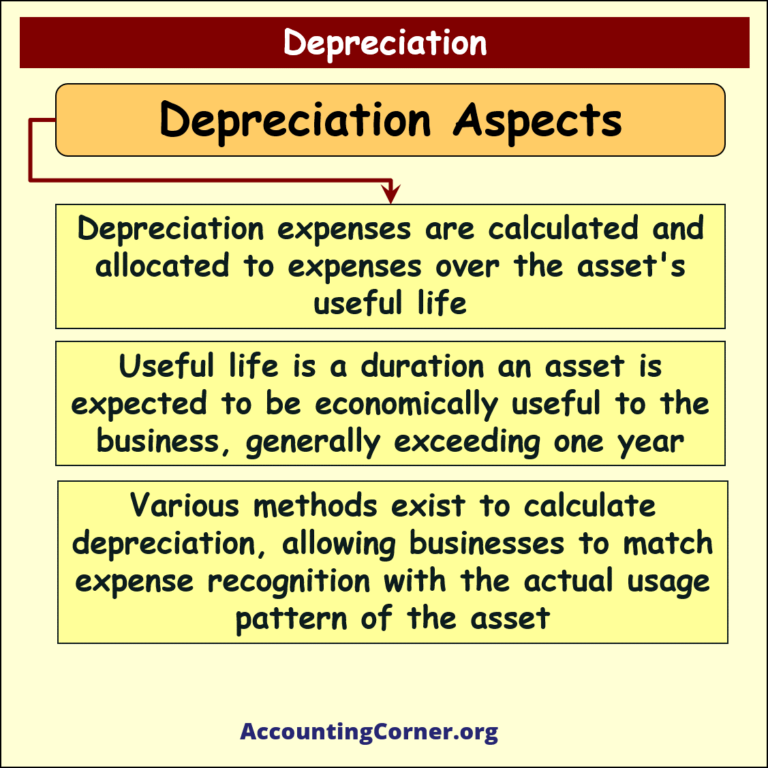

Depreciation is a fundamental accounting process that distributes the cost of a tangible asset over its useful life. This gradual cost allocation reflects the asset’s consumption, wear and tear, and obsolescence, ensuring that expenses match the revenues generated by the asset over time. Understanding depreciation is essential for maintaining accurate financial records and ensuring the appropriate replacement of assets.

What is Depreciation?

In accounting, depreciation is not a measure of asset valuation but rather a method of cost allocation. It involves systematically charging a portion of the asset’s original cost to each period in which the asset is expected to generate economic benefit. Unlike a one-time expense, depreciation distributes this cost over several periods, making it a vital aspect of financial reporting.

Key Points:

- Expense Recognition: Depreciation is recorded as an expense on the income statement.

- Balance Sheet Impact: Accumulated depreciation is reflected as a reduction in asset value on the balance sheet.

- Long-Term Implications: It provides insight into the need for asset replacement or disposal.

Factors Affecting Depreciation

The calculation of depreciation is based on several critical factors, which include:

- Asset Cost: This is the initial acquisition cost, including purchase price, installation, and any other expenses necessary to prepare the asset for use.

- Useful Life: The expected duration the asset will contribute to the business, which may differ from its physical life due to factors like obsolescence or company needs.

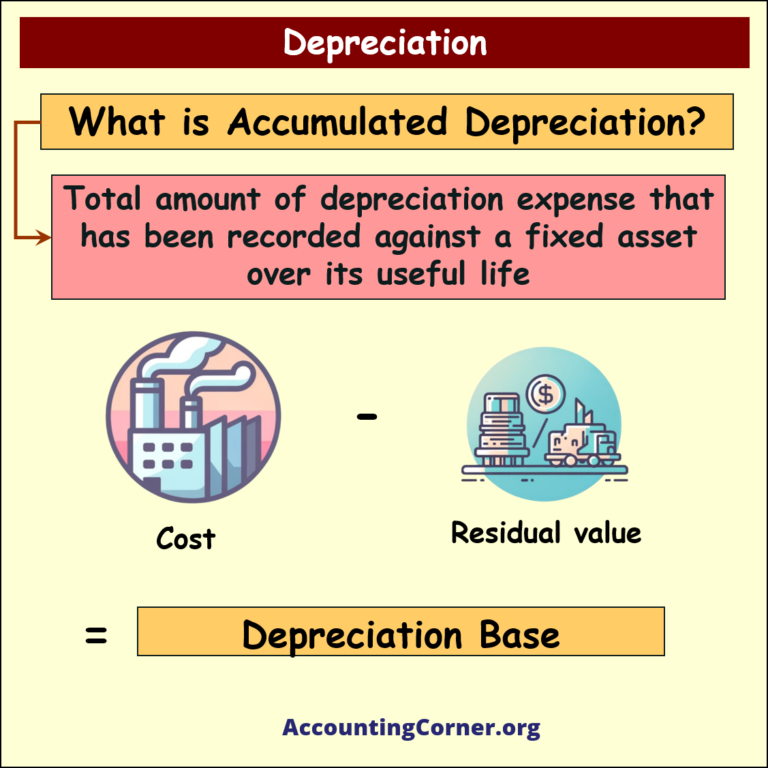

- Residual (Salvage) Value: The estimated value at the end of the asset’s useful life. The depreciation base is the asset cost minus this salvage value.

- Depreciation Method: Different methods are used to allocate the depreciation expense based on the asset’s utility pattern.

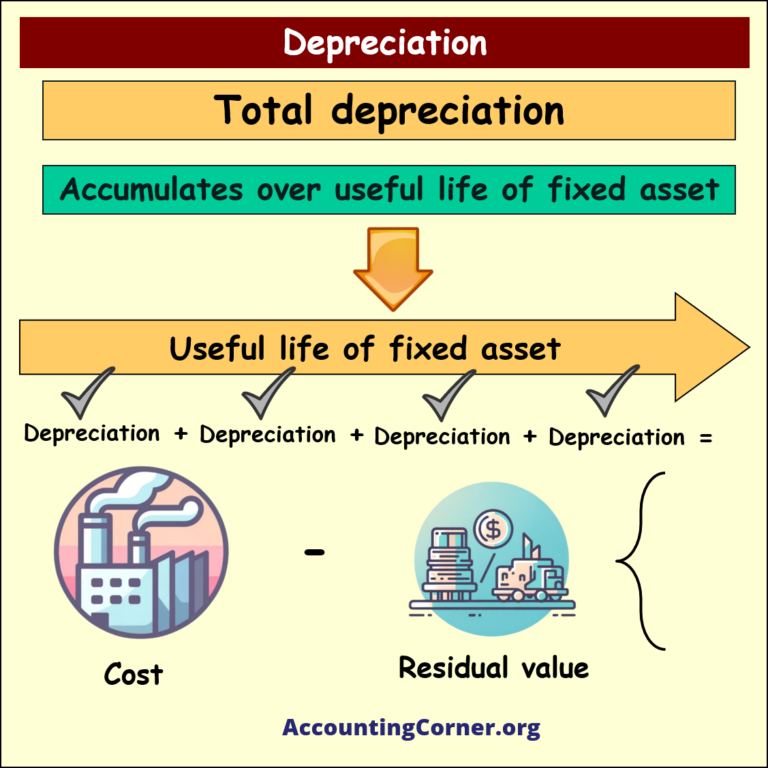

Depreciation Base Formula

The depreciation base of an asset is calculated as follows:

Depreciation Base = Asset Cost – Residual Value

For example, if an asset costs $15,000 and has a residual value of $2,000, the depreciation base would be $13,000.

Estimation of Service Life

The service life of an asset can be affected by:

- Physical Factors: Wear and tear due to usage, exposure to elements, or decay.

- Economic Factors: Changes in demand, technological advances, or obsolescence can shorten an asset’s useful life.

Types of Economic Factors:

- Inadequacy: When an asset can no longer meet the company’s production requirements.

- Supersession: Replacement due to a more efficient alternative.

- Obsolescence: The asset becomes outdated, often due to technological changes.

Common Depreciation Methods

- Straight-Line Method: This method allocates an equal depreciation expense to each period. It is ideal for assets with a steady usage pattern.Formula: Annual Depreciation = (Cost – Residual Value) / Useful Life

Example: A machine costing $10,000 with a $1,000 residual value and a 5-year useful life has an annual depreciation of $1,800.

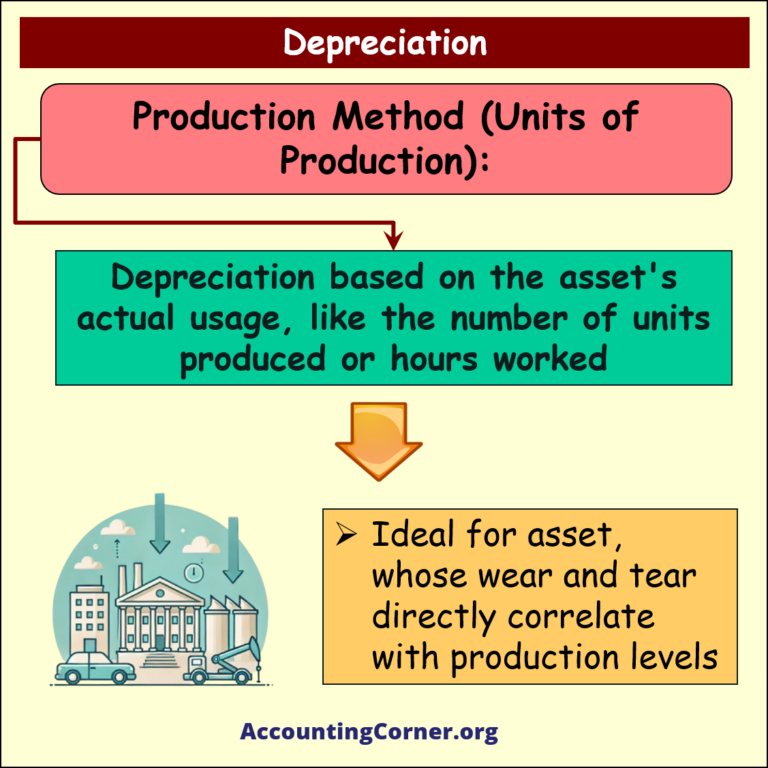

- Units of Production Method: Depreciation is based on actual usage, ideal for assets whose wear correlates with activity levels.Formula: Depreciation per Unit = (Cost – Residual Value) / Total Expected Units

Example: If a machine produces 100,000 units and has a depreciation base of $9,000, each unit produced depreciates $0.09.

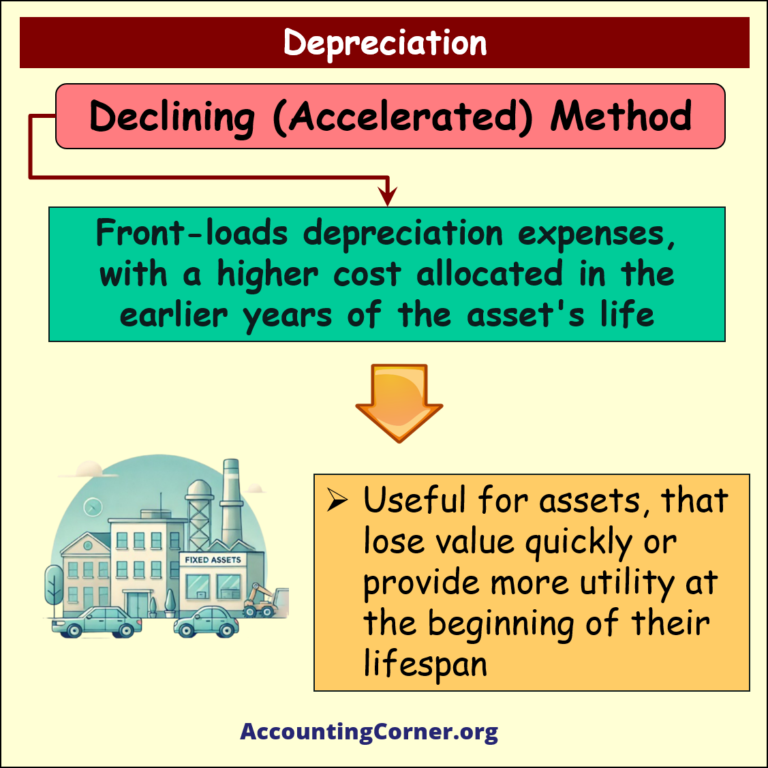

- Declining Balance Method: An accelerated method where more depreciation is recorded in the asset’s early years, useful for assets that lose value faster initially.

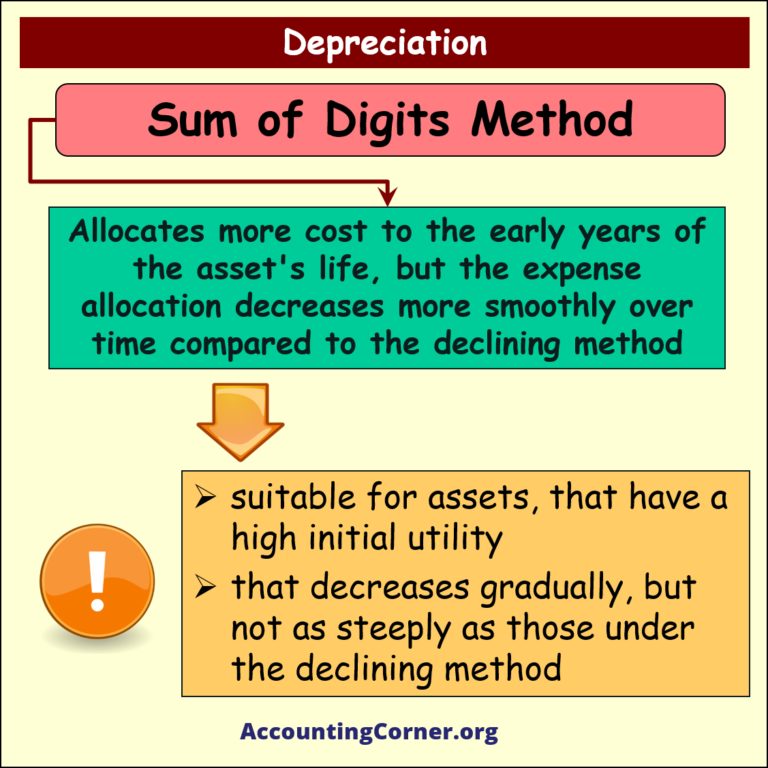

- Sum-of-the-Years’ Digits Method: Another accelerated method, allocating more expense in early years but declining smoothly.

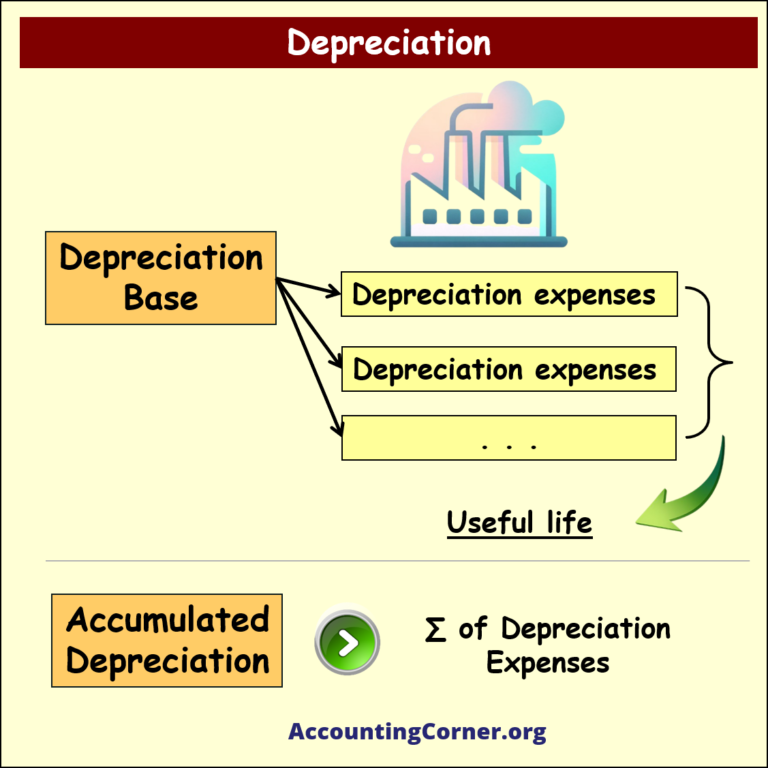

Accumulated Depreciation and Book Value

Accumulated Depreciation is the total depreciation recorded against an asset since its acquisition, reducing its book value on the balance sheet.

Net Book Value Formula: Net Book Value = Asset Cost – Accumulated Depreciation

Example: An asset costing $25,000 with $12,000 in accumulated depreciation has a net book value of $13,000.

Impact of Depreciation on Financial Statements

Depreciation affects both the Income Statement and Balance Sheet:

- Income Statement: Recognized as an expense, reducing net income.

- Balance Sheet: Accumulated depreciation lowers the asset’s carrying amount, offering a realistic value of long-term assets.

The Role of Depreciation in Financial Analysis

Depreciation is not merely an accounting formality; it reflects a business’s commitment to maintaining a realistic view of asset value. It aids in strategic planning for future asset replacements and aligns expenses with income generation. Different depreciation methods allow companies to choose a model that best fits the asset’s utility pattern, ensuring transparency and accuracy in financial reporting.

Conclusion

Depreciation is a critical tool for aligning asset cost with revenue periods, providing a fair representation of asset value over time. By accurately calculating and applying depreciation, companies can strategically manage assets, maintain financial transparency, and ensure sound planning for future investments.

Summary:

- Depreciation Definition: Systematic allocation of asset cost over useful life.

- Depreciation Base: Asset cost minus residual value.

- Depreciation Methods: Straight-line, units of production, declining balance, and sum-of-the-years’ digits.

- Financial Impact: Reduces income through expenses and lowers asset value on balance sheet.

- Strategic Role: Essential for financial planning and accurate asset management.

Through these methods, depreciation not only ensures compliance with accounting standards but also supports better financial decision-making and asset lifecycle management.

Depreciation – Visuals

Depreciation – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Depreciation to AccountingCorner.org home