Carriage Inward Meaning

Carriage inward refers to the cost of transportation incurred by a business to bring goods or materials from suppliers to the business premises or warehouses. In accounting and finance, it is treated as a part of the inventory cost or cost of goods sold (COGS), depending on the accounting method used.

Carriage inward refers to the cost of transportation incurred by a business to bring goods or materials from suppliers to the business premises or warehouses. In accounting and finance, it is treated as a part of the inventory cost or cost of goods sold (COGS), depending on the accounting method used.

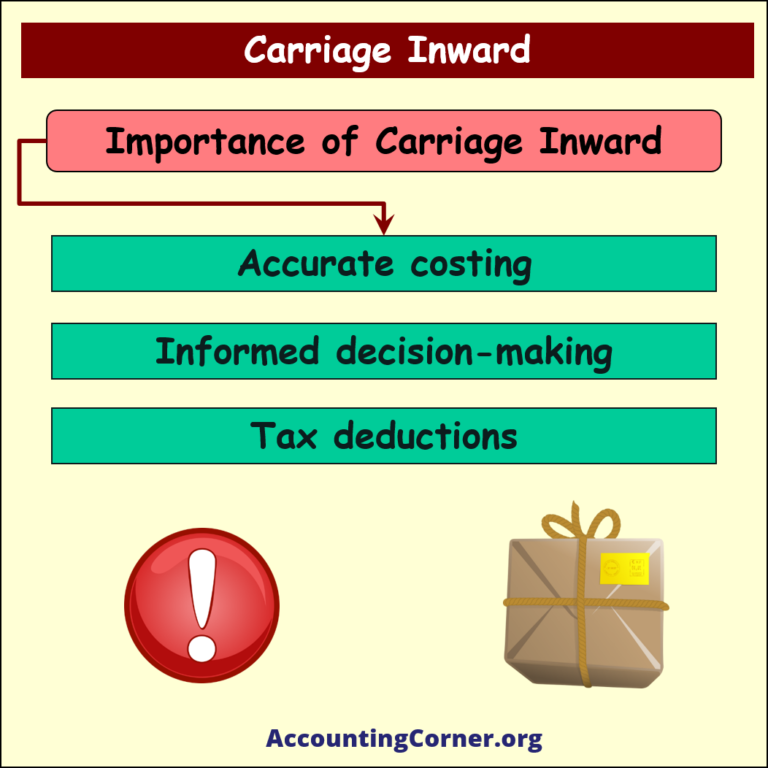

Importance of carriage inward:

- Accurate costing: Including carriage inward in inventory costs ensures that the total cost of goods is accurately reflected, which is essential for calculating gross profit margins and determining the profitability of the business.

- Decision-making: It helps businesses make informed decisions about supplier choices, transportation modes, and inventory management to minimize transportation costs.

- Tax implications: Properly accounting for carriage inward ensures that businesses can claim tax deductions for allowable expenses related to the transportation of goods.

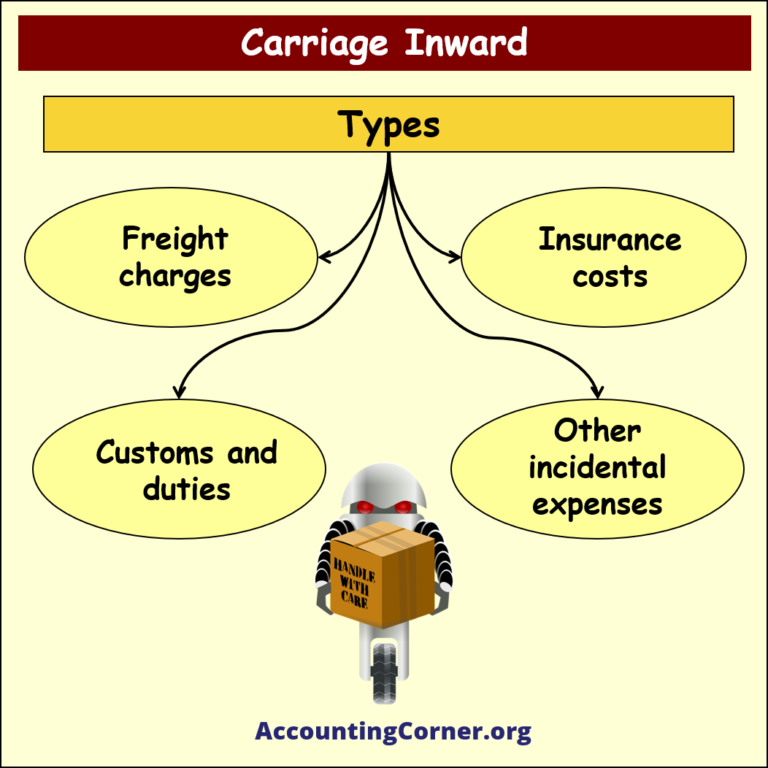

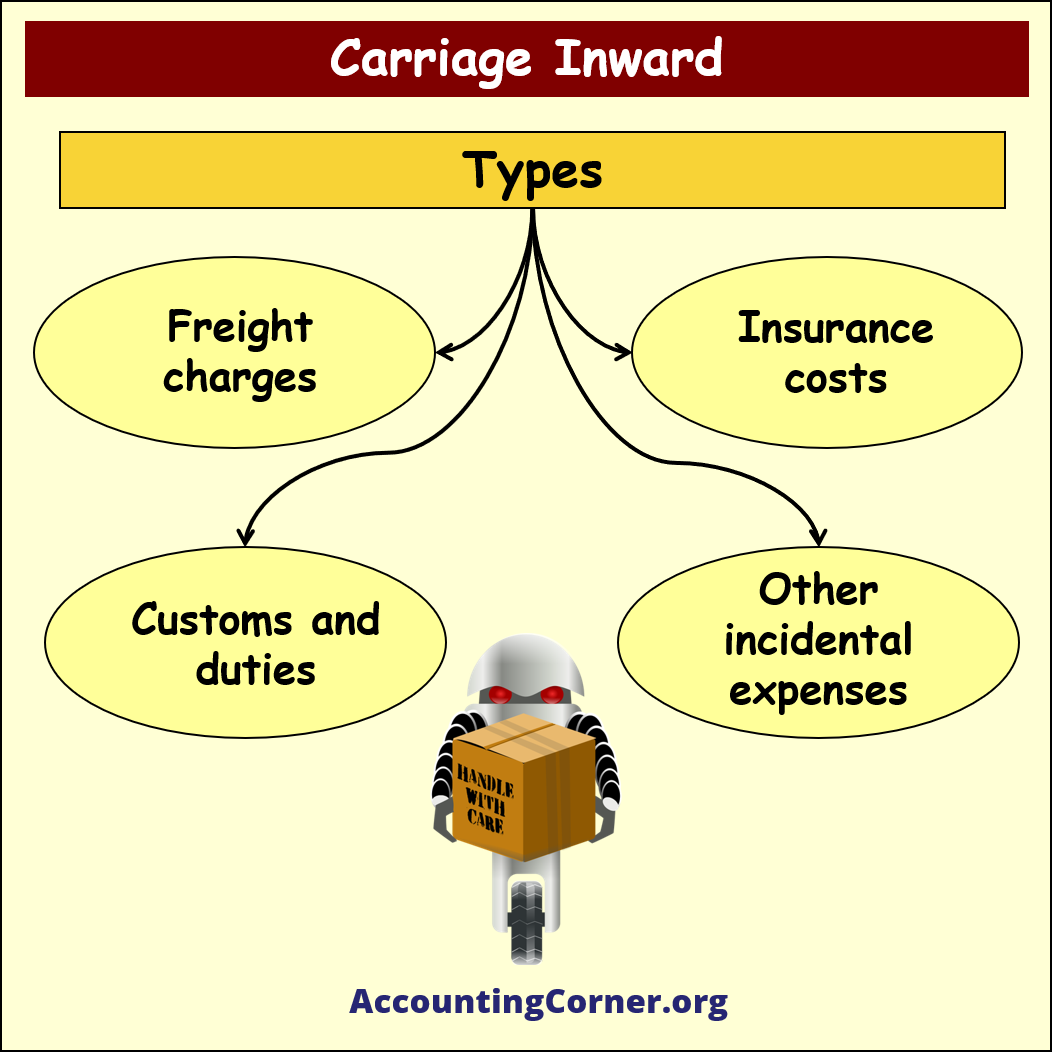

Types of carriage inward:

- Freight charges: Fees charged by transportation companies to move goods from one location to another.

- Insurance costs: The cost of insuring the goods during transportation.

- Customs and duties: Fees charged by customs authorities for importing goods into a country.

- Other incidental expenses: Additional costs incurred during transportation, such as loading and unloading charges, or any special handling fees.

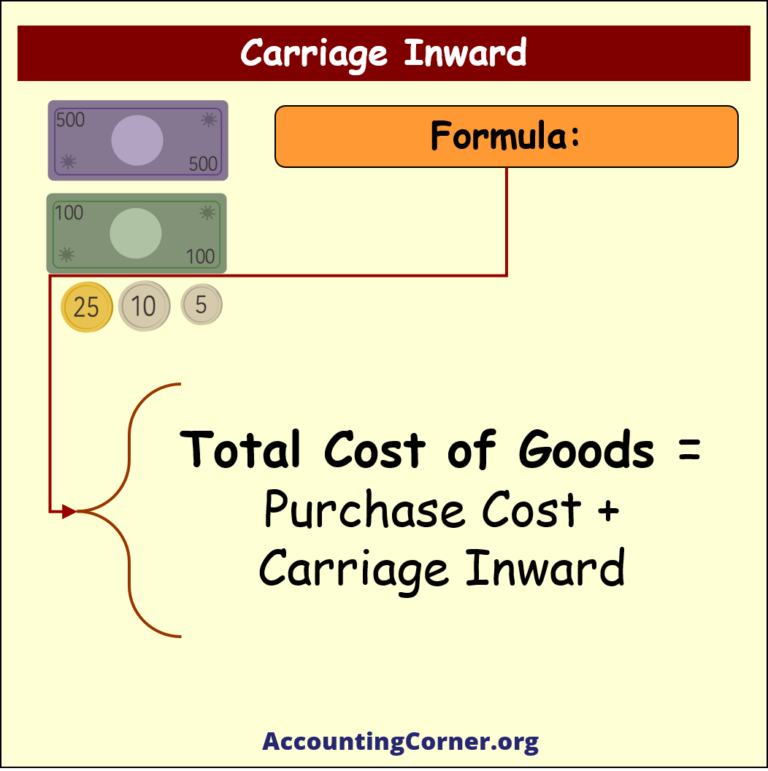

Formula on carriage inward:

Formula on carriage inward:

Carriage inward is added to the purchase cost of goods to determine the total cost of goods:

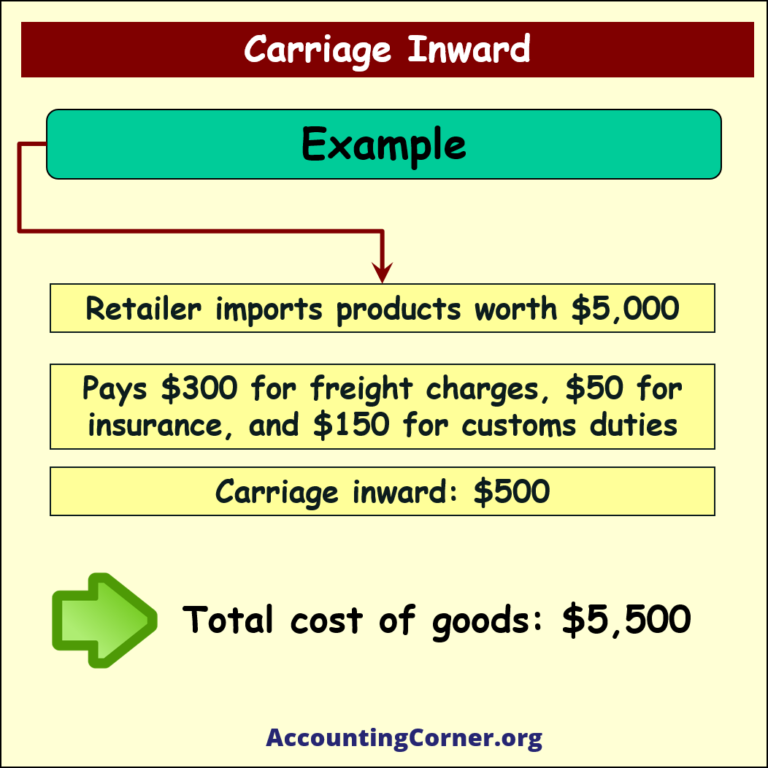

Examples of carriage inward:

- A manufacturer pays $2,000 for raw materials and $100 for transportation to their factory. The carriage inward is $100 and the total cost of goods is $2,100.

- A retailer imports products worth $5,000 and pays $300 for freight charges, $50 for insurance, and $150 for customs duties. The carriage inward is $500 ($300 + $50 + $150) and the total cost of goods is $5,500.

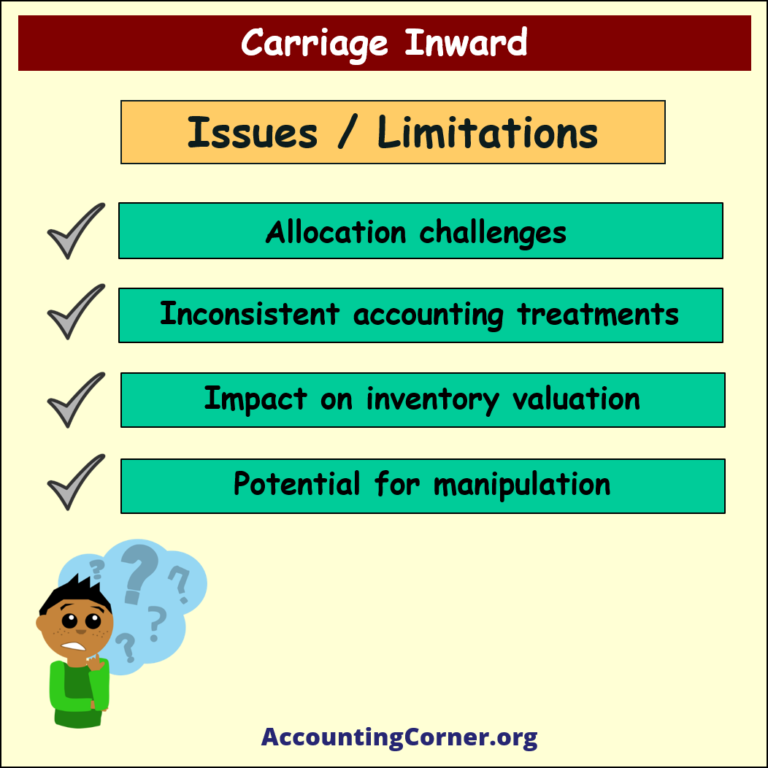

Issues and limitations of carriage inward:

- Allocation challenges: Allocating carriage inward costs among multiple inventory items can be complex, especially when the transportation costs are not uniform for all items.

- Inconsistent accounting treatments: Different businesses may account for carriage inward differently, leading to inconsistencies in financial reporting and analysis.

- Impact on inventory valuation: Carriage inward costs can impact the valuation of inventory on the balance sheet, potentially affecting key financial ratios.

- Potential for manipulation: Businesses may manipulate carriage inward costs to inflate or deflate inventory values and COGS, which can impact financial statements and lead to unethical practices.

Recording Carriage Inward Is Debit or Credit Entry?

Carriage inward is typically recorded as a debit. Since it represents the cost of transportation incurred to bring goods or materials to the business, it increases the overall cost of goods or inventory. Debiting the carriage inward account will reflect this increase in cost.

Visual material: Carriage Inward

Video: Carriage Inward

Return from Carriage Inward to AccountingCorner.org home