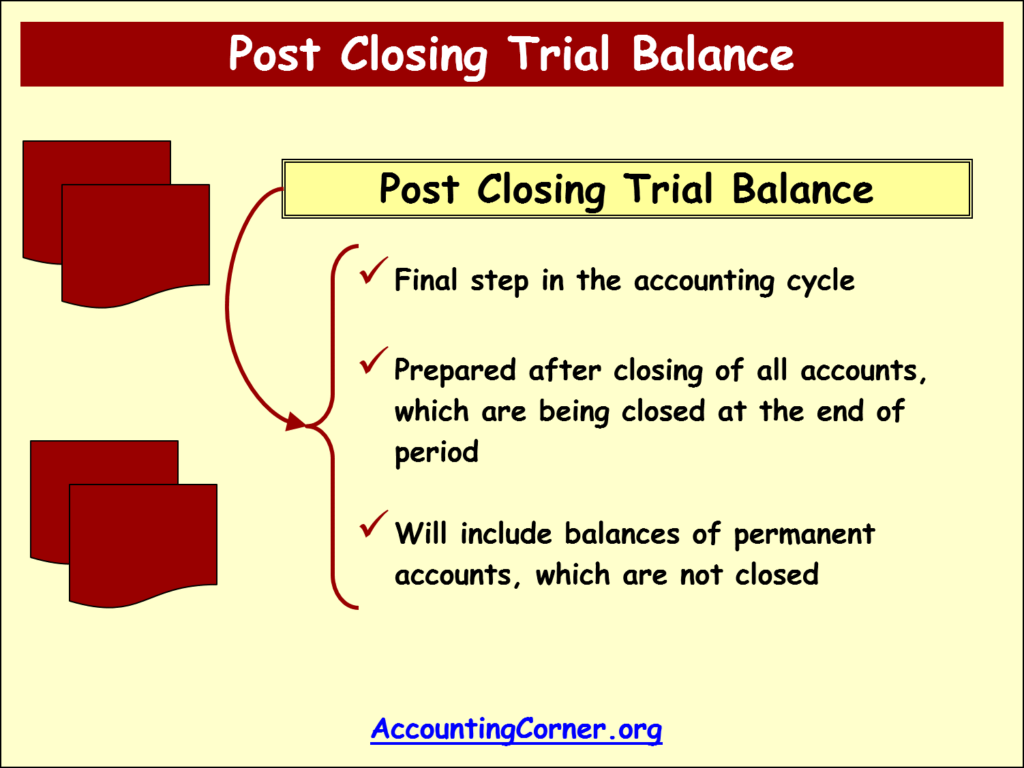

What is post closing trial balance? After the accounting period is closed, post closing trial balance is prepared in order to have the final balances of all accounts, which do have balances, i.e. are not belong to accounts which are closed. Also while preparing post closing trial balance, it is checked that all accounts, which are closed at the end of the accounting period, have zero balances. In the post closing trial balance there will be no Revenue, Expenses accounts, and also no Profit and Loss (Income) summary account, since these accounts are closed at the end of each accounting period. Post closing trial balance also provides a check between debits and credits of accounts with balances, i.e. if there is an equation between those. Preparation of post closing trial balance finalizes accounting period close process

Post Closing Trial Balance Format

Format of post-closing trial balance is the same as for other trial balances, i.e. non-adjusted trial balance, adjusted trial balance. The difference is the accounts, which are present and which are not in post closing trial balance, as described above. This type of trial balance will include only the following accounts (so called permanent general ledger accounts, which always will have balances and are not being close at the end of the accounting period):

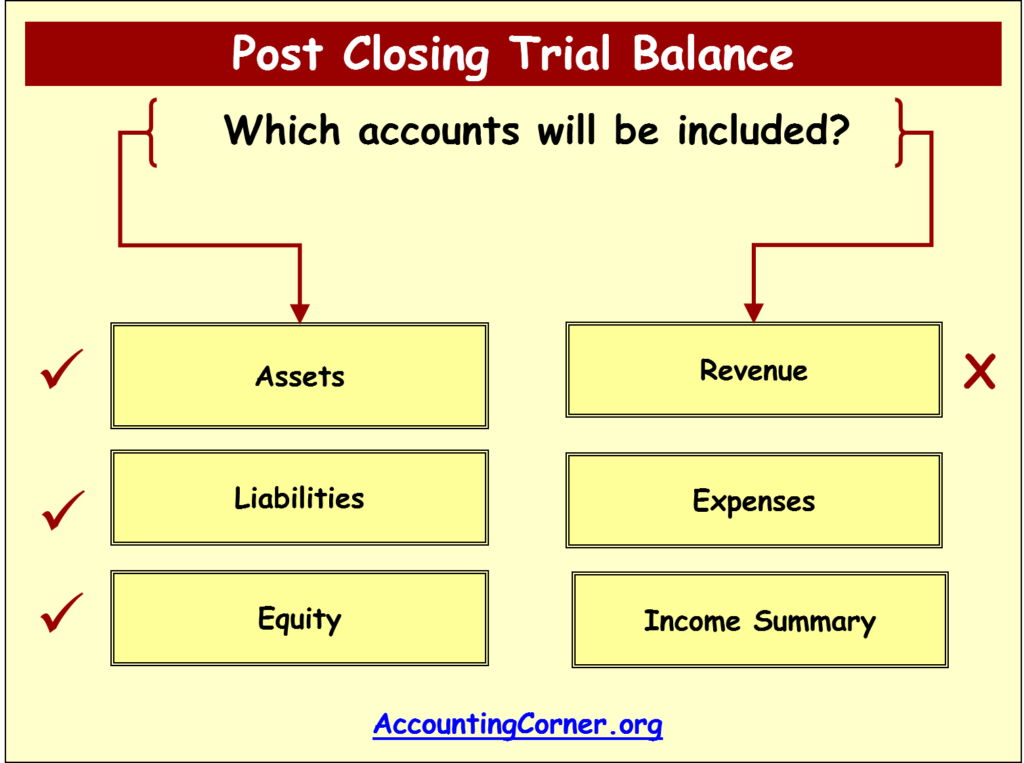

This type of trial balance will include only the following accounts (so called permanent general ledger accounts, which always will have balances and are not being close at the end of the accounting period):

- Assets

- Liabilities

- Equity

So, to test yourself once again, which of the following accounts ordinarily appears in the post-closing trial balance?

So, to test yourself once again, which of the following accounts ordinarily appears in the post-closing trial balance?

- Revenue

- Liabilities

- Expenses

- Revenue/Expenses – Income summary account

- Equity

- Assets