Double Entry Accounting is a crucial concept in the field of accounting and finance, particularly important for readers of a blog focused on these topics. Here’s a detailed explanation covering various aspects of this subject:

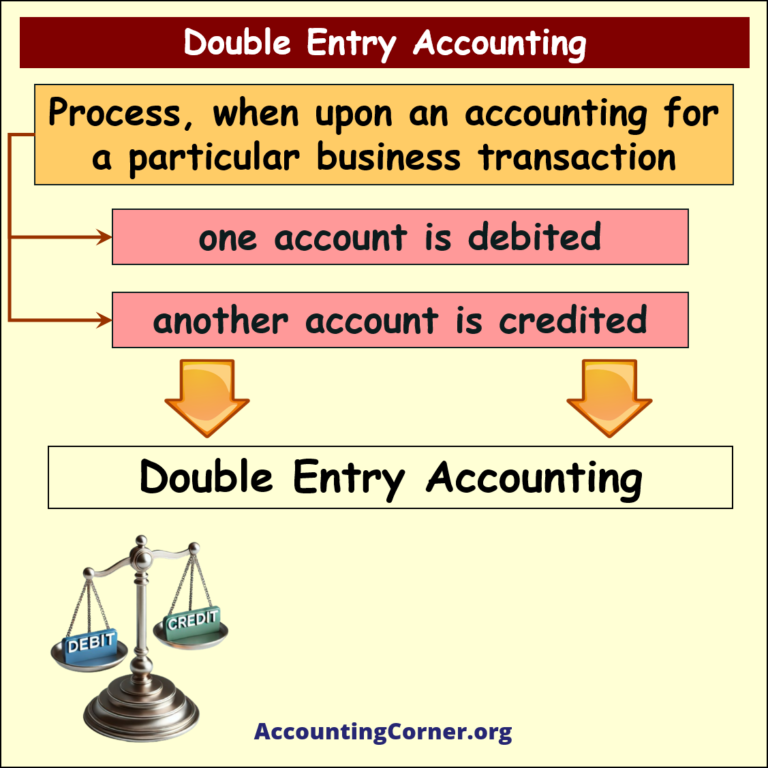

- Definition of Double Entry Accounting:

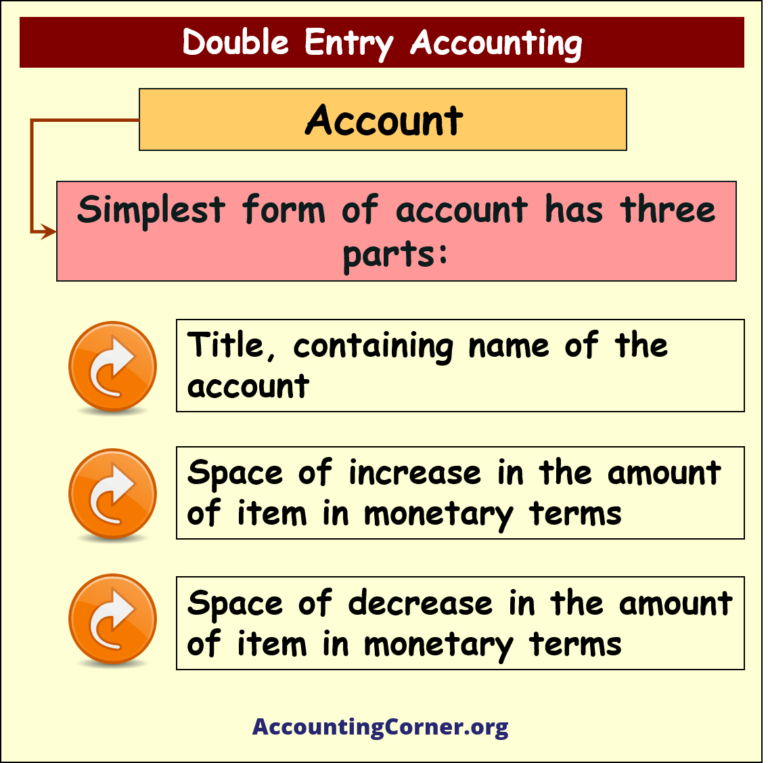

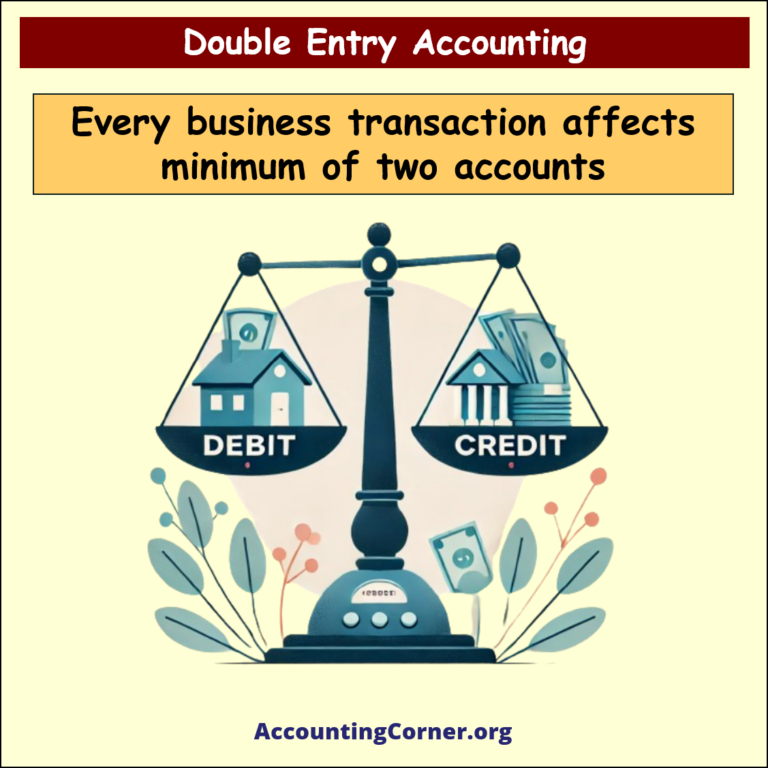

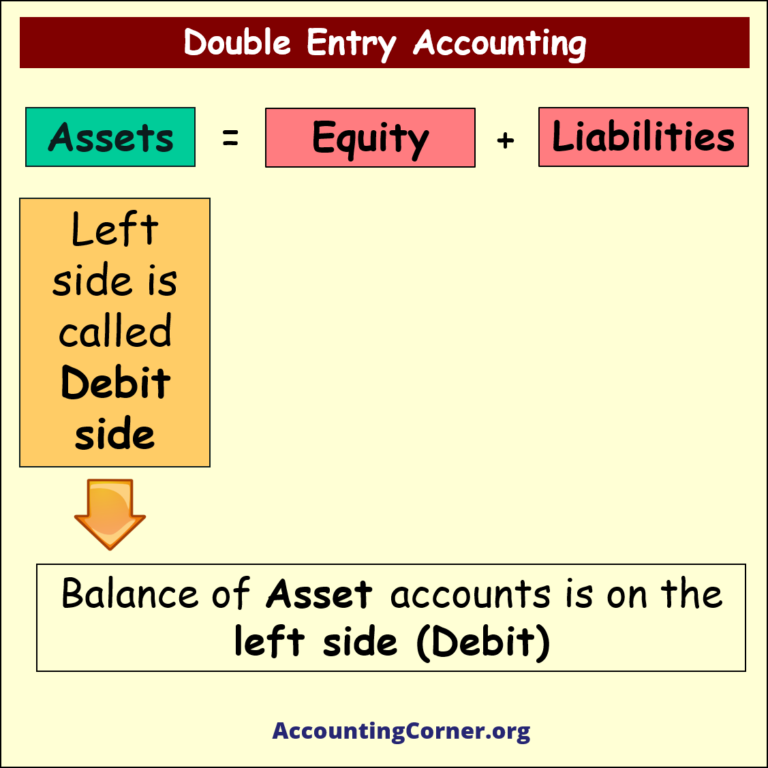

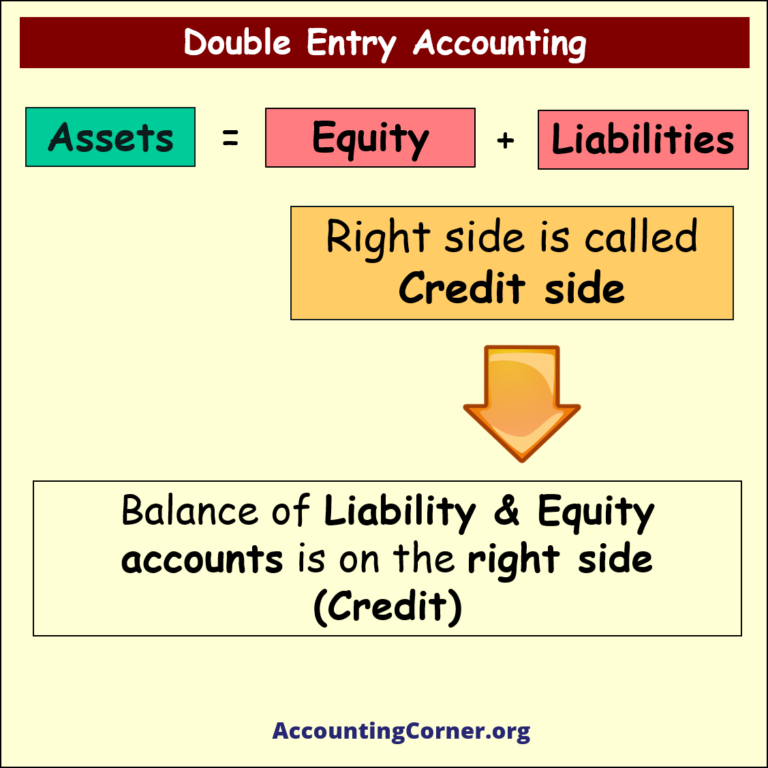

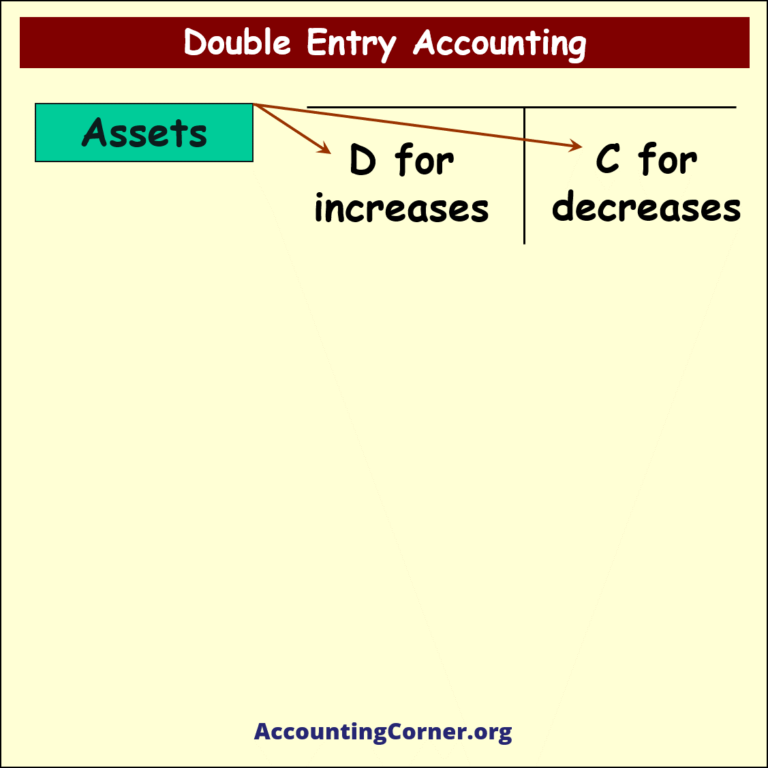

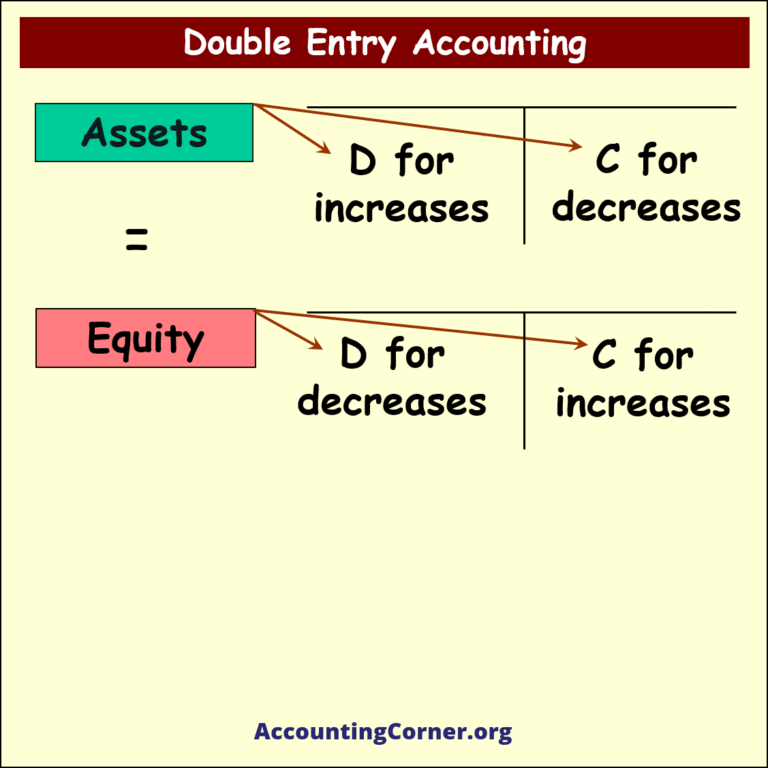

- Double Entry Accounting is a bookkeeping system where every financial transaction has equal and opposite effects in at least two different accounts. It is based on the accounting equation: Assets = Liabilities + Equity. For every debit entry, there is a corresponding credit entry, and vice versa, ensuring the accounting equation remains balanced.

- Importance of Double Entry Accounting:

- This system provides a complete record of financial transactions, making it easier to produce accurate financial statements like the balance sheet, income statement, and cash flow statement.

- It enhances the accuracy and reliability of financial information, as each entry is balanced by another, reducing the risk of errors.

- Double Entry Accounting is fundamental for businesses of all sizes as it helps in detailed financial analysis and aids in decision-making.

- Practical Examples:

- For instance, when a business makes a sale on credit, it would record the transaction by debiting accounts receivable and crediting sales revenue. This reflects the increase in assets (receivable) and the increase in equity (revenue).

- If a company purchases equipment, it would debit the equipment account and credit the cash or accounts payable account, reflecting the acquisition of a new asset and the decrease in another asset (cash) or increase in liability (payable).

- Issues and Concerns Related to Double Entry Accounting:

- Complexity: It can be more complex than single-entry accounting, requiring a more in-depth understanding of accounting principles.

- Error Detection and Correction: While the system helps in minimizing errors, detecting and correcting them can be challenging, as it requires tracing back through various accounts.

- Software Dependency: Many businesses rely on accounting software to manage double-entry bookkeeping, which necessitates a dependency on technology and software reliability.

- Training and Expertise Required: Proper implementation of double entry accounting requires trained personnel with a good understanding of accounting principles.

In summary, Double Entry Accounting is a comprehensive and systematic approach to recording financial transactions, which is essential for accurate and reliable financial reporting. It is a cornerstone of modern accounting practices and is crucial for businesses and organizations to maintain a clear and complete financial record.

Double Entry Accounting – Visuals

Double Entry Accounting – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Double Entry Accounting to AccountingCorner.org home