What is inventory?

In order to understand what is inventory, remember, that Inventory is a category of short-term (current) assets, that business owns for the purpose of selling or using in the manufacturing of other inventory types.

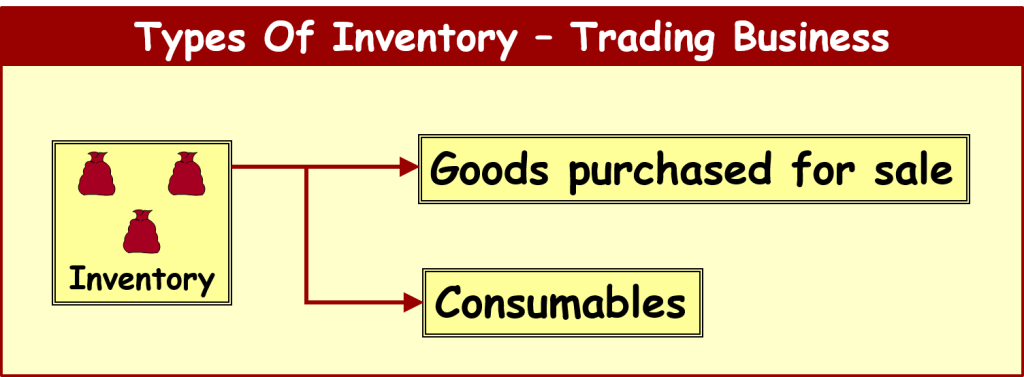

Depending on the type of business activities, business might have various types of inventory on hand.

Trading company will have inventory held for selling – goods purchased for sale (merchandise inventory), which will represent major part of the inventory balance. Also trading business will have some consumables on hand, which are necessary for everyday operations and might represent various items, like office stationary, office cleaning goods or similar to be consumed in everyday business activities.

Trading company will have inventory held for selling – goods purchased for sale (merchandise inventory), which will represent major part of the inventory balance. Also trading business will have some consumables on hand, which are necessary for everyday operations and might represent various items, like office stationary, office cleaning goods or similar to be consumed in everyday business activities.

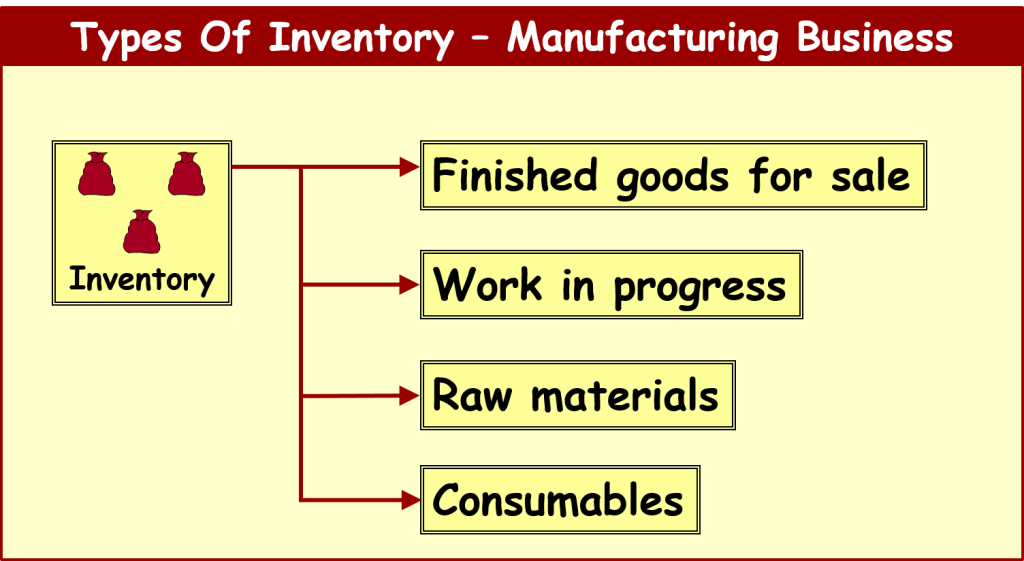

Manufacturing company will have the following categories of inventory:

Manufacturing company will have the following categories of inventory:

- Finished goods ready for sale

- Work in progress, which includes partly manufactured goods at the end of a particular accounting period. The value of work in progress usually includes cost of raw materials consumed, direct labor costs and overhead costs, incurred in manufacturing process

- Raw materials – inventory to be used in manufacturing process

- Consumables – various items to be used in everyday business activities. This category also might include various miscellaneous items to be used in manufacturing process. This type of inventory can be also called supplies.

Inventory is attributed to thr current assets category since usually it is being sold or consumed during the period shorter than one year.

Inventory is attributed to thr current assets category since usually it is being sold or consumed during the period shorter than one year.

Inventory in the Balance Sheet & Income Statement

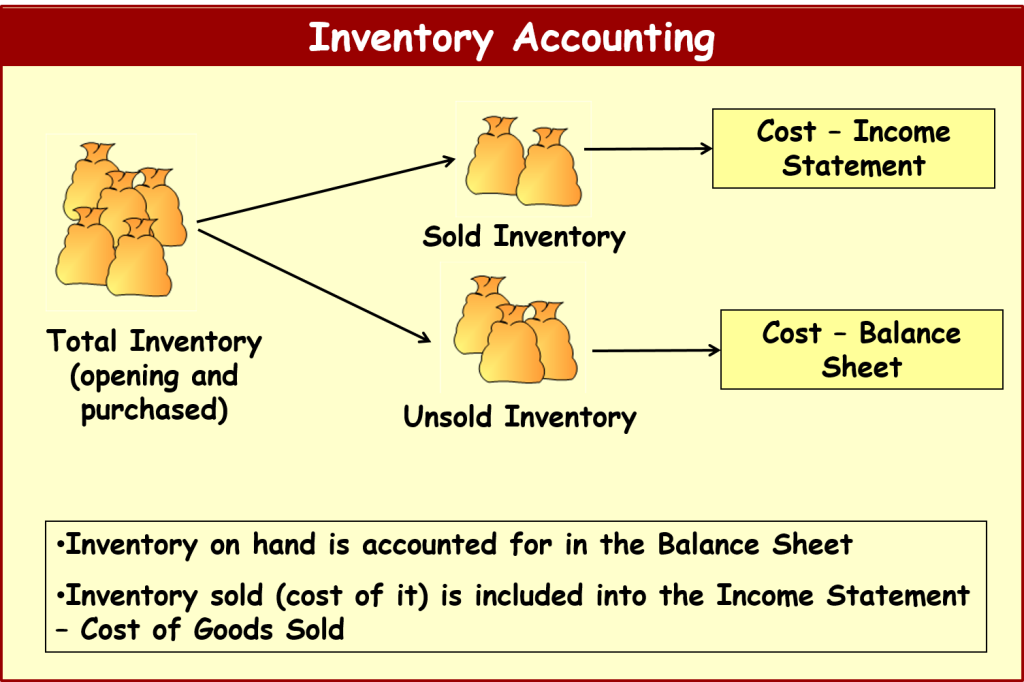

In order to follow matching accounting principle, when expenses have to be matched with the revenues, with which the expenses are related, it is essential to understand, that until inventory is not sold, its cost cannot be included into the Income Statement.

All such inventory remains on the Balance Sheet under Inventory category

All such inventory remains on the Balance Sheet under Inventory category

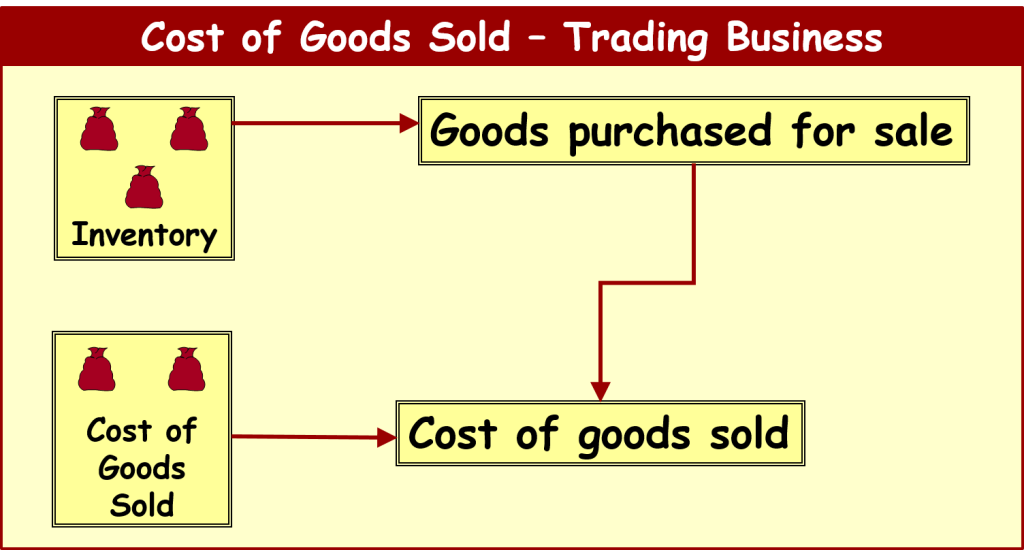

For the trading company, Income Statement will include cost of goods (merchandising inventory) sold during the accounting period.

For the trading company, Income Statement will include cost of goods (merchandising inventory) sold during the accounting period.

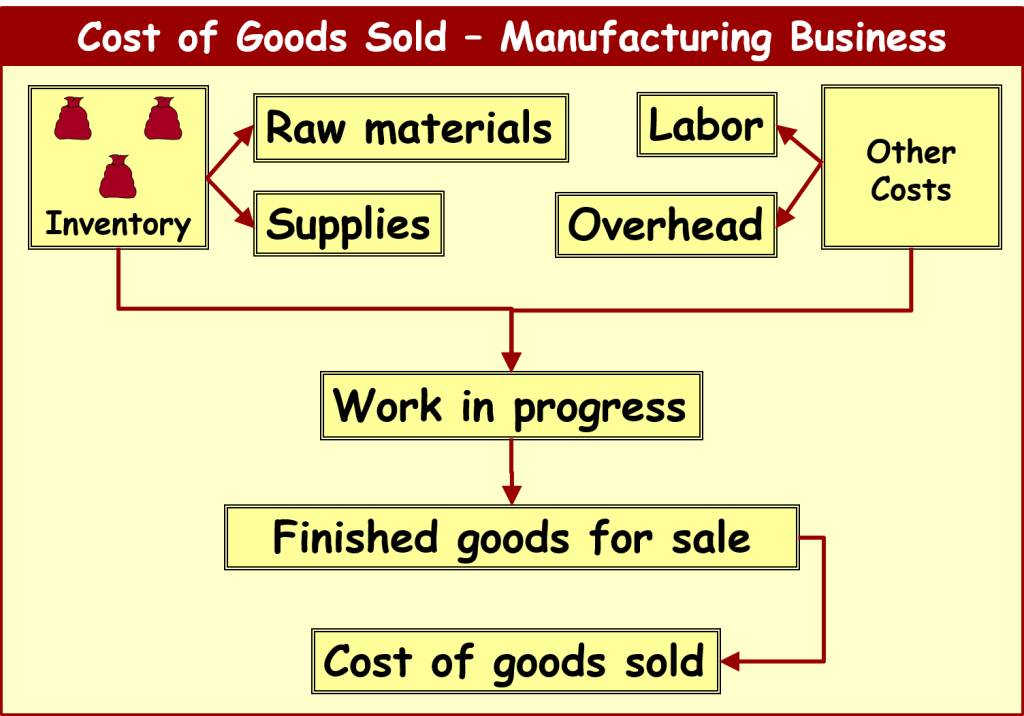

For manufacturing company, Income Statement will include cost of finished goods sold during the accounting period.

For manufacturing company, Income Statement will include cost of finished goods sold during the accounting period.

- At first, all manufacturing costs, such as cost of raw materials, supplies, labor, overhead costs will be included into work in progress

- When goods are manufactured, their cost is transferred into the finished goods ready for sale category on the Balance Sheet

- Only when these goods are sold, their cost is transferred to the Income Statement – Cost of Goods Sold caption

Both for trading and manufacturing business inventory, which was not sold during the accounting period, remains on the Balance Sheet under Inventory category of assets.

Both for trading and manufacturing business inventory, which was not sold during the accounting period, remains on the Balance Sheet under Inventory category of assets.

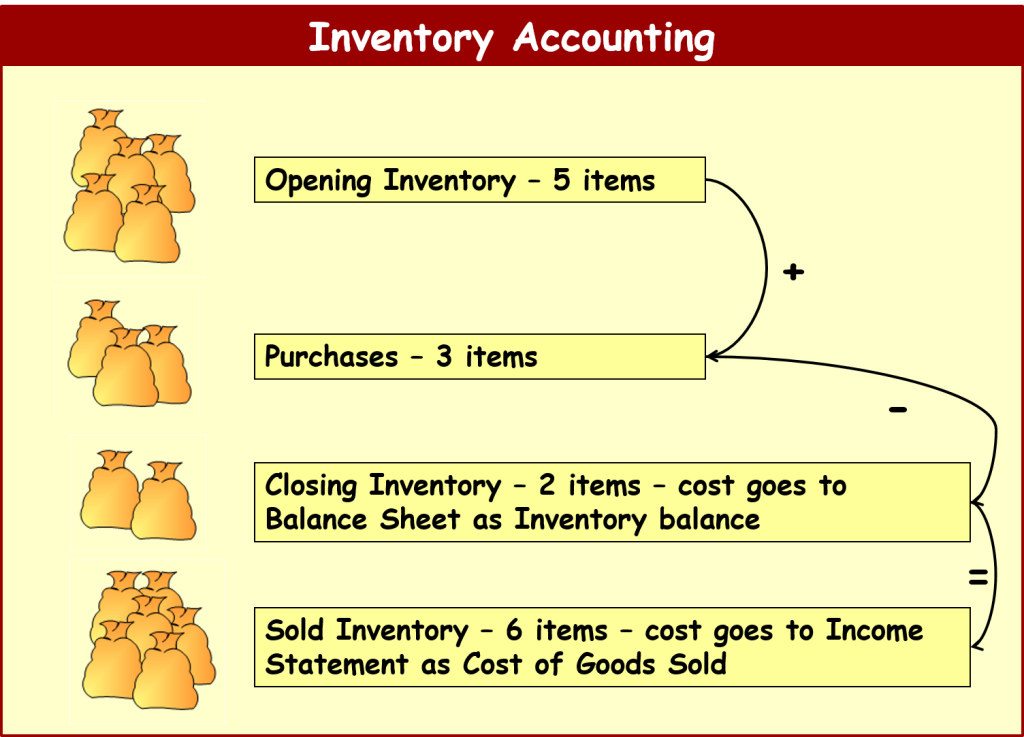

This principle can be also illustrated by the simple example, which is presented in the picture below:

- The company at the beginning of the accounting period had 5 inventory items on hand

- During the accounting period 3 more inventory items were acquired

- At the end of the accounting period it was estimated, that the company had on hand only 2 inventory items

This means that 6 items of inventory were sold during the accounting period and cost of this inventory to be included into the Income Statement – Cost of Goods Sold.

This means that 6 items of inventory were sold during the accounting period and cost of this inventory to be included into the Income Statement – Cost of Goods Sold.

Return from Inventory Accounting to AccountingCorner.org