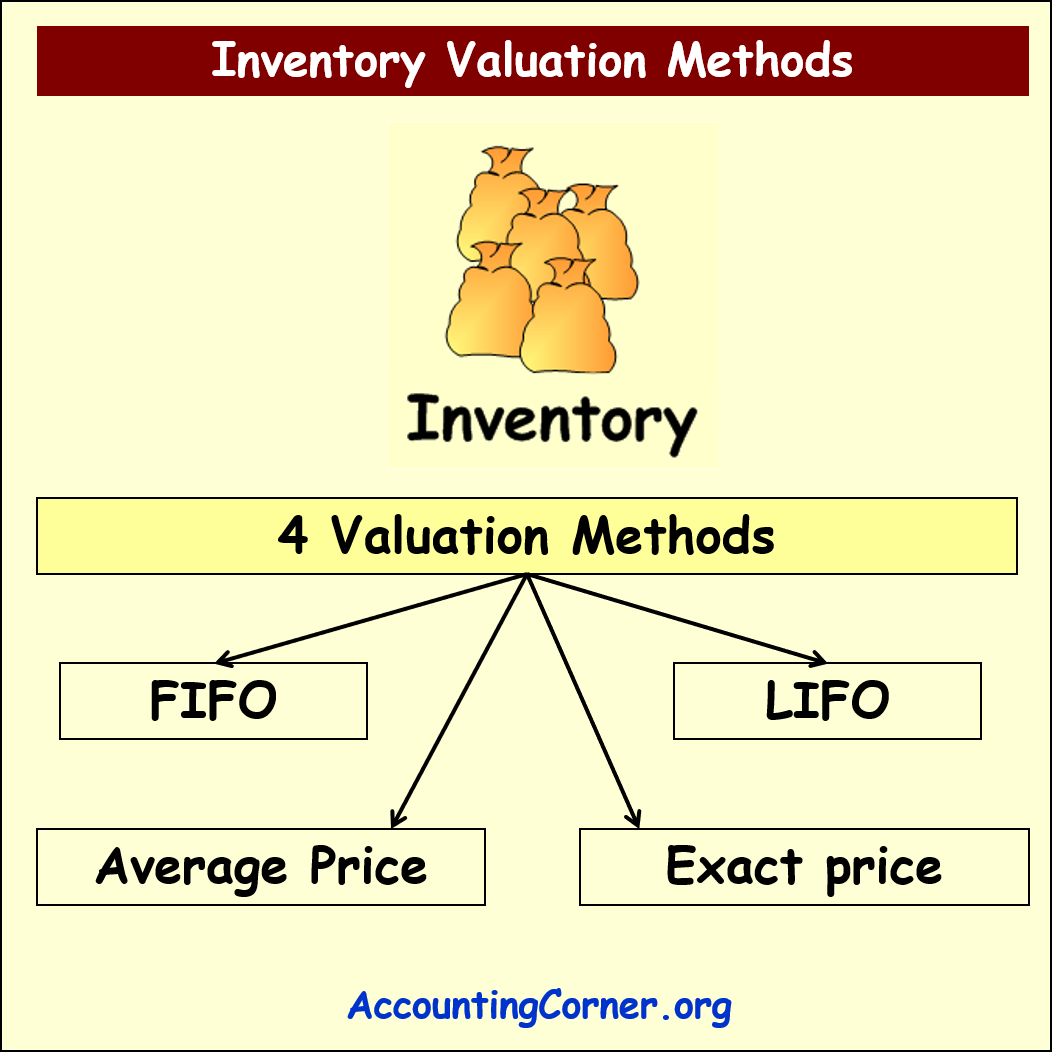

In case the company has a number of inventory items acquired during a particular period and having different prices, certain valuation methods has to be applied to calculate Cost of Goods Sold and value of the inventory remaining on hand. These methods are:

- FIFO (First-in-First-out)

- LIFO (Last-in-First-out)

- Average Price

- Exact price

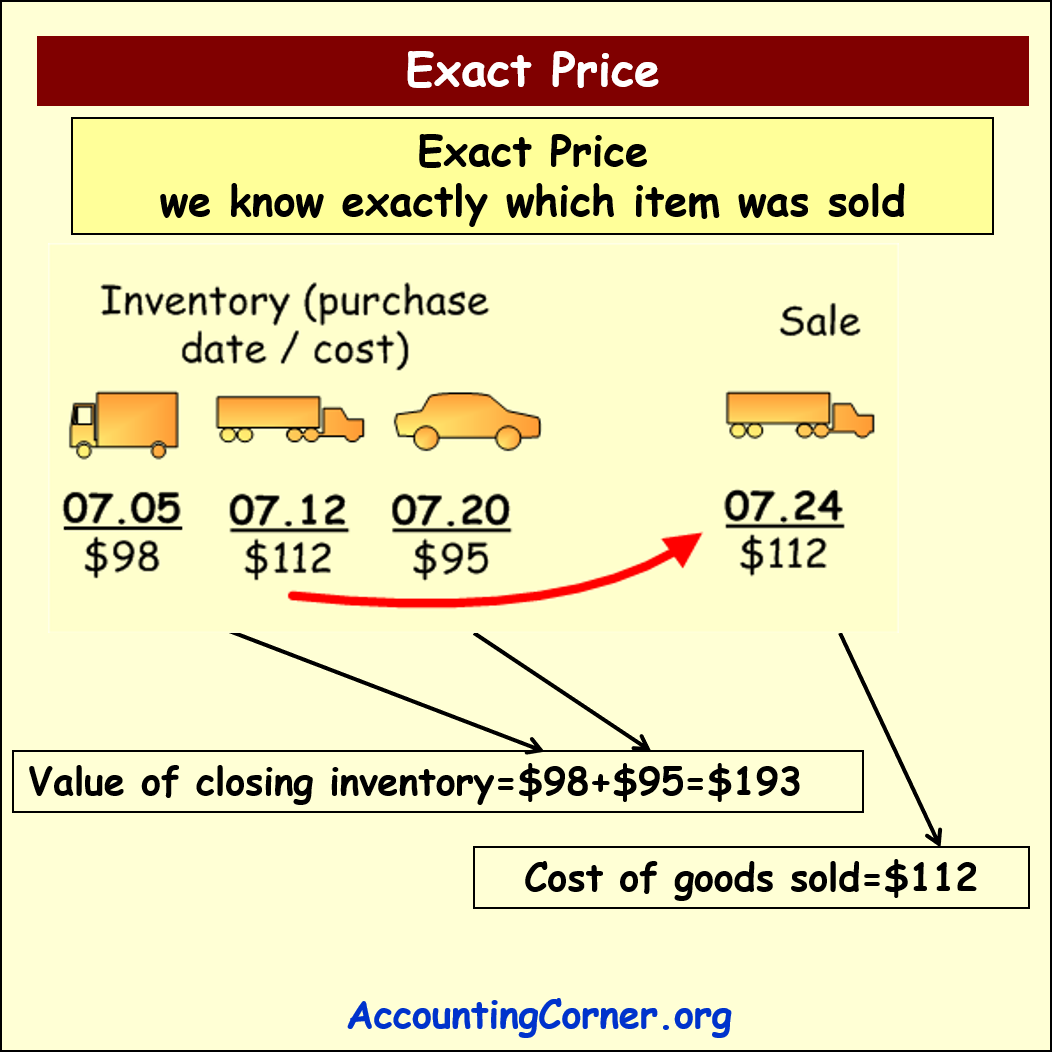

Exact Price

Applying Exact price inventory valuation method, it is know exactly, which item was sold and what was the cost of that item.

Applying Exact price inventory valuation method, it is know exactly, which item was sold and what was the cost of that item.

This method applies, when inventory items are unique in nature and it is easy to identify, which particular item was sold. The picture below demonstrates this principle:

- The company has 3 different items, acquired during July

- One item is sold

Applying Exact price inventory valuation method, it is known which item was sold

Applying Exact price inventory valuation method, it is known which item was sold

- Therefore Cost of Goods Sold will amount to $112 – exact price of the item sold

- Cost of inventory on hand, i.e. cost of closing inventory, will amount to the cost of reamining 2 items, valued at their exact price, i.e. $193

Further explore also other inventory valuation methods:

Further explore also other inventory valuation methods:

Return from Exact Price inventory valuation method to AccountingCorner.org