Let’s explore What is Cost of Goods Sold

![]() It is essential to understand that the below explanation and Cost of Goods Sold represents concept applicable only to manufacturing or to trading business.

It is essential to understand that the below explanation and Cost of Goods Sold represents concept applicable only to manufacturing or to trading business.

It cannot be applied to the businesses, which provide services, since such businesses do not produce or sell goods. Therefore there will be no Inventory (manufactured or purchased) and there will be no Cost of Goods Sold.

- Cost of Goods Sold (COGS) – Direct costs, tied to the production of the goods a business sells.

It includes:

- material cost

- direct labor cost

- overhead directly involved in creating the product

For the manufacturing or trading business it is important to understand that we must apply matching principle and match revenues earned with the costs incurred to earn such revenue.

Cost of Goods Sold – Financial Statements

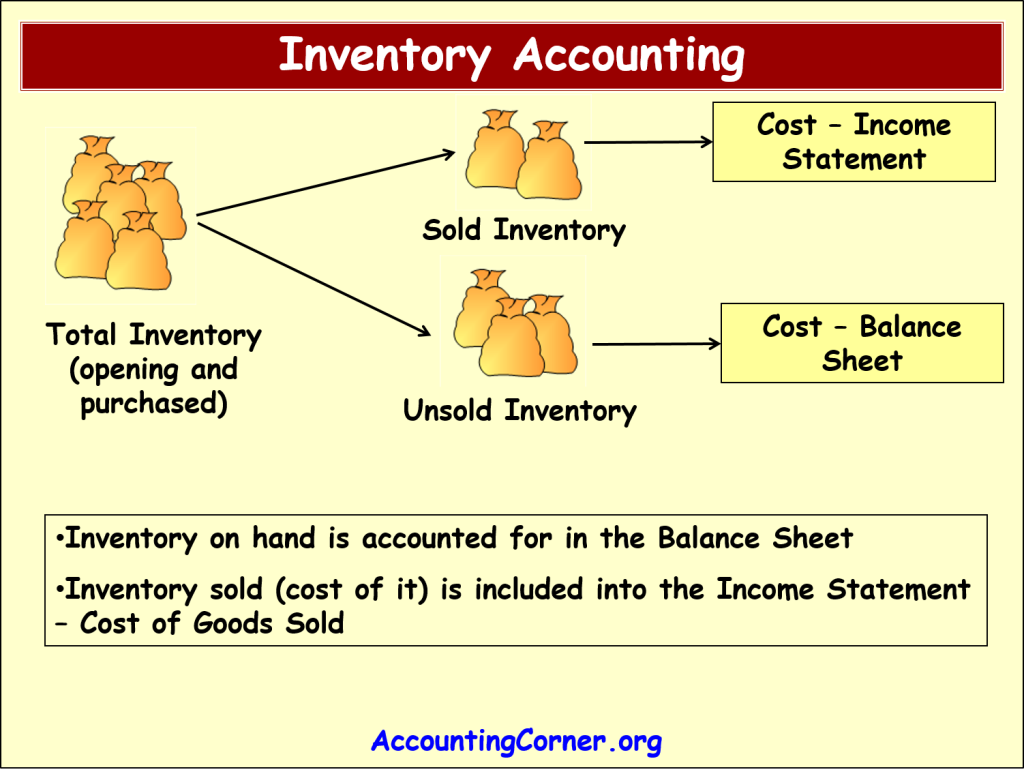

![]() From the picture below you can note that only costs of that inventory, which was sold during the particular period of time can be included into the Income Statement. All the inventory, which was not yet sold during the accounting period is accounted for in the Balance Sheet until is being sold.

From the picture below you can note that only costs of that inventory, which was sold during the particular period of time can be included into the Income Statement. All the inventory, which was not yet sold during the accounting period is accounted for in the Balance Sheet until is being sold.

Usually we analyse and account for transactions on already operating business, therefore the manufacturing and/or trading flow is continuous, i.e. inventory being purchased/manufactured, stored, sold and process runs again and again.

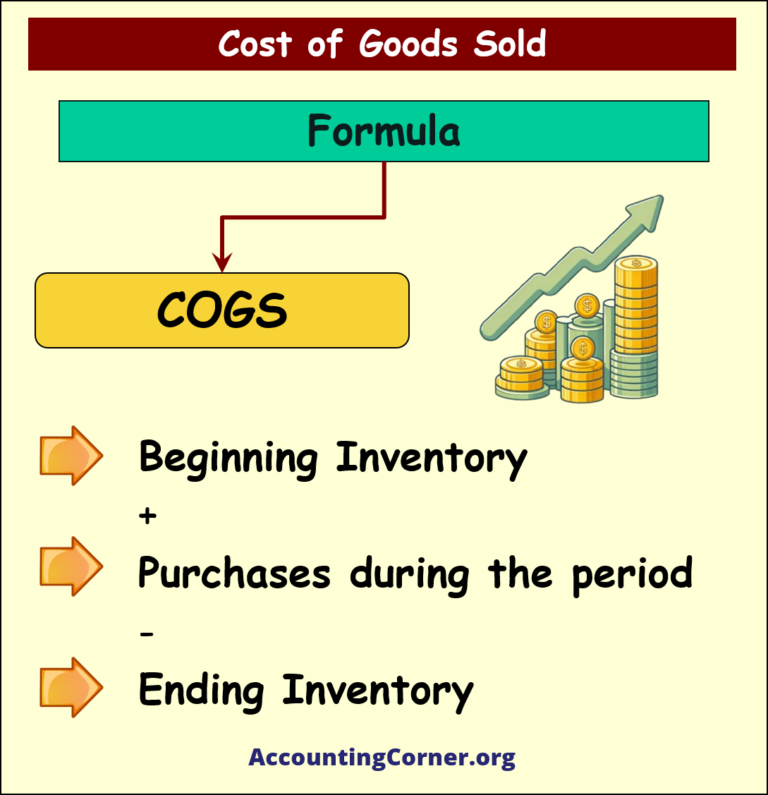

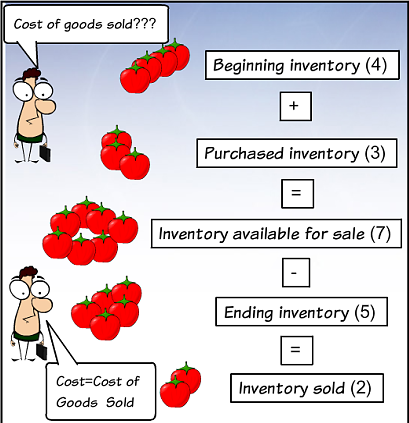

![]() In order to understand how to calculate cost of goods sold, we will use the following Cost of Goods Sold formula:

In order to understand how to calculate cost of goods sold, we will use the following Cost of Goods Sold formula:

Beginning Inventory + Purchased/Manufactured Inventory = Inventory Available For Sale

Inventory Available for Sale – Ending Inventory = Inventory Sold

In the above formula costs in monetary means are being used. Only cost of inventory sold will go to the Income Statement and will be included into the Cost of Good Sold.

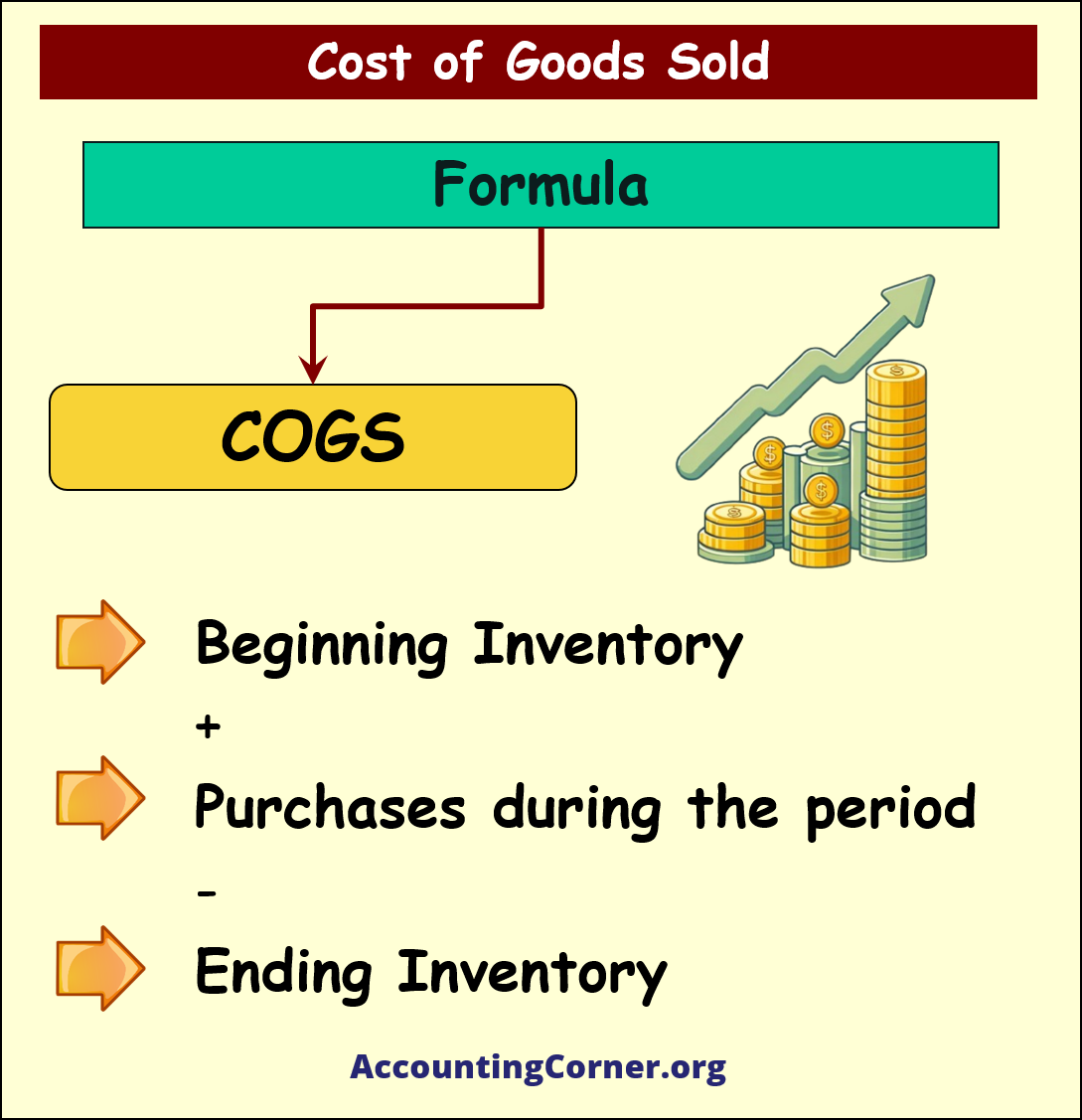

![]() More simplified formula can look like this:

More simplified formula can look like this:

Cost of Goods Sold – Practical Example

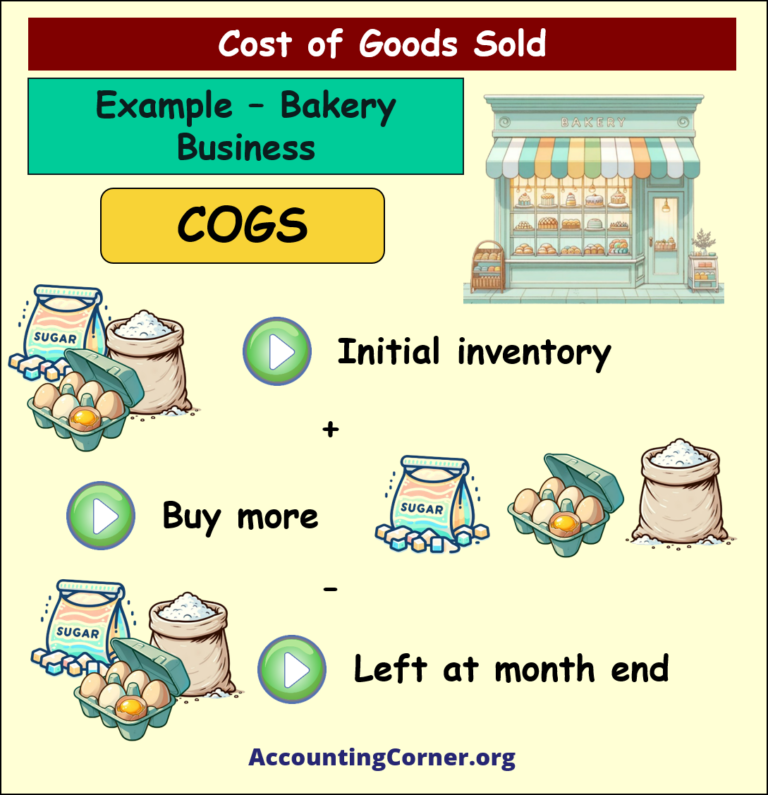

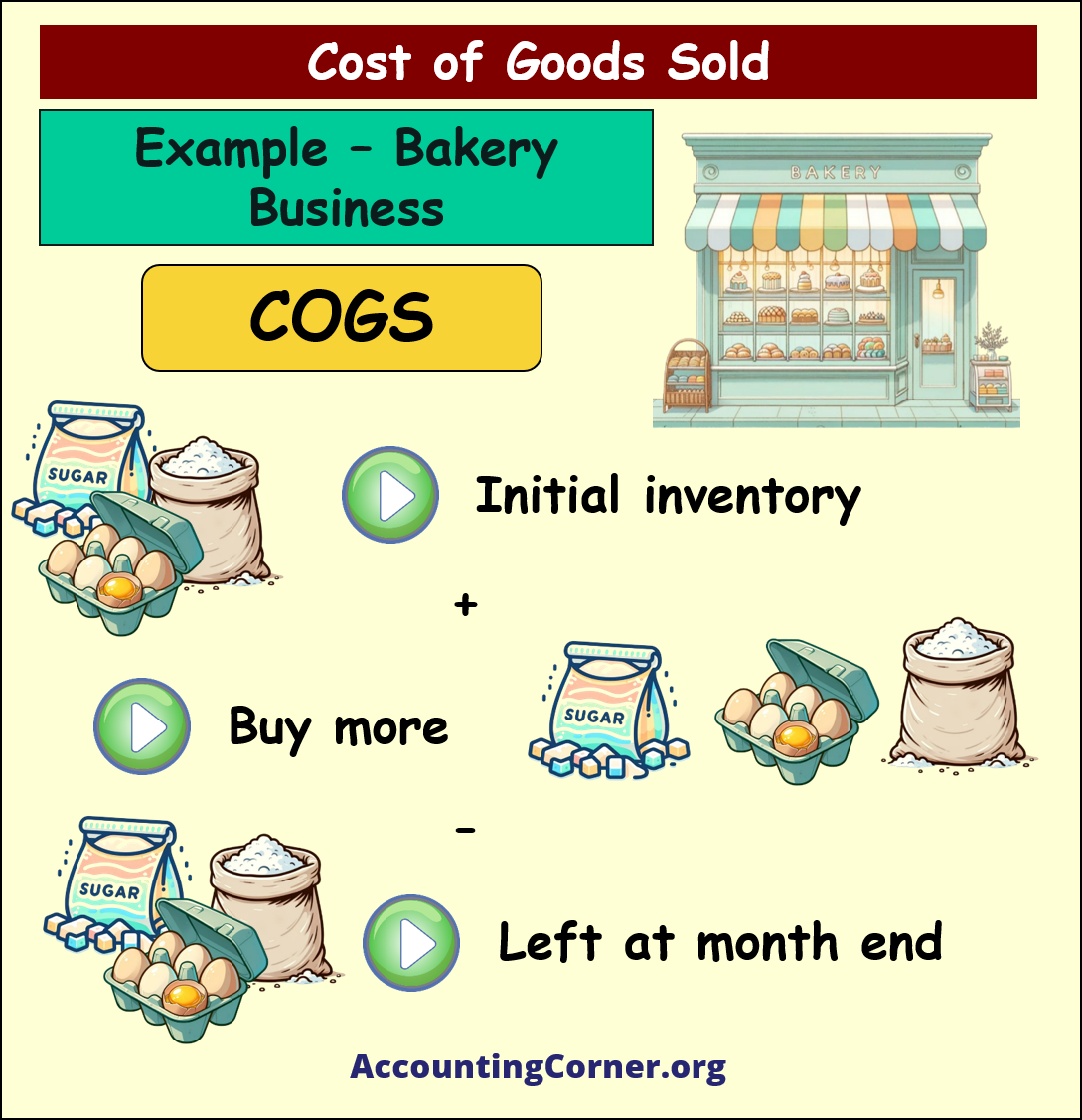

Let’s take as an example bakery business.

To whip up the perfect Cost of Goods Sold (COGS) for a bakery, you’ll need to mix a few key ingredients. 🍰

- Start with a Base of Initial Inventory: Scoop up the total value of your pantry staples—think heaping piles of flour, sugar, and crates of eggs—ready at the dawn of your financial feast.

- Fold in Additional Purchases: Throughout the month, sprinkle in the cost of extra supplies. These are the fresh dollops of cream and chocolate chips that keep your bakery churning out delicious treats.

- Weigh Your Ending Inventory: As the month closes, weigh out what’s left on your shelves. This leftover mix is your ending inventory, ready to roll over into the next month’s recipe.

- Calculate Your COGS Soufflé: Now, subtract the value of your leftover ingredients from your initial mix plus the extra sprinkles added during the month. Voilà! The result is the true cost of the ingredients devoured in your month’s sales.

With this recipe, you’ll not only keep your financials as neat as your kitchen but also price your pastries perfectly to keep the dough rising in more ways than one! 🍞💸

Cost of Goods Sold – Importance

Cost of Goods Sold (COGS) is an essential measure in business that accounts for the direct costs of producing goods. It includes material and labor expenses but not indirect costs like marketing and sales. Calculating COGS is vital for several reasons:

- Pricing Strategy: It helps set profitable prices by understanding the baseline cost of products.

- Inventory Management: Efficient inventory control can reduce COGS and enhance profit margins.

Effective management of COGS is thus not only beneficial for accurate financial reporting, but also crucial for operational strategy and profitability

Cost of Goods Sold (COGS) – Video Visuals

Cost of Goods Sold (COGS) – Video Material

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Cost of Goods Sold to AccountingCorner.org home