Introduction to Accounts Receivable

Accounts receivable (AR) is a key concept in business and accounting, representing the amounts owed to a company by its customers for goods or services delivered on credit. It is classified as a current asset on the balance sheet, as it reflects money expected to be collected within a specified period, usually within a year. Managing accounts receivable effectively is essential for maintaining healthy cash flow and financial stability.

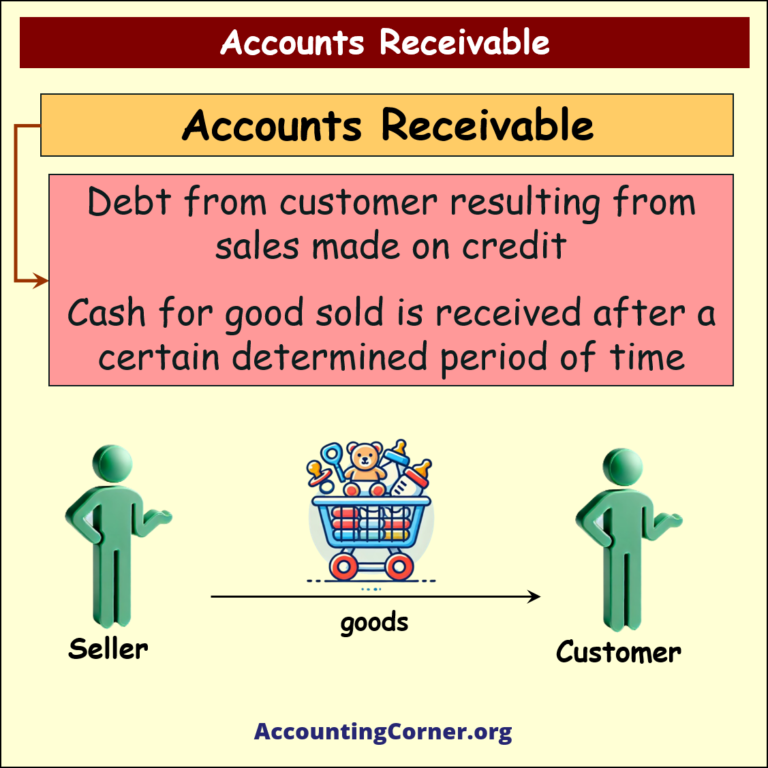

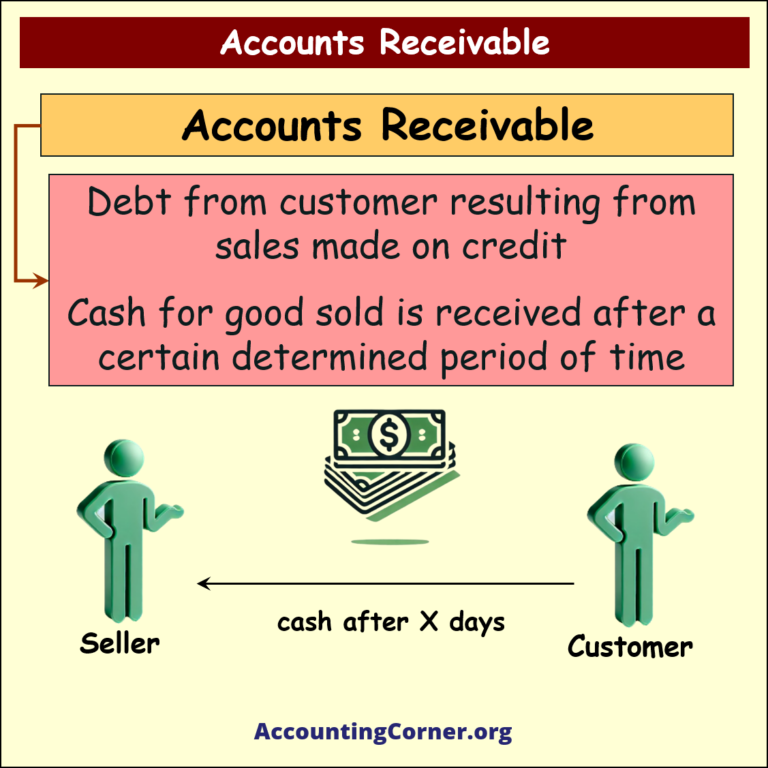

What is Accounts Receivable?

Accounts receivable arises when a business sells goods or services on credit. This means the company provides the goods upfront, and the customer is expected to pay after a specified period, commonly 30, 60, or 90 days. During this period, the company has a legal claim to the amount owed, which is recorded as an asset on the balance sheet.

Types of Receivables

Receivables can be classified into trade receivables and nontrade receivables.

- Trade Receivables:

- These typically arise from a company’s normal business activities, such as the sale of goods or services on credit.

- Trade receivables are further divided into accounts receivable and notes receivable:

- Accounts Receivable: These are oral promises from customers to pay for goods or services, representing short-term credit, generally collected within 30 to 60 days.

- Notes Receivable: These are written promises from customers to pay a specified amount of money on a future date. Notes receivable may be short-term or long-term, depending on the agreed-upon terms.

- Nontrade Receivables:

- Nontrade receivables result from transactions unrelated to the company’s main business activities. Examples include:

- Advances to officers or employees.

- Advances to subsidiaries.

- Deposits made for potential damages or as a guarantee.

- Dividends and interest receivable.

- Claims against various parties, such as insurance companies for casualty claims or governmental bodies for tax refunds.

- Nontrade receivables result from transactions unrelated to the company’s main business activities. Examples include:

Due to their nature, nontrade receivables are often reported separately from trade receivables on the balance sheet.

Key Features of Accounts Receivable:

- Credit Sales: Goods or services are sold, and the payment is deferred.

- Asset Recognition: The right to receive payment is recognized as an asset.

- Receivable Period: Payment is typically expected after a set number of days (e.g., 30 days).

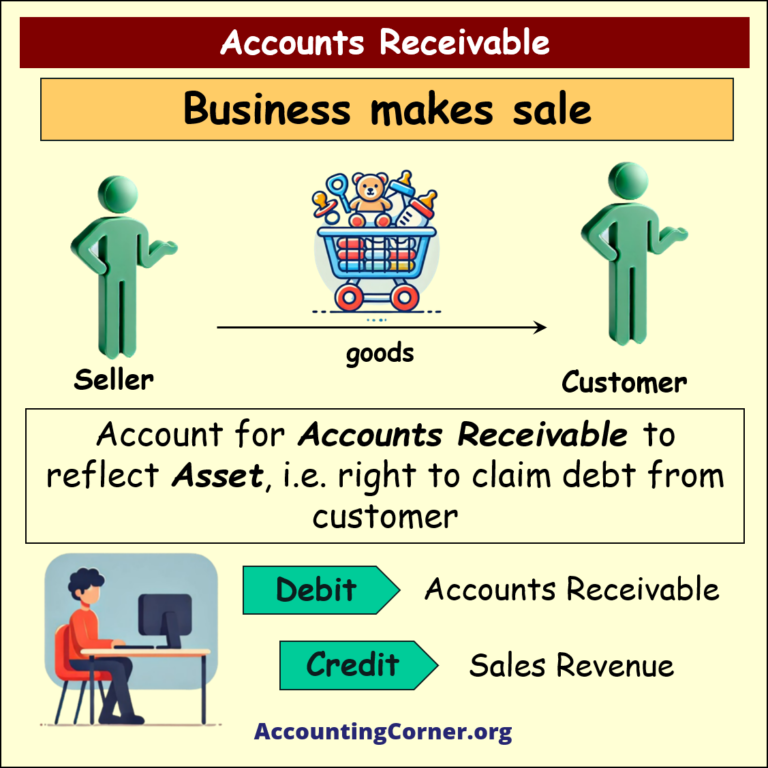

Typical Transaction Process:

- Sale: The company sells goods to a customer on credit.

- Debit: Accounts Receivable

- Credit: Sales Revenue

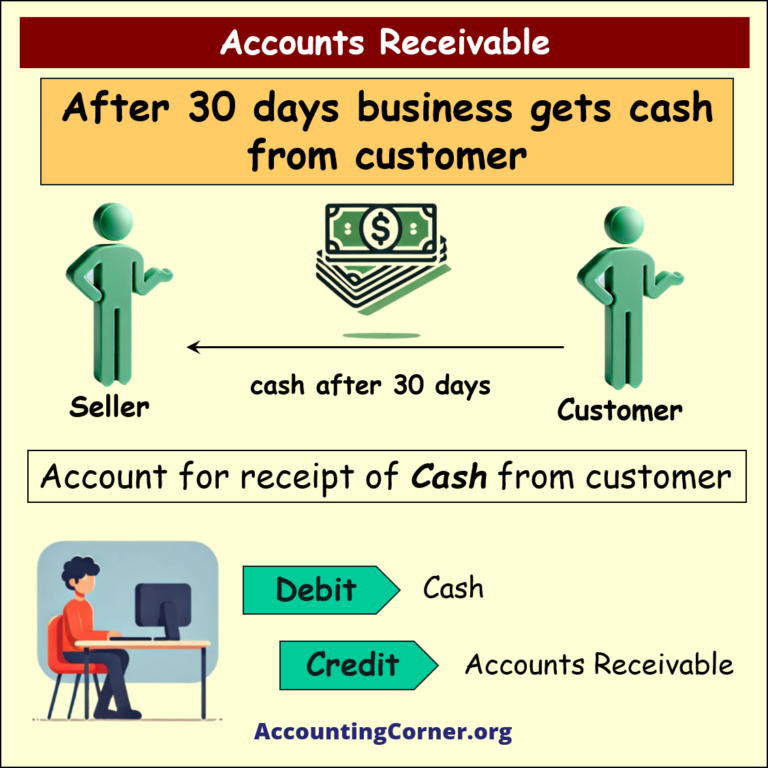

- Payment: The customer makes the payment after the agreed period.

- Debit: Cash

- Credit: Accounts Receivable

Accounting Entries for Accounts Receivable

Let’s look at the typical accounting entries involved in a credit sale and the subsequent payment.

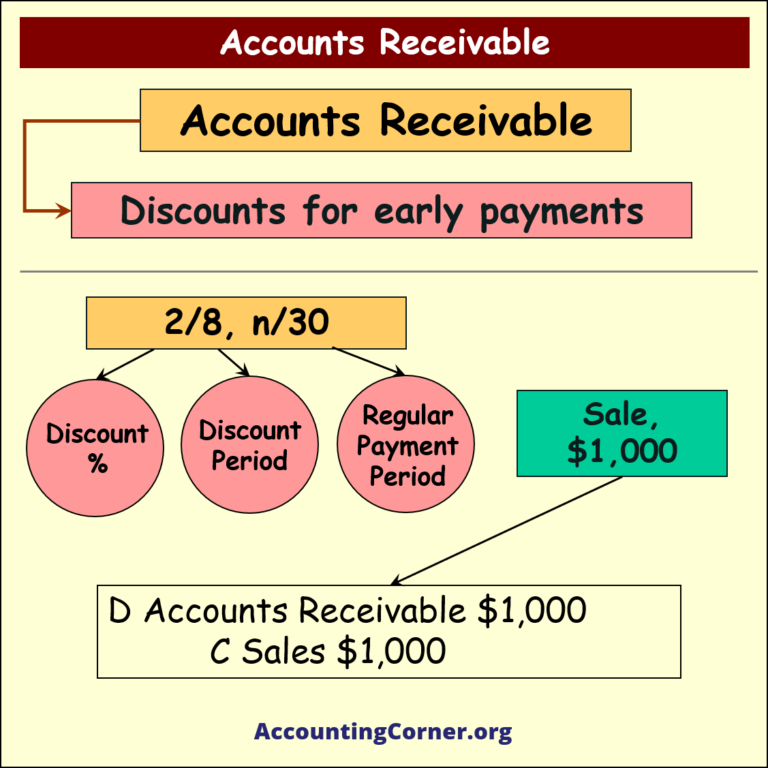

- Sale on Credit: When a company makes a sale on credit, it records the transaction as follows:

- Debit: Accounts Receivable $1,000 (to reflect the amount owed by the customer)

- Credit: Sales Revenue $1,000 (to record the income from the sale)

- Payment Received from Customer: When the customer pays the amount owed, the company records the payment as:

- Debit: Cash $1,000

- Credit: Accounts Receivable $1,000 (removing the debt from the records)

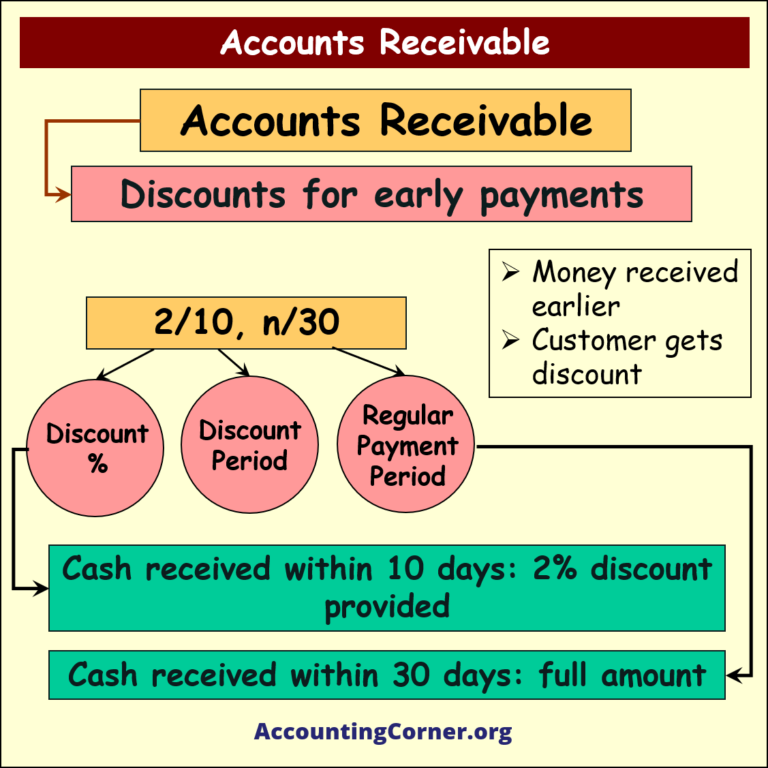

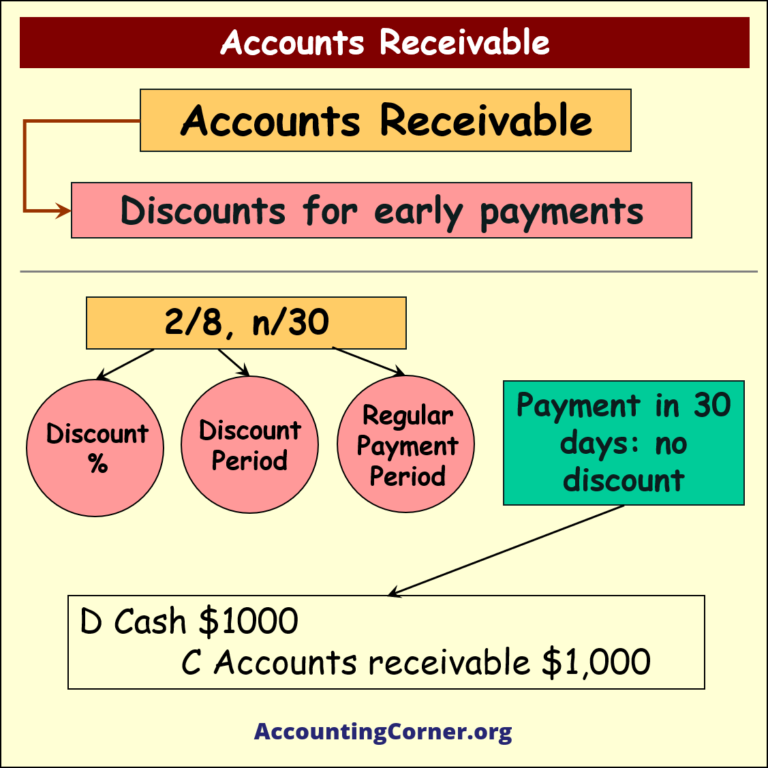

Discounts for Early Payments

To encourage faster payment, businesses often offer discounts for early settlement of receivables. A common arrangement is called 2/10, n/30, which means:

- 2% Discount: If the customer pays within 10 days.

- Net Amount Due in 30 Days: The full amount is due if payment is made after the 10-day window but before 30 days.

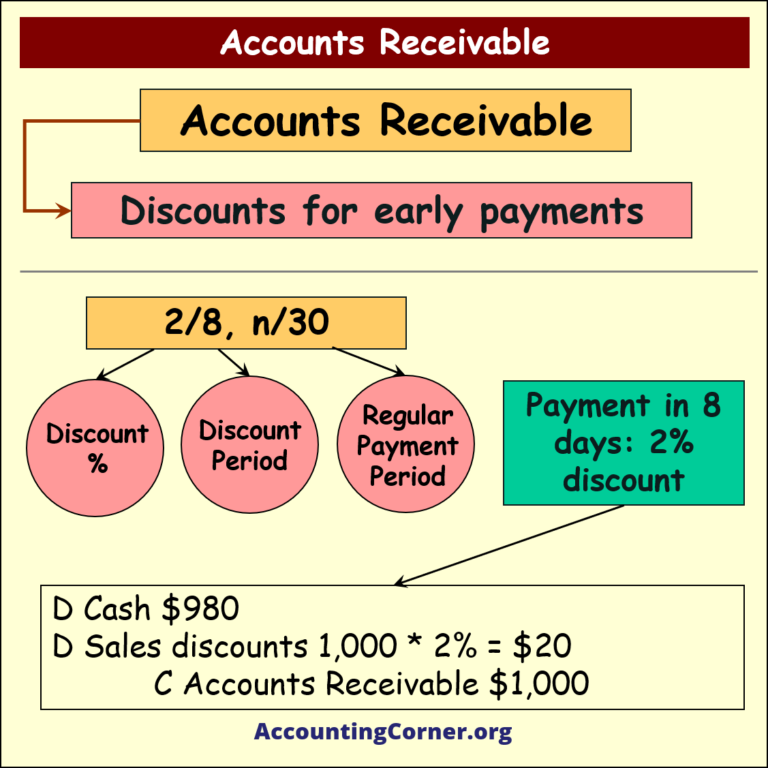

Example: A company sells goods worth $1,000 with payment terms of 2/10, n/30. If the customer pays within 8 days, they receive a 2% discount, resulting in the following accounting entry:

- Debit: Cash $980

- Debit: Sales Discount $20 (2% of $1,000)

- Credit: Accounts Receivable $1,000

If the customer pays after 10 days but before 30 days, no discount applies:

- Debit: Cash $1,000

- Credit: Accounts Receivable $1,000

Importance of Accounts Receivable

Accounts receivable is crucial for managing a company’s cash flow and liquidity. It allows businesses to:

- Extend Credit to Customers: AR enables businesses to offer credit to customers, which can boost sales and improve customer relationships.

- Monitor Cash Flow: Proper tracking of AR helps companies ensure timely collection, preventing cash flow issues.

- Assess Financial Health: A growing AR balance may signal issues with collections, while a high turnover indicates efficient credit management.

Issues with Accounts Receivable

While accounts receivable provides flexibility in customer payments, it also presents challenges:

- Risk of Bad Debt: Some customers may fail to pay, resulting in bad debts. To address this, companies often establish an allowance for doubtful accounts to estimate potential losses.

- Cash Flow Delays: A long receivable period can lead to cash flow challenges, particularly if the company relies heavily on timely collections to meet its own financial obligations.

- Credit Management: Companies need to carefully manage their credit policies to minimize the risk of non-payment and ensure timely collections.

Conclusion: The Role of Accounts Receivable in Business

Accounts receivable plays an essential role in business operations, providing companies with a mechanism to extend credit to customers, increase sales, and manage cash flow. However, it requires careful management to avoid cash flow disruptions and minimize the risk of bad debts. By offering early payment discounts and monitoring the AR balance, companies can maintain healthy financial operations and foster strong customer relationships.

Summary Points:

- Definition: Accounts receivable represents amounts owed by customers for goods or services sold on credit.

- Accounting Entries: Debit accounts receivable when sales are made; credit accounts receivable when payment is received.

- Discounts: Offering discounts for early payments encourages faster collection of receivables.

- Challenges: Risks include bad debt, cash flow delays, and the need for efficient credit management.

- Financial Impact: AR is a vital component of working capital, impacting a company’s liquidity and financial health.

By effectively managing accounts receivable, companies can optimize their cash flow, maintain strong customer relationships, and ensure their long-term financial stability.

Accounts Receivable – Visuals

Accounts Receivable – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Accounts Receivable to AccountingCorner.org