A Comprehensive Guide to Common Stock

Common stock represents an essential aspect of a company’s equity, providing shareholders with ownership, potential profits, and voting rights. This blog post delves into the details of common stock, including its characteristics, advantages, risks, and how it is accounted for.

What is Common Stock?

- Ownership Stake: Common stockholders hold an ownership share in the company. This entitles them to a portion of the company’s profits and assets.

- Claim on Residual Assets: In case of liquidation, common shareholders are the last to receive any residual value after debts and preferred shareholders are paid.

Key Characteristics of Common Stock

- Voting Rights:

- Common shareholders generally have voting rights, often one vote per share, allowing them to participate in major company decisions.

- Voting matters typically include mergers, board elections, and significant policy changes.

- Dividends:

- Common shareholders may receive dividends, although these are not guaranteed.

- Dividends are distributed if the company earns profits and decides to share them with shareholders.

- Capital Appreciation:

- Shareholders benefit from the appreciation in stock price, reflecting the company’s growth and success.

- Selling appreciated shares allows shareholders to realize capital gains.

Issuance of Common Stock

- Initial Public Offering (IPO): Companies issue common stock during an IPO to raise capital for operations, expansion, or other needs.

- Secondary Offerings: Additional shares may be issued later to raise more funds, known as secondary offerings.

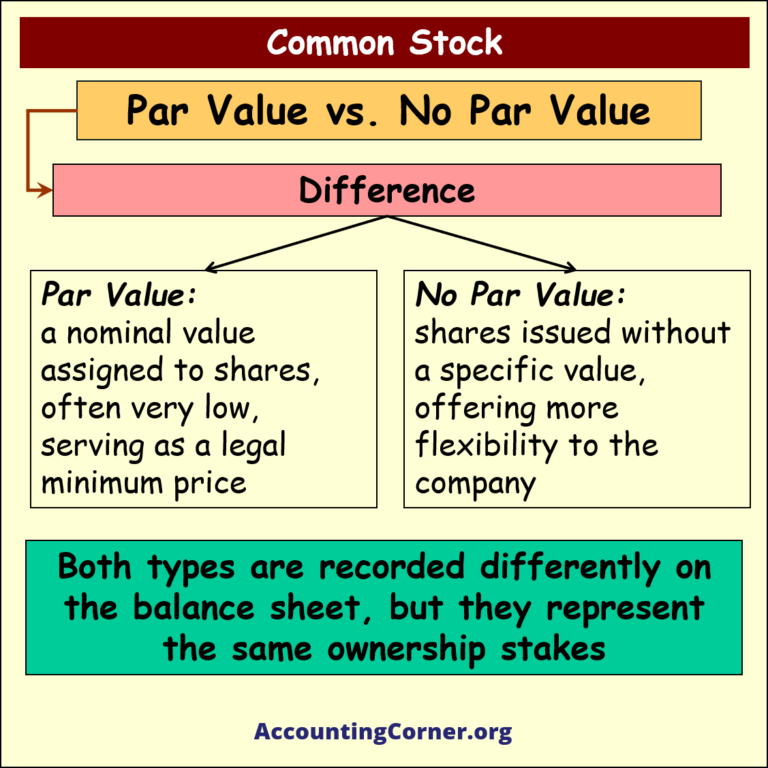

Par Value vs. No Par Value

- Par Value:

- This is a nominal value assigned to shares, typically very low, serving as a legal minimum price for issuing shares.

- Common stock with par value is recorded on the balance sheet at the par value multiplied by the number of shares.

- No Par Value:

- Shares issued without a specified value, providing more flexibility to the company.

- Regardless of par or no par, both types represent the same ownership stakes in the company.

Common Stock vs. Preferred Stock

- Voting Rights:

- Common stockholders usually have voting rights, unlike preferred stockholders, who generally do not.

- Dividend Priority:

- Preferred stockholders receive dividends first, often at a fixed rate, while common stockholders receive them if profits allow.

- Liquidation Priority:

- In case of bankruptcy, preferred stockholders are paid before common stockholders, making common stock riskier.

Benefits for Shareholders

- Voting Influence:

- Common shareholders can vote on essential company matters, such as mergers, acquisitions, and leadership changes.

- Potential Dividends:

- Although not guaranteed, dividends can provide a source of income if the company performs well.

- Capital Gains:

- Shareholders can profit by selling their shares at a higher price than the purchase price if the company’s stock value appreciates.

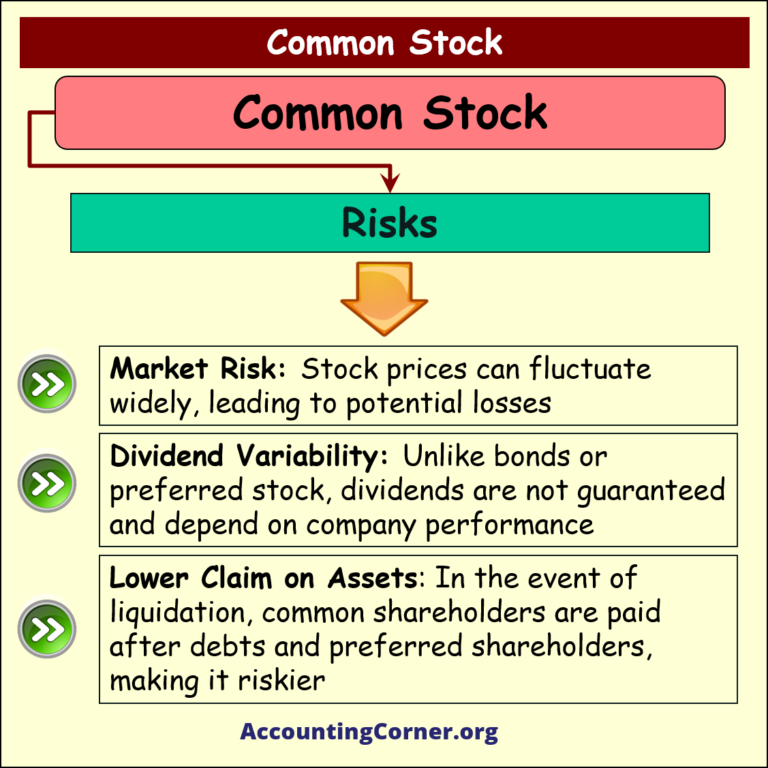

Risks Associated with Common Stock

- Market Risk:

- Common stock prices can be volatile, leading to potential losses for shareholders.

- Dividend Variability:

- Unlike bonds or preferred stock, dividends for common stock are not fixed and depend on the company’s profitability and decisions.

- Lower Claim on Assets:

- In the event of liquidation, common shareholders are paid after debts and preferred shareholders, which adds to the risk.

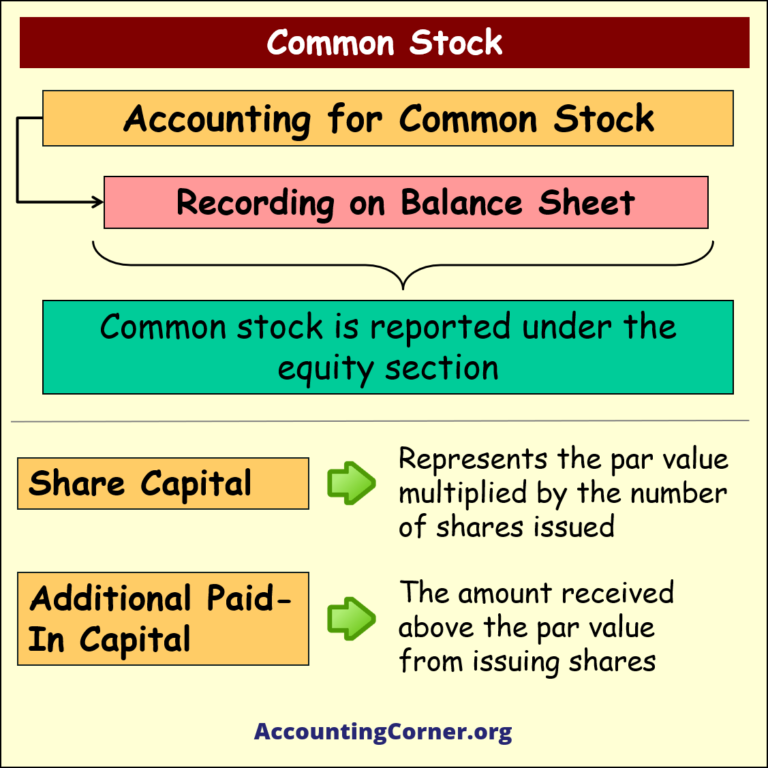

Accounting for Common Stock

- Balance Sheet Representation:

- Common stock appears under the equity section on the balance sheet.

- Share Capital: This represents the par value multiplied by the number of shares issued.

- Additional Paid-In Capital: The amount received above the par value from issuing shares.

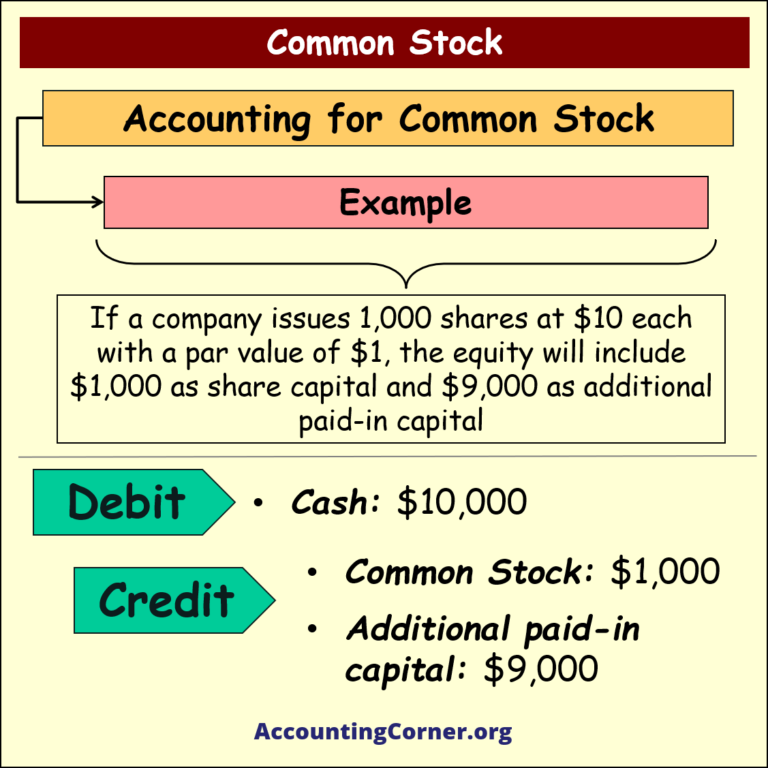

- Example of Accounting Entry:

- Suppose a company issues 1,000 shares at $10 each with a par value of $1.

- Share Capital: $1,000 (1,000 shares x $1 par value)

- Additional Paid-In Capital: $9,000 (total cash received $10,000 – $1,000 par value)

- Journal Entry:

- Debit Cash: $10,000

- Credit Common Stock: $1,000

- Credit Additional Paid-In Capital: $9,000

- Suppose a company issues 1,000 shares at $10 each with a par value of $1.

Conclusion

Common stock is a vital tool for companies to raise capital while giving shareholders an opportunity to benefit from the company’s growth. It provides voting rights, potential dividends, and capital appreciation. However, it also carries risks, such as market volatility and a lower claim on assets in liquidation. Understanding common stock, its benefits, risks, and accounting treatment helps investors make informed decisions and allows companies to manage their equity effectively.

Common Stock – Visuals

Common Stock – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Common Stock to AccountingCorner.org home