Discounted Cash Flow (DCF) Model

The Discounted Cash Flow model (DCF) is a valuation method used to determine the value of an investment based on its expected future cash flows, discounted back to the present value. Essentially, it answers the question, “How much is the future cash flow of an asset worth today?”

Components of a DCF Model:

- Forecast Period: The period over which you expect to receive the cash flows from the investment. This is often several years.

- Cash Flow Estimation: For each year in the forecast period, you’ll estimate the cash flows the investment is expected to produce. This might include revenues, costs, taxes, and net income.

- Discount Rate: This represents the time value of money (i.e., a dollar today is worth more than a dollar tomorrow). Typically, the discount rate is the investment’s weighted average cost of capital (WACC), but it can also be the investor’s required rate of return.

- Terminal Value: This is the value of all future cash flows beyond the forecast period, into perpetuity. It can be calculated using a perpetuity growth model (where cash flows grow at a constant rate forever) or via an exit multiple approach.

How to Create a DCF Model:

- Forecast Cash Flows: Begin by projecting the future cash flows for the investment for each year in your forecast period.

- Determine the Discount Rate: This is often the WACC, but it could be any rate that reflects the perceived risk of the cash flows.

- Calculate Present Value of Forecasted Cash Flows: For each year, divide the projected cash flow by (1+Discount Rate)^n, where n is the year number.

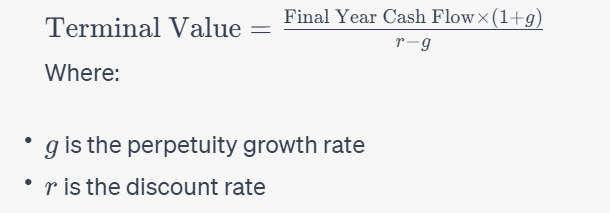

- Calculate the Terminal Value: If using the perpetuity growth model, use the formula:

- Discount the Terminal Value: Divide the terminal value by (1+Discount Rate)^n, where n is the number of years into the future when the terminal value is expected.

- Sum the Present Values: The value of the investment is the sum of the present values of the projected cash flows and the discounted terminal value.

Benefits of DCF:

- Fundamental-Based: It focuses on intrinsic value, which means it’s based on tangible, measurable items.

- Flexibility: It can be tailored to specific situations and adjusted for various scenarios.

- Time Value of Money: It accounts for the diminished value of future cash flows.

Issues with DCF:

- Dependent on Assumptions: The output is only as good as the input. Incorrect forecasts can lead to erroneous valuations.

- Sensitive to Discount Rate: Small changes in the discount rate can drastically change the valuation.

- Terminal Value Impact: A large portion of the valuation can be tied up in the terminal value, making it particularly sensitive to assumptions.

Practical Applications of DCF:

- Investment Appraisal: It helps in evaluating the attractiveness of an investment opportunity.

- Business Valuation: It’s used in mergers and acquisitions to determine the value of a target company.

- Stock Valuation: It helps investors determine the intrinsic value of a stock and whether it’s over or underpriced.

Example:

Let’s assume we want to invest in a business projected to generate $100,000 in year 1, growing by 5% each subsequent year for 5 years. If our discount rate is 10%, and we assume a terminal growth rate of 3%, we can use the DCF model to determine the present value of this investment.

For simplicity’s sake, after doing the math for each year and calculating the terminal value, we might find that the business’s present value based on future cash flows is $400,000.

In conclusion, the DCF model, while powerful, has its limitations, and its accuracy is heavily dependent on the quality of assumptions and inputs used.

All Cash Flow Related Topics to Explore:

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Cash Flow

- Discounted Cash Flow

- Discounted Cash Flow Model

- Cash Flow Analysis

- Free Cash Flow

- Operating Cash Flow

- Cash Flow Quadrant

- Net Cash Flow

- Cash Flow Management

- Cash Flow Forecast

- Cash Flow Calculator

- Free Cash Flow Calculator

- Discounted Cash Flow Calculator

- Cash Flow From Investing Activities

Return from Discounted Cash Flow Model to AccountingCorner.org