Additional Paid-In Capital (APIC) is a critical financial concept, primarily found in the equity section of a company’s balance sheet. It refers to the amount that investors pay above the par value of a company’s stock during the initial issuance. This capital represents the extra funds raised by a company beyond the face value of the shares and highlights investor confidence in the business’s potential for growth. Understanding APIC is crucial for analyzing a company’s financial structure, its ability to raise equity capital, and how it manages shareholder investments.

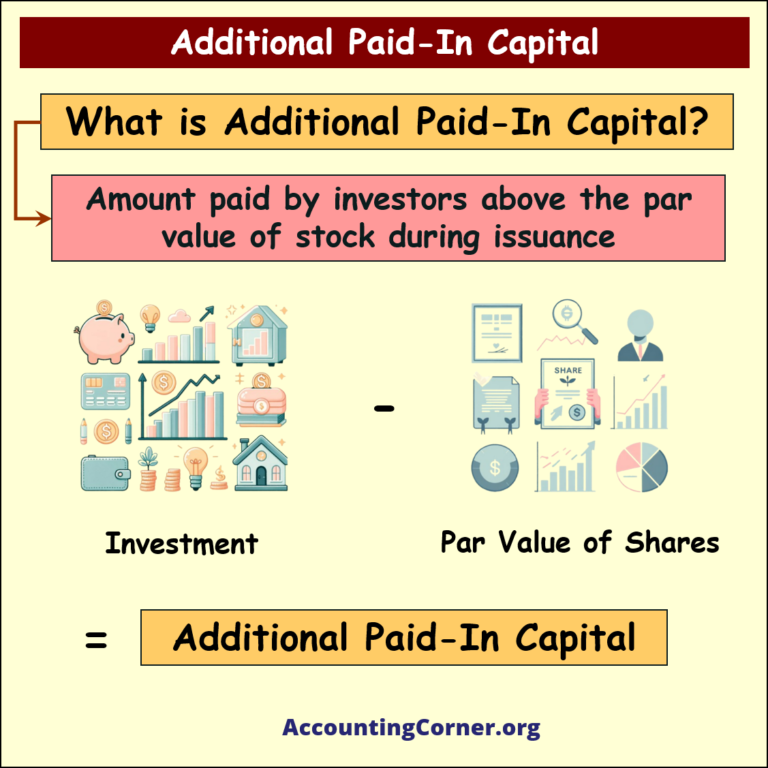

What is Additional Paid-In Capital?

APIC is the excess of investment received over the par value of the stock issued by a company. This concept comes into play when shares are sold at a price higher than their nominal value. The additional amount that investors are willing to pay above the par value is recorded under APIC.

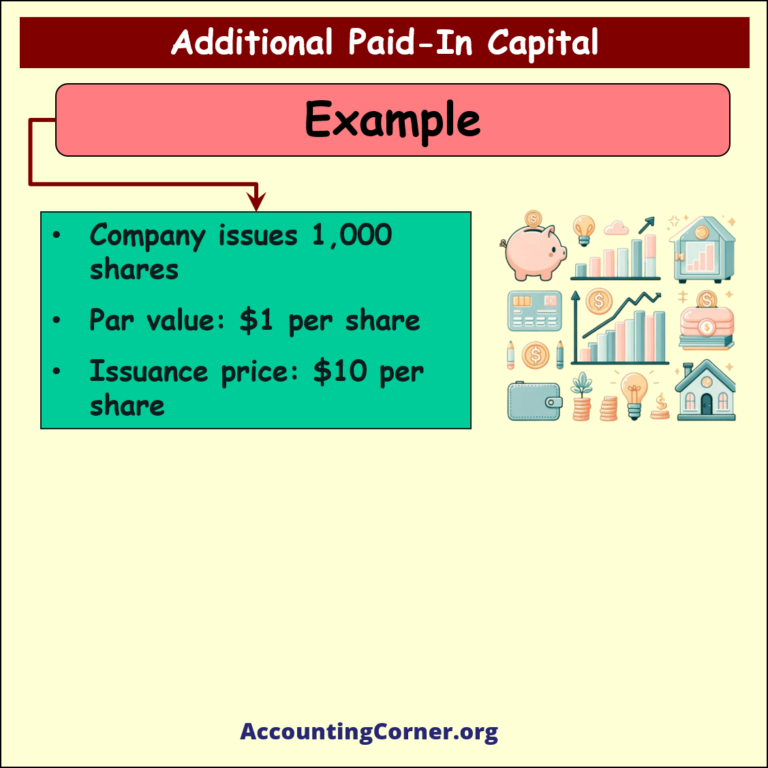

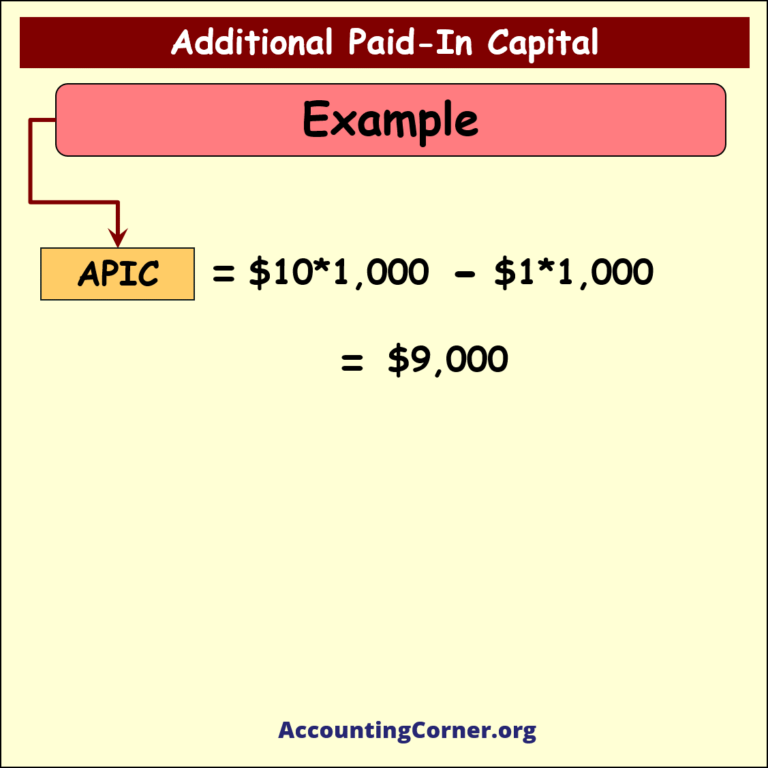

For Example:

- A company issues 1,000 shares at $10 per share.

- The par value is $1 per share.

- APIC = ($10 – $1) * 1,000 = $9,000.

This $9,000 is recorded as Additional Paid-In Capital on the company’s balance sheet, separate from the common stock’s par value.

Key Components of APIC

- Investment Above Par Value: Investors may pay more than the nominal value of the stock, reflecting confidence in the company.

- Recorded in Equity Section: APIC is part of the shareholders’ equity in the balance sheet, along with retained earnings and common stock.

- APIC Calculation: The formula is straightforward:

- APIC=(Issuance Price−Par Value)×Number of Shares Issued

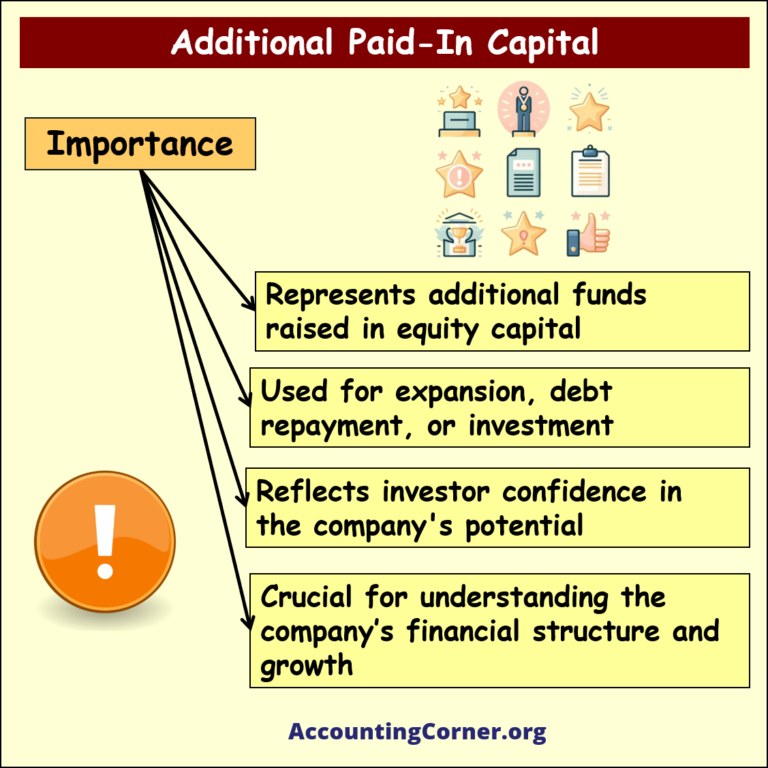

Importance of Additional Paid-In Capital

APIC serves multiple roles in the financial landscape of a business:

- Equity Capital: It represents additional funds raised through equity capital, often used for expansion, repaying debt, or further investment.

- Investor Confidence: A higher APIC value indicates that investors believe in the company’s long-term growth, as they are willing to pay more than the nominal value for shares.

- Growth Potential: Companies with significant APIC have more flexibility to utilize this equity for future business ventures or expansion strategies.

How APIC Impacts Financial Reporting

Properly recording APIC is essential for transparency in financial reporting. Misstatements in APIC can lead to investor distrust and regulatory issues. Accurate representation ensures that the company’s financial health is correctly conveyed to stakeholders.

Key Reporting Considerations:

- Transparency: Ensures stakeholders understand the company’s true equity position.

- Compliance: Proper APIC reporting helps companies meet accounting standards and legal regulations.

Potential Issues and Challenges with APIC

While APIC is an indicator of strong investor confidence, there are several challenges and considerations that companies need to manage:

- Investor Expectations: A high APIC figure can set high expectations from investors regarding the company’s performance. Failing to meet these expectations may negatively affect stock prices.

- Market Perception: APIC fluctuations, particularly through subsequent equity offerings, can influence the market’s view of a company. Sudden changes can signal shifts in financial strategy or investor sentiment.

- Tax Implications: While APIC itself does not have direct tax consequences, the capital-raising strategy associated with it can affect a company’s broader tax strategy. Companies need to consider tax-efficient methods when structuring capital raises.

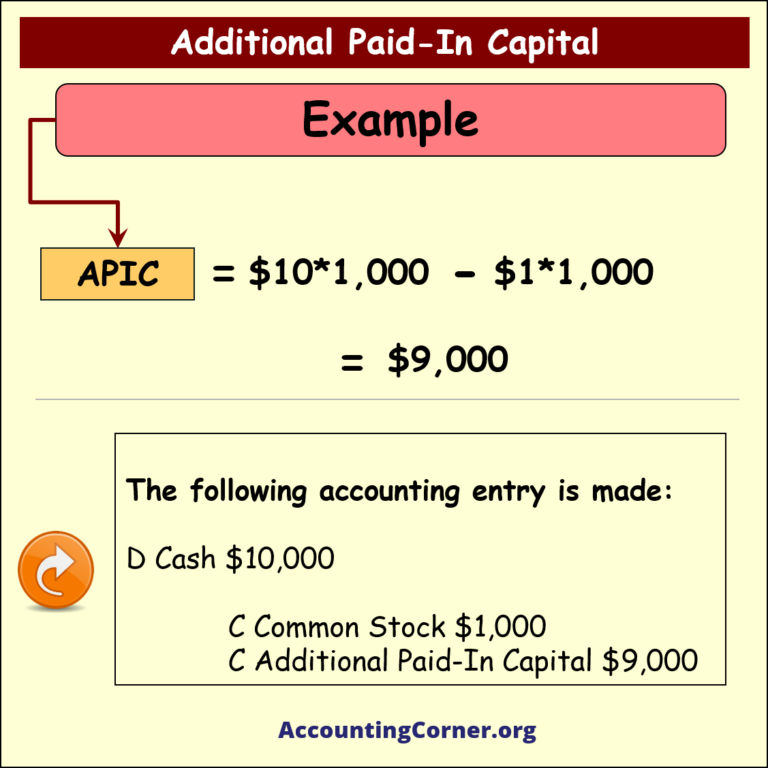

Practical Example: APIC Accounting Entry

When a company issues shares at a price higher than the par value, the accounting entries reflect both the common stock and APIC components.

Example Accounting Entry:

- Debit: Cash $10,000 (1,000 shares issued at $10 per share)

- Credit: Common Stock $1,000 (par value $1 per share)

- Credit: Additional Paid-In Capital $9,000 (the difference between issuance price and par value)

Conclusion: The Strategic Role of APIC

Additional Paid-In Capital is more than just an accounting term—it represents investor trust, future growth potential, and the financial strength of a company. By providing additional equity capital, APIC plays a vital role in a company’s ability to expand operations, reduce debt, and strategically position itself in the market.

Understanding the nuances of APIC helps investors, financial analysts, and companies make informed decisions about equity financing and shareholder equity management. Maintaining accurate and transparent APIC records ensures that businesses remain compliant with regulations while fostering investor confidence.

Summary Points:

- 📊 APIC Definition: The amount paid by investors above the par value of issued shares.

- 💡 Importance: Reflects investor confidence and is a critical component of shareholder equity.

- 💼 Practical Example: APIC = (Issuance Price – Par Value) × Number of Shares Issued.

- ⚖️ Reporting: Vital for ensuring transparency, regulatory compliance, and clear financial structure.

- 💰 Use of Funds: APIC is often used for business expansion, debt repayment, or reinvestment in growth initiatives.

Additional Paid-In Capital – Visual Material

Additional Paid-In Capital – Video Material

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Additional Paid In Capital to AccountingCorner.org home