For the purpose to analyze sample general ledger journal entry first let us distinguish two steps of this concept, i.e.:

-

business transactions having an impact on the financial position of the business are first recorded in the general journal, which is one of the accounting prime entry books, then

-

entries from general journal are posted to the general ledger, i.e. to the corresponding account, the universe of which composes general ledger.

This process is divided into 2 steps, since recording of business transactions directly to the general ledger accounts due to significant volume of transactions causes huge amount of mistakes and lost track of their corrections.

General Journal

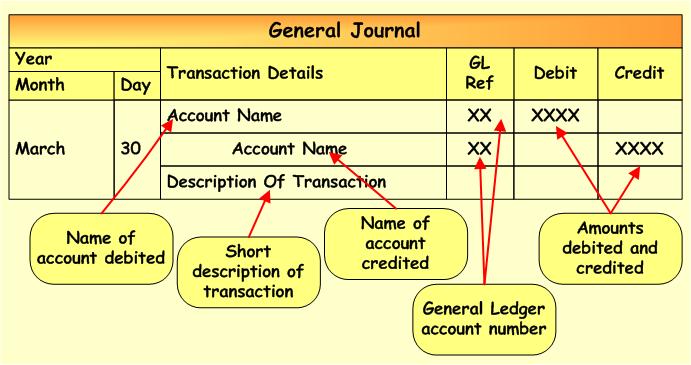

General journal includes all the business transactions which are recorded in the chronological manner, i.e. day by day. Structure and form of general journal differs depending on the business needs, however there is a mandatory data to be present in any journal. This data is:

-

date of transaction;

-

names of accounts which are debited and credited

-

description of the transactions

-

columns for debit and credit where exact figures of business transaction are recorded.

In the picture below you can see how the general journal looks like and what information is included there. Considering sample general ledger journal entry below each transaction will be first recorded into the general journal in the way as it is presented in the picture.

General Ledger

Next step to record any sample general ledger journal entry is to post transactions recorded in the general journal to the general ledger accounts. The accounts classify accounting data into certain categories, the main of which are:

-

Assets

-

Liabilities

-

Equity

-

Revenue

-

Expenses

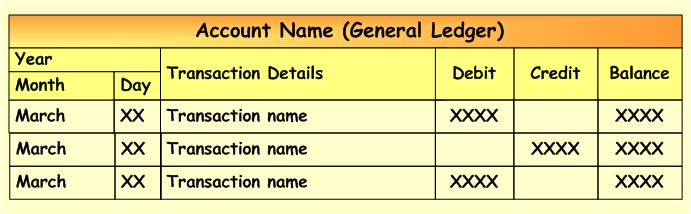

We can use either T accounts, which have T form, with one side for Debit and one side for Credit. In practice of course there are no T accounts and several column general ledger format is used. In the picture below you can see how this forma looks like. The first column includes date, second column – description of transaction, third and fourth – debit and credit columns, and the last one – balance of the account after the transaction has been posted. Positive balance means debit, negative balance -means credit.

Sample General Ledger Journal Entry will be presented by analyzing several transactions performed by XYZ company.

We will be analyzing the following transactions of XYZ company in December of the year 2008:

-

-

1. December 15 – shareholders established XYZ company and invested cash of $12000. This is a trading company reselling furniture and also providing furniture maintenance services;

-

2. December 17 – Acquired on account land costing $15000 and building for cash $10000;

-

3. December 19 – acquired on account supplies costing $1200 and goods (furniture) for resale for $6000;

-

4. December 20 – Provided services to customers for cash, i.e. for $570

-

Sample General Ledger Journal Entry Process

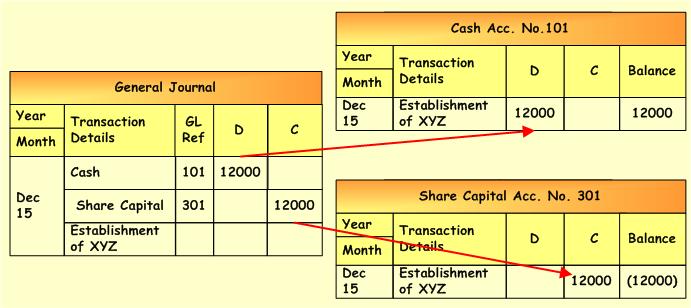

Journalizing and posting 1st transaction:

On December 15 shareholders established company XYZ by investing cash. First step is to journalize the transaction, i.e. record it in the general journal. The following entry is being done:

D Cash $12000

C Share Capital $12000

In the picture below you can see how general journal entries look like. The next step of this sample general ledger journal entry is to post these entries to the according general ledger accounts, i.e. Cash and Share Capital.

Here we are using multi-column general ledger format (not T accounts).

-

$12000 is debited to the Cash account of the general ledger and afterwards balance in the Cash account is calculated, which is $12000 on the debit side. Since Cash account belongs to the assets category, its balance after the posting will be always on the debit side.

-

The same amount of $12000 is credited to the Share Capital account and afterwards balance in this account is calculated. The balance is $12000 with a minus sign (we show it in the brackets), since it is credit balance. Share Capital account belong to the equity category and after the posting the balance of this account is always on the credit side.

Illustration of Journalizing and Posting – Transaction No. 1

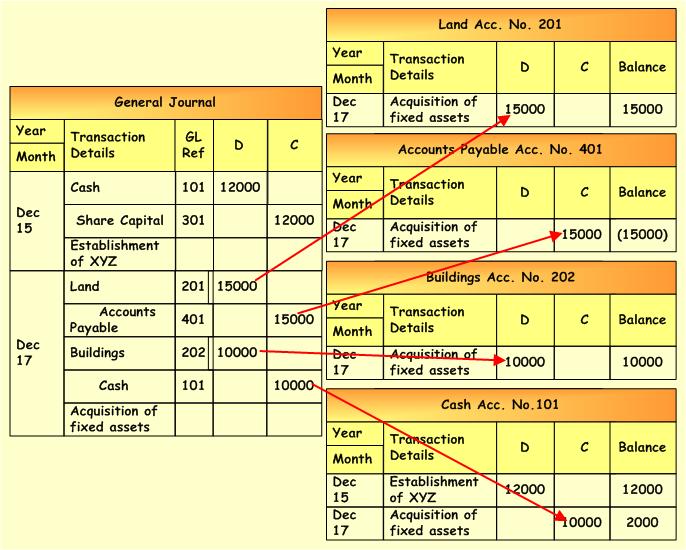

Journalizing and posting 2nd transaction:

On December 17 the company XYZ acquired on account (i.e. cash for the acquisition will be paid on the later agreed date after the purchase) land cost of which is $15000 and for cash building cost of which is $10000. The following entry is being done:

D Land $15000

D Building $10000

C Accounts Payable $15000

C Cash $10000

In the picture below you can see how general journal entries look like. Please note that the entries for this transaction go below the journal entries of the previous transaction. The next step of this sample general ledger journal entry is to post these entries to the according general ledger accounts, i.e. Land, Building, Accounts Payable, Cash.

Here we are using multi-column general ledger format (not T accounts).

-

$15000 and $10000 are debited to the Land and Building accounts of the general ledger and afterwards balances in the Land and Building accounts are calculated, which are accordingly $15000 and $10000 on the debit side. Since Land and Building accounts belong to the assets category, their balances after the posting will be always on the debit side.

-

$15000 is credited to the Accounts Payable account and afterwards balance in this account is calculated. The balance is $15000 with a minus sign (we show it in the brackets), since it is credit balance. Accounts Payable account belong to the liabilities category and after the posting the balance of this account is always on the credit side.

-

$10000 is credited to the Cash account. Note that Cash account already contains data related to the previous transactions and has a balance of $12000. Afterwards balance in this account is calculated. The balance is $2000, which is the balance before posting this transaction decreased by credited amount of $10000.

Journalizing and posting 3rd transaction:

On December 19 the company XYZ acquired on account supplies cost of which is $1200 and inventory for resale cost of which is $6000. The following entry is being done:

D Supplies $1200

D Inventory $6000

C Accounts Payable $7200

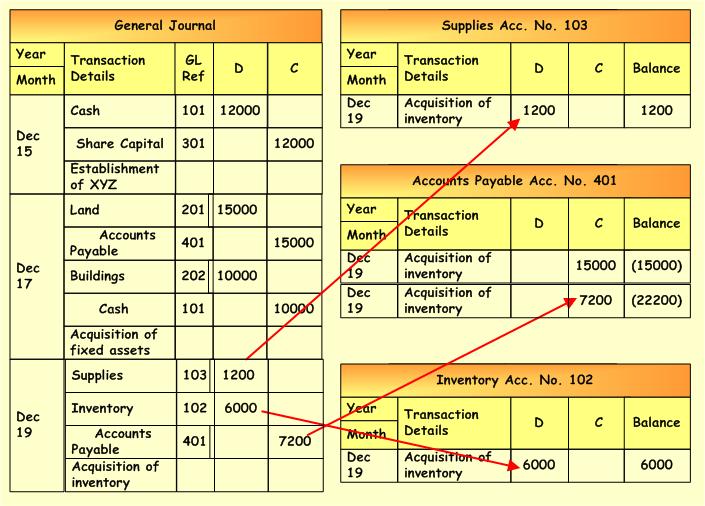

In the picture below you can see how general journal entries look like. The next step of this sample general ledger journal entry is to post the’s entries to the according general ledger accounts, i.e. Supplies, Inventory and Accounts Payable.

Here we are using multi-column general ledger format (not T accounts).

-

$1200 and $6000 are debited to the Supplies and Inventory accounts of the general ledger and afterwards balances in the Supplies and Inventory accounts are calculated, which are accordingly $1200 and $6000 on the debit side. Since Supplies and Inventory accounts belong to the assets category, their balances after the posting will be always on the debit side.

-

$7200 is credited to the Accounts Payable account. Note that Accounts Payable account already contains data related to the previous transactions and has a credit balance of $15000. Afterwards balance in this account is calculated. The balance is $22200, which is the balance before posting this transaction increased by credited amount of $7200.

Illustration of Journalizing and Posting – Transaction No. 3

Journalizing and posting 4th transaction:

On December 20 the como any XYZ provided services to the customers for $570 and the customers paid by cash. The following entry is being done:

D Cash $570

C Revenue $570

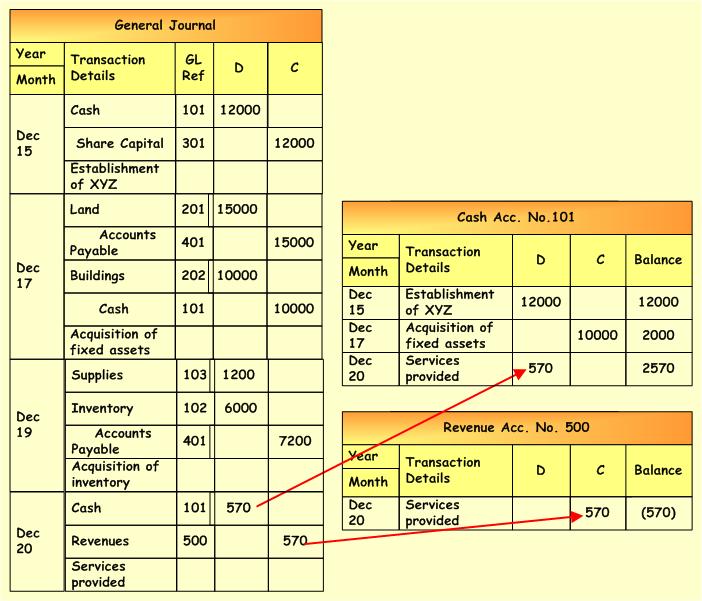

In the picture below you can see how general journal entries look like. The next step of this sample general ledger journal entry is to post these entries to the according general ledger accounts, i.e. Cash and Revenue.

Here we are using multi-column general ledger format (not T accounts).

-

$570 is debited to the Cash account as an increase in Cash. Note that Cash account already contains data related to the previous transactions and has a balance of $2000. Afterwards balance in this account is calculated. The balance is $2570, which is the balance before posting this transaction increased by debited amount of $570.

-

The same amount of $570 is credited to the Revenue account and afterwards balance in this account is calculated. The balance is $570 with a minus sign (we show it in the brackets), since it is credit balance. Revenue account after the posting will always be on the credit side.

So this was a comprehensive sample general ledger journal entry explaining how business transactions are recorded and classified in the accounting books.

-

Return from General Journal to AccountingCorner.org home