Prudent Definition

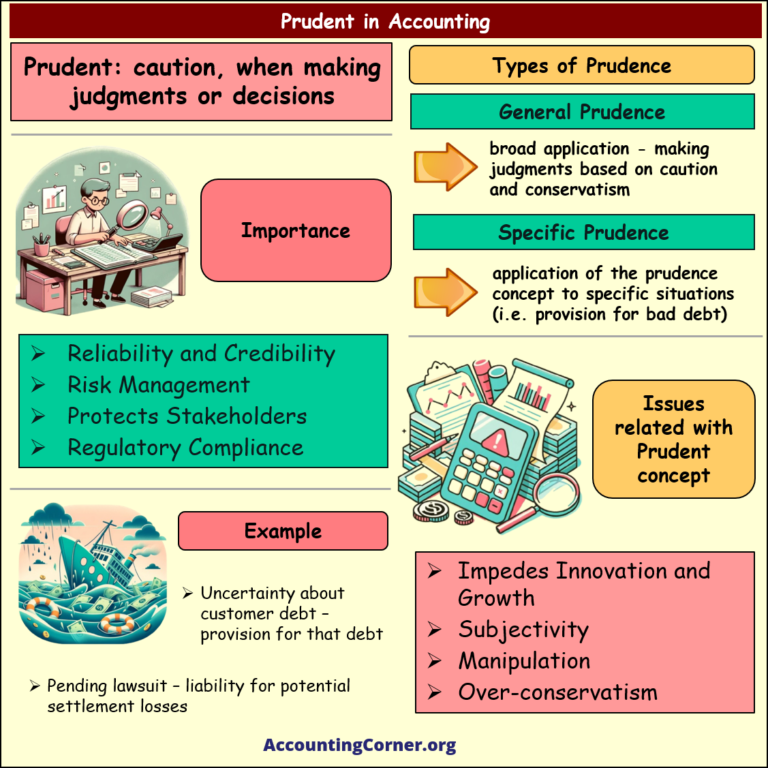

So what does prudent mean?

![]() Prudent concept in accounting and finance refers to the exercise of caution, when making judgments or decisions. This concept is grounded in ensuring, that:

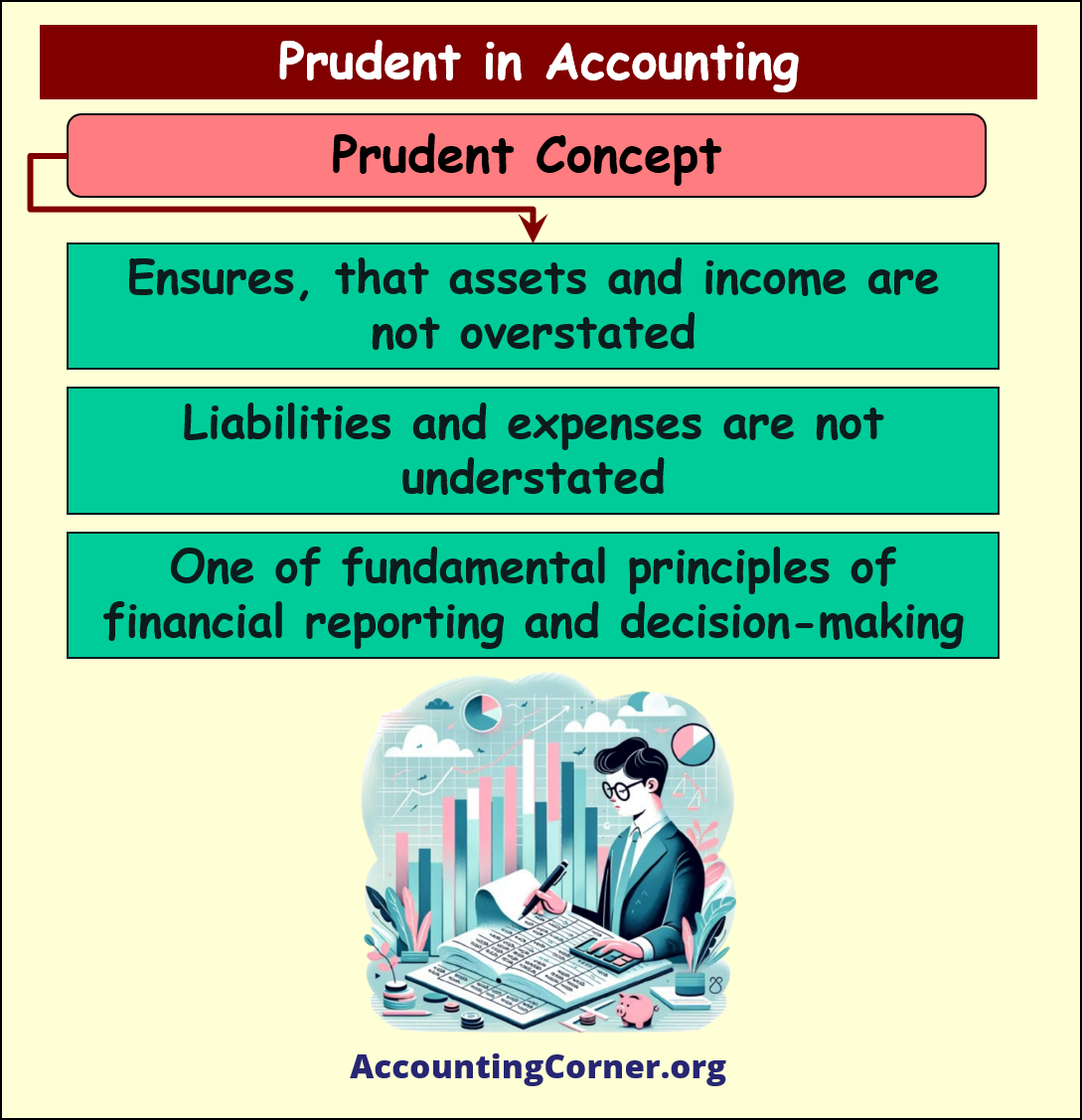

Prudent concept in accounting and finance refers to the exercise of caution, when making judgments or decisions. This concept is grounded in ensuring, that:

-

-

- assets and income are not overstated, and

- liabilities and expenses are not understated

-

![]() Prudent concept, when we defint prudent meaning, is one of the fundamental principles that underpin financial reporting and decision-making.

Prudent concept, when we defint prudent meaning, is one of the fundamental principles that underpin financial reporting and decision-making.

Importance of Prudent Concept:

- Reliability and Credibility: Prudence ensures that financial statements give a true and fair view of a company’s financial position, making them reliable and credible for stakeholders

- Risk Management: Being prudent helps businesses anticipate potential losses and avoid overly optimistic assumptions

- Protects Stakeholders: Ensures that stakeholders such as shareholders, creditors, and others are not misled by over-optimistic financial statements

- Regulatory Compliance: Many accounting standards and regulations require the application of the prudence principle

Types of Prudent Concept

- General Prudence: This is a broad application of the concept, where accountants and financial professionals make judgments based on caution and conservatism.

- Specific Prudence: This is the application of the prudence concept to specific situations, like creating provisions for doubtful debts or recognizing potential liabilities.

Formula on Prudent Concept

![]() There’s no specific “formula” for prudence. However, its application often involves estimations and provisions. For instance, when calculating the provision for doubtful debts:

There’s no specific “formula” for prudence. However, its application often involves estimations and provisions. For instance, when calculating the provision for doubtful debts:

Provision for Doubtful Debts = Total Receivables * Estimated % of Bad Debts

Examples of Prudent Concept Aplication

- If there is uncertainty about a customer paying their debt, a company might create a provision for doubtful debts

- If a lawsuit is pending against a company, and there’s a probability that the company might lose, the company may recognize a liability for the potential legal settlement

- When valuing inventory, companies might use the lower of cost or net realizable value, reflecting a prudent view of the asset’s value

Issues and Limitations of the Concept of Prudent

- Over-conservatism: Excessive prudence can lead to significant under-reporting of assets or income, which might not give a true and fair view of the financial position

- Manipulation: Prudence can sometimes be used to manipulate earnings, for instance by changing provisions or deferring income

- Impedes Innovation and Growth: Excessive caution might prevent companies from taking calculated risks that could lead to growth and innovation

- Subjectivity: The degree of prudence applied can vary among accountants, leading to inconsistencies

Prudent Definition – What does Prudent Mean? – Visuals

Prudent Definition – What does Prudent Mean? – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Prudent Meaning to AccountingCorner.org