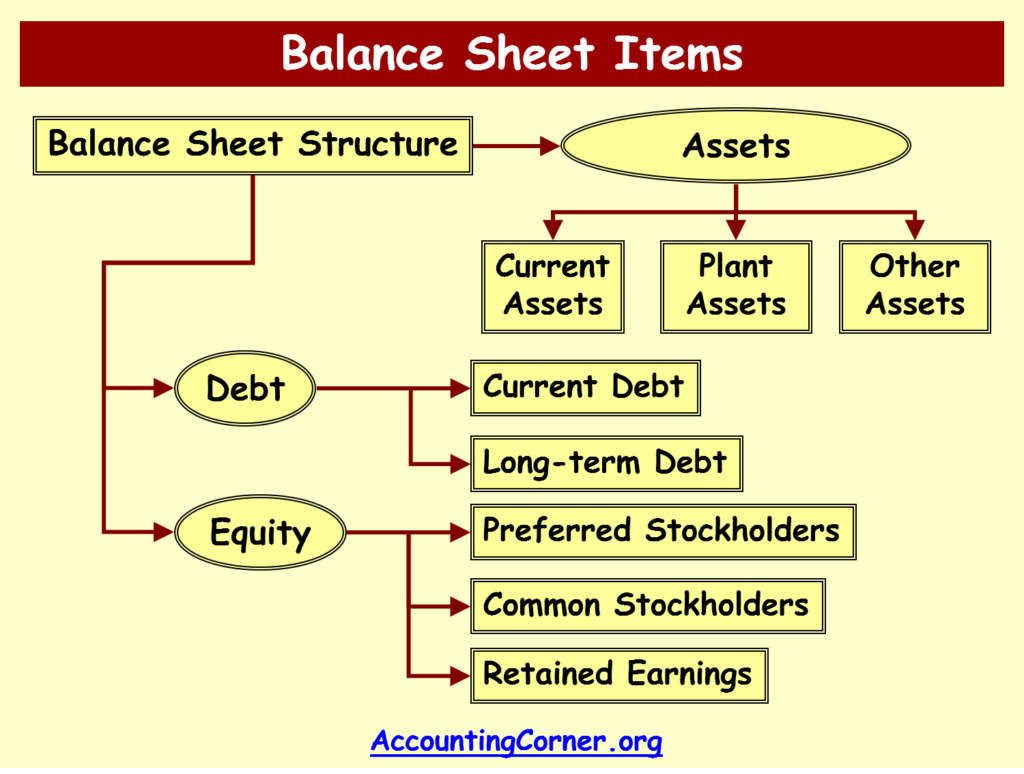

Let’s explore balance sheet accounts. Note, that Balance Sheet, also called Statement of Financial Position, measures financial position of the business. It is dated at the particular moment of time, i.e. end of the accounting period.

What is included in the Balance Sheet?

What is included in the Balance Sheet?

Balance Sheet accounts are divided into 3 main groups:

Balance Sheet accounts are divided into 3 main groups:

- Assets

- Liabilities

- Shareholders’ equity

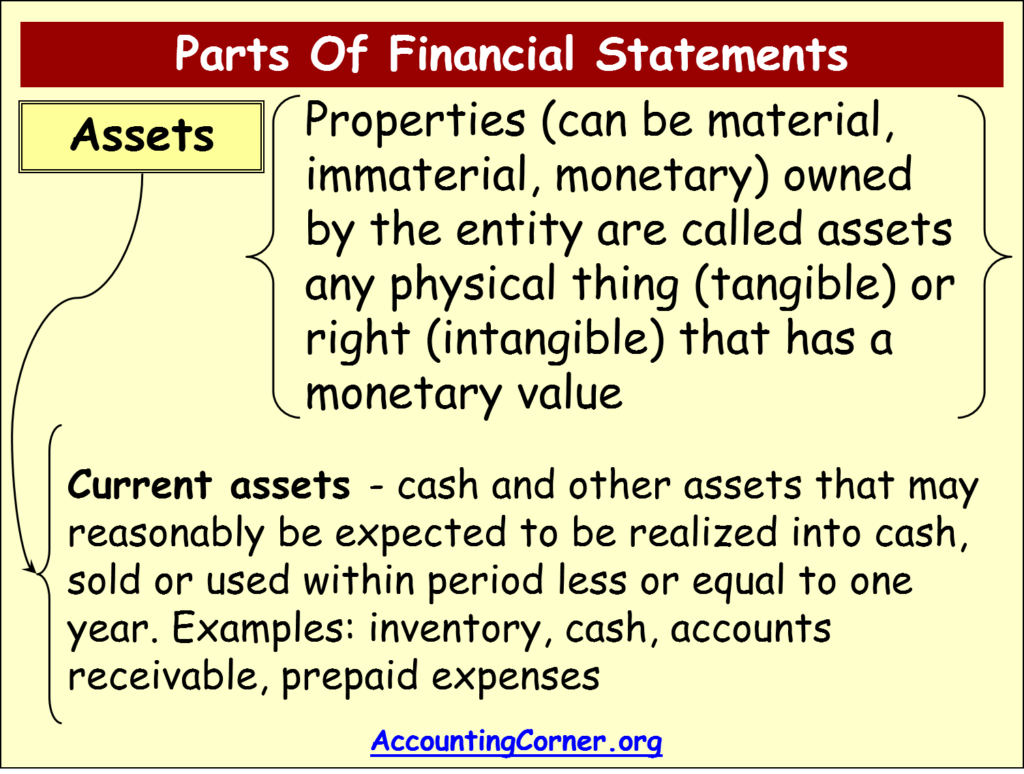

Assets

First group of Balance Sheet accounts is called Assets. Assets are divided into 2 categories;

- Current (Short-Term) Assets

- Long-Term Assets

Current (Short-Term) Assets

Current assets are those, which will be converted to cash, sold or consumed in the business activities during 12 months

Current assets are those, which will be converted to cash, sold or consumed in the business activities during 12 months

Current assets include:

- Cash and cash equivalents – the most liquid asset of the business. This balance sheet accounts can also include money-market accounts, other financial instruments, which can be easily converted to cash

- Short-term investments – stocks and bonds in other companies, kept for sale over coming 12 months

- Accounts receivable – amounts, the business plans to collect from customers for sale of goods or provision of services. Accounts receivable are created, when sale is made on credit, i.e. cash is not received at the moment of sale

- Notes receivable – amounts, the business plans to get from the third parties owed to it based on the signed promissory notes

- Inventory – depending on the type of business the entity operates in, inventory can include items for sale (inventory or merchandise inventory), raw materials for production, manufactured goods for resale

- Prepaid expenses – amounts paid in advance for future expenses, like insurance, advertising. They are included into the balance sheet as the business will benefit from these expenses only in the coming periods of time

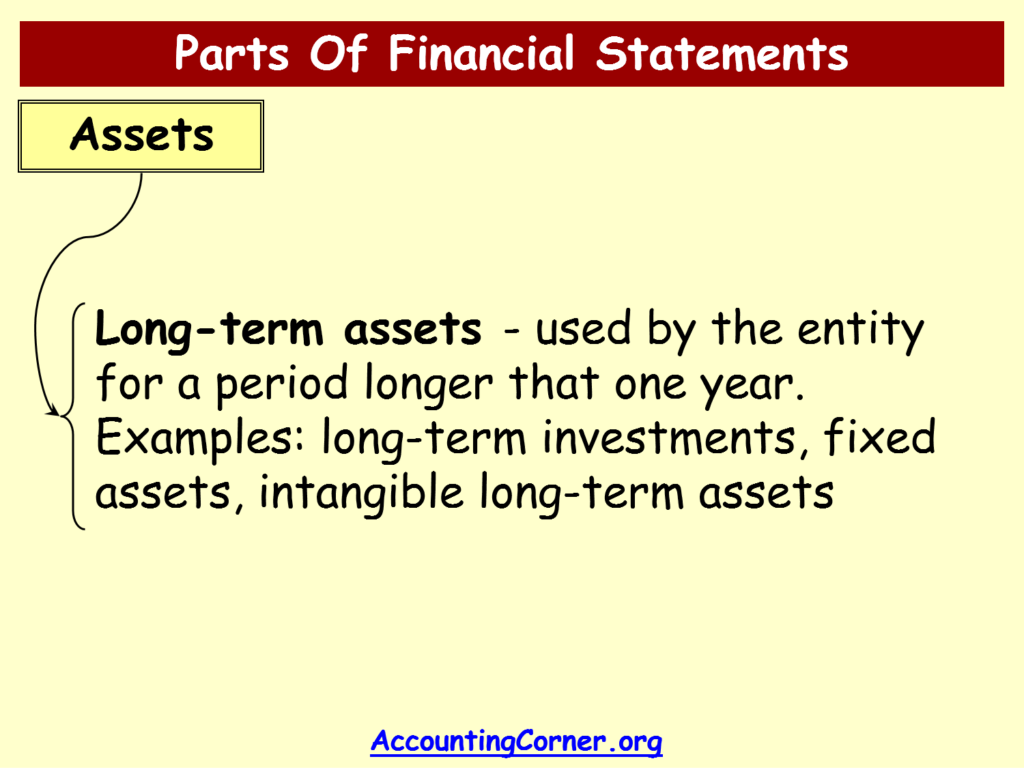

Long-Term Assets

Long-term assets are used in the activities of the business for a long (longer than 12 months) period of time

Long-term assets are used in the activities of the business for a long (longer than 12 months) period of time

These assets include:

- Property, Plant and Equipment (also called plant assets) – usually include land, buildings, machinery, computers, office equipment. These assets are stated at historical acquisition costs less accumulated depreciation. This difference is called Net Book Value. It does not mean that in case the assets will be sold, the business will get the same amount of money for the sale of these assets. Depending on the form of balance sheet, historical acquisition cost and accumulated depreciation might be stated separately. If not, these items can be seen in the explanatory notes to the financial statements.

- Other assets might include intangible assets, which have no physical form (patents, trademarks, goodwill), long-term investments, which are kept for longer period of time and there is no intention to sell them within 12 months. Also other assets might include those, which cannot be assigned to any category.

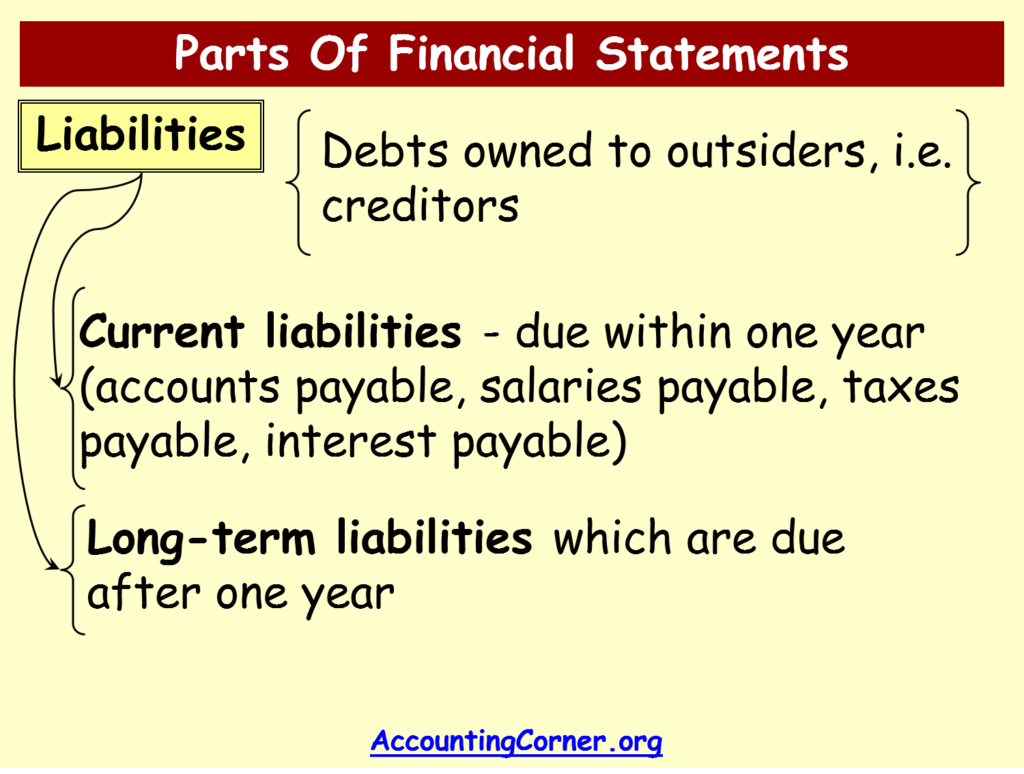

Liabilities

Liabilities are also divided into 2 categories:

- Current (Short-Term) Liabilitiess

- Long-Term Liabilities

Current (Short-Term) Liabilities

Current liabilities are liabilities to be repaid within 12 months period of time

Current liabilities are liabilities to be repaid within 12 months period of time

They include:

- Accounts payable – debt of the business to suppliers of goods and services

- Income taxes payable – tax debt to the state budget

- Short-term notes payable – other amounts to be repaid back to creditors within 12 months

- Other current liabilities – salaries payable, utilities, other accrued, but not paid yet expenses

Long-Term Liabilities

Long-term liabilities include debts to creditors to be repaid after the period of 12 months.

Long-term liabilities include debts to creditors to be repaid after the period of 12 months.

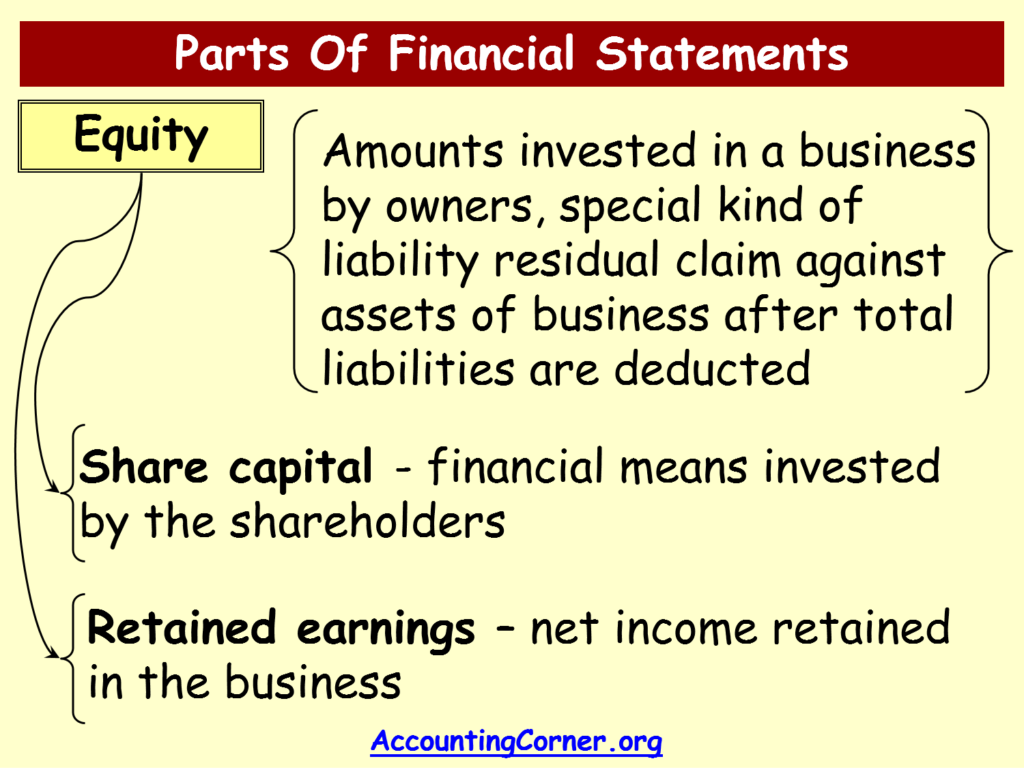

Shareholders’ Equity

Other category of Balance Sheet accounts is Shareholders’ Equity, which is a difference between Assets and Liabilities – net worth of the business belonging to shareholders. The following items are included into Shareholders’ Equity:

Other category of Balance Sheet accounts is Shareholders’ Equity, which is a difference between Assets and Liabilities – net worth of the business belonging to shareholders. The following items are included into Shareholders’ Equity:

- Common stock – shares issued to shareholders, stated at par value

- Paid-in capital – includes amounts of cash received on initial sale of shares of the business, which was received since payment was higher than par value

- Retained earnings – accumulated profit (loss) from the beginning of business operations and not distributed to (covered by) shareholders.

Sometimes Shareholders’ Equity might also include own shares of the business, which were re-purchased from shareholders.

Let’s explore, which account does not appear on the Balance Sheet:

Let’s explore, which account does not appear on the Balance Sheet:

Accounts that do not appear on the balance sheet are typically income statement accounts. The balance sheet focuses on assets, liabilities, and shareholders’ equity at a specific point in time, while the income statement reports revenues, expenses, and profits or losses over a specific period. Here are two examples of accounts that do not appear on the balance sheet:

- Revenue (or Sales): This is the amount of money generated by the business from its operations. Revenue is an income statement account that shows how much a business earned over a specific period, such as a month, quarter, or year.

- Operating Expenses: These are costs incurred during the regular course of doing business, such as salaries, utilities, and rent. Operating expenses are also income statement accounts and are deducted from revenues to calculate net income.

Both of these types of accounts have a significant impact on the overall financial performance of a company, but they do not represent assets, liabilities, or equity at a specific point in time and therefore do not appear on the balance sheet.

Let’s explore more examples, what account does not appear on the Balance Sheet:

Let’s explore more examples, what account does not appear on the Balance Sheet:

Accounts that do not appear on the balance sheet are usually part of the income statement or sometimes the statement of cash flows. Here are two more examples:

- Cost of Goods Sold (COGS): This account represents the direct costs associated with producing or purchasing the goods that a company sells. It is subtracted from revenues to calculate the gross margin. Cost of Goods Sold is an income statement account and does not appear on the balance sheet.

- Interest Expense: This account shows the cost incurred for borrowed funds. If a company has loans, bonds, or other types of debt, the interest payments on that debt will be recorded under Interest Expense. Like COGS, Interest Expense is an account that appears on the income statement, not the balance sheet.

These accounts are used to calculate net income or loss over a specific period and do not represent the financial position of a company at a specific point in time, which is what the balance sheet is designed to do.

Let’s explore Prepaid Expenses on Balance Sheet:

Prepaid expenses appear in the section of Balance Sheet, i.e. specifically, they are often classified as current assets, assuming they will be used up or will expire within the next 12 months. If the prepaid items are expected to last longer than a year, they could be classified as long-term assets, although this is less common.

Here’s why prepaid expenses are considered assets:

When a company pays for expenses in advance (like rent, insurance premiums, or subscriptions), it is essentially providing payment for benefits it will receive in the future. Until those benefits are received, the advance payment is recorded as an asset on the balance sheet. As the benefits are received — for instance, as time passes in the case of prepaid rent or insurance — the amount of the asset is gradually reduced, and the expense is recognized on the income statement.

When a company pays for expenses in advance (like rent, insurance premiums, or subscriptions), it is essentially providing payment for benefits it will receive in the future. Until those benefits are received, the advance payment is recorded as an asset on the balance sheet. As the benefits are received — for instance, as time passes in the case of prepaid rent or insurance — the amount of the asset is gradually reduced, and the expense is recognized on the income statement.

Here is how it works in practice:

- Initial Recording: When the company first pays for the expense, the prepaid expense account (an asset account) is increased, and cash or another form of payment is decreased. This reflects the future economic benefit that will be received.Accounting Entry: Debit Prepaid Expenses, Credit Cash

- Expense Recognition: As the prepaid expense “expires” (e.g., as each month of a 12-month insurance policy passes), an expense is recognized, and the asset account is reduced.Accounting Entry: Debit Insurance Expense (or appropriate expense account), Credit Prepaid Expenses

By following this method, the company ensures that the expenses are matched with the periods in which they are incurred, in accordance with the matching principle of accounting. This approach provides a more accurate picture of the company’s financial health in each accounting period.

Let’s explore Retained Earnings on Balance Sheet:

Retained earnings in Balance Sheet appear under the “Equity” section of the balance sheet, alongside other equity accounts like common stock, additional paid-in capital, and possibly treasury stock. The equity section is usually broken down into these components to show the origins of the shareholders’ equity. This section is typically found near the bottom of the balance sheet, after the asset and liability sections.

The balance sheet entry for retained earnings shows the accumulated earnings that have been retained (i.e., not distributed) from the inception of the business up to the end of the reporting period. It’s a cumulative number that gets updated at the end of each accounting period to reflect net income earned and dividends paid.

The Retained Earnings account may be presented simply as a single line item with its corresponding monetary value:

Or it could be detailed out in a separate “Statement of Retained Earnings” that usually accompanies the balance sheet, which will show the beginning balance, any additions/subtractions like net income or dividends, and the ending balance.

Example of how retained earnings might change and how to check what is Retained Earnings on a Balance Sheet:

- Beginning Balance of Retained Earnings: $10,000

- Net Income for the Period: $5,000

- Dividends Paid: $2,000

Then, the Ending Balance of Retained Earnings would be calculated as follows:

This ending balance would then be reported as Retained Earnings on a Balance Sheet under the Equity section as the new Retained Earnings figure, ready for the next accounting period.

The retained earnings amount is significant because it provides insight into how much capital is available for reinvestment into the business, debt repayment, or distribution of dividends. Investors often scrutinize this figure to understand a company’s capacity to generate future growth or reward shareholders.

Let’s explore Accumulated Depreciation on Balance Sheet:

Accumulated depreciation appears on the balance sheet under the category of Non-Current Assets, typically right below or next to the asset it relates to. It’s shown as a contra asset account, meaning it has a credit balance that is subtracted from the asset’s original cost to arrive at its net book value.

For example, imagine a company has equipment originally costing $50,000. Over time, this equipment has accumulated depreciation of $20,000. On the balance sheet, you would see:

- Under Non-Current Assets:

- Equipment listed at $50,000

- Directly below or next to it, you would see “Less: Accumulated Depreciation” at $20,000

The net book value of the equipment, often termed as “Net Equipment,” would be calculated as $50,000 (original cost) – $20,000 (accumulated depreciation), which equals $30,000. This $30,000 is the carrying amount of the asset and represents its reduced value on the balance sheet.

The “Total Assets” at the bottom of the balance sheet would then include this net book value of $30,000, along with all other assets, to reflect the company’s total assets at that point in time.

Let’s explore what is Goodwill on a Balance Sheet:

Goodwill is an intangible asset that appears on a company’s balance sheet, usually under the “Non-Current Assets” or “Intangible Assets” section. It generally arises when one company acquires another company for a price that is higher than the fair market value of the acquired company’s net identifiable assets. In simpler terms, if Company A buys Company B and pays more than the value of Company B’s tangible and intangible assets minus liabilities, the excess amount is recorded as goodwill on Company A’s balance sheet.

For example, if Company A acquires Company B for $100 million and the fair market value of Company B’s net identifiable assets is $80 million, then the goodwill generated from the acquisition would be $20 million.

Goodwill can be thought of as a representation of a variety of factors that make a business valuable, such as strong brand recognition, customer relationships, intellectual property, and overall business reputation. These factors contribute to a company’s ability to generate future income but are not individually identifiable assets that can be sold separately from the business.

Here’s how goodwill might appear on a simplified balance sheet:

Current Assets

- Cash: $10,000

Non-Current Assets

- Equipment: $50,000

- Goodwill: $20,000

Total Assets: $80,000

Unlike physical assets like equipment, which depreciate over time, goodwill is not amortized. However, companies are required to annually test goodwill for impairment. If it is determined that the value of goodwill has been impaired—perhaps due to declining business performance, adverse changes in the market, or other factors—the carrying value of goodwill on the balance sheet must be reduced, and an impairment charge is recognized on the income statement.

Goodwill is an important asset to both analysts and investors as it can give insight into a company’s competitive advantages, though its intangible nature also makes it somewhat subjective and difficult to accurately quantify.

All Balance Sheet Related Topics to Explore:

- Balance Sheet – What is a Balance Sheet?

- Balance Sheet Accounts

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement Vs Balance Sheet

- Balance Sheet Equation

- Balance Sheet Formula

- Balance Sheet Format

- How to Read Balance Sheet?

- Personal Balance Sheet

- Common Size Balance Sheet

- Trial Balance Sheet

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Balance Sheet Accounts to AccountingCorner.org