A comparative balance sheet is a financial statement that presents the financial position of a company at two or more different points in time. It allows for easy comparison and analysis of changes in assets, liabilities, and equity over a specific period. By presenting financial data side-by-side, it enables stakeholders to evaluate the company’s performance, financial health, and growth over time.

Importance of comparative balance sheet:

- Performance evaluation: It helps stakeholders evaluate the company’s financial performance by comparing the changes in assets, liabilities, and equity over a given period.

- Trend analysis: By comparing data over multiple periods, stakeholders can identify trends, patterns, and areas of improvement.

- Decision-making: A comparative balance sheet aids management in making informed decisions related to investments, expansions, or cost-cutting measures.

- Benchmarking: It allows companies to compare their financial position and performance with industry peers and competitors.

- Compliance: It helps ensure that the company is meeting its regulatory and financial reporting requirements.

Types of comparative balance sheet:

- Horizontal analysis: This involves comparing financial data of the company over multiple periods to identify trends and changes in financial position.

- Vertical analysis: This involves comparing each item on the balance sheet to a specific base figure (e.g., total assets) to determine the proportionate contribution of each item.

Issues and limitations of comparative balance sheet:

- Inflation: Changes in the value of money due to inflation can distort the comparison of financial data across different periods.

- Accounting policies: Differences in accounting policies or changes in accounting standards may affect the comparability of financial statements.

- Seasonality: Some businesses are affected by seasonality, which can cause fluctuations in their financial position and make it challenging to compare balance sheets across periods.

- Industry-specific factors: Certain industries may have unique characteristics that make it difficult to compare balance sheets directly.

- Limited scope: Comparative balance sheets only provide a snapshot of a company’s financial position at specific points in time, and may not capture the complete picture of its financial health.

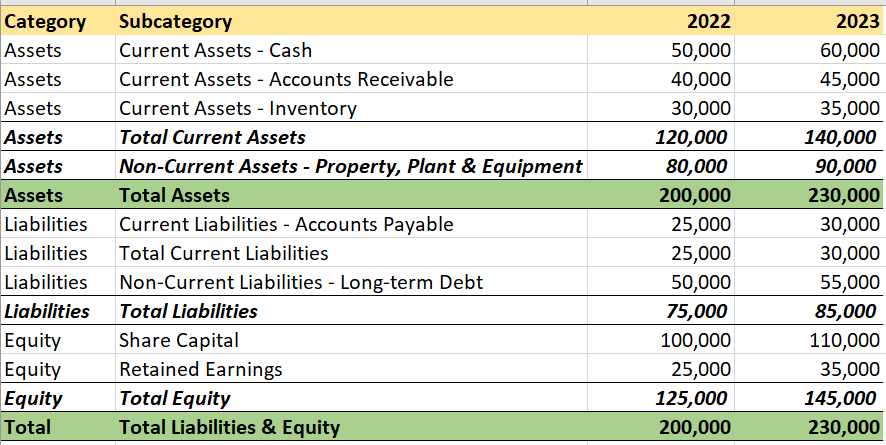

Example of comparative balance sheet (in table format):

All Balance Sheet Related Topics to Explore:

- Balance Sheet – What is a Balance Sheet?

- Balance Sheet Accounts

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement Vs Balance Sheet

- Balance Sheet Equation

- Balance Sheet Formula

- Balance Sheet Format

- How to Read Balance Sheet?

- Personal Balance Sheet

- Common Size Balance Sheet

- Trial Balance Sheet

Return from Comparative Balance Sheet to AccountingCorner.org