![]() Accrued income refers to revenue that has been earned by providing goods or services but has not yet been received or invoiced. This concept plays a critical role in accrual accounting, ensuring that income is recognized when it is earned, not when payment is received. This approach provides a more accurate financial picture of a company’s performance by matching revenues with expenses in the period they occur.

Accrued income refers to revenue that has been earned by providing goods or services but has not yet been received or invoiced. This concept plays a critical role in accrual accounting, ensuring that income is recognized when it is earned, not when payment is received. This approach provides a more accurate financial picture of a company’s performance by matching revenues with expenses in the period they occur.

What is Accrued Income?

Accrued income is a financial principle where revenue is recorded at the time it is earned, even if payment will be received in the future. It adheres to the accrual accounting principle, which contrasts with cash accounting, where income is only recorded when payment is received.

Key Aspects of Accrued Income:

- Revenue Earned: The income is recorded when the service or product is delivered, even if cash hasn’t been received yet.

- Payment is Delayed: The payment may be received in a future period.

- Accrual Principle: This ensures that financial statements reflect the actual earnings in the period they occur, aligning revenues with expenses for accurate reporting.

Examples of Accrued Income

Accrued income can occur in various forms, depending on the industry and services provided. Some common examples include:

- Accrued Services: When a business delivers a service, such as consulting, but payment is not immediately received.

- Accrued Rent: A landlord earns rental income but the tenant has not yet made the payment.

- Accrued Interest: Interest is earned on a loan or financial product, but the cash payment will be made at a later date.

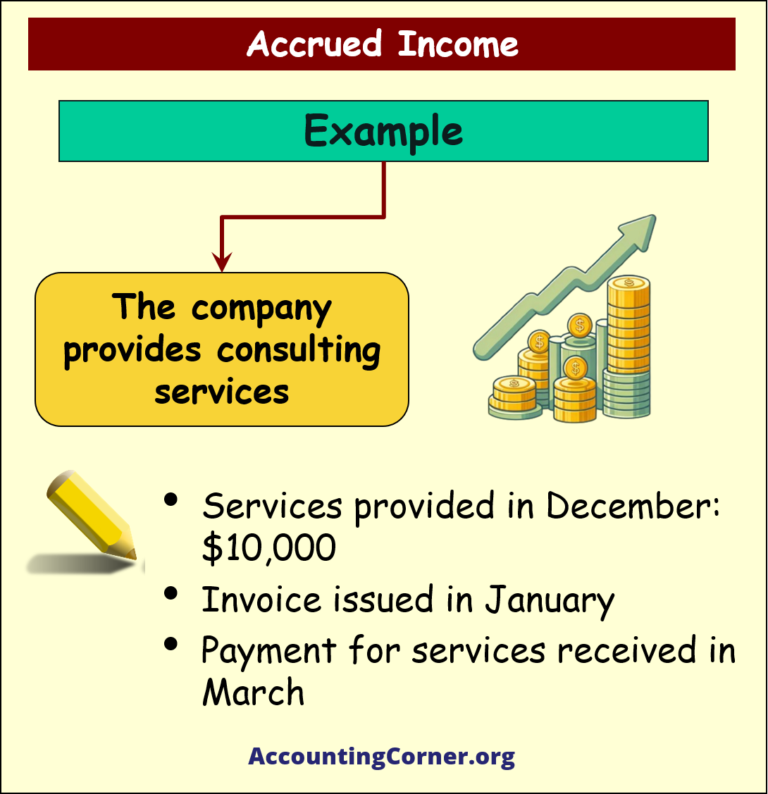

Detailed Example:

- A company provides consulting services in December worth $10,000.

- An invoice is issued in January, and payment is received in March.

For the December financial period, the $10,000 will be recorded as accrued income, even though the cash is yet to be received.

Accounting for Accrued Income

The accounting for accrued income involves recognizing the income in the period it is earned, regardless of when payment is made. This ensures that financial records accurately reflect the company’s earnings.

Accounting Entries for Accrued Income:

- In December (When Services are Provided):

- Debit: Accrued Income $10,000

- Credit: Revenue $10,000

This reflects the income earned from services provided but not yet invoiced.

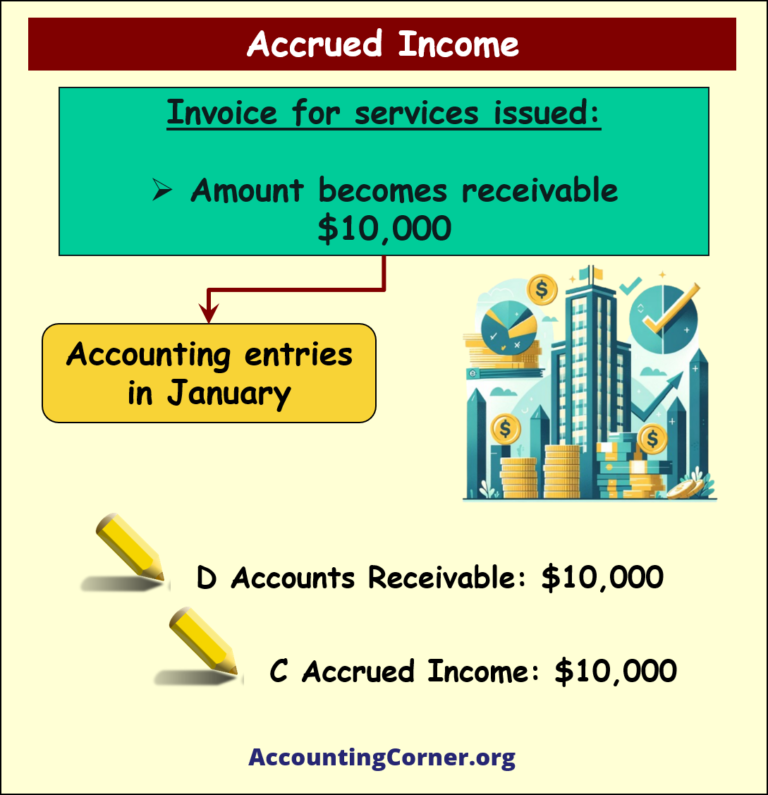

- In January (When Invoice is Issued):

- Debit: Accounts Receivable $10,000

- Credit: Accrued Income $10,000

At this point, the company has issued the invoice, and the income is transferred from accrued income to accounts receivable.

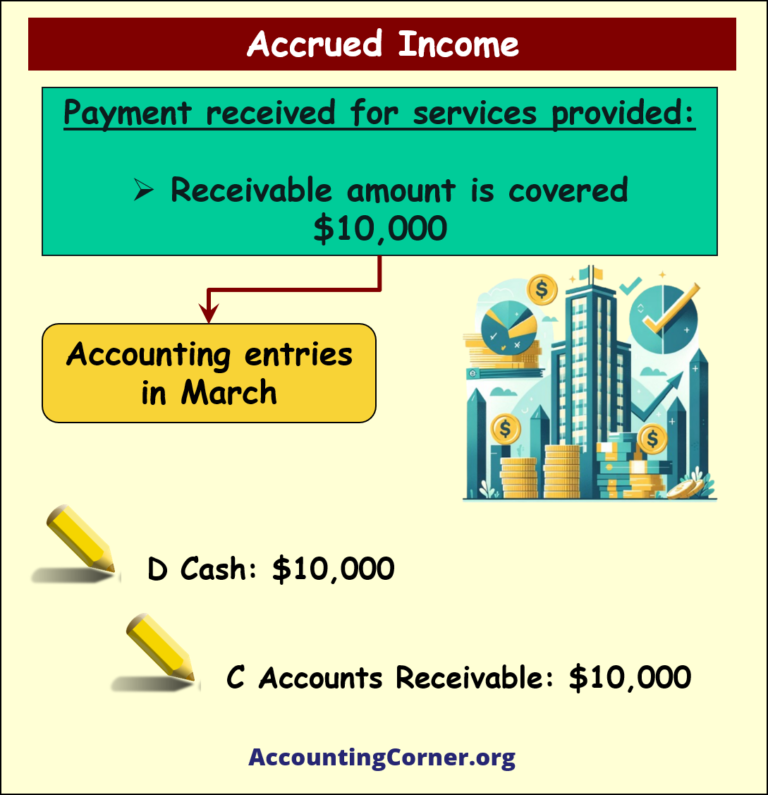

- In March (When Payment is Received):

- Debit: Cash $10,000

- Credit: Accounts Receivable $10,000

The final entry occurs when the payment is received, closing the accounts receivable and reflecting the cash inflow.

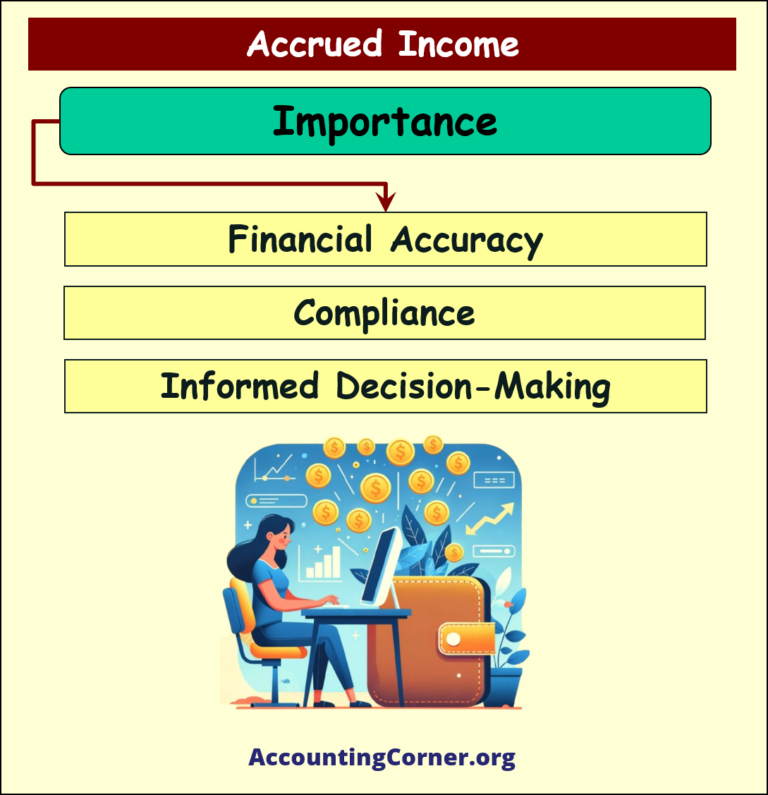

Importance of Accrued Income

Accrued income provides a more accurate reflection of a company’s financial performance and position. By recognizing revenue when it is earned rather than when cash is received, companies ensure that their financial statements are complete and reliable.

Key Benefits:

- Financial Accuracy: Ensures that financial statements provide a true picture of the company’s earnings within the correct period.

- Compliance: Accrual accounting aligns with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the region.

- Informed Decision-Making: Provides managers and investors with a clearer understanding of the company’s financial health, helping them make more informed decisions.

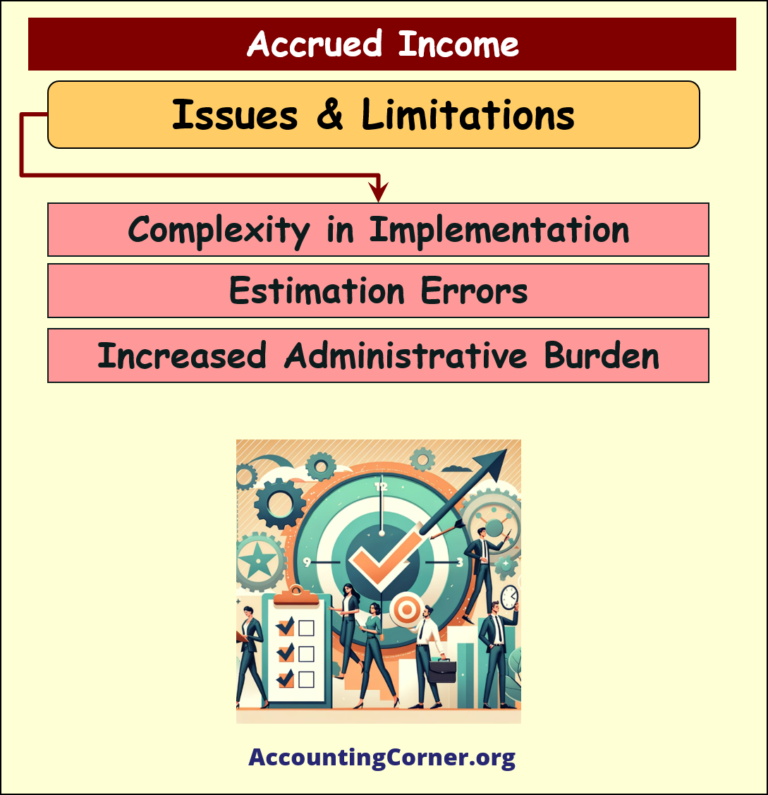

Issues and Challenges with Accrued Income

While accrued income ensures accurate financial reporting, it also introduces several challenges:

- Complexity in Implementation: Accrual accounting, including accrued income, requires careful tracking of services provided and the timing of payments. This increases the complexity of financial management.

- Estimation Errors: Accrued income involves estimating future payments for services already rendered. Incorrect estimates can lead to financial inaccuracies.

- Administrative Burden: Accrued income requires additional administrative oversight to track when payments are received and ensure proper accounting entries are made.

Conclusion: The Significance of Accrued Income

Accrued income is essential for any business that provides goods or services on credit or with delayed payments. It ensures that financial records reflect the company’s true revenue within the correct periods, helping businesses maintain transparency and compliance with accounting standards. Despite the complexities associated with its implementation, accrued income provides a more accurate and reliable measure of a company’s financial performance, supporting better financial planning and decision-making.

Summary Points:

- 📅 Definition: Accrued income is revenue that has been earned but not yet received.

- 💼 Accrual Principle: It ensures revenue is recognized when earned, aligning with the accrual accounting principle.

- 🧾 Common Examples: Accrued services, rent, and interest.

- 📝 Accounting Entries: Include recording accrued income, accounts receivable, and cash payments when received.

- 📊 Importance: Ensures financial accuracy, supports compliance, and aids informed decision-making.

- ⚠️ Challenges: Complexity, potential estimation errors, and administrative burdens.

Accrued Income – Visuals

Accrued Income – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Accrued Income to AccountingCorner.org home