Introduction to the Classified Balance Sheet

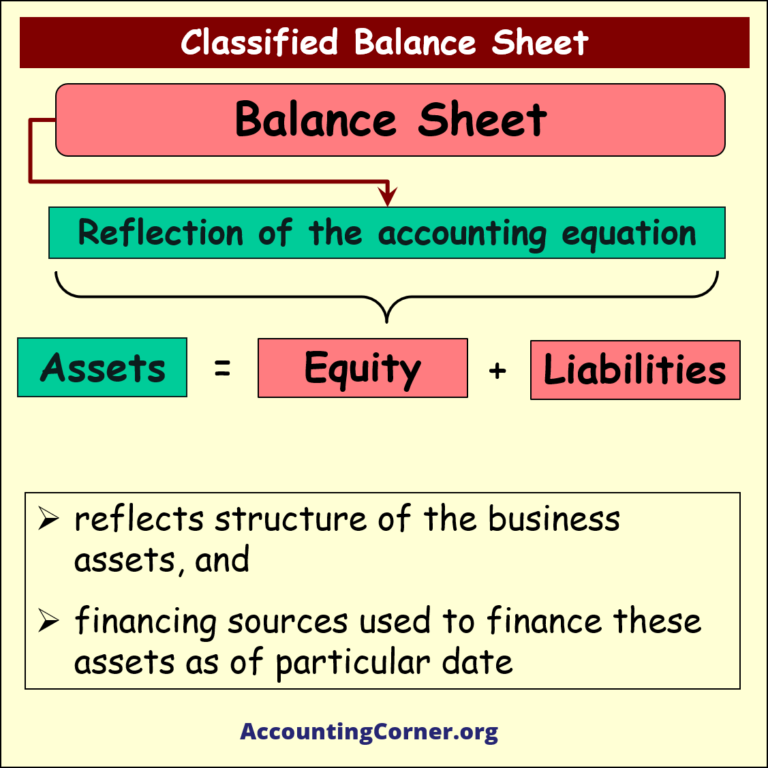

A Classified Balance Sheet provides a detailed view of a company’s financial position by organizing assets, liabilities, and equity into specific categories. This classification enhances clarity, helping stakeholders understand the structure of a business’s resources and obligations. The classified balance sheet reflects the accounting equation:

Assets=Liabilities+Equity

By organizing financial data into clear categories, it offers deeper insights into liquidity, financial health, and the nature of assets and liabilities.

What is a Classified Balance Sheet?

A Classified Balance Sheet is a financial statement where the balances of assets, liabilities, and equity are grouped into meaningful categories. This helps stakeholders quickly assess the company’s liquidity, operational efficiency, and capital structure. The classification is typically done by grouping assets and liabilities into current and long-term categories.

Key Features:

- Current Assets and Liabilities: Items expected to be settled within a year.

- Non-current (Long-Term) Assets and Liabilities: Items expected to extend beyond one year.

The classified balance sheet provides a clearer snapshot of the company’s financial structure compared to a standard balance sheet, allowing for detailed analysis.

Components of a Classified Balance Sheet

A classified balance sheet divides the financial data into several categories:

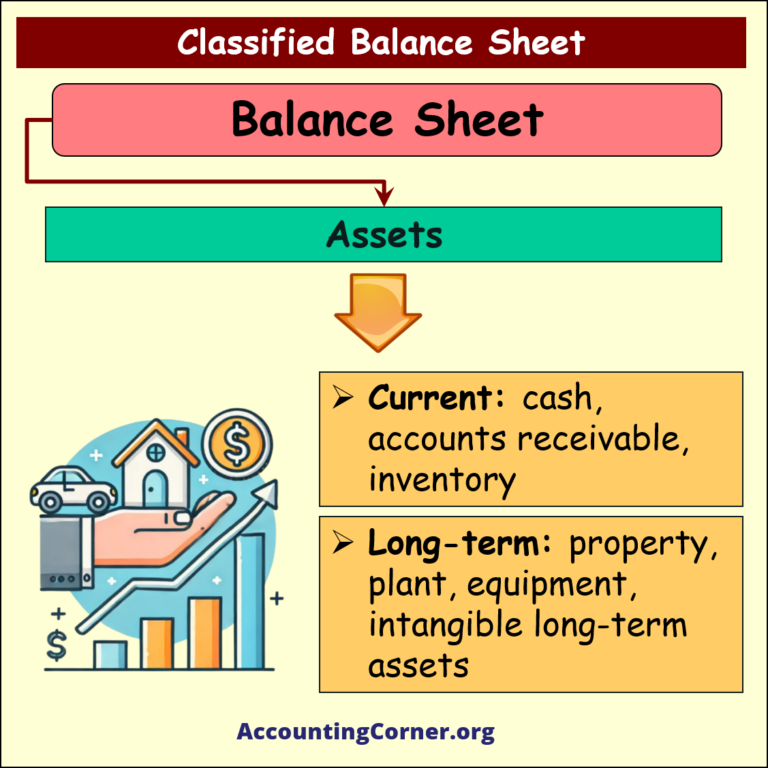

1. Assets

Assets are the resources owned by the business that are expected to generate future economic benefits. They are classified into:

- Current Assets: These include assets that can be converted into cash or used up within a year, such as:

- Cash

- Accounts Receivable

- Inventory

- Long-Term Assets: These are assets that will provide economic benefits over multiple years, such as:

- Property, Plant, and Equipment (PPE)

- Long-term investments

- Intangible Assets (e.g., patents)

2. Liabilities

Liabilities represent obligations the company owes to external parties. They are divided into:

- Current Liabilities: These are obligations that are due within a year, such as:

- Accounts Payable

- Salaries Payable

- Other short-term liabilities

- Long-Term Liabilities: These include obligations that extend beyond one year, such as:

- Long-term Loans

- Bonds Payable

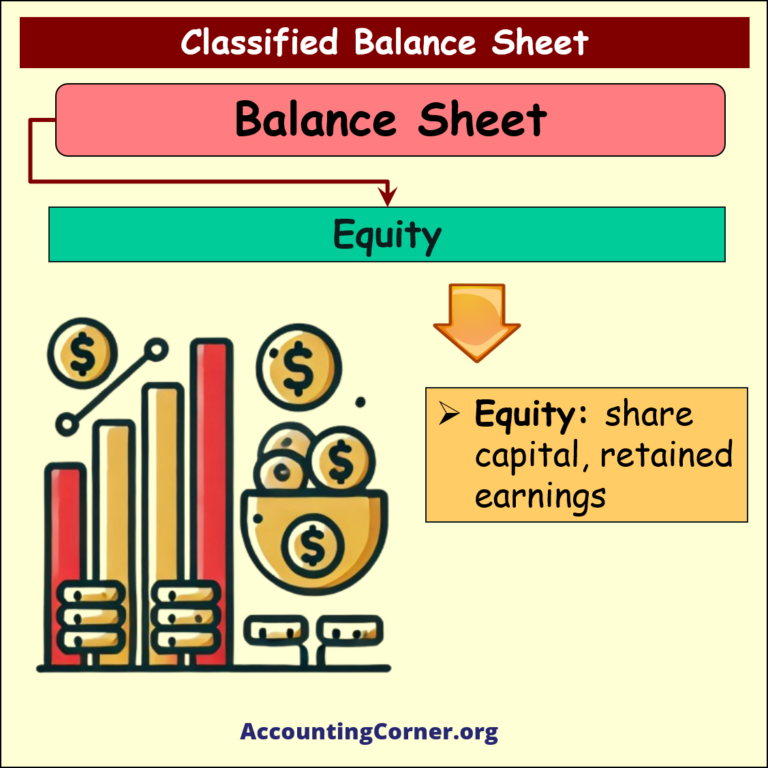

3. Equity

Equity represents the residual interest in the assets after deducting liabilities. It typically includes:

- Share Capital: The initial investment made by shareholders.

- Retained Earnings: The accumulated profits that are retained in the business rather than distributed as dividends.

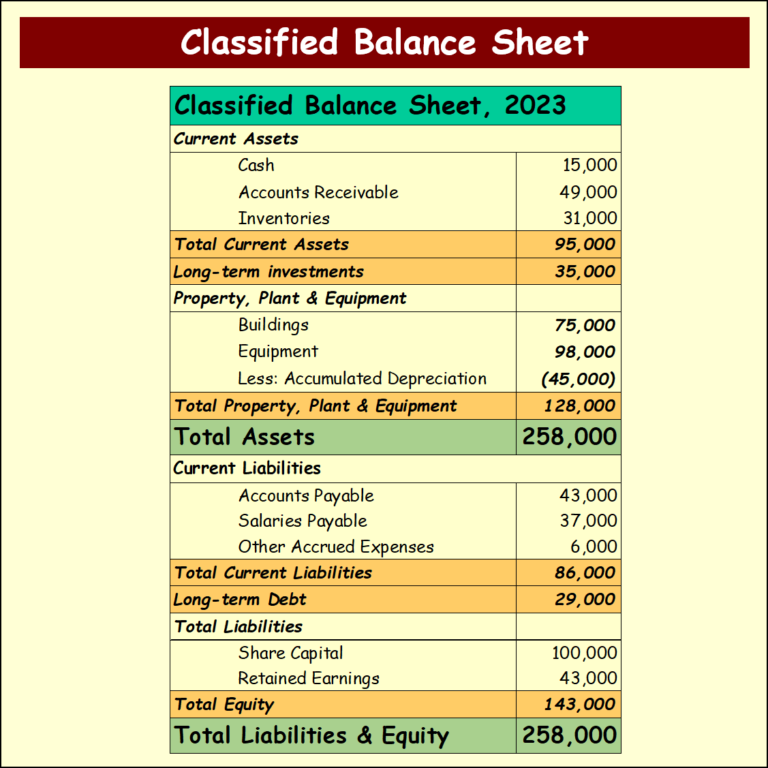

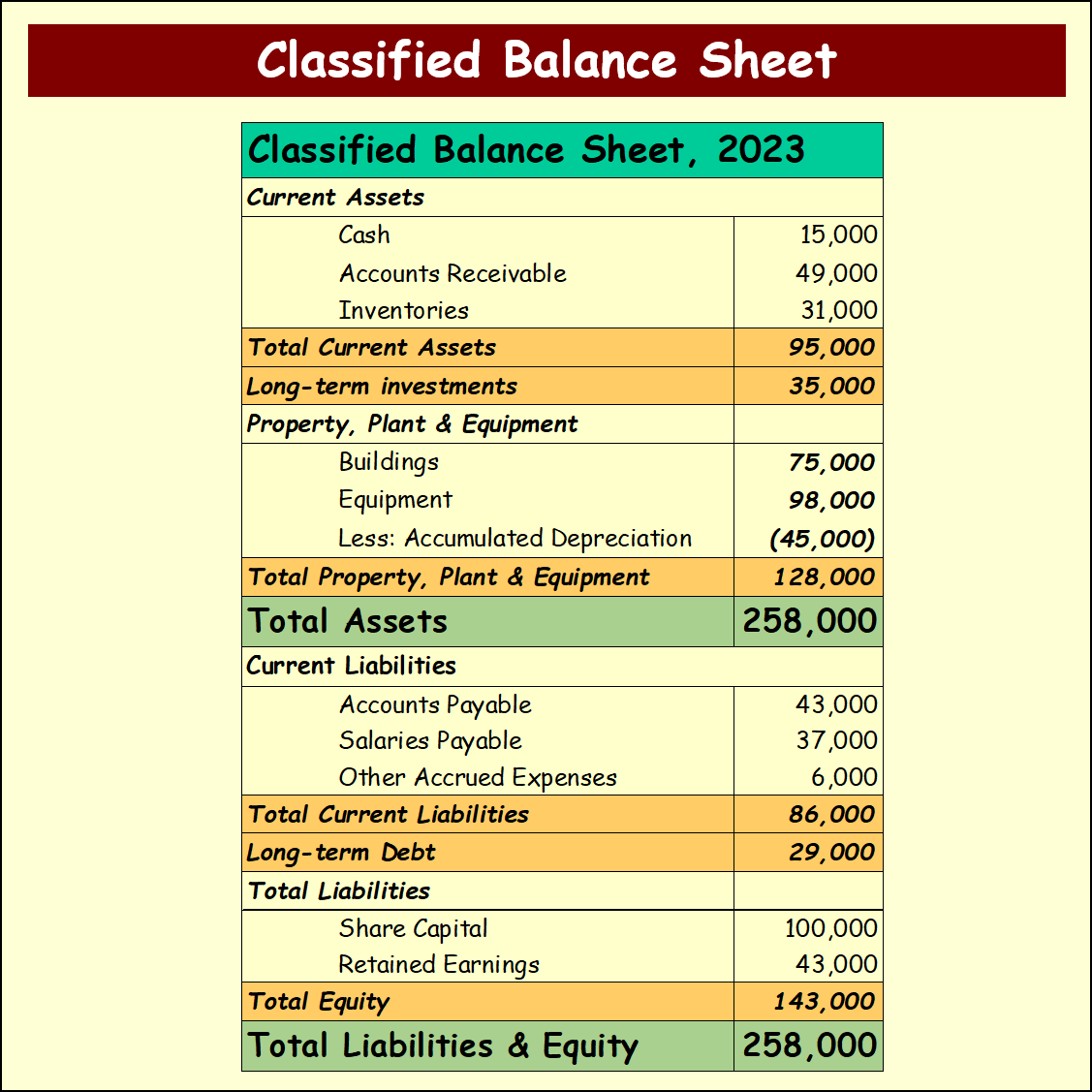

Example of a Classified Balance Sheet

Below is an example of how a classified balance sheet might be structured:

Types of Classified Balance Sheets

There are two primary approaches to structuring a classified balance sheet:

- Liquidity-Based Classification

In this type, assets and liabilities are ordered based on their liquidity, or how easily they can be converted to cash. Current assets and liabilities are listed first, followed by long-term assets and liabilities. - Function-Based Classification

This approach groups assets and liabilities based on their role in business operations, such as production assets, operational liabilities, or financing items.

Importance of a Classified Balance Sheet

A classified balance sheet provides several advantages:

- Enhanced Clarity: The classification of assets and liabilities allows stakeholders to quickly understand the company’s liquidity and financial health. It helps in identifying the company’s short-term and long-term resources and obligations.

- Liquidity Insight: Grouping items based on their liquidity helps investors, creditors, and managers assess the company’s ability to meet short-term obligations and invest in long-term projects.

- Strategic Planning: The detailed breakdown allows management to make informed decisions regarding asset management, liability reduction, and capital investments.

Issues and Considerations

While the classified balance sheet is highly useful, it does have some challenges:

- Complexity: The detailed nature of the classified balance sheet can make it more complex to prepare and interpret, especially for smaller businesses with fewer assets and liabilities.

- Overemphasis on Current Status: The balance sheet is a snapshot at a specific point in time and may not reflect recent changes in the business, such as the acquisition of new assets or the settlement of liabilities.

Conclusion: The Value of the Classified Balance Sheet

The Classified Balance Sheet is an essential financial tool that enhances the clarity of financial reporting by grouping assets, liabilities, and equity into meaningful categories. It provides detailed insights into a company’s financial health, helping stakeholders make informed decisions regarding liquidity, solvency, and long-term financial strategy.

Summary Points:

- 📊 Definition: A classified balance sheet categorizes assets, liabilities, and equity into current and long-term items.

- 💰 Current Assets: Includes cash, accounts receivable, and inventory.

- 🏗 Non-Current Assets: Includes property, plant, equipment, and long-term investments.

- 🏦 Liabilities: Divided into current liabilities (due within a year) and long-term liabilities (due after one year).

- 🔄 Equity: Reflects ownership interest in the company, including share capital and retained earnings.

- 📋 Types: Classified based on liquidity or function, offering enhanced clarity and detailed financial insight.

A classified balance sheet provides a structured and clear view of a company’s financial position, allowing for better decision-making and strategic planning. By understanding the detailed breakdown of assets and liabilities, businesses can maintain transparency and foster long-term financial stability.

Classified Balance Sheet – Visuals

Classified Balance Sheet – Video

All Balance Sheet Related Topics to Explore:

- Balance Sheet – What is a Balance Sheet?

- Balance Sheet Accounts

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement Vs Balance Sheet

- Balance Sheet Equation

- Balance Sheet Formula

- Balance Sheet Format

- How to Read Balance Sheet?

- Personal Balance Sheet

- Common Size Balance Sheet

- Trial Balance Sheet

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Classified Balance Sheet to AccountingCorner.org