Debt to Asset Ratio Definition

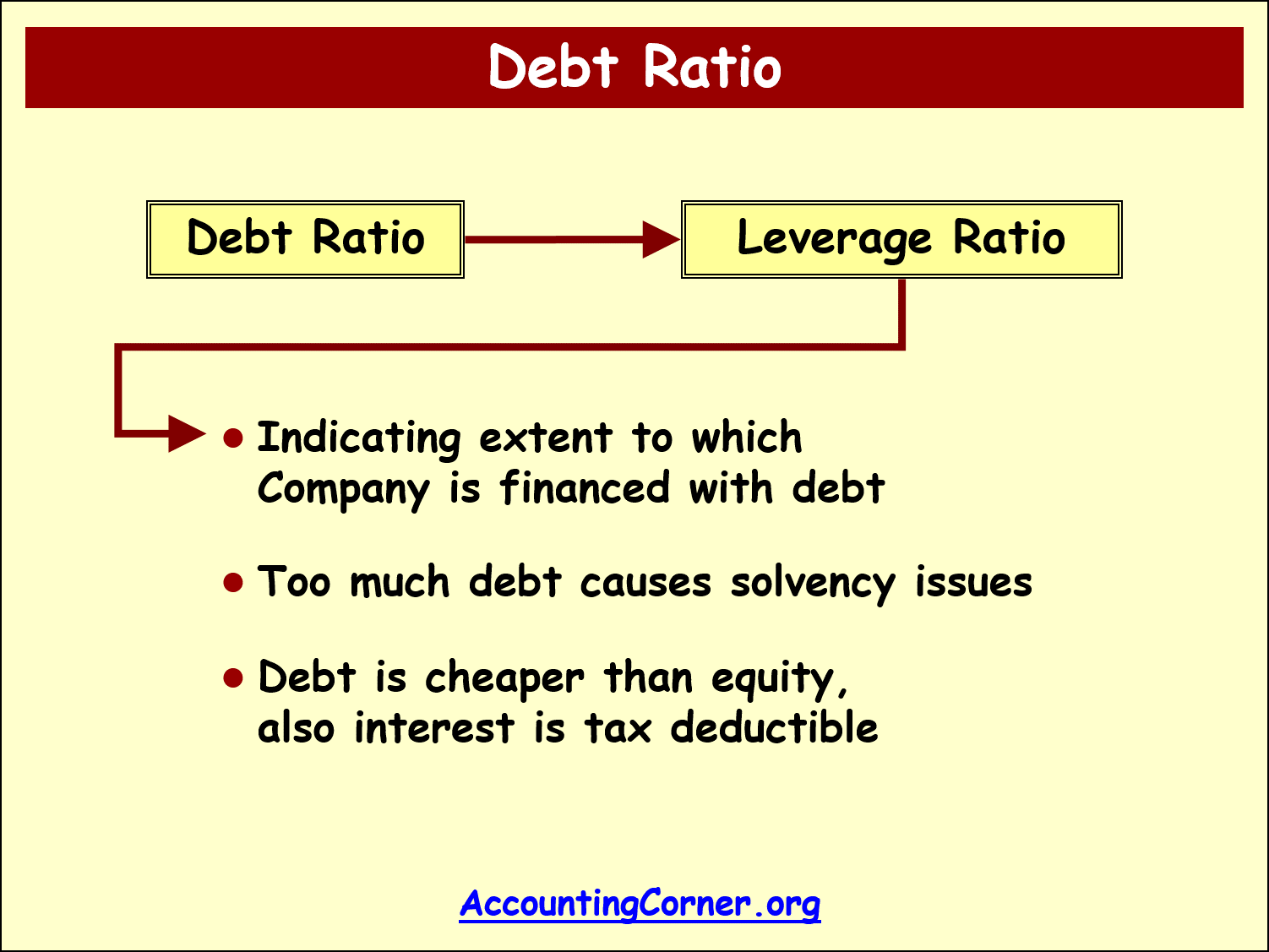

Debt to Asset ratio (it also can be called Debt Ratio) provides a comparison of debt and asset ratio, i.e. indicates, which part of assets is financed by borrowed means (debt). This ratio is attributed to the group of Leverage Ratios, which serve as indication of the business financial risk and ability of the business to repay its debt on time.

Debt to Asset Ratio Formula

Debt to Asset ratio – this ratio compares debt to assets. The following debt to asset ratio formula is used:

Debt to Asset ratio – this ratio compares debt to assets. The following debt to asset ratio formula is used:

This ratio indicates what part of assets is financed by debt.

While calculating this ratio, it is necessary to divide Total Liabilities by Total Assets, where the data can be derived from the Balance Sheet of the company.

Understanding Debt to Asset Ratio

Debt to Asset ratio is widely used to analyze financial risk of the business, compare it to the peers in the industry and also identify the trend over the certain period of time.

Debt to Asset ratio is widely used to analyze financial risk of the business, compare it to the peers in the industry and also identify the trend over the certain period of time.

For the question: “What is a good debt to asset ratio?” – there is no straightforward answer, since in isolation this ratio will only show part of assets financed by debt.

![]() In order to get more clear trend, it is necessary to check this ratio for the business in the same industry and also analyze value of this debt to asset ration over a period of time, which will show how business tends to finance its assets. Other rations must also be taken into account.

In order to get more clear trend, it is necessary to check this ratio for the business in the same industry and also analyze value of this debt to asset ration over a period of time, which will show how business tends to finance its assets. Other rations must also be taken into account.

Also it is essential to bear in mind that it is not an adverse factor to finance assets with debt. Debt usually is cheaper than equity, interest costs are tax deductible. The most important here is to ensure business is able to earn sufficient profits and pay back debt on time.

Debt to Asset Ratio – Example

For example, we have a business, where Total Assets amount to 11 938 m$ and Total Debt amounts to 6 745 m$.

In this example 56.5% of total assets of the business are being financed by debt.

It is difficult to identify whether such Debt Ratio is good or bad.

It is difficult to identify whether such Debt Ratio is good or bad.

It has to be analysed together with other criteria, as:

- other businesses in the same industry

- trend of the ratio over longer period of time

- profitability of the business

- cash flow generated, which allows paying debt on time

Return from Debt to Asset to https://accountingcorner.org home