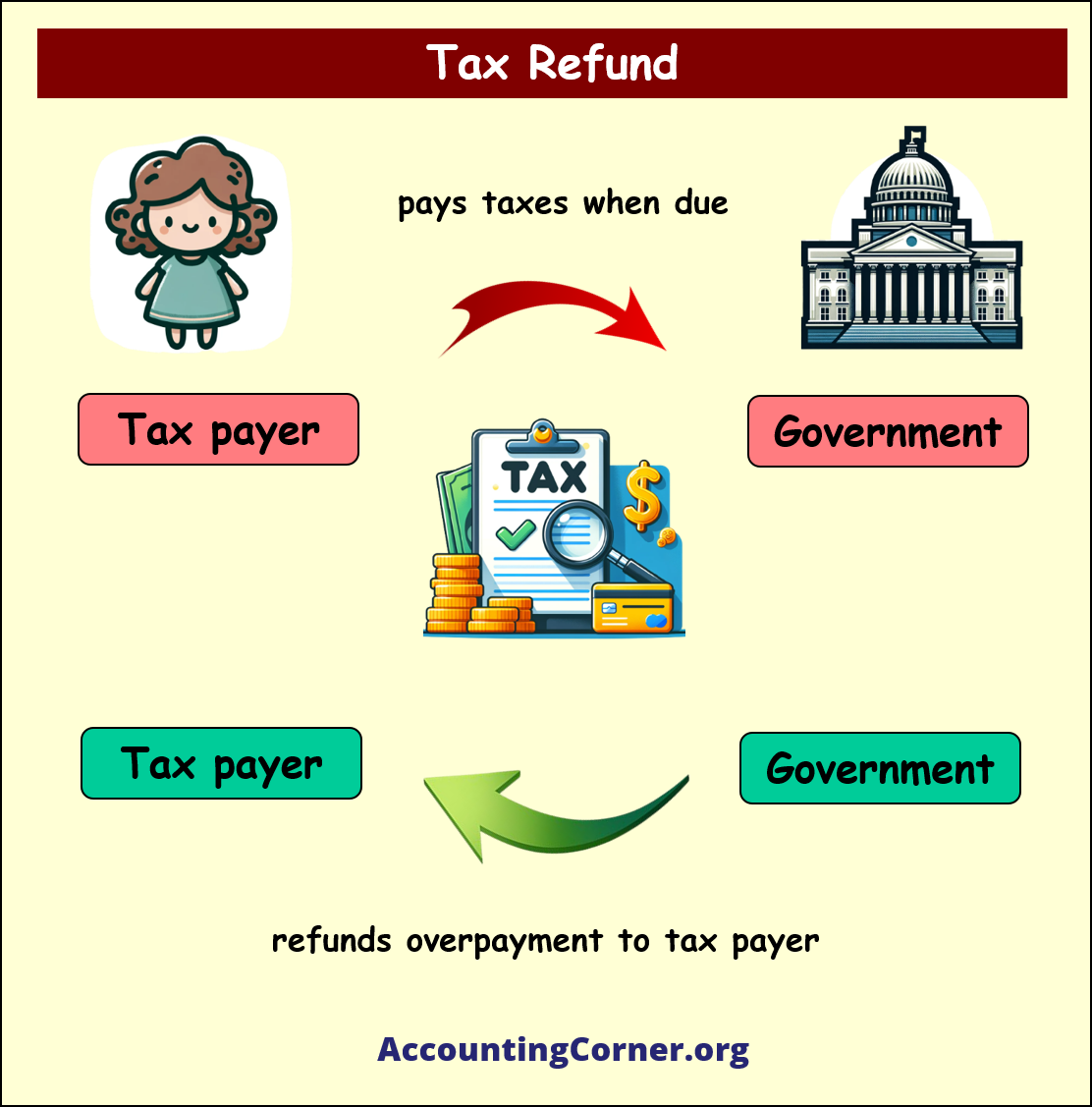

A tax refund is a return of excess taxes paid by an individual or business to the government over the course of a tax year. Here’s a detailed breakdown of the concept:

General Concept

- Overpayment of Taxes: Tax refunds occur when taxpayers pay more in taxes throughout the year than what they owe. This overpayment can result from withholding too much from paychecks or overestimating quarterly tax payments.

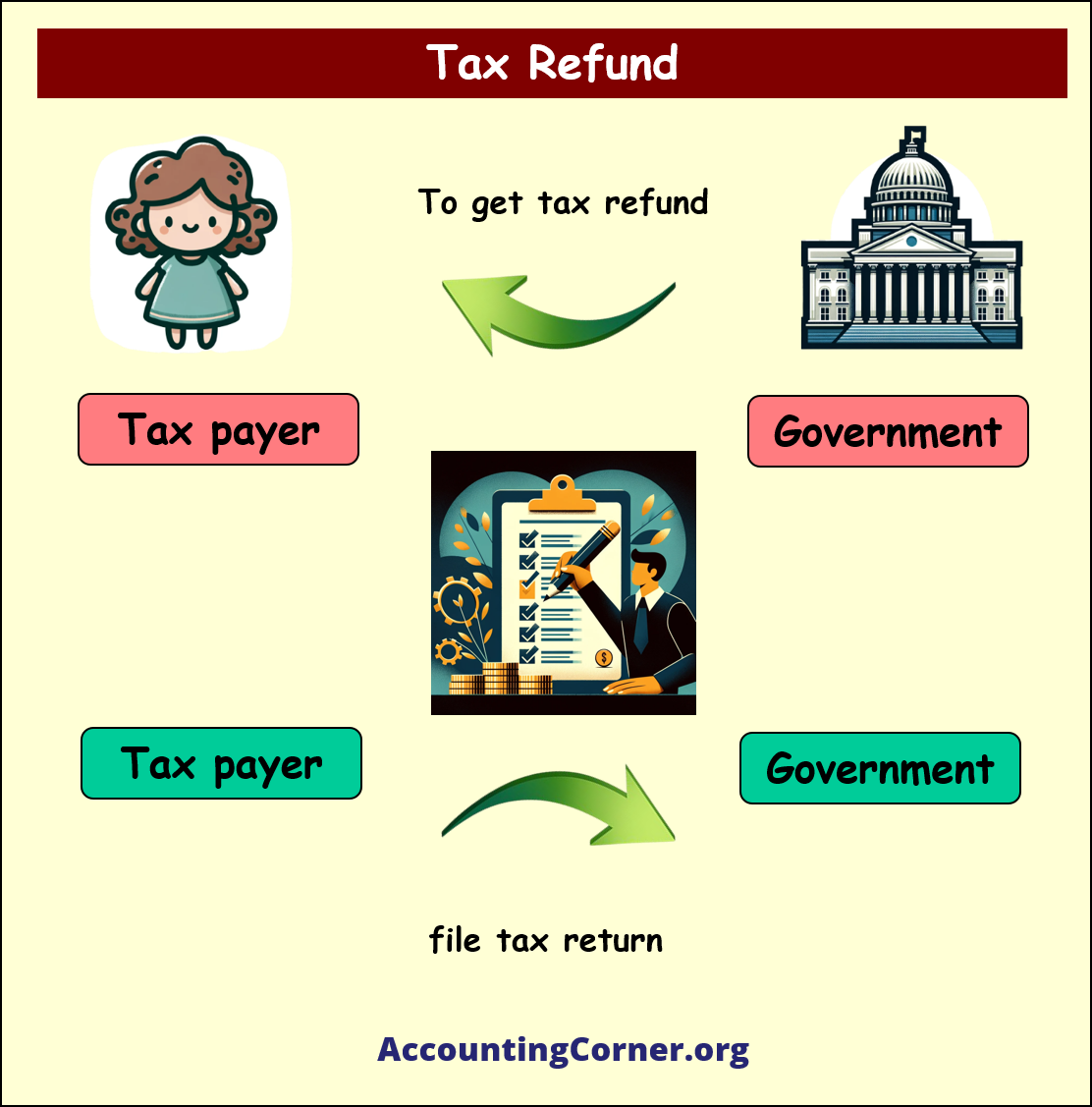

- Filing a Tax Return: To receive a refund, taxpayers must file a tax return, detailing their income, deductions, and credits. If the calculations show that they’ve paid more than their actual tax liability, the government refunds the difference.

Practical Examples

- Employee Withholding: An employee may have more tax withheld from their paycheck than necessary. When they file their tax return and account for deductions and credits, it may turn out they’ve paid more than they owe.

- Self-Employed Estimates: A self-employed individual makes estimated tax payments quarterly. If they overestimate their income, they may pay more in taxes than needed, leading to a refund after filing their return.

Importance of the Concept

- Financial Planning: Tax refunds can impact personal finance, acting as a form of forced savings which is returned after filing taxes.

- Economic Indicator: Large aggregate tax refunds can influence consumer spending, impacting the economy.

Types of Tax Refunds

- Regular Tax Refund: Based on overpayment of income taxes.

- Refundable Tax Credits: Credits like the Earned Income Tax Credit (EITC) in the U.S., which can result in a refund even if the taxpayer has no tax liability.

Applicability and Country Dependence

- Varies by Country: Each country has its own tax laws and systems, affecting how and when tax refunds are issued.

- Different Tax Systems: Some countries may have more straightforward or automated tax systems, reducing the frequency of large refunds.

Rules in the USA

- Deadline for Filing: Typically, April 15th for filing a tax return.

- Withholding and Estimated Taxes: Employees have taxes withheld; self-employed individuals make estimated tax payments.

- Tax Credits and Deductions: Eligibility for various credits and deductions can affect the refund amount.

- IRS Processing: The Internal Revenue Service (IRS) processes returns and issues refunds, often within a few weeks of filing.

Conclusion

The concept of a tax refund is integral to many tax systems, serving as a mechanism to return overpayments. Its importance lies in both personal financial management and broader economic impact. The specifics, such as when a refund is applicable and the rules governing it, vary significantly from country to country. In the USA, the IRS manages the process, with specific rules and deadlines dictating how refunds are calculated and distributed.

Return from Tax Refund to AccountingCorner.org