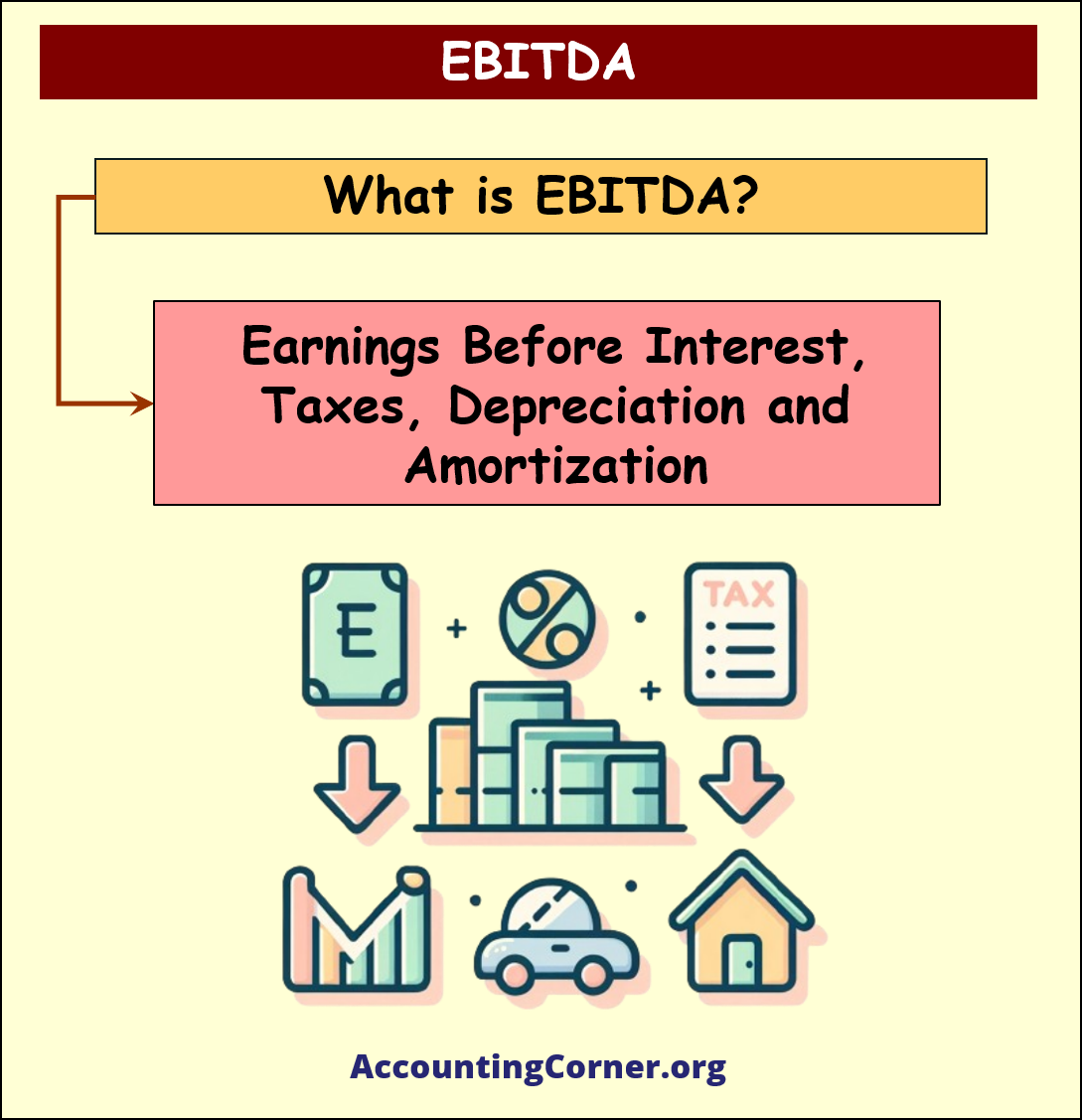

What Does EBITDA Stand For?

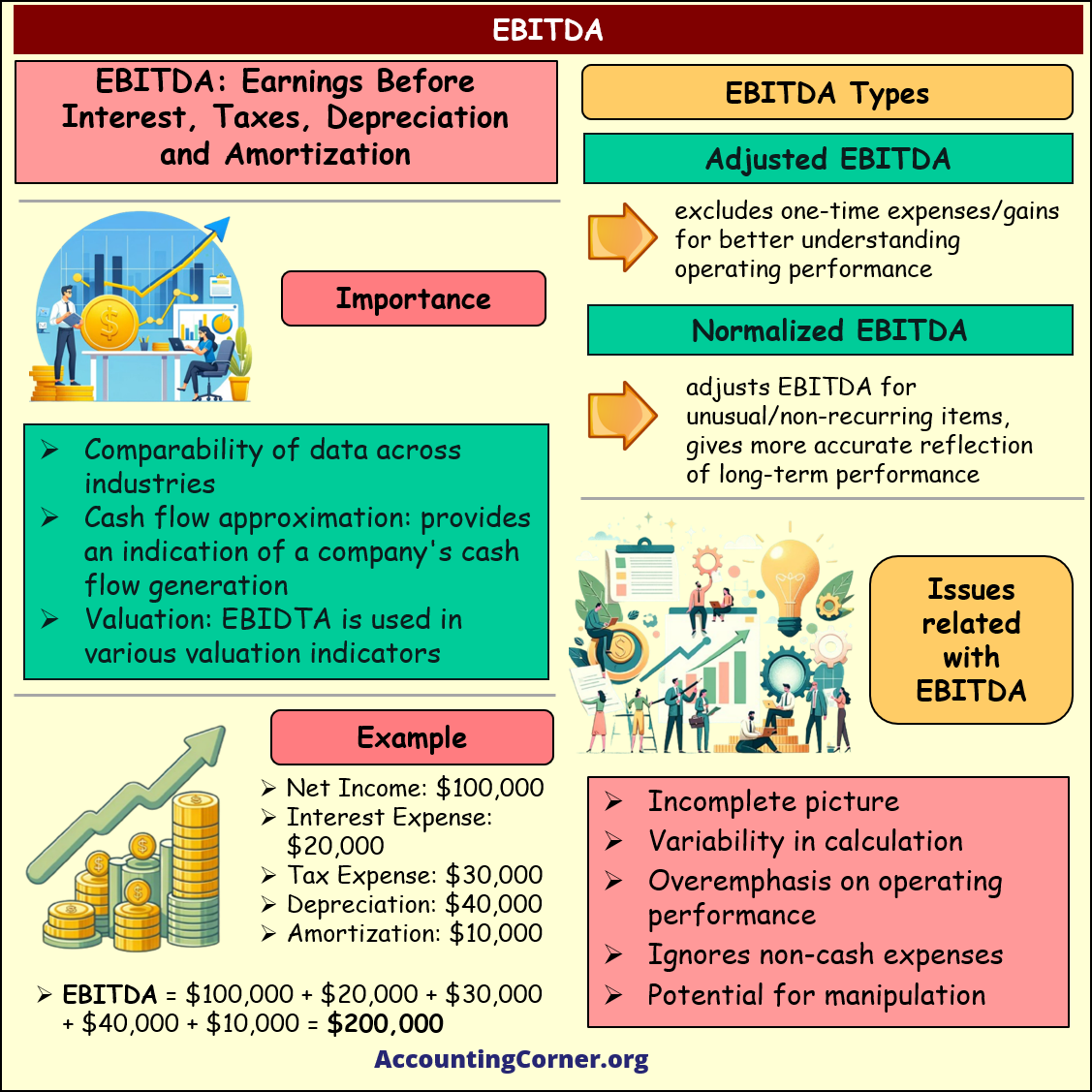

EBITDA stands for: Earnings Before Interest, Taxes, Depreciation, and Amortization. So what is EBITDA? It is a financial metric used in accounting and finance to measure operating performance of the business.

EBITDA stands for: Earnings Before Interest, Taxes, Depreciation, and Amortization. So what is EBITDA? It is a financial metric used in accounting and finance to measure operating performance of the business.

It provides an approximation of the business cash flow generated from its core operations, excluding non-operating activities such as interest, taxes, and non-cash expenses like depreciation and amortization.

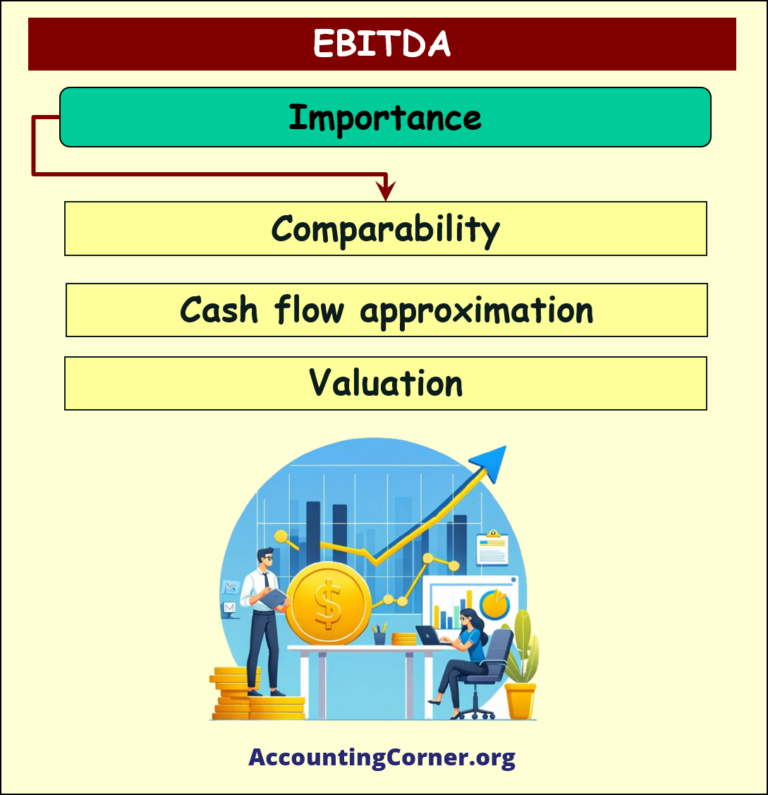

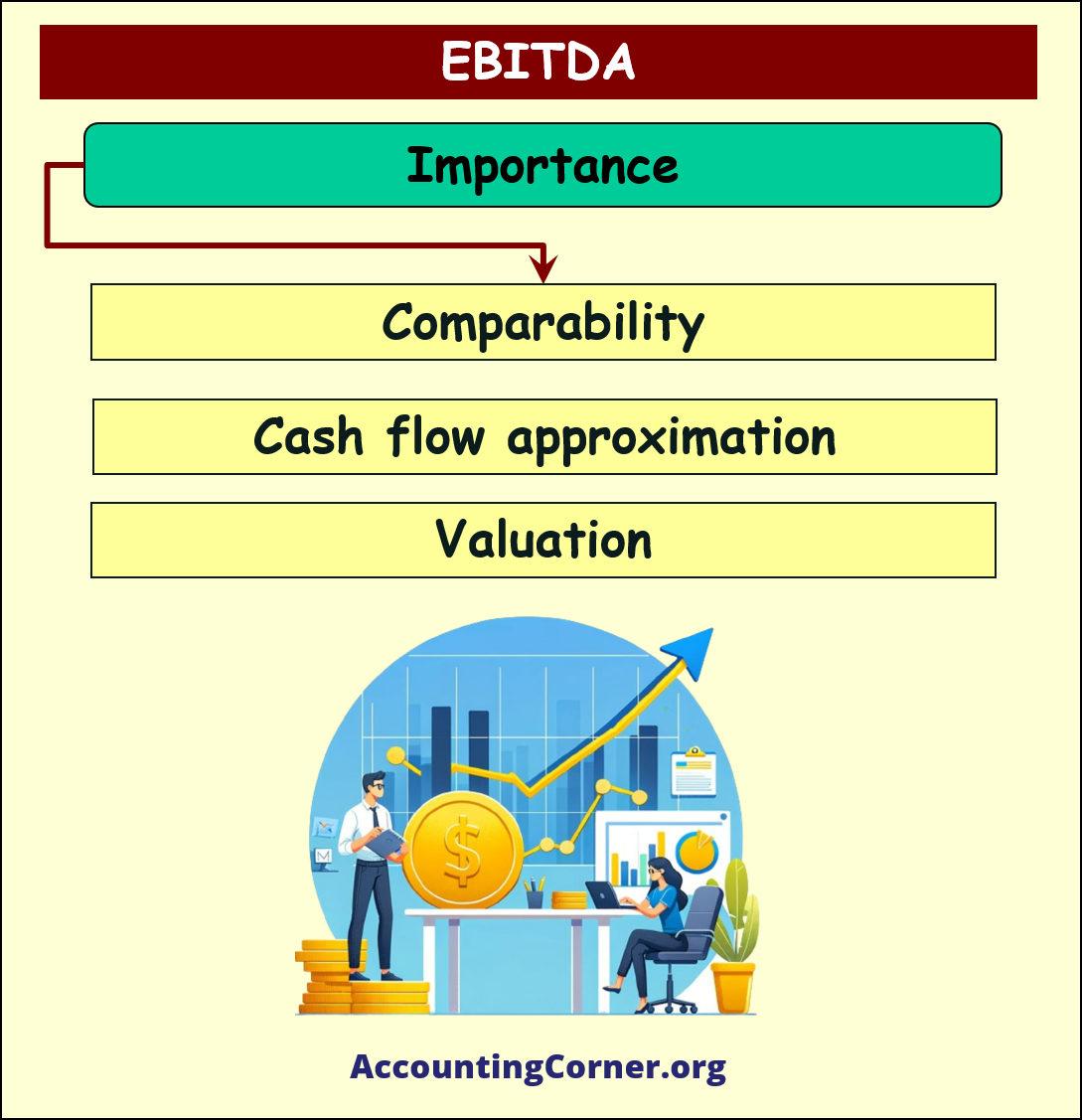

Importance of EBITDA:

- Comparability: EBITDA helps compare companies across industries, as it focuses on operating performance and excludes non-operating factors.

- Cash flow approximation: EBITDA can provide an indication of a company’s cash flow generation, which can be useful for assessing the company’s ability to meet financial obligations or invest in growth opportunities.

- Valuation: EBITDA is often used in valuation multiples like EV/EBITDA (Enterprise Value to EBITDA) to compare the relative value of companies.

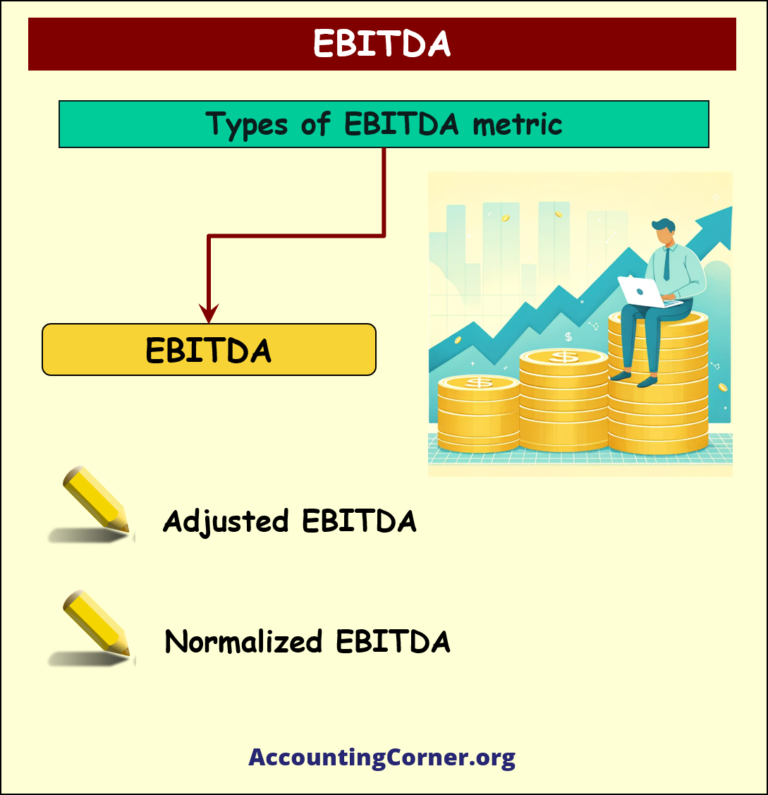

Types of EBITDA:

There aren’t distinct types of EBITDA, but companies may adjust EBITDA to exclude or include certain items, such as:

- Adjusted EBITDA: This metric may exclude one-time, non-recurring expenses or gains to provide a better understanding of a company’s ongoing operating performance.

- Normalized EBITDA: This metric adjusts EBITDA for unusual or non-recurring items to provide a more accurate reflection of a company’s long-term performance.

The key difference lies in the nature of the adjustments made

Here’s a breakdown of the key differences between Normalized EBITDA and Adjusted EBITDA:

- Nature of Adjustments:

- Adjusted EBITDA: Adjustments made in Adjusted EBITDA typically include items like non-recurring expenses, one-time charges, and certain non-operating items. These adjustments aim to present a clearer picture of a company’s core operating performance.

- Normalized EBITDA: Normalized EBITDA goes a step further and often includes adjustments for cyclical or seasonal variations in a company’s business, changes in accounting methods, or significant fluctuations in operating expenses or revenues that are not considered part of the company’s ongoing operations. Normalized EBITDA is used to provide a more stable and consistent view of a company’s earnings.

- Purpose of Use:

- Adjusted EBITDA: Adjusted EBITDA is typically used to help investors and analysts understand a company’s operating performance by excluding items that are not expected to recur or are considered non-core to the business. It is often used for comparing a company’s performance to peers and tracking changes over time.

- Normalized EBITDA: Normalized EBITDA is used when there are significant fluctuations in a company’s earnings due to factors beyond non-recurring items, such as seasonal variations or cyclical downturns. It aims to provide a more accurate reflection of the company’s earnings potential under normal, stable conditions.

- Scope of Adjustments:

- Adjusted EBITDA: Adjustments in Adjusted EBITDA typically focus on items that have a direct impact on the income statement, such as adjusting for one-time legal settlements, restructuring costs, or gains/losses from asset sales.

- Normalized EBITDA: Normalized EBITDA may include adjustments that go beyond the income statement, such as smoothing out the effects of significant changes in working capital or adjustments related to changes in accounting policies.

In summary, while both Adjusted EBITDA and Normalized EBITDA aim to provide a more accurate picture of a company’s earnings by making adjustments, Normalized EBITDA tends to make broader and more comprehensive adjustments to account for a wider range of factors that can affect a company’s earnings stability over time. The specific use of these metrics may vary based on the circumstances and the goals of the analysis being conducted.

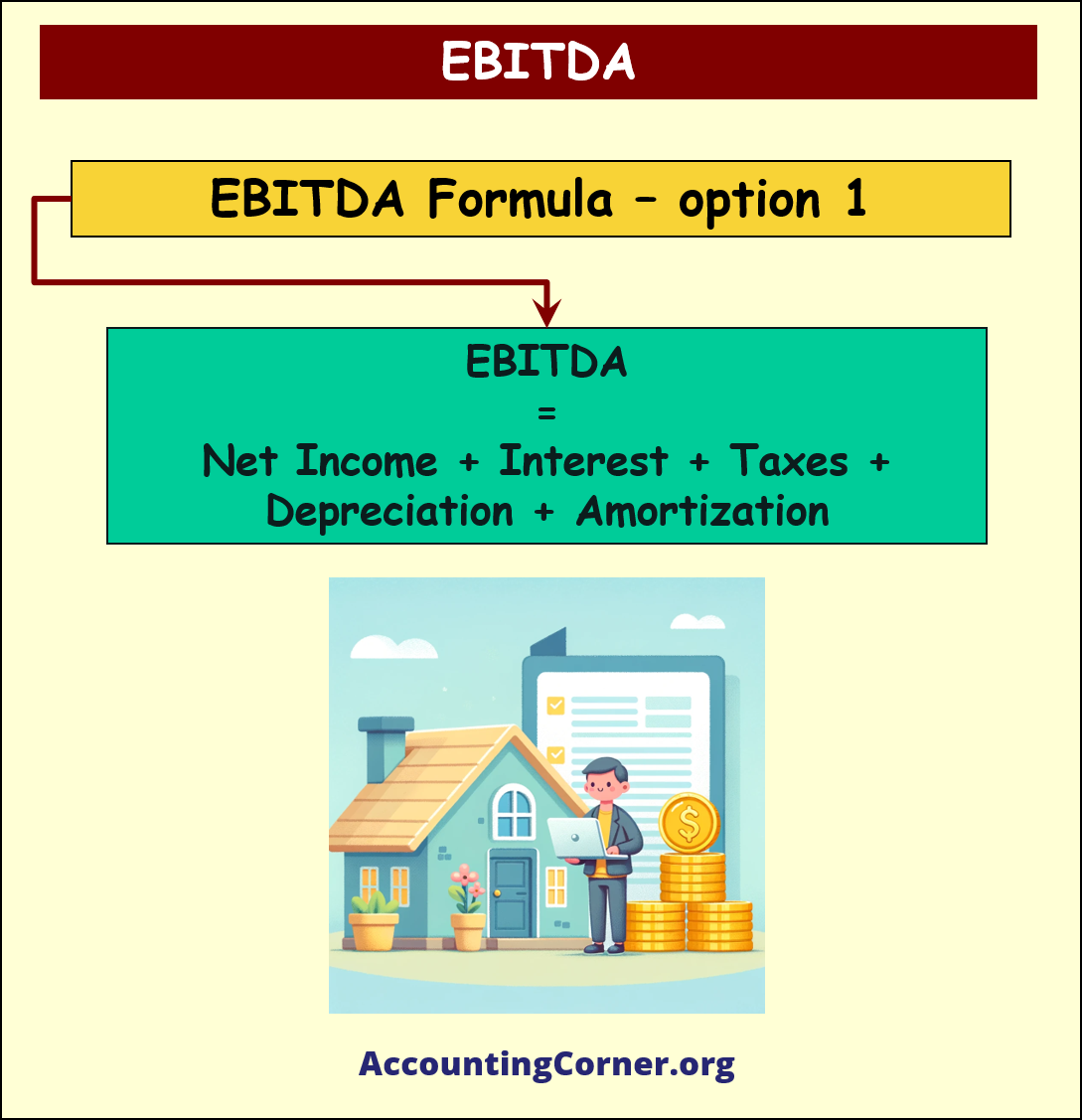

EBITDA formula and calculation:

Explore further how to calculate EBITDA.

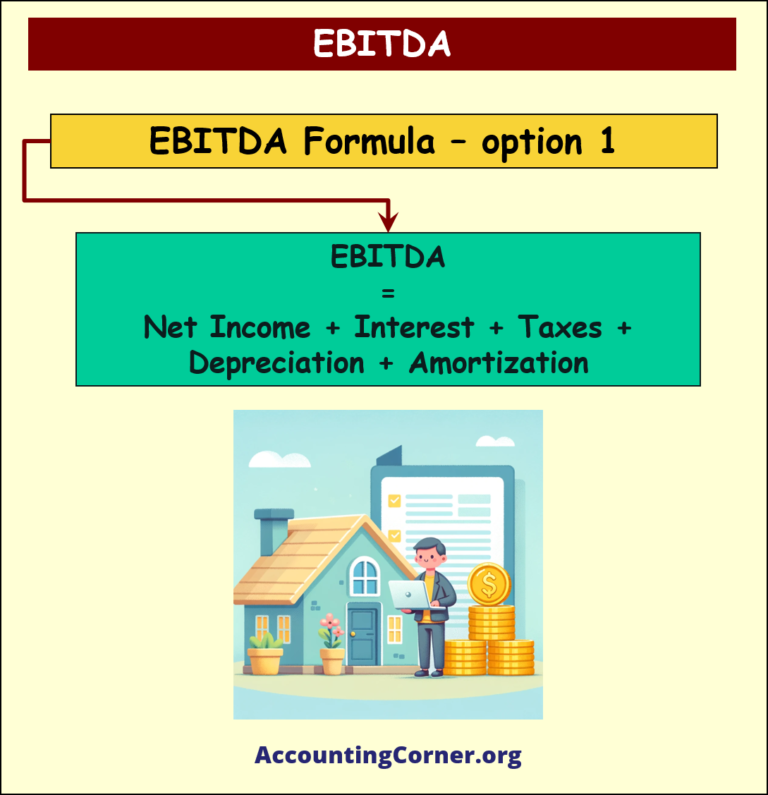

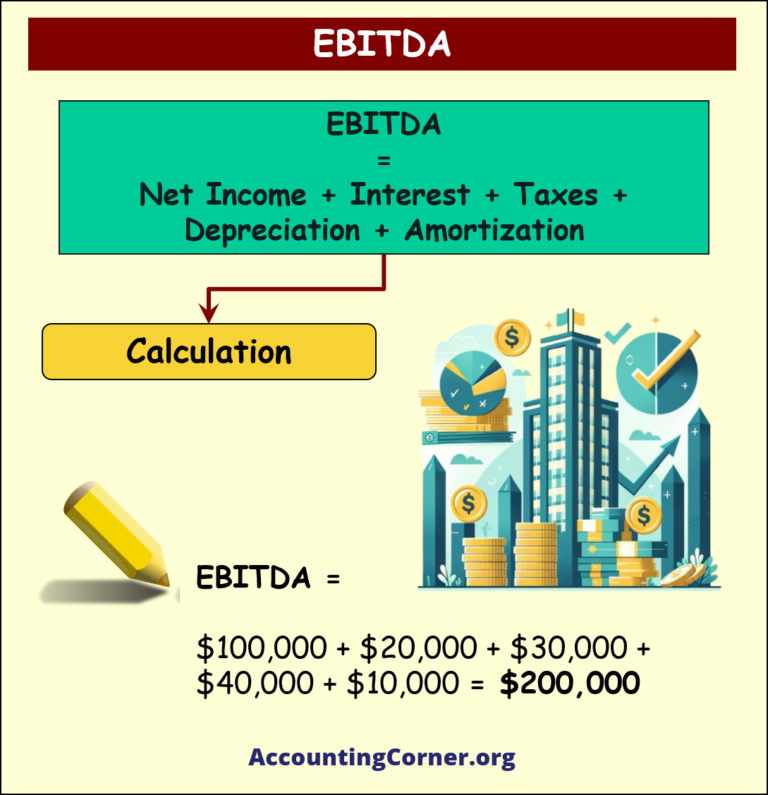

The following formula is used to calculate EBITDA:

The following formula is used to calculate EBITDA:

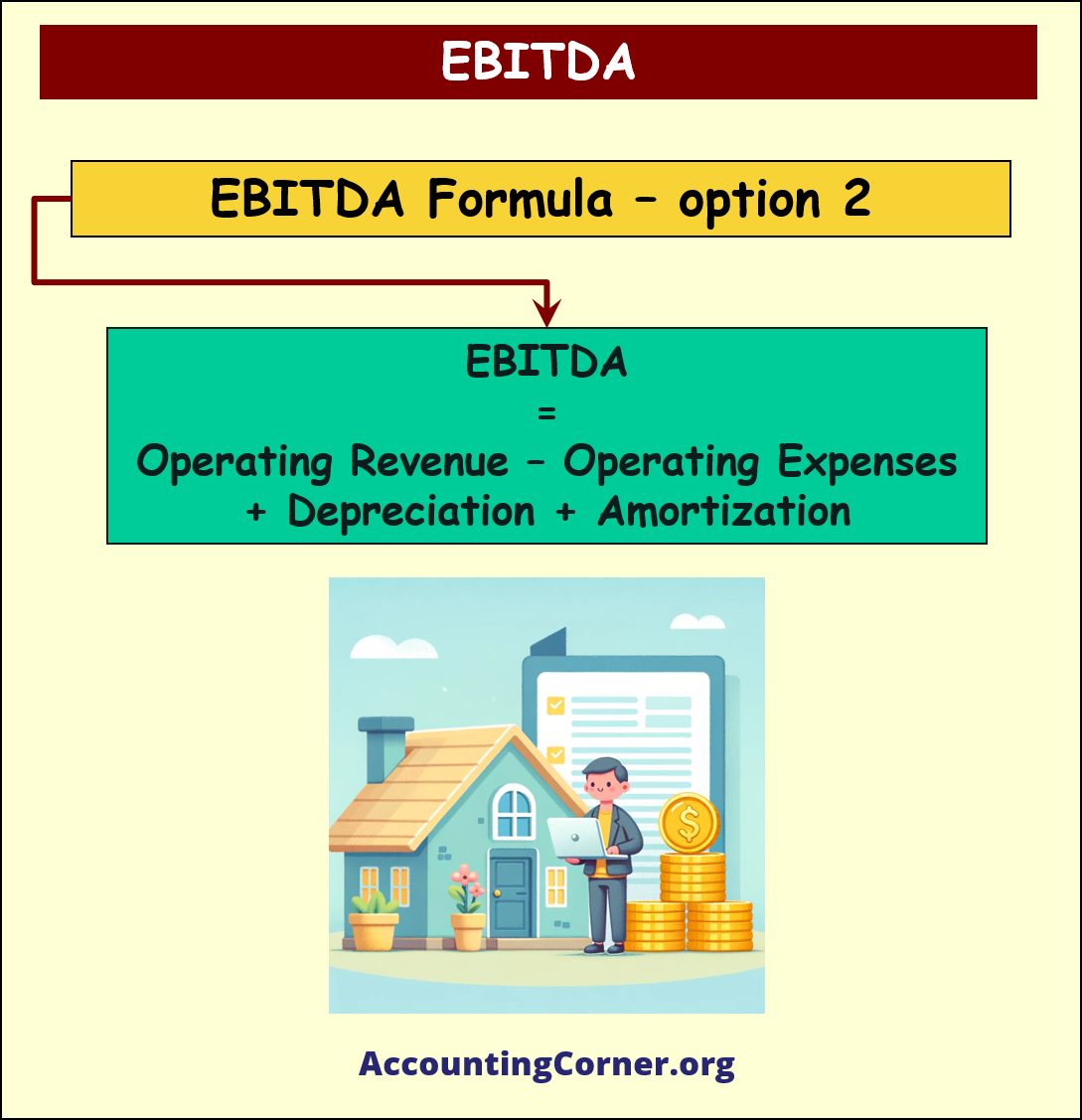

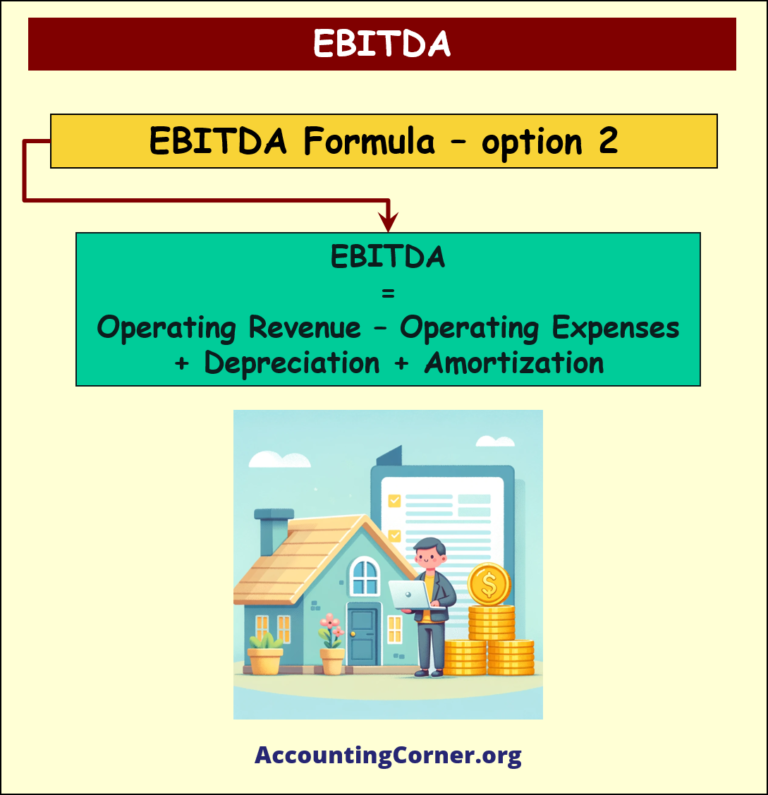

Alternatively, EBITDA can also be calculated as:

Alternatively, EBITDA can also be calculated as:

EBITDA calculation example

Lets explore practical example in order to understand how to calculate EBITDA and understand EBITDA definition:

Suppose a company has the following financial information:

Suppose a company has the following financial information:

- Net Income: $100,000

- Interest Expense: $20,000

- Tax Expense: $30,000

- Depreciation: $40,000

- Amortization: $10,000

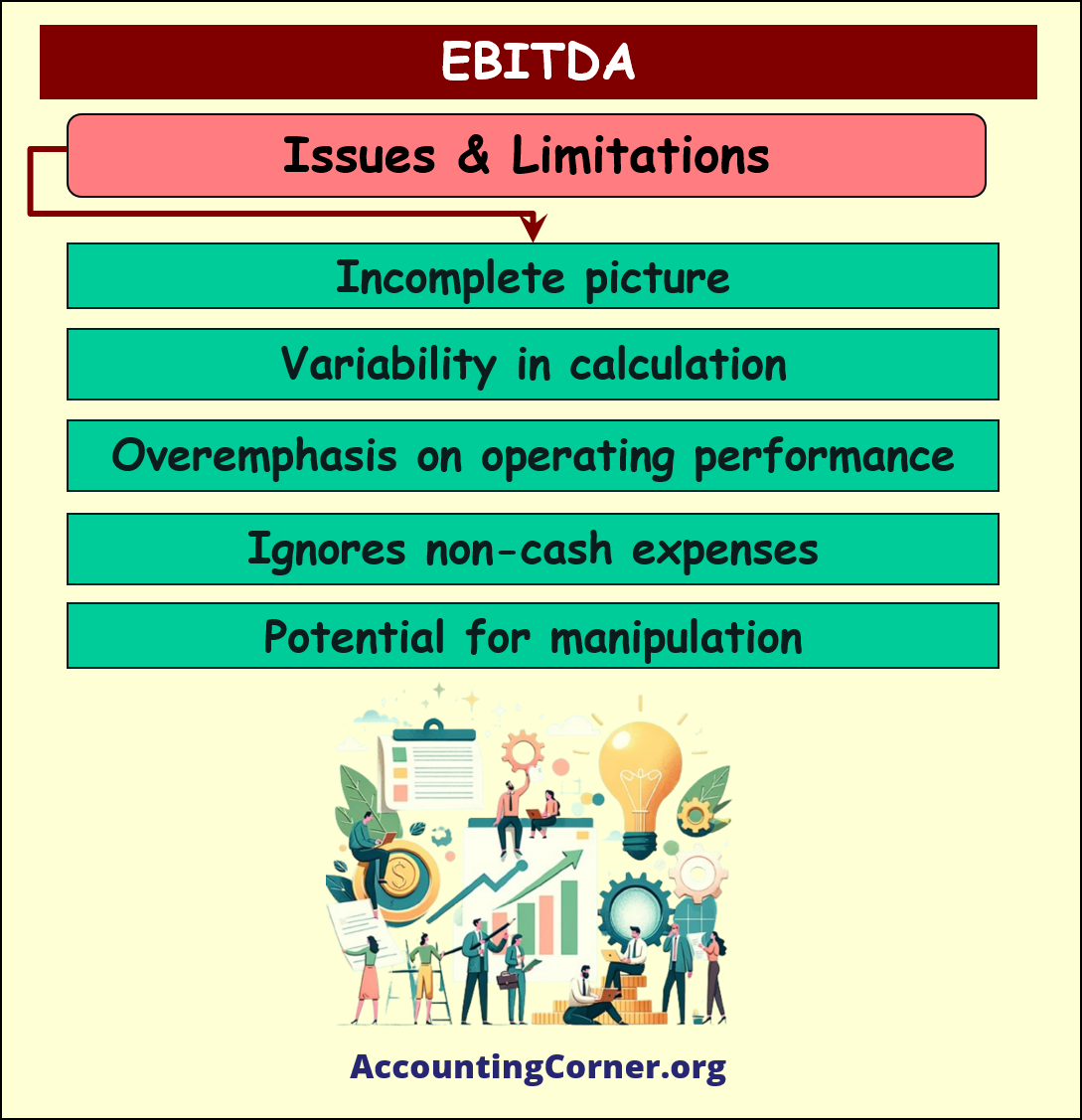

Issues and Limitations of EBITDA:

- Incomplete picture: EBITDA does not consider the impact of capital expenditures (CAPEX), working capital requirements, or debt payments, which can impact a company’s cash flow and financial health.

- Variability in calculation: Companies may calculate and report EBITDA differently, making it challenging to compare EBITDA across companies.

- Overemphasis on operating performance: EBITDA does not account for the cost of capital, which can be significant for certain industries or companies with high debt levels.

- Ignores non-cash expenses: Depreciation and amortization are important for understanding the ongoing costs of maintaining a company’s assets, but EBITDA does not consider these expenses.

- Potential for manipulation: Companies may adjust EBITDA to exclude certain expenses, making their financial performance appear better than it truly is.

EBITDA – Meaning, Formula, Calculation – One Pager

EBITDA – Meaning, Formula, Calculation – All Visual Material

EBITDA – Meaning, Formula, Calculation – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from EBITDA Meaning to AccountingCorner.org home