Find below explanations on the main accounting principles. There are a lot of basic accounting principles, however the most important are the following four:

- cost principle

- accrual accounting principle

- matching principle

- full disclosure principle

Accounting Principles

Definition:

- Accounting principles are standardized rules and guidelines for recording, classifying, and reporting financial transactions.

Purpose:

- They ensure consistency, reliability, and comparability in financial statements across companies and time periods.

Importance:

-

- Transparency: Provide clear and accurate financial information to stakeholders.

- Credibility: Ensure that businesses maintain trust and integrity in their financial reporting.

- Informed Decision-Making: Help investors, creditors, and other users of financial statements make better decisions based on reliable data.

Global Relevance:

- Accounting principles are used internationally, fostering uniformity in global financial markets.

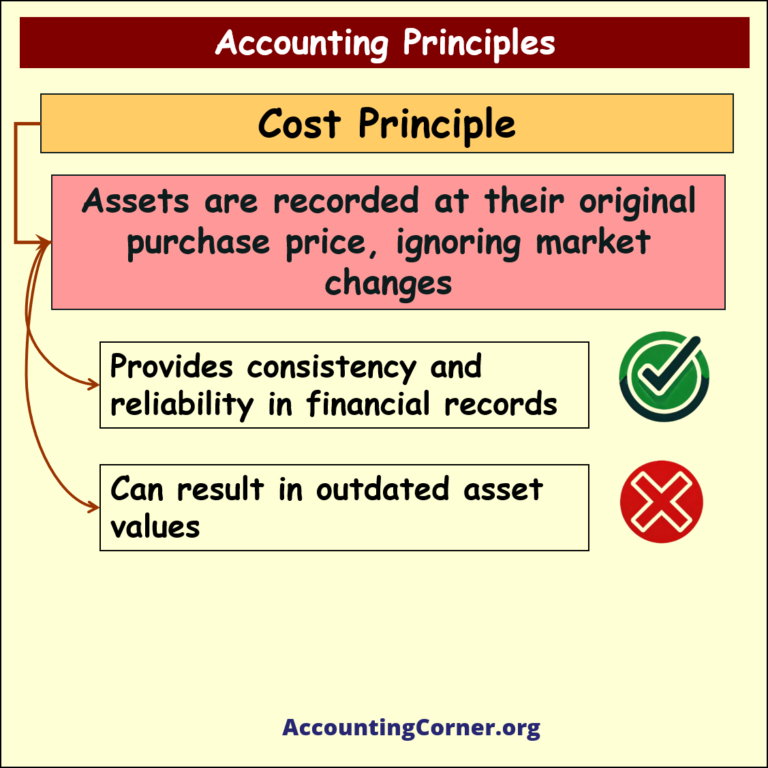

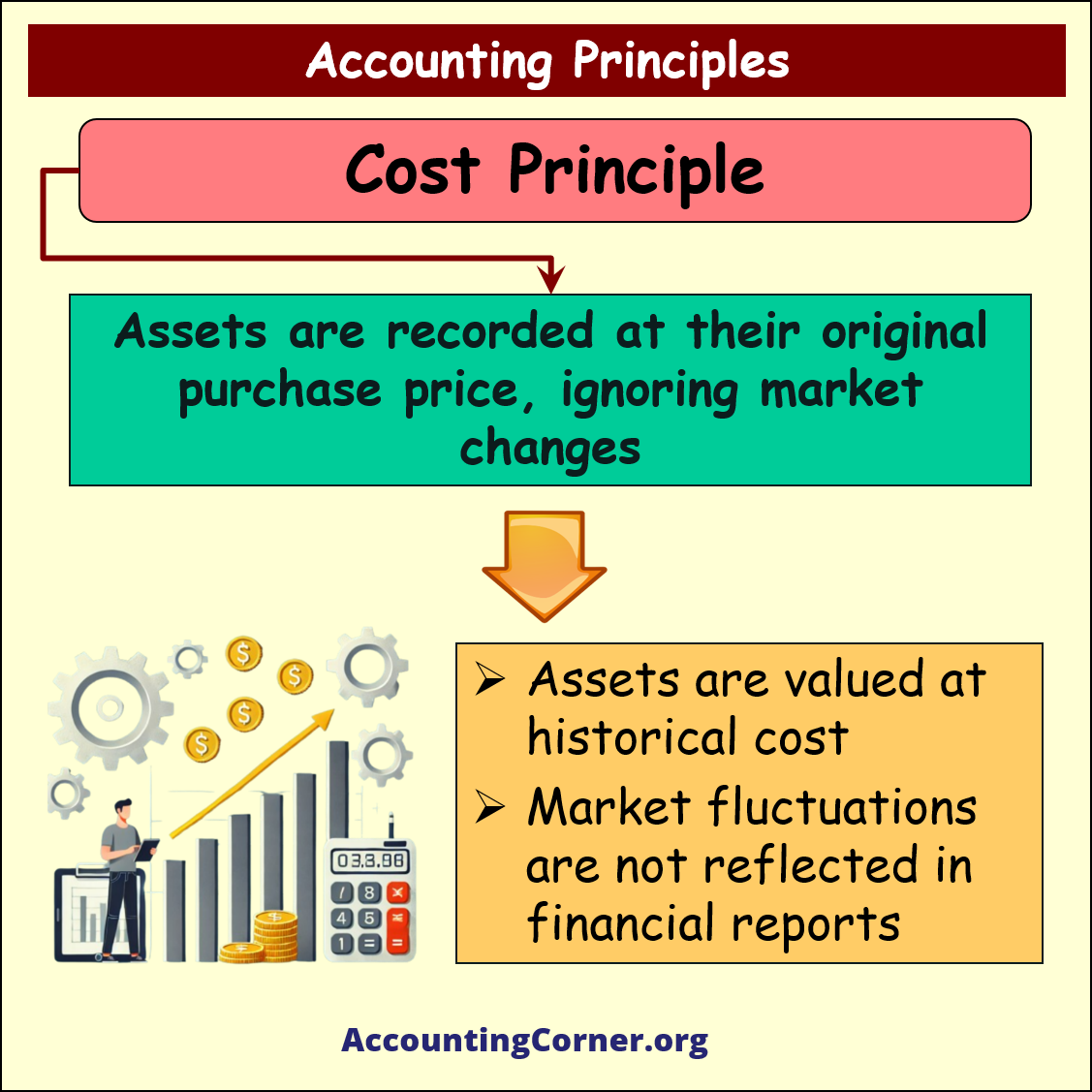

Cost Principle

➤ Essence: Assets are recorded at their original purchase price, ignoring market changes.

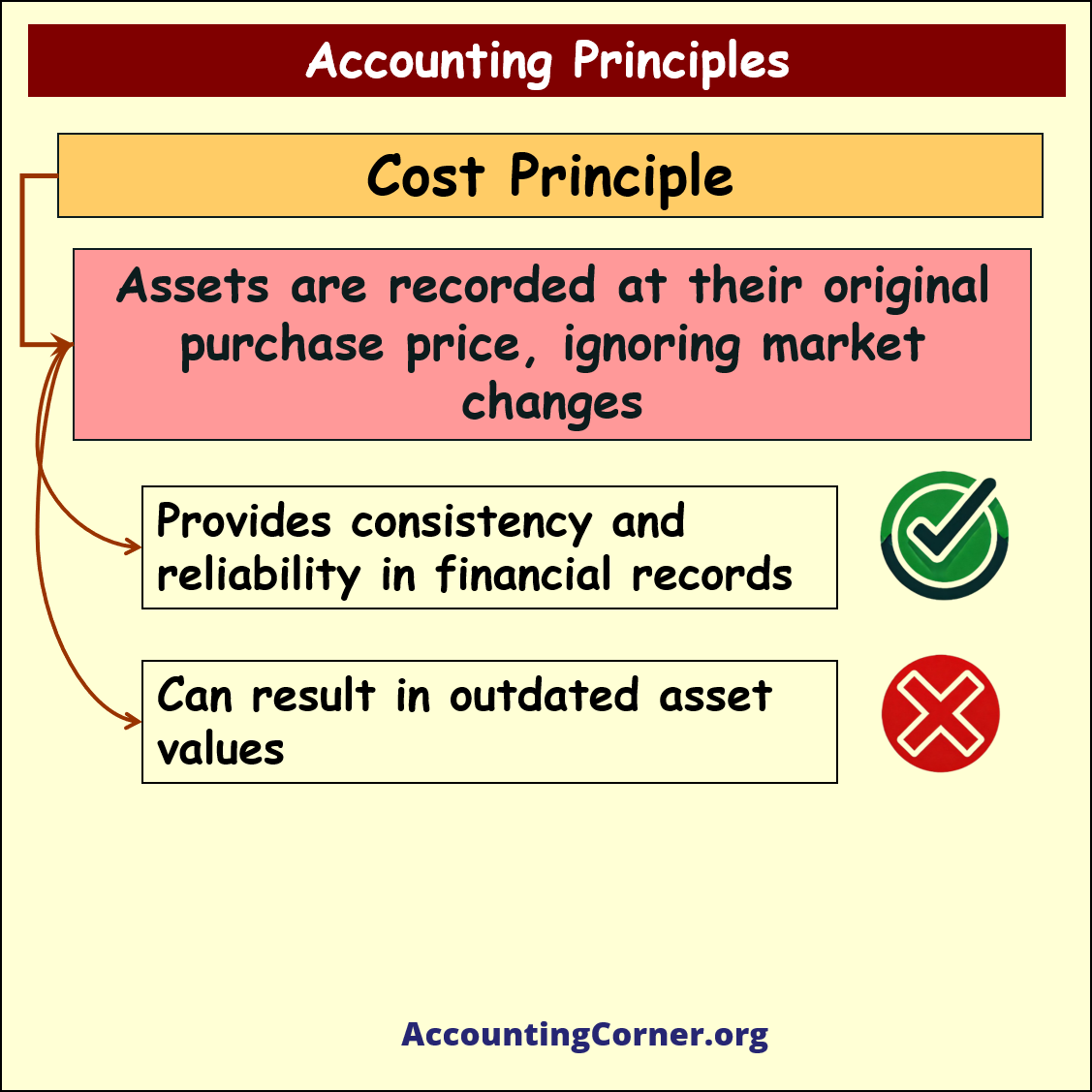

The cost principle dictates that companies should record assets based on their historical cost, meaning the amount that was paid during acquisition, rather than reflecting their current market value. This principle ensures objectivity and reliability in financial reporting because the purchase price is a verifiable figure. While this method emphasizes consistency, it doesn’t account for inflation or market value fluctuations, which can lead to outdated financial information over time.

The cost principle dictates that companies should record assets based on their historical cost, meaning the amount that was paid during acquisition, rather than reflecting their current market value. This principle ensures objectivity and reliability in financial reporting because the purchase price is a verifiable figure. While this method emphasizes consistency, it doesn’t account for inflation or market value fluctuations, which can lead to outdated financial information over time.

- Assets are valued at historical cost: For example, if a company buys a piece of equipment for $50,000, it will continue to list that equipment at $50,000 on its balance sheet, even if its market value increases or decreases over time.

- Market fluctuations are not reflected in financial reports: If that same piece of equipment is worth $60,000 today, the financial statement will still report the original purchase price of $50,000.

Benefit:

✅ The cost principle provides consistency and reliability in financial records because it relies on factual, objective figures from actual transactions.

Issue:

🚫 It can result in outdated asset values, particularly for long-held assets, which may no longer reflect their true worth in the market.

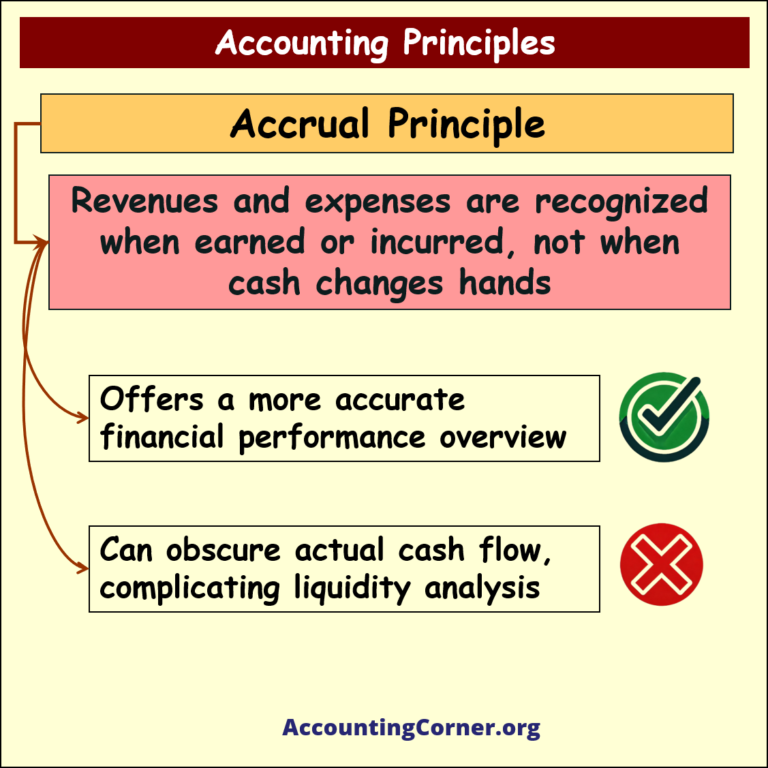

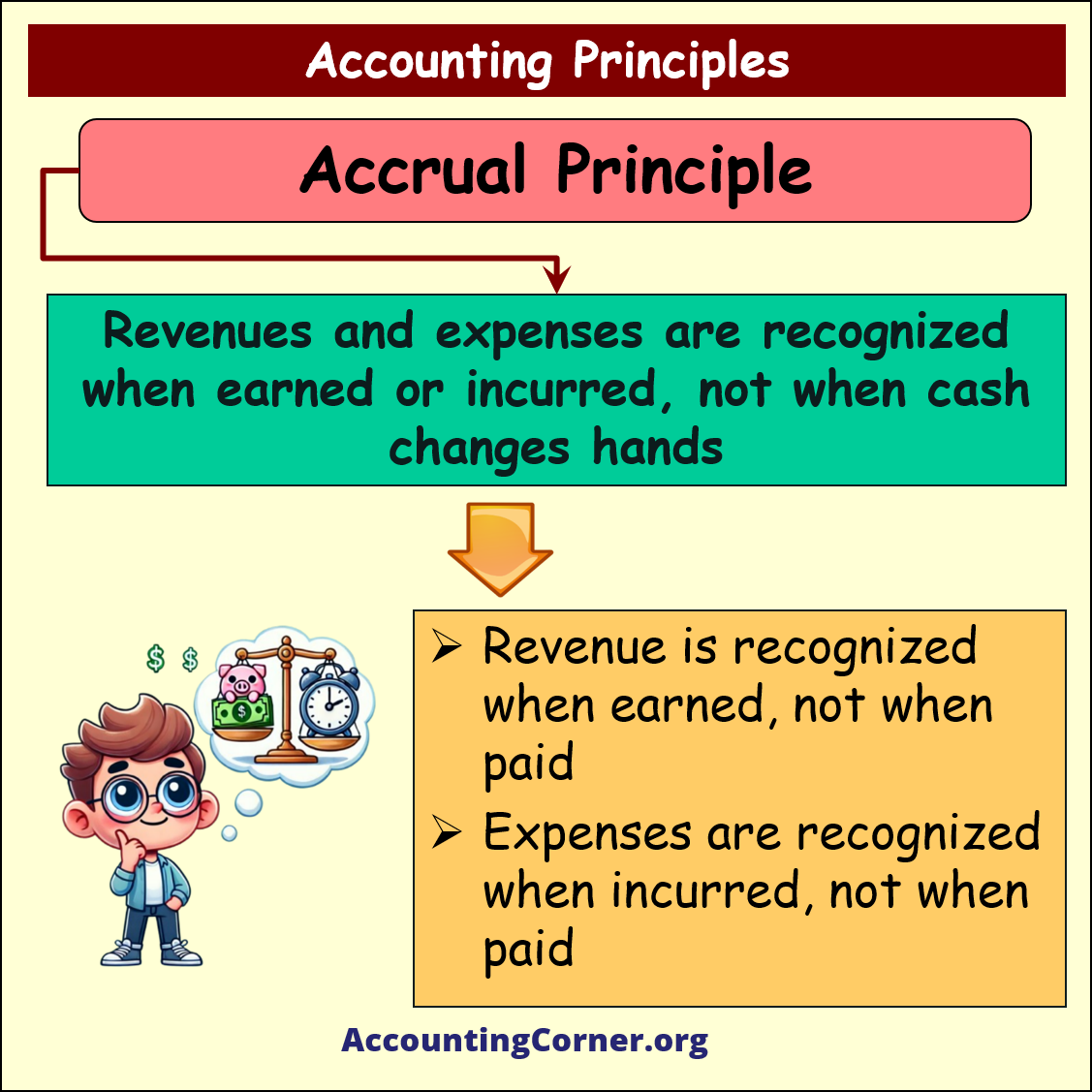

Accrual Accounting Principle

➤ Essence: Revenues and expenses are recognized when earned or incurred, not when cash changes hands.

Accrual accounting focuses on recording revenues when they are earned and expenses when they are incurred, regardless of when cash is exchanged. This approach provides a more accurate picture of a company’s financial performance by reflecting actual business activity rather than just cash flow. For example, if a company delivers a service in December but doesn’t get paid until January, the revenue is recorded in December because that’s when it was earned.

Accrual accounting focuses on recording revenues when they are earned and expenses when they are incurred, regardless of when cash is exchanged. This approach provides a more accurate picture of a company’s financial performance by reflecting actual business activity rather than just cash flow. For example, if a company delivers a service in December but doesn’t get paid until January, the revenue is recorded in December because that’s when it was earned.

- Revenue is recognized when earned, not when paid: For instance, a company delivers a product to a client in November but only receives payment in December. The revenue should still be recorded in November when the product was delivered.

- Expenses are recognized when incurred, not when paid: If the company incurs costs to manufacture a product in October but pays the supplier in November, the expense is recognized in October.

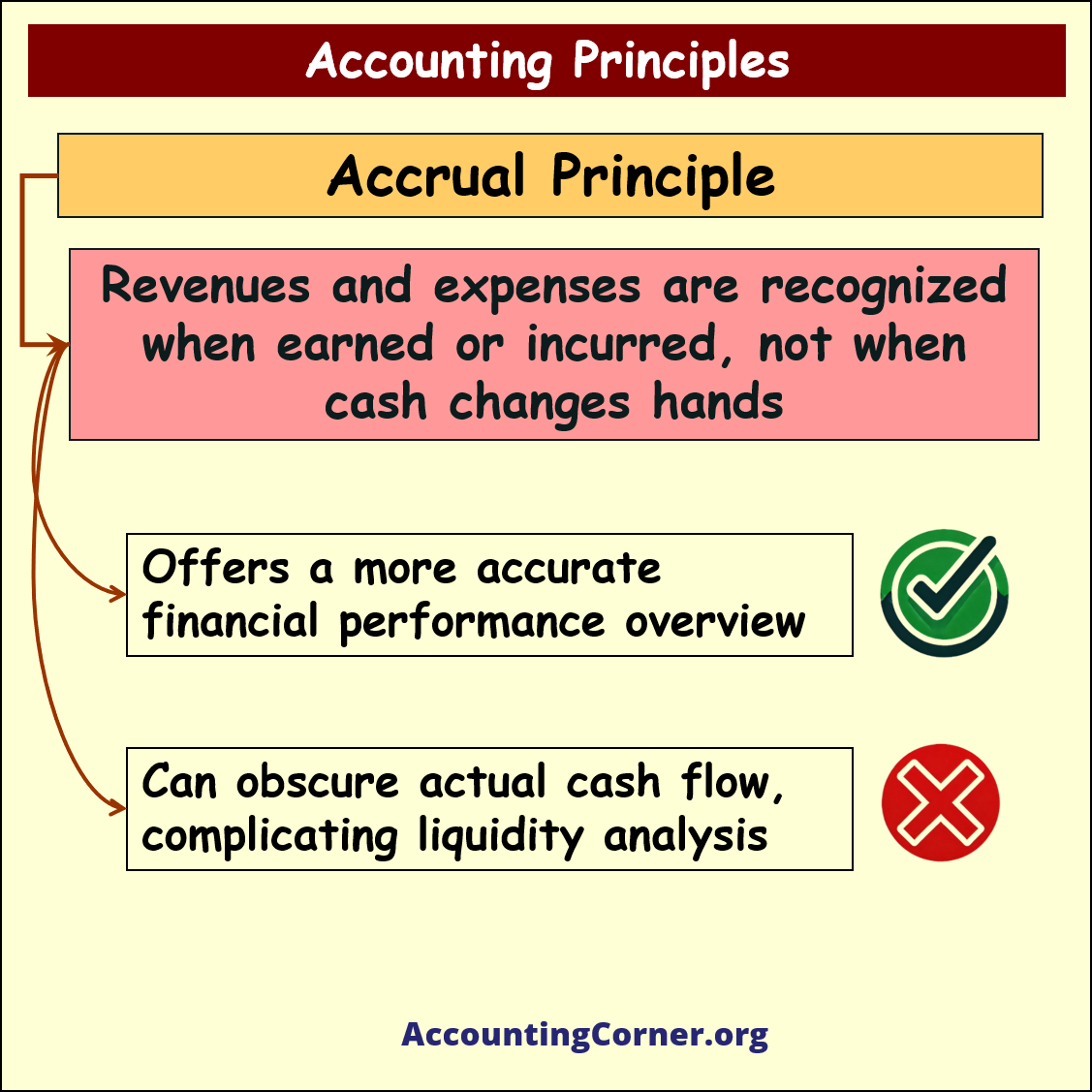

Benefit:

✅ Accrual accounting offers a more accurate financial performance overview by aligning revenues and expenses with the period they are earned or incurred.

Issue:

🚫 It can obscure a company’s actual cash position, complicating liquidity management since the company may record profits without having the cash on hand.

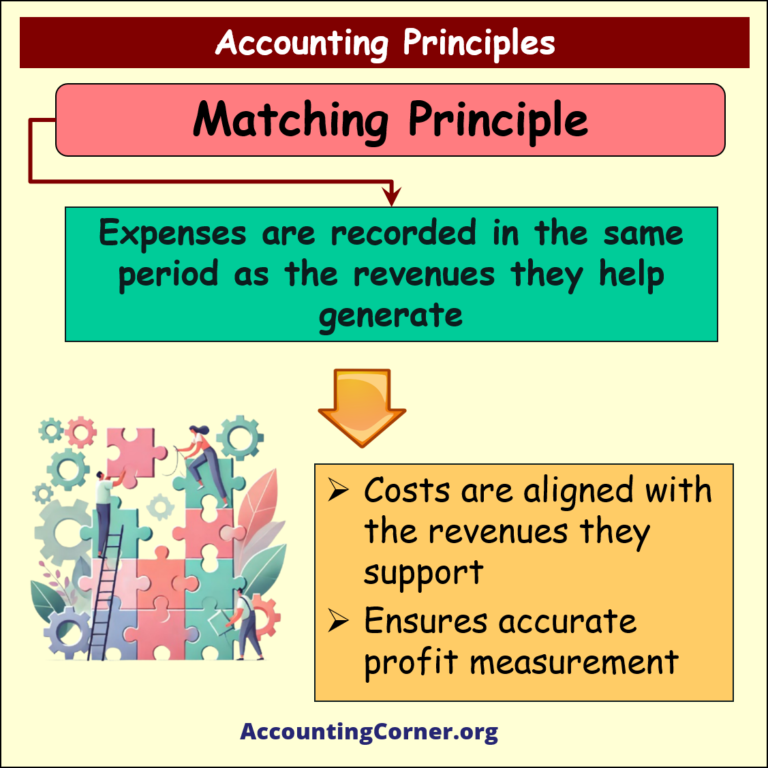

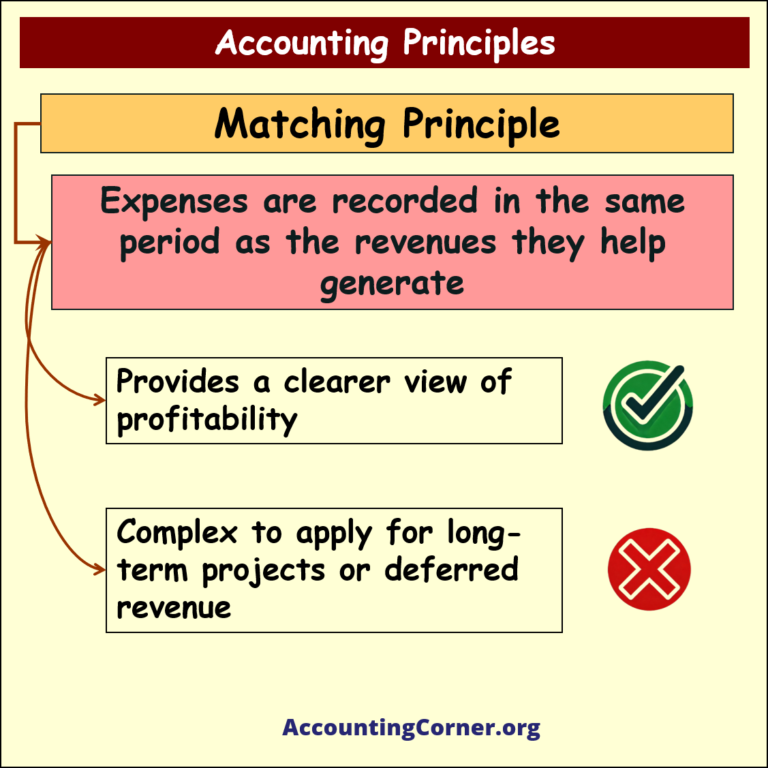

Matching Principle

➤ Essence: Expenses are recorded in the same period as the revenues they help generate.

The matching principle states that companies should record expenses in the same period in which the related revenues are earned. This ensures that the financial statements accurately reflect the profitability of the company. For example, if a business spends money on advertising in December but earns the revenue from those ads in January, the expenses should be recorded in January to match them with the corresponding revenue.

The matching principle states that companies should record expenses in the same period in which the related revenues are earned. This ensures that the financial statements accurately reflect the profitability of the company. For example, if a business spends money on advertising in December but earns the revenue from those ads in January, the expenses should be recorded in January to match them with the corresponding revenue.

- Costs are aligned with the revenues they support: For instance, if a company spends $5,000 in December on advertising for a product sold in January, the advertising expense should be recorded in January to match the revenue earned from the product sales.

- Ensures accurate profit measurement: This way, the company’s reported profits reflect the true cost of generating the revenue.

Benefit:

✅ The matching principle provides a clearer view of profitability by ensuring that revenues and the expenses tied to them are reported together.

Issue:

🚫 It can be challenging to implement for long-term projects or contracts where revenues and expenses occur over extended periods, making accurate matching complex.

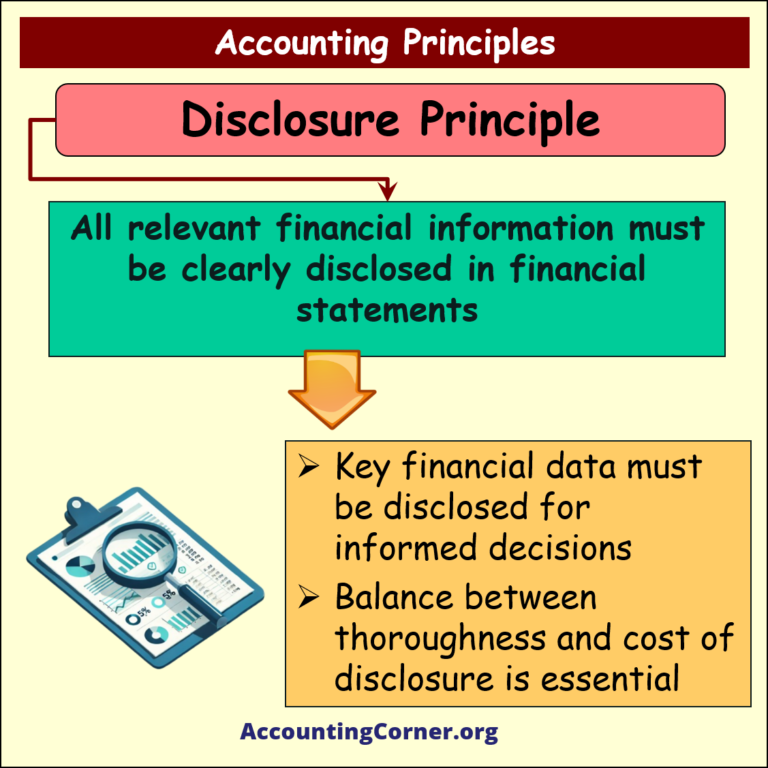

Full Disclosure Principle

➤ Essence: All relevant financial information must be clearly disclosed in financial statements.

The full disclosure principle requires that all information that could affect decision-making must be included in the financial statements. This ensures that stakeholders—such as investors, creditors, or regulatory bodies—have access to all relevant data that might impact their decisions. While disclosure is important for transparency, it should also be balanced against the costs and effort of preparing and providing the information.

The full disclosure principle requires that all information that could affect decision-making must be included in the financial statements. This ensures that stakeholders—such as investors, creditors, or regulatory bodies—have access to all relevant data that might impact their decisions. While disclosure is important for transparency, it should also be balanced against the costs and effort of preparing and providing the information.

- Key financial data must be disclosed for informed decisions: If a company is involved in a lawsuit that could significantly impact its financial position, this information should be disclosed in the financial statements, even if the outcome is uncertain.

- Balance between thoroughness and cost of disclosure is essential: While it’s crucial to provide necessary information, companies should avoid overloading users with irrelevant details that make it hard to extract meaningful insights.

Benefit:

✅ The full disclosure principle promotes transparency, ensuring that stakeholders have all the information they need to make informed decisions.

Issue:

🚫 Excessive disclosure can overwhelm users with too much information, increasing the cost and complexity of financial reporting without necessarily improving the usefulness of the data.

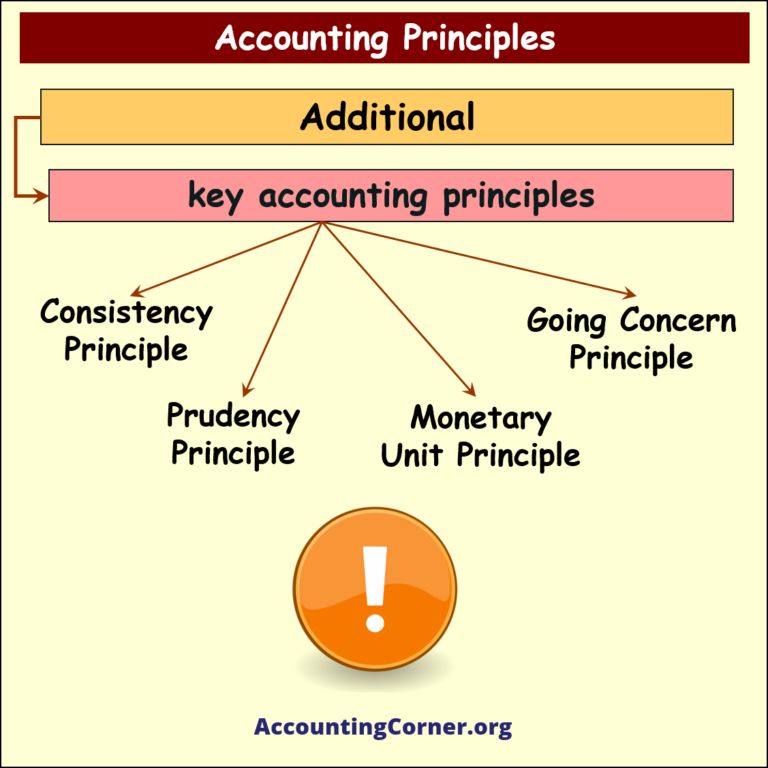

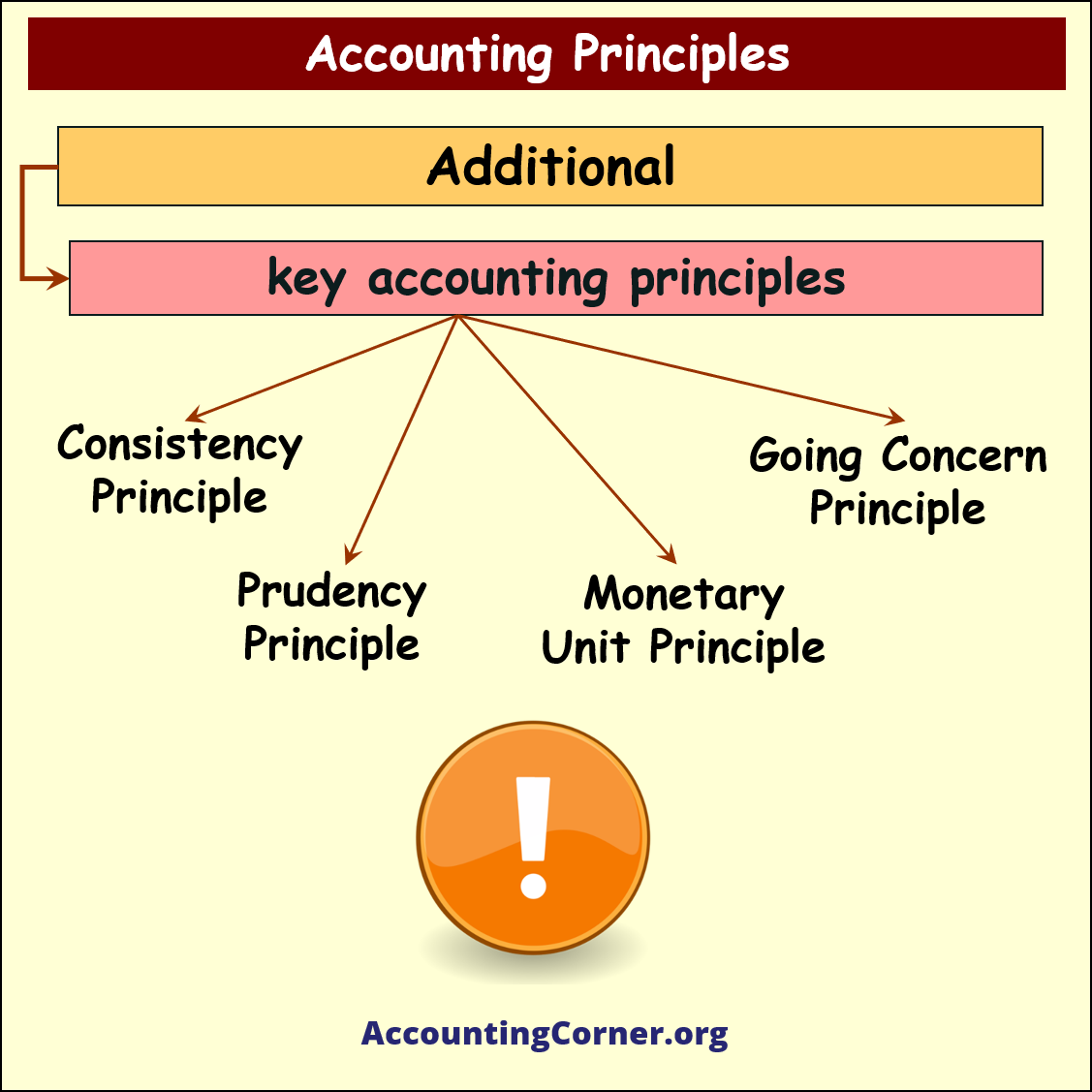

Apart from the main principles discussed above, here are additional also important accounting principles:

Consistency Principle

- Once an accounting method is chosen, it should be used consistently across periods.

This allows for better comparison of financial statements over time and ensures reliability in reporting.

Prudency Principle

- In cases of uncertainty, expenses and liabilities should be recorded as soon as possible, but revenue only when it’s assured.

- This leads to more cautious financial reporting, preventing overstatement of assets or income.

Monetary Unit Principle

- Only transactions that can be measured in monetary terms are recorded in the financial statements.

This simplifies financial reporting but ignores the effect of inflation or qualitative aspects.

Going Concern Principle

- Financial statements are prepared under the assumption that the business will continue operating for the foreseeable future.

- This affects how assets and liabilities are valued, as liquidation is not expected.

Generally Accepted Accounting Principle – Visual Material

Generally Accepted Accounting Principle – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Accounting Principles to AccountingCorner.org