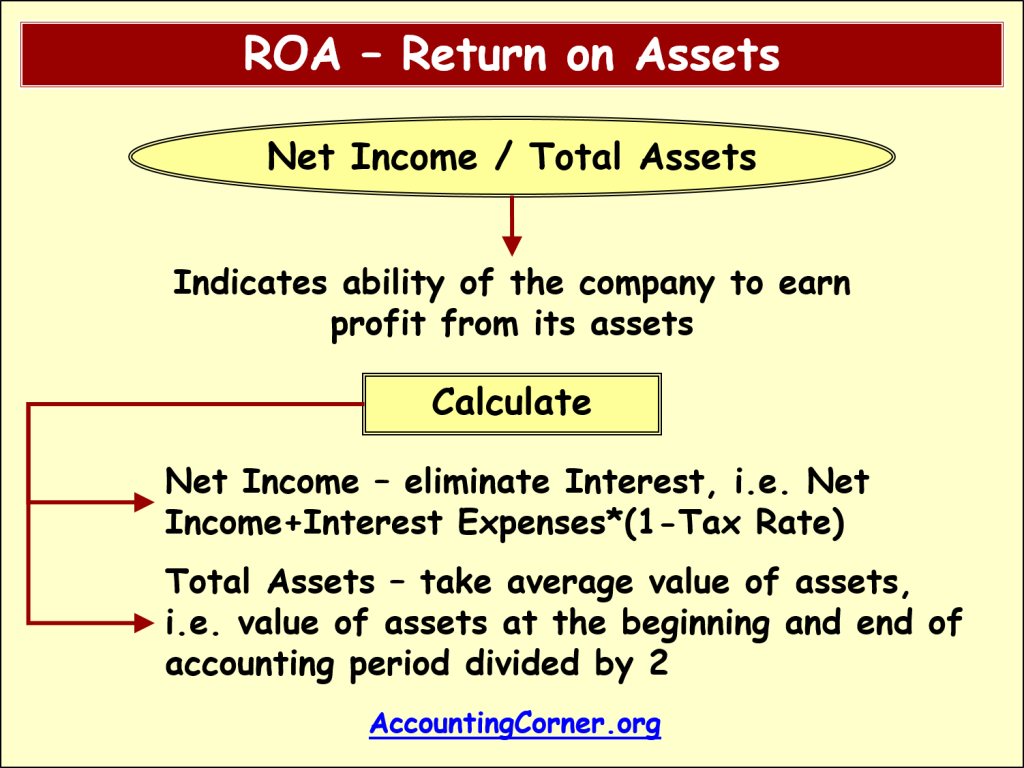

ROA – Return on Assets Ratio indicates the ability of the business to earn profit from its assets. It is a comparisons of profits earned with the assets used to earn these profits.

The most common ROA formula to calculate this ratio is to divide Net Income by Average Total Assets, i.e.:

ROA (Return on Assets) = Net Income / Average Total Assets

Average value of assets is used since it varies through the periods and there might be quite a significant difference in value at the start of the accounting period and at its end.

Therefore for calculation purposes we need to take value of total assets at the beginning of the accounting period and at its end and calculated average value, which to be used in ratio calculation. This is necessary since we need to compare Net Profit for the period with the assets value, where we use average value to have an indicative level over the whole period.

Also worth to mention that usually Net Income used in Return on Assets ratio calculation does not cover interest costs, i.e. Net Income before Interest Expenses (taking into account taxation) should be taken. The reason for this is that assets are being financed either by equity or debt, therefore it is essential to eliminate cost of borrowing in order to get proper result.

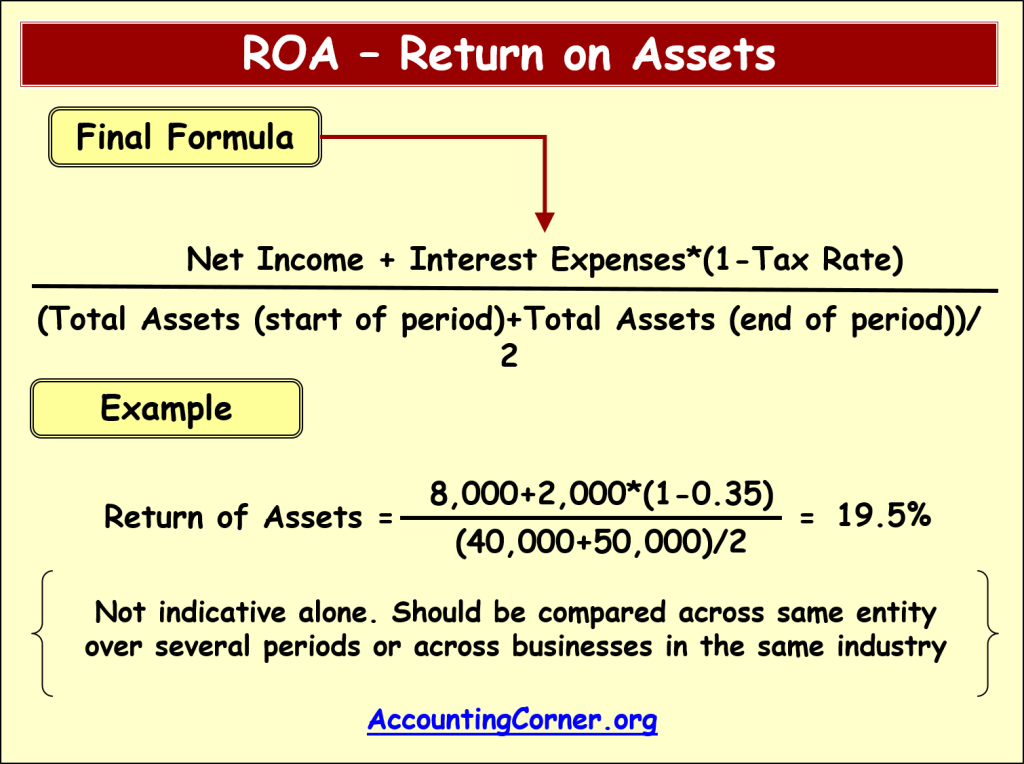

So, the final Return on Assets formula would look like this:

ROA (Return on Assets) = (Net Income+Interest Expenses * (1-Tax Rate)) / Average Total Assets

Of course, the ratio itself is not sufficiently indicative. It should be compared to the same ratio of the company for previous periods and to industry level.

Only this comparison will tell the data user whether the company is efficient enough in using its assets while the time passes and in comparison with the competitors. Of course, the higher the ROA ratio the better, which would mean that the business is able to earn more profits with less assets utilized. Investors can judge about the ability of the business to generate profits from investments in assets.

For example, if we have a business with the average value of assets amounting to 100 000 $, which earned annual profit of 4 000 $. And we have the second business with average value of assets amounting to 20 000 $, which earned 2 000 $ annual profit, comparison of only these figures will not provide us any judgment on how efficiently the assets were used.

For this purpose we will calculate Return on Assets (ROA).

-

ROA1 is 4 000 / 100 000=4%

-

ROA2 is 2 000 / 20 000=10%

This would lead us to the conclusion that the second business is able to utilize assets more efficiently and earn more profits comparing to the first business. Of course, as it was mentioned above it is necessary to compare ratios of the businesses across similar industry in order to draw proper conclusions on how well the company performs. And in addition it is essential to understand that businesses in those industries, which are more capital investment intensive (i.e. more assets are need for activities, like mining, oil refinery and similar) will have relatively lower ROA comparing to less capital investment intensive industries.

Usually the acceptable ROA (Return on Assets) level is not less than 5%. You can also check one more ratio – Gross Profit Margin for additional knowledge on financial analysis.

Check Balance Sheet Example and Income Statement Example to find data for ratio calculation.

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Return on Assets Ratio to AccountingCorner.org home