Equity: Understanding the Financial Backbone of a Business

Equity represents the financial interest of shareholders in a business. It is essentially what remains of a company’s assets after all liabilities are settled. Equity provides a residual claim to shareholders, making it a fundamental aspect of a company’s financial structure. This blog explores equity’s features, calculation, main components, types of stock, and the intricacies of dividends and retained earnings.

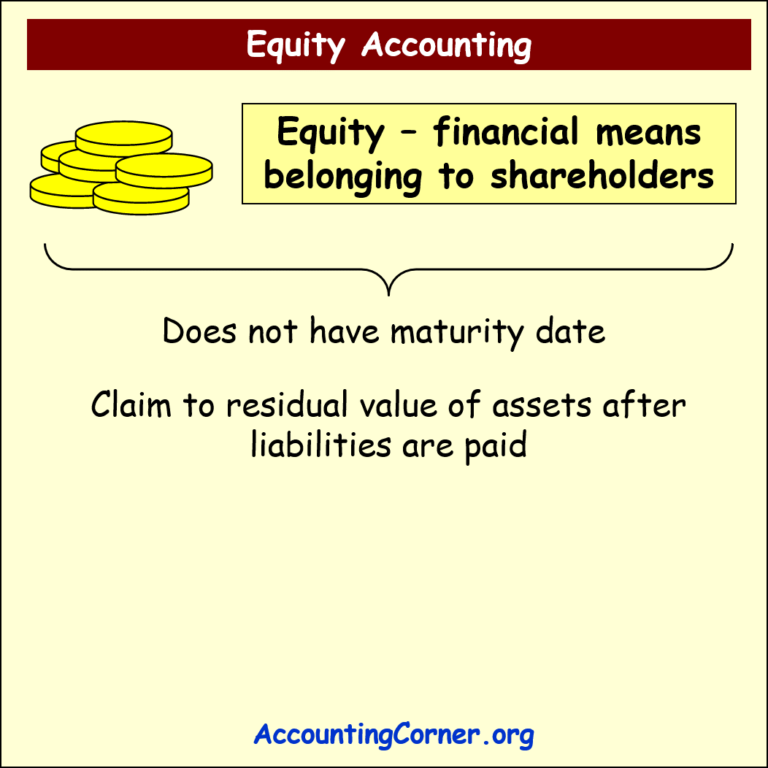

Features of Equity

Equity possesses unique characteristics that distinguish it from other financial components:

- No Fixed Maturity: Unlike debt, equity does not have a repayment deadline. Shareholders do not expect their initial investment to be returned on a specific date.

- Residual Claim: Equity represents the claim on the remaining assets after all liabilities are satisfied. This residual interest gives shareholders ownership in the company’s assets and profits.

- Variable Return: Equity holders earn returns in the form of dividends, which vary based on the company’s profitability and decision to distribute profits.

These features underline the risk and reward profile of equity; shareholders share in both the potential growth and downturns of the business.

Equity Value Calculation

The value of equity in a company is derived from the Accounting Equation:

Assets=Equity+Liabilities

Thus, equity can be calculated as:

Equity=Assets−Liabilities

In simpler terms, equity represents the amount left for shareholders after paying off all obligations.

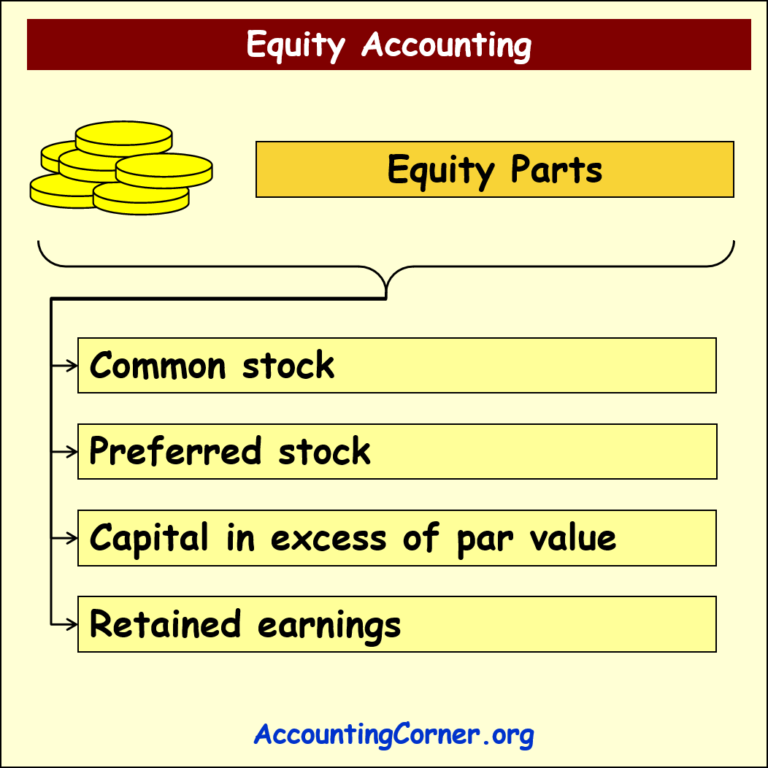

Components of Equity

Equity is composed of several components, each serving a specific function within the financial framework of a company:

- Common Stock: Shares representing ownership in a company, granting holders voting rights and a share in profits.

- Preferred Stock: Shares that usually carry a fixed dividend and have priority over common stock in asset distribution during liquidation.

- Capital in Excess of Par Value (Additional Paid-In Capital): Represents contributions from shareholders that exceed the par value of issued stock. This component captures the premium paid by investors over the nominal value of shares.

- Retained Earnings: The portion of net income that the company retains for reinvestment or to cover future obligations, rather than distributing as dividends.

Each part contributes to the overall financial stability and growth potential of the company.

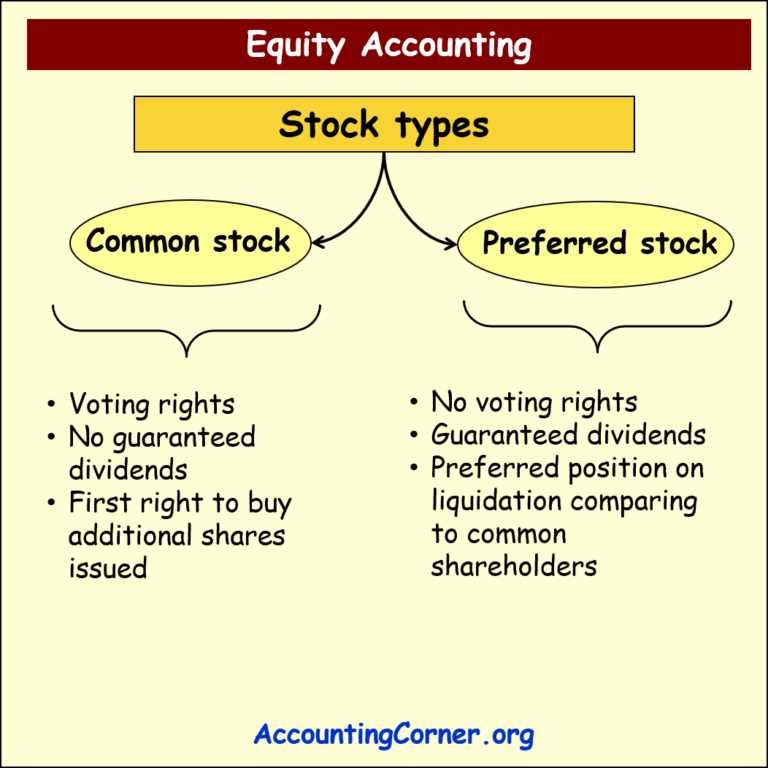

Types of Stock

Stock represents ownership in a corporation, and each type of stock confers different rights and priorities.

Common Stock

Common stockholders are the primary owners of a company. Their main features include:

- Voting Rights: Common stockholders generally have voting rights, allowing them to influence major decisions like electing the board of directors.

- Variable Dividends: There is no guarantee of dividends; if declared, dividends for common shareholders vary depending on company profits.

- Preemptive Rights: Common stockholders may have the right to buy additional shares if the company issues more, allowing them to maintain their ownership percentage.

Preferred Stock

Preferred stock offers shareholders certain advantages over common stock but often lacks voting rights. Key features include:

- Dividend Priority: Preferred stockholders receive dividends before common shareholders, often at a fixed rate, providing a more stable income stream.

- Priority in Liquidation: In the event of liquidation, preferred stockholders are paid from remaining assets before common stockholders, though they still come after creditors.

These distinctions create a different risk and return profile for common and preferred stock, catering to various investor preferences.

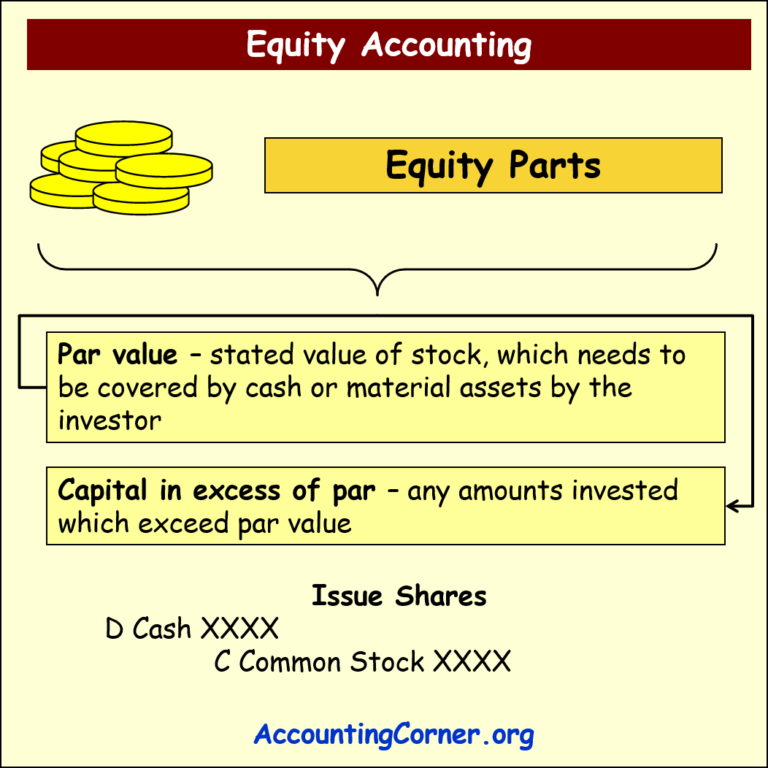

Capital in Excess of Par Value (Additional Paid-In Capital)

When shareholders pay more than the par value for shares, the excess is recorded as Capital in Excess of Par. This account reflects the additional amount investors are willing to pay beyond the nominal value, highlighting their confidence in the company’s future. For instance, if the par value of a share is $1 but investors purchase it at $5, the $4 difference is recorded in this account.

Key Points:

- Often referred to as Additional Paid-In Capital.

- Represents a premium paid by investors over the base value of shares.

- Captures market confidence and can be a major equity component, especially for well-regarded companies.

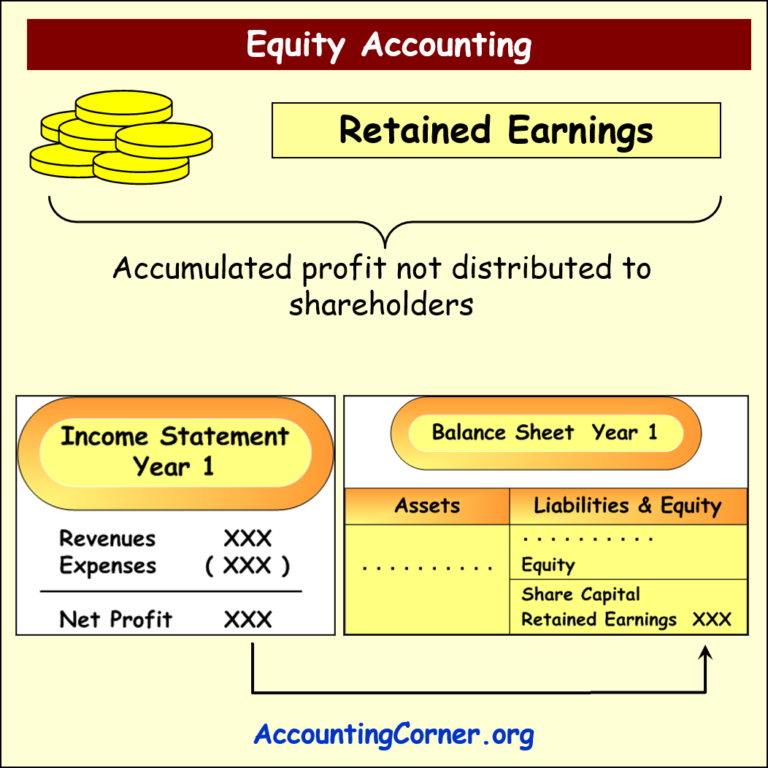

Retained Earnings

Retained Earnings is the accumulated portion of profits not distributed as dividends but kept within the business to support growth, pay off debt, or reinvest in operations. This account reflects the cumulative effect of a company’s profitability and management’s choice to reinvest rather than distribute profits.

- Positive Retained Earnings: Indicates profits have been retained and reinvested over time.

- Negative Retained Earnings: Known as an accumulated deficit, this may reflect continuous losses or substantial dividend payments that exceed retained income.

Each fiscal year, the Net Profit (or Net Loss) from the income statement is transferred to retained earnings, showing the relationship between the income statement and the balance sheet.

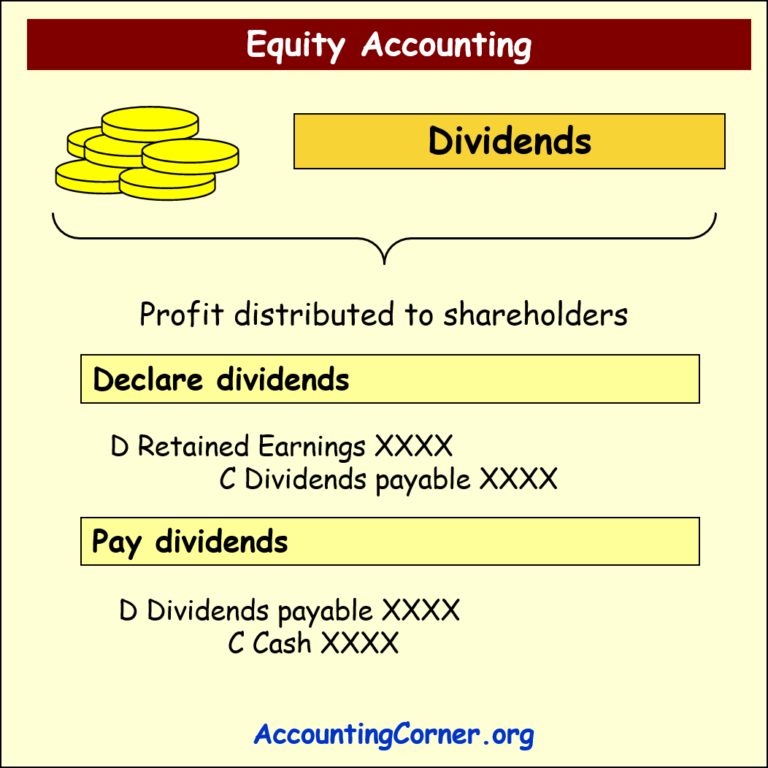

Dividends: Distributing Profit to Shareholders

Dividends represent the portion of earnings distributed to shareholders as a return on their investment. Not all companies pay dividends, but those that do often follow a structured process:

- Declaration of Dividends: The board of directors announces a dividend, creating an obligation to pay shareholders.

- Journal Entry:

- Debit: Retained Earnings (decrease in equity)

- Credit: Dividends Payable (liability to shareholders)

- Journal Entry:

- Payment of Dividends: When the dividend is paid, the company settles its liability.

- Journal Entry:

- Debit: Dividends Payable

- Credit: Cash

- Journal Entry:

Dividends represent a direct connection between a company’s retained earnings and shareholder returns. However, declaring dividends does not imply liquidation but rather a sharing of accumulated profit.

Summary of Equity Components on the Balance Sheet

A company’s equity section on the balance sheet typically includes:

- Capital Stock: Common and preferred stock issued by the company.

- Additional Paid-In Capital: Contributions above the par value of stock.

- Retained Earnings: Accumulated profits or losses.

Equity, as reported, provides insights into the financial health, ownership structure, and capital management strategies of a company. Each component plays a role in reflecting the shareholders’ stake and the company’s capacity for growth and resilience.

Conclusion

Equity is more than just an accounting figure; it represents shareholder investment, financial stability, and potential for growth. By understanding equity and its components, investors and analysts can assess a company’s financial strategy, risk tolerance, and long-term value. From retained earnings to dividends, each part of equity reveals critical aspects of a company’s financial narrative, helping stakeholders make informed decisions.

Watch the video

Visual Presentation

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Equity to AccountingCorner.org