Discounted Cash Flow (DCF) is a financial valuation method used to determine the value of an investment based on its expected future cash flows. By discounting these cash flows back to their present value, one can estimate the current value of a future income stream. It is widely used in finance for various purposes, including investment appraisal, capital budgeting, and mergers and acquisitions.

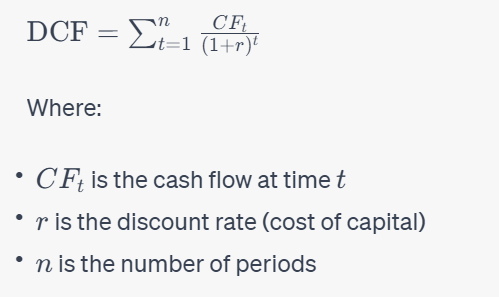

Formula for DCF:

Importance of DCF:

- Objective Valuation: DCF provides a methodology to value investments or businesses based on their intrinsic value, which is determined by their expected cash generation capability in the future.

- Flexibility: Allows for the modeling of different scenarios to understand the potential range of values.

- Comparability: Provides a basis to compare different investments or projects based on their expected return and risks.

Practical Examples:

- Investment Appraisal: Evaluating the profitability of a new project or investment. If the DCF is greater than the initial investment, it might be considered a good investment.

- Valuing a Company: To determine the intrinsic value of a company based on its expected future cash flows. This is a key component in equity research and mergers and acquisitions.

- Capital Budgeting: Helping corporations to decide where to allocate their capital by comparing the DCF of different projects.

Issues and Problems with DCF:

- Estimation Errors: The accuracy of a DCF model depends on the accuracy of the projected future cash flows and the discount rate. Small changes in either can result in significant changes in valuation.

- Discount Rate Determination: Selecting an appropriate discount rate can be challenging and can significantly impact the result.

- Assumptions and Forecasting: Forecasts are inherently uncertain, especially for longer time horizons.

- Changing Business Environments: Economic conditions, technological changes, or regulatory shifts can impact future cash flows, making previous DCF valuations obsolete.

- Subjectivity: While DCF is a structured approach, it’s still influenced by subjective judgments, especially regarding growth rates and terminal values.

- Terminal Value: Estimating the value of cash flows beyond a certain projection period (often 5-10 years) is done through the terminal value. This value can sometimes be a large portion of the DCF and is based on assumptions that can be very subjective.

- May Not Capture Competitive Dynamics: DCF focuses on the cash flow generation capability of a business and might not fully capture the strategic value or competitive positioning of a business.

In summary, while DCF is a powerful tool and widely used, it comes with its set of challenges and limitations. It’s crucial to understand these when using the methodology and to always apply judgment and sensitivity analyses to test the robustness of the assumptions made.

All Cash Flow Related Topics to Explore:

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Cash Flow

- Discounted Cash Flow

- Discounted Cash Flow Model

- Cash Flow Analysis

- Free Cash Flow

- Operating Cash Flow

- Cash Flow Quadrant

- Net Cash Flow

- Cash Flow Management

- Cash Flow Forecast

- Cash Flow Calculator

- Free Cash Flow Calculator

- Discounted Cash Flow Calculator

- Cash Flow From Investing Activities

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Discounted Cash Flow to AccountingCorner.org