Introduction to the Balance Sheet

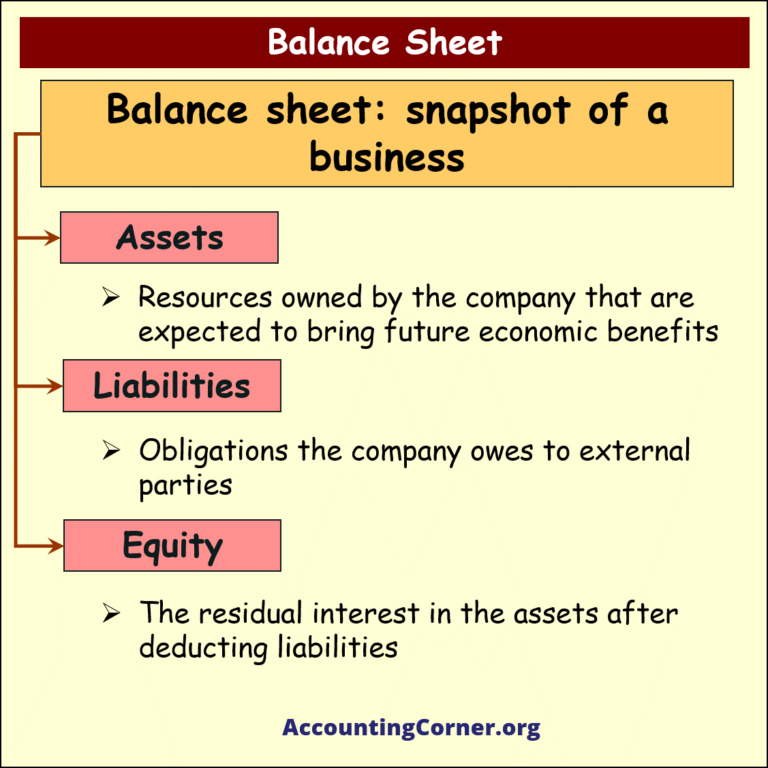

The Balance Sheet is one of the three fundamental financial statements, providing a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and equity, helping stakeholders understand how the business is financed and where its resources are allocated. The balance sheet follows the accounting equation:

Assets=Liabilities+Equity

This equation ensures that a company’s resources (assets) are financed either by borrowing (liabilities) or by the owner’s investments (equity).

Key Components of the Balance Sheet

The balance sheet is divided into three main sections: Assets, Liabilities, and Equity. Each section plays a crucial role in showing the financial health and structure of a business.

1. Assets

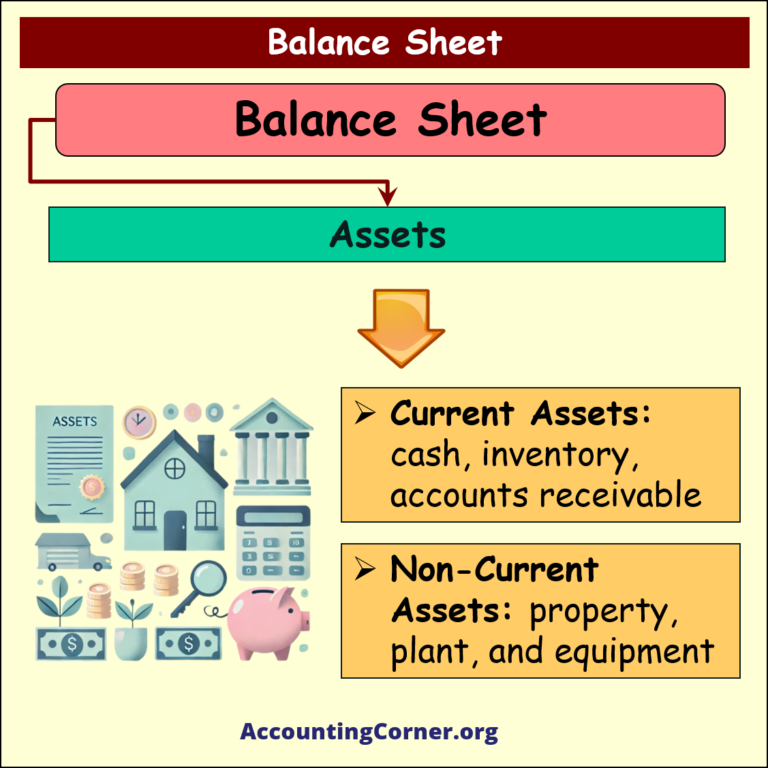

Assets represent the resources owned by a company that are expected to bring future economic benefits. They are categorized into current and non-current assets.

- Current Assets: These are short-term assets expected to be converted into cash within one year. Examples include:

- Cash

- Accounts Receivable

- Inventory

- Non-Current Assets: Long-term resources used in business operations for more than one year. Examples include:

- Property, Plant, and Equipment (PPE)

- Intangible Assets (e.g., patents)

2. Liabilities

Liabilities represent the company’s obligations to external parties that must be settled in the future. Like assets, they are classified as current and long-term liabilities.

- Current Liabilities: Short-term debts or obligations due within one year, such as:

- Accounts Payable

- Short-term Loans

- Long-term Liabilities: Obligations due after more than one year, such as:

- Bonds Payable

- Long-term Loans

3. Equity

Equity reflects the residual interest in the assets after all liabilities have been deducted. It includes:

- Share Capital: The investment made by the company’s shareholders.

- Retained Earnings: The portion of net income that is retained in the company rather than distributed as dividends.

The Accounting Equation

The foundation of the balance sheet is the accounting equation:

Assets=Liabilities+Equity

This equation ensures that the resources of a company (assets) are balanced by the claims against those resources (liabilities and equity). It reflects how a business is financed, either through external debts or internal investments.

For example, if a company has total assets of $100,000, liabilities of $60,000, and equity of $40,000, the balance sheet equation will be balanced:

100,000=60,000+40,000

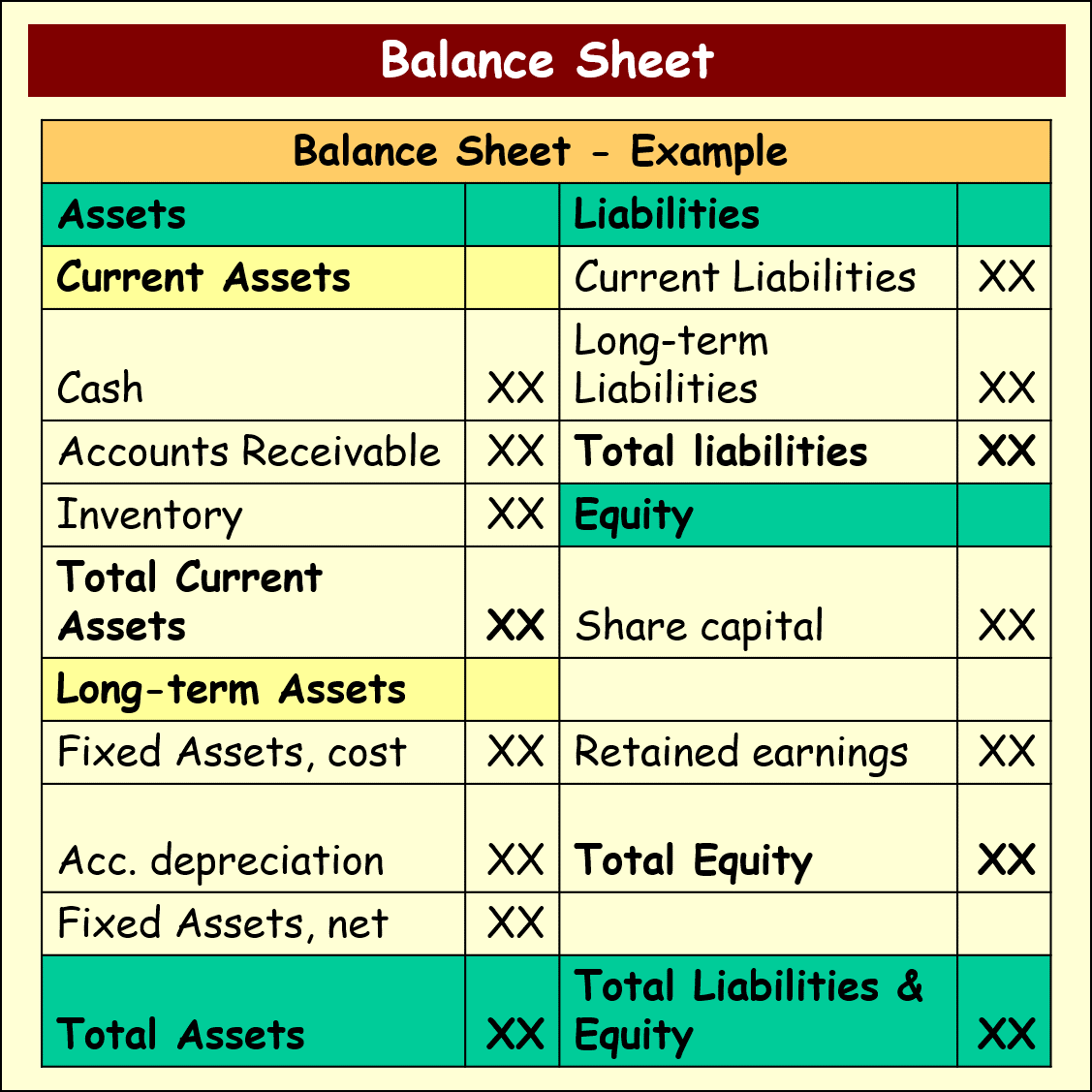

Example of a Balance Sheet

Below is a simplified structure of a balance sheet:

Types of Balance Sheets

- Classified Balance Sheet: This type categorizes assets and liabilities into current and non-current items, providing a clearer view of the company’s liquidity and long-term financial stability.

- Common Size Balance Sheet: In this version, each line item is presented as a percentage of total assets, allowing for easier comparison across different periods or companies.

- Vertical and Horizontal Balance Sheets: These layouts vary in presentation. A vertical balance sheet lists items vertically, while a horizontal one displays assets on the left and liabilities and equity on the right.

Importance of the Balance Sheet

The balance sheet is a critical financial tool that offers several key benefits:

- Clarity and Transparency: Provides a clear view of a company’s financial standing, making it easier for stakeholders to understand how the business is financed and where its resources are allocated.

- Regulatory Compliance: Ensures that the company complies with financial reporting standards.

- Risk Management: Helps identify financial risks, such as high levels of debt, which may pose liquidity challenges.

- Insight into Financial Health: By comparing assets to liabilities, stakeholders can assess whether the company has enough resources to cover its debts.

- Decision-Making: A well-prepared balance sheet serves as a basis for strategic decisions, such as whether to take on more debt or invest in new assets.

Issues with the Balance Sheet

Despite its importance, the balance sheet has some limitations:

- Static Snapshot: The balance sheet provides a snapshot of the company’s financial position at a specific point in time, which may not reflect changes in the business immediately afterward.

- Subjectivity in Valuations: Some assets and liabilities may be valued based on estimates or subjective judgments, such as depreciation methods or the valuation of intangible assets.

Conclusion: The Role of the Balance Sheet

The Balance Sheet is a fundamental financial statement that provides valuable insight into a company’s assets, liabilities, and equity. It reflects the company’s financial structure, its ability to meet short- and long-term obligations, and the extent to which it relies on debt or equity financing. By understanding the balance sheet, stakeholders can make informed decisions regarding the company’s financial health and future strategies.

Summary Points:

- 📊 Definition: A snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- 💰 Assets: Resources owned by the company, including current and non-current assets.

- 📉 Liabilities: Obligations to external parties, categorized into current and long-term liabilities.

- 🏦 Equity: The residual interest in the assets after deducting liabilities, including share capital and retained earnings.

- 🧮 Accounting Equation: Ensures that the balance sheet always balances by showing that assets are financed by liabilities and equity.

- 📋 Types: Classified, common size, vertical, and horizontal balance sheets.

- 📈 Importance: Essential for financial health assessment, regulatory compliance, and informed decision-making.

A well-prepared balance sheet offers transparency, helping businesses assess their financial health and make strategic decisions to support long-term success.

Balance Sheet – Visuals

Balance Sheet – Video

All Balance Sheet Related Topics to Explore:

- Balance Sheet – What is a Balance Sheet?

- Balance Sheet Accounts

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement Vs Balance Sheet

- Balance Sheet Equation

- Balance Sheet Formula

- Balance Sheet Format

- How to Read Balance Sheet?

- Personal Balance Sheet

- Common Size Balance Sheet

- Trial Balance Sheet

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Financial Statements

- Petty Cash

- General Ledger

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Contribution Margin Ratio

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Leverage Ratio

- FOB Shipping Point

- WACC Formula

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- EBITA meaning

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Provision Definition

- EBITDA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Total Asset Turnover

- Additional Paid In Capital

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Accumulated Depreciation

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Journal Entry

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Perpetual Inventory System

- Vouching

- Work in Progress

- EBIT Meaning

- Return on Assets – ROA Formula

Return from Balance Sheet – What is a Balance Sheet? to AccountingCorner.org