What is depreciation?

Remembering depreciation concept, it is a gradual attribution of the asset cost to expenses over its useful life. Different depreciation methods can be applied.

Double Declining Balance Method of Depreciation

In certain cases businesses do use double declining balance method of depreciation to attribute cost of property, plant and equipment to expenses.

When this method is applied, in the first years of depreciation bigger part of the cost value for the asset is attributed to expenses, gradually declining over the useful life of the asset.

Such method is supported in case the asset actually depreciated more during its first years of usage

Such method is supported in case the asset actually depreciated more during its first years of usage

Also in certain cases such method is allowed to defer recognition of profit to later periods, for example for corporate income tax purposes.

Double Declining Balance Formula

Here is double declining balance formula:

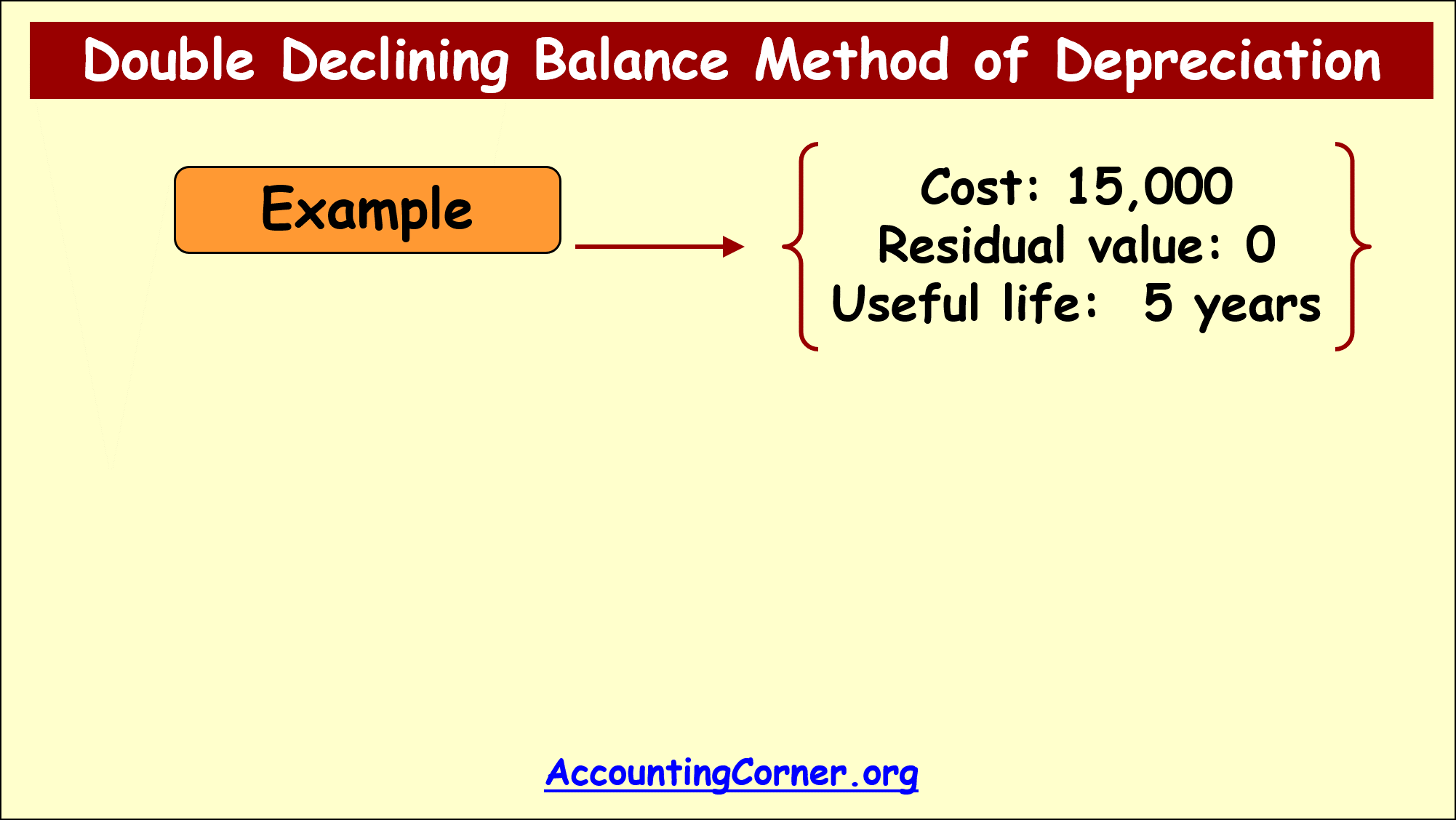

Double Declining Balance Depreciation – Example

In order to demonstrate application of double declining balance method of depreciation explore the below example:

- Asset cost 15,000

- Residual value 0

- Useful life 5 years

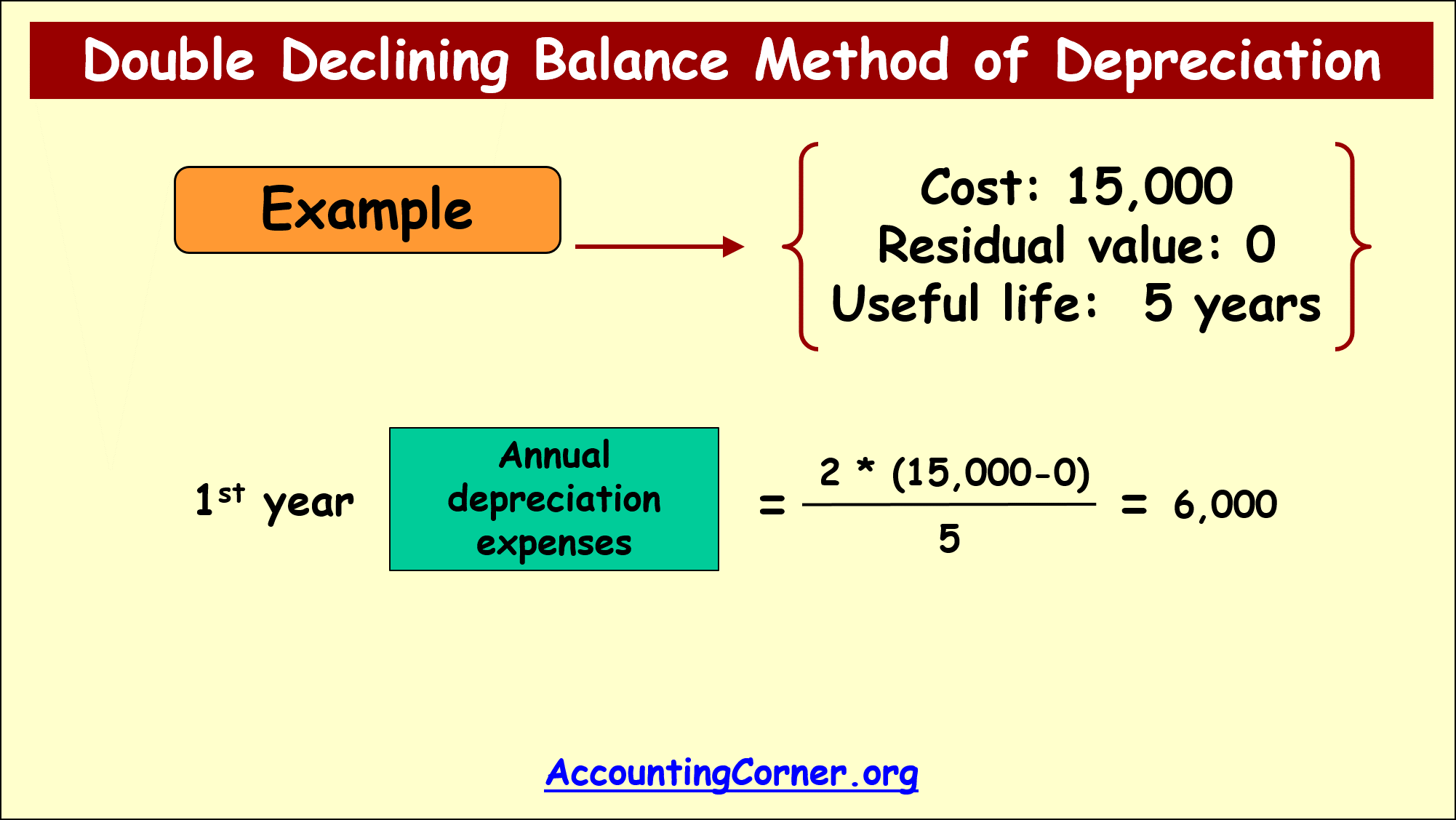

1st year annual depreciation=2*(15,000-0)/5=6,000

1st year annual depreciation=2*(15,000-0)/5=6,000

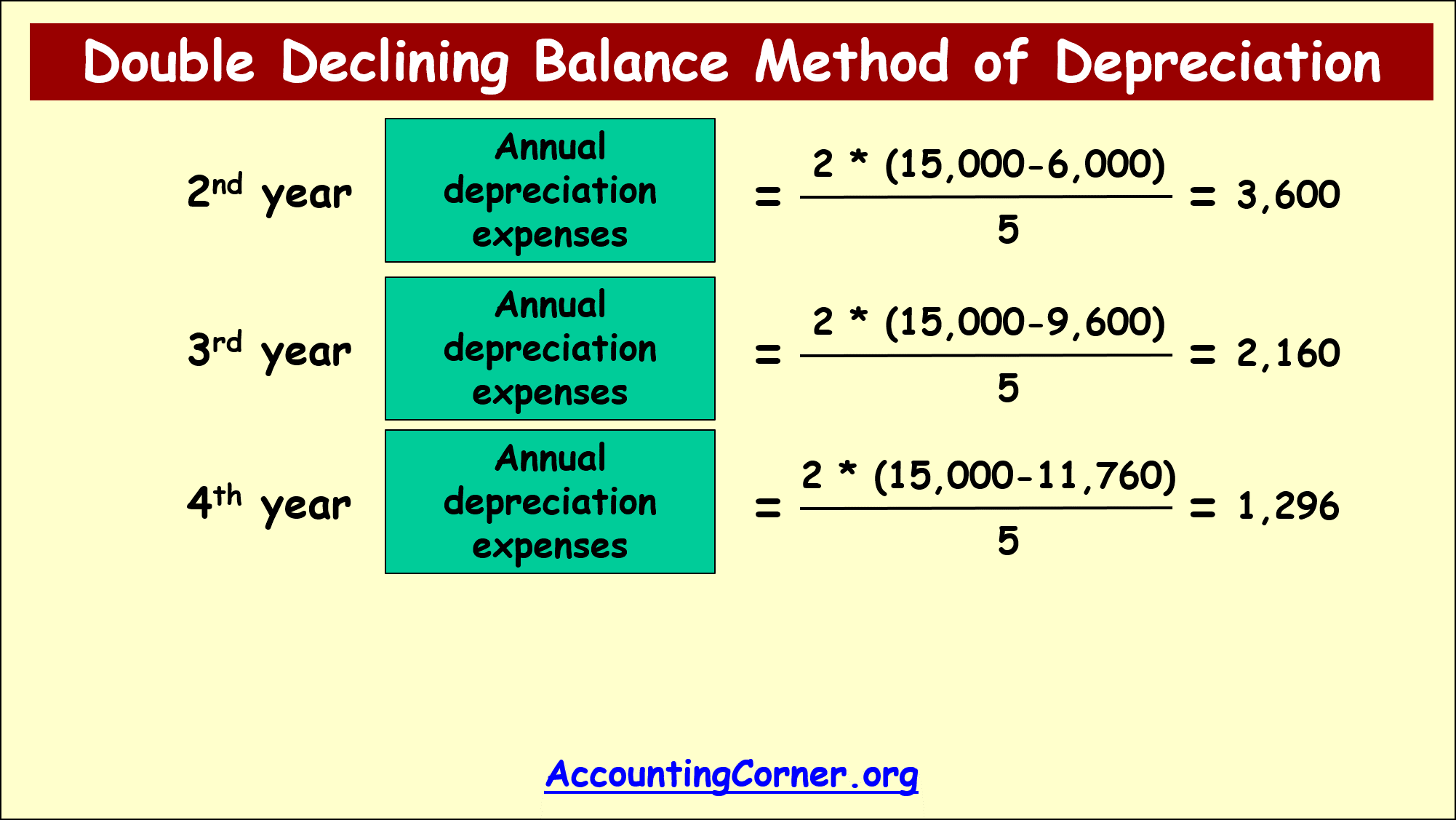

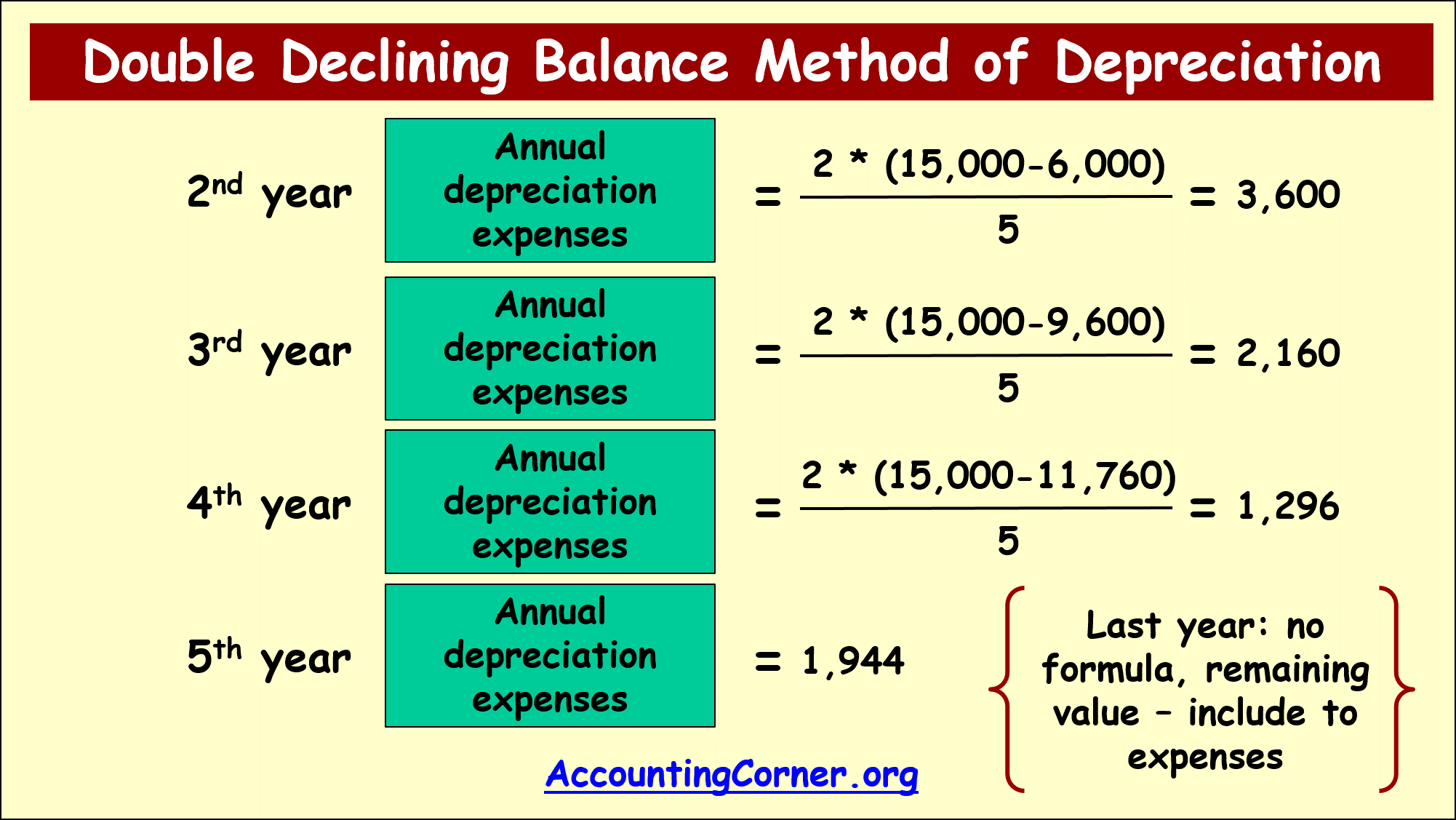

2nd year annual depreciation=2*(15,000-6,000)/5=3,600

2nd year annual depreciation=2*(15,000-6,000)/5=3,600

3rd year annual depreciation=2*(15,000 – (6,000+3,600))/5=2,160

3rd year annual depreciation=2*(15,000 – (6,000+3,600))/5=2,160

4th year annual depreciation=2*(15,000-(6,000+3,600+2,160))/5=1,296

4th year annual depreciation=2*(15,000-(6,000+3,600+2,160))/5=1,296

5th year annual depreciation=1,944

5th year annual depreciation=1,944

From this example it is obvious, that over the 5 years useful life of the asset in the beginning depreciation is much higher comparing to later years.

Over the last year no formula is applied, since the remaining book value is attributed to depreciation expenses.

Double Declining Balance Method of Depreciation – Video

Visual Presentation

Return from Double Declining Balance Method of Depreciation to AccountingCorner.org