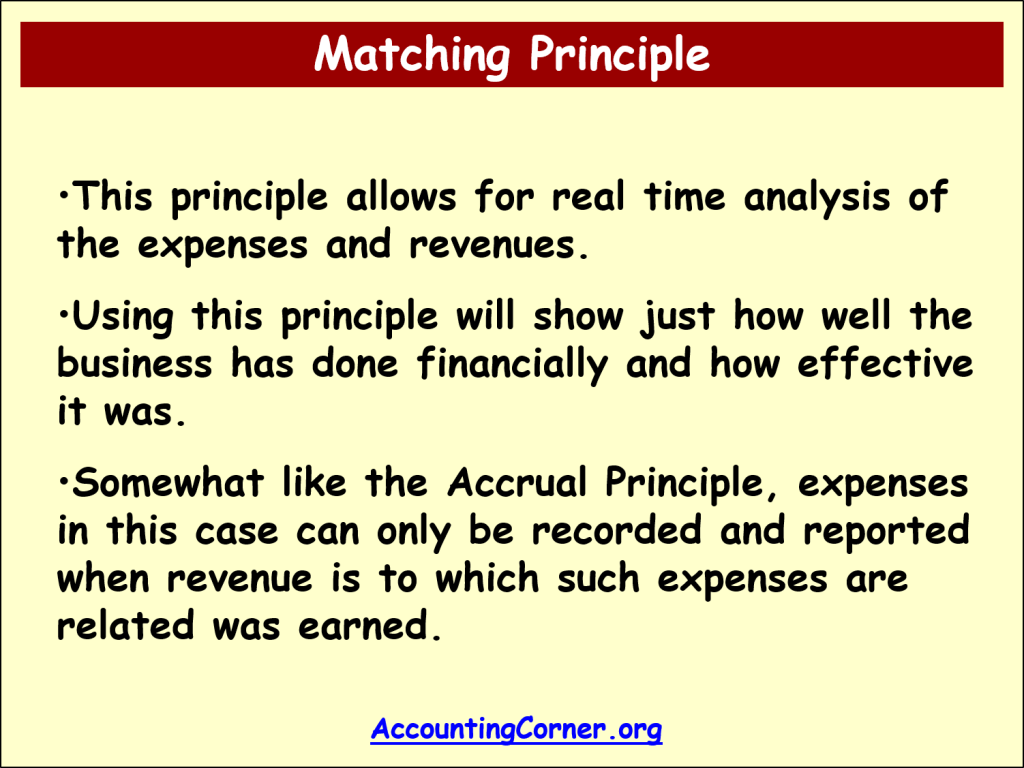

Matching Principle. This principle relates to the accounting for expenses and it states that we should recognize in the income statement only those expenses, which are related to revenue earned. Therefore if business incurs expenses related to the earned revenue, only then these expenses can be included into the Income Statement and deduct such expenses from revenue. However, if certain expenses were incurred and the revenue were not yet earned, it is not allowed to record such expenses and it is not allowed to deduct them from revenue. Matching principle is closely related to the accrual principle. Explore here income statement example for more knowledge about this financial statement.

Matching Principle

Third one – matching principle. While preparing financial statements we must follow accrual principle or matching principle, which in principle have similar meaning. It is essential to recognize assets, liabilities, equity, income or expenses, when they satisfy certain definition and recognition of criteria.

For example, revenue under accrual principle is recognized when earned, despite when cash will be actually received for the sale made. Another example is that liabilities are recognized when the business is obliged to pay money to the creditors, despite that cash was not yet spent. So this is accrual principle and these are the examples of that principle.

Return from Matching Principle to AccountingCorner.org home