Total Assets Turnover Ratio compares revenues generated by the business with the value of total assets.

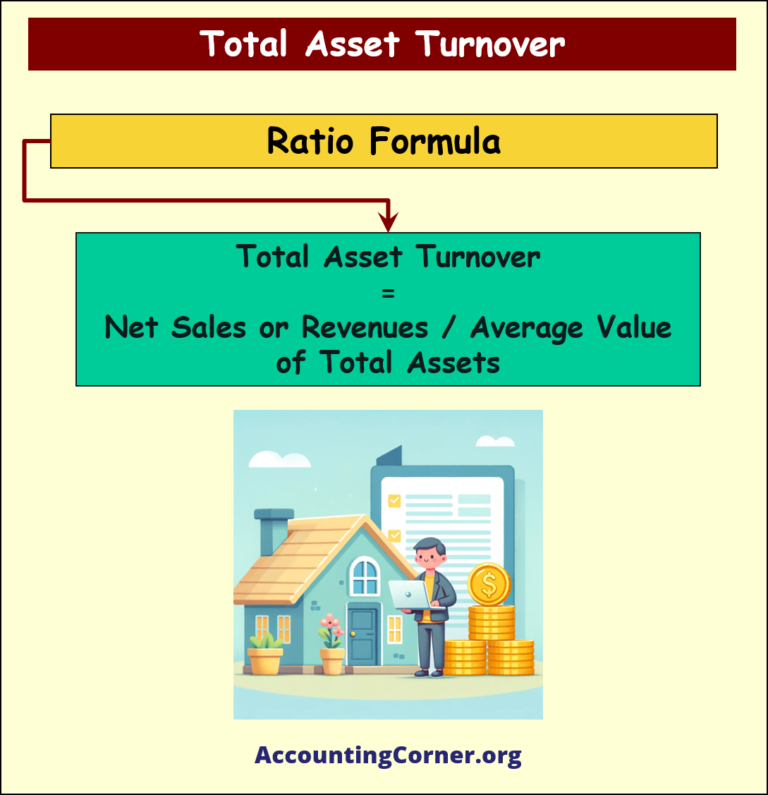

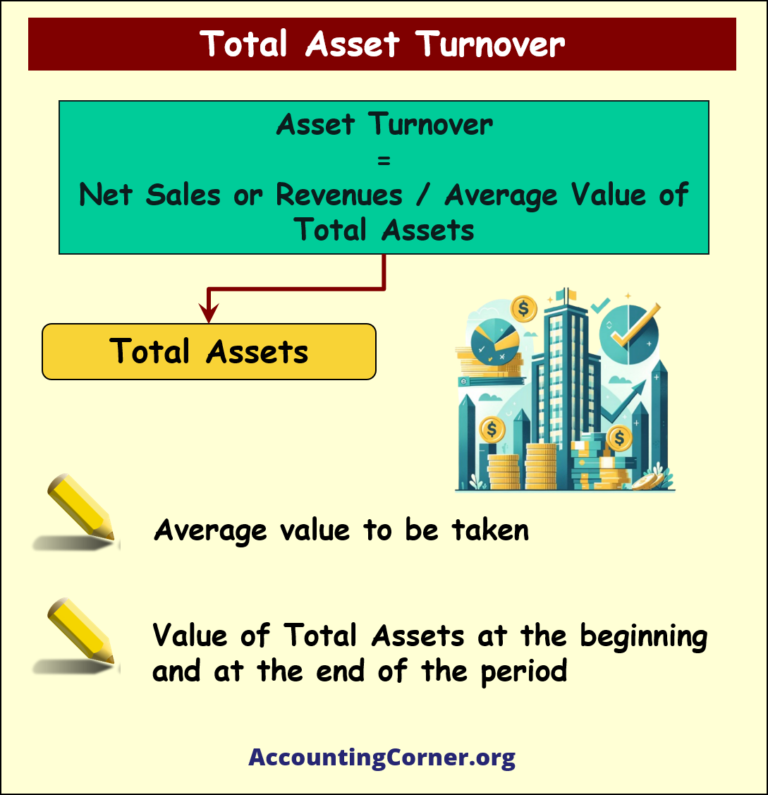

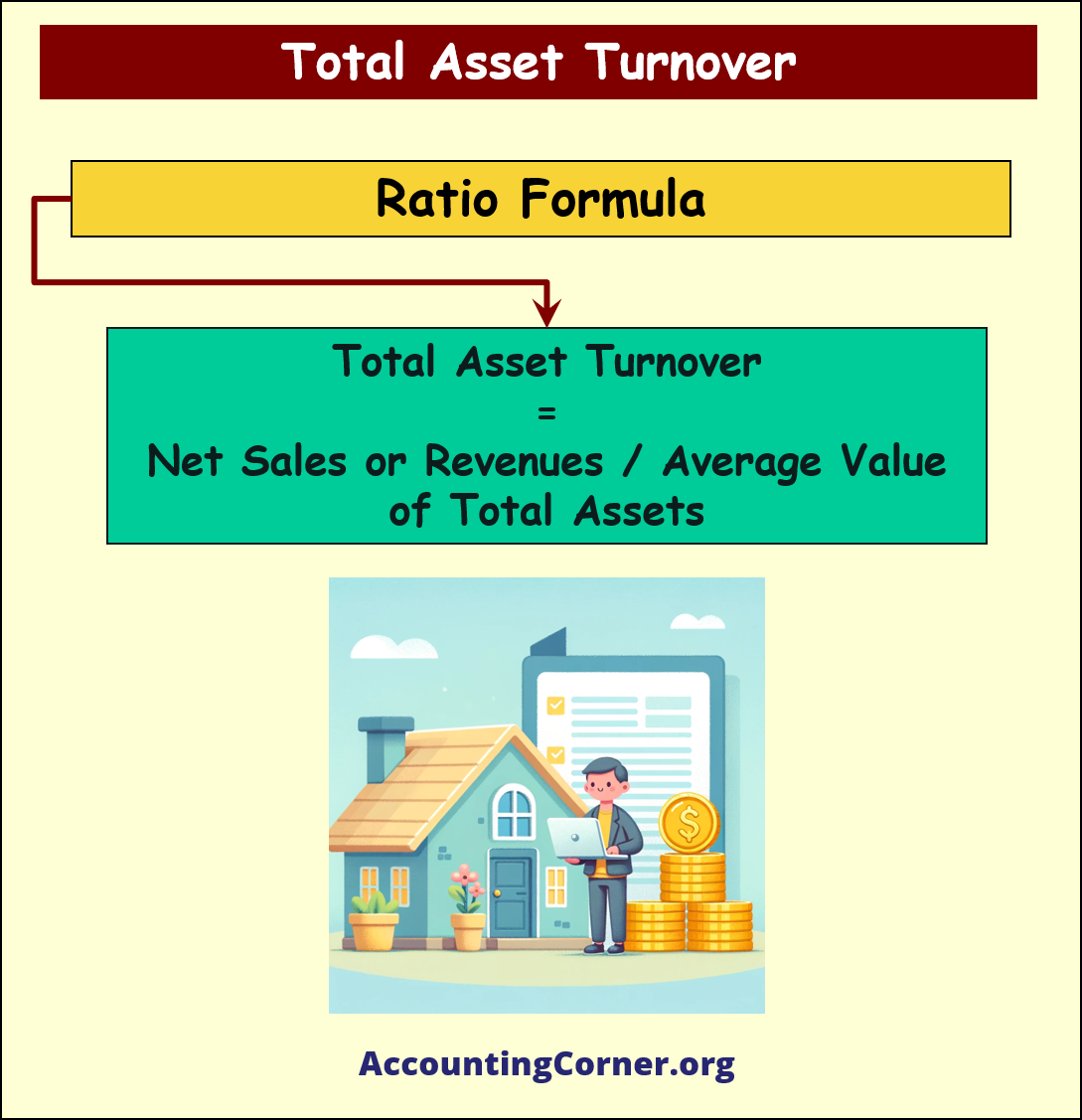

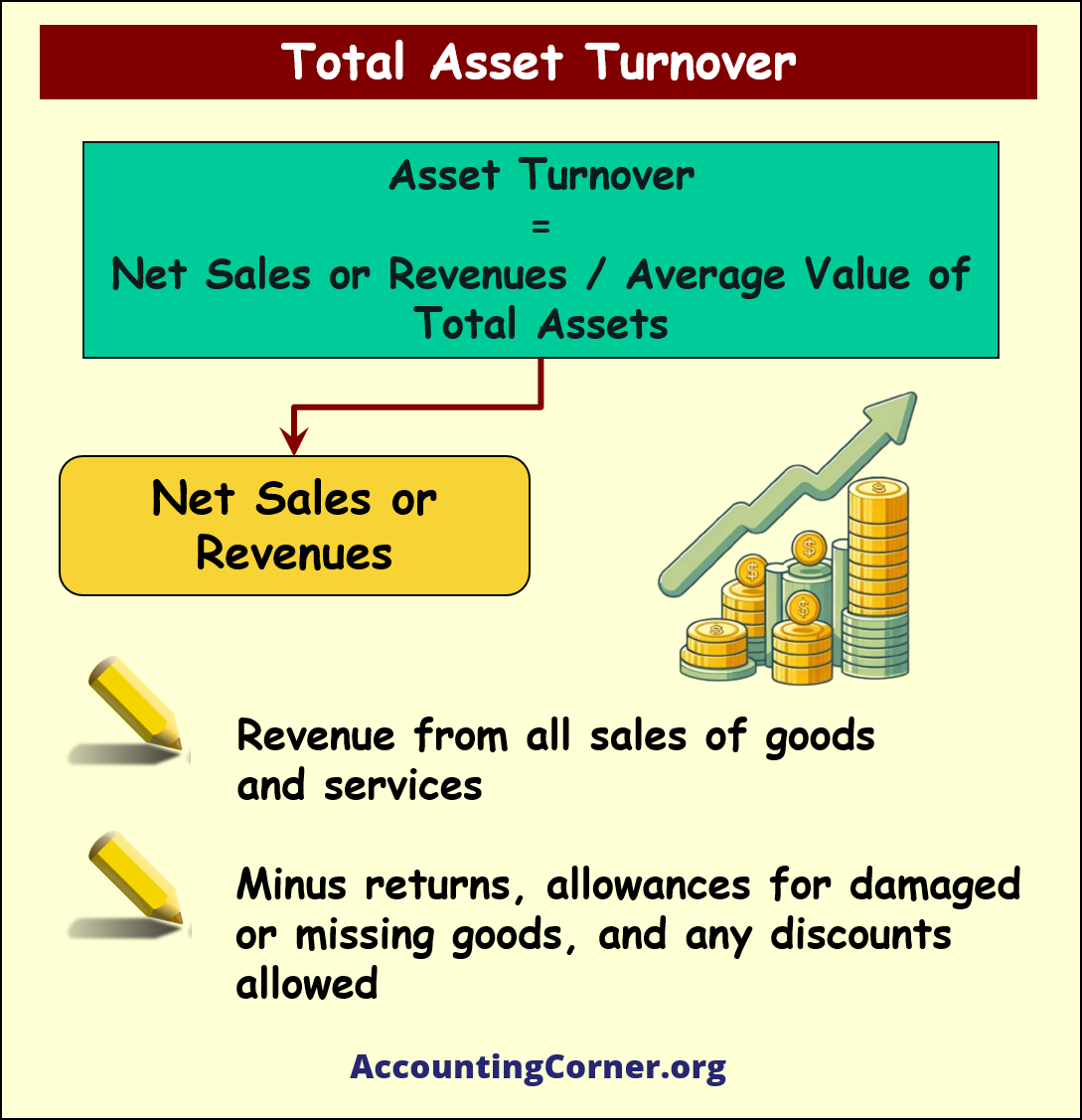

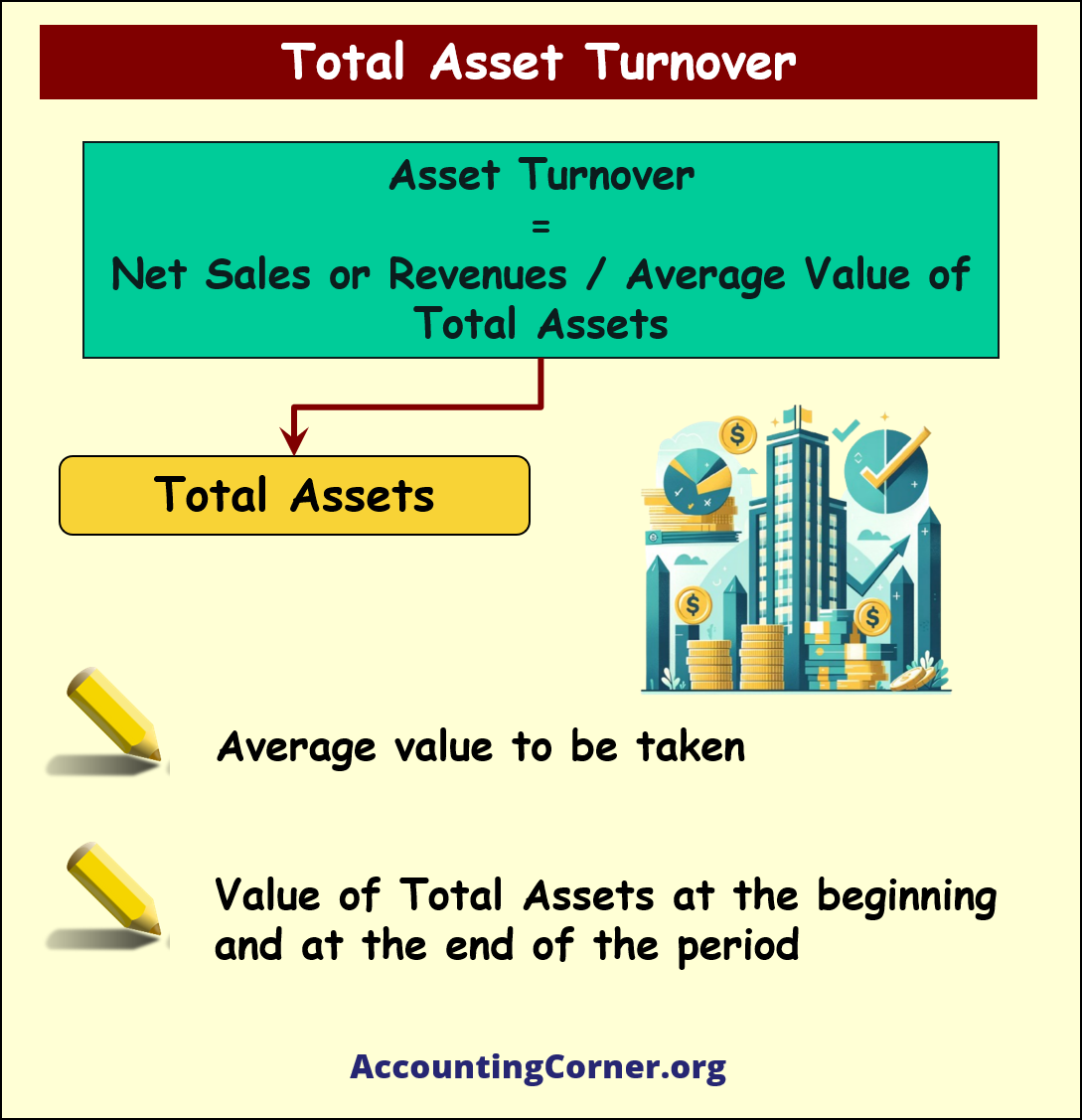

The following formula is used to calculate this ratio:

- Net Sales (or Revenues): This is the revenue from all sales of goods and services, minus returns, allowances for damaged or missing goods, and any discounts allowed

- Average Total Assets: This is the average value of all a company’s assets, calculated by adding the beginning and ending total asset balances for a period (usually a year) and dividing by two

Taking average value of assets into the calculation better represents the value of assets in the business, since it can fluctuate through the period depending on seasonality or other factors. Also this is logical comparison, since average value of assets is then compared to net sales, which represent level of sales through all the period in question.

Taking average value of assets into the calculation better represents the value of assets in the business, since it can fluctuate through the period depending on seasonality or other factors. Also this is logical comparison, since average value of assets is then compared to net sales, which represent level of sales through all the period in question.

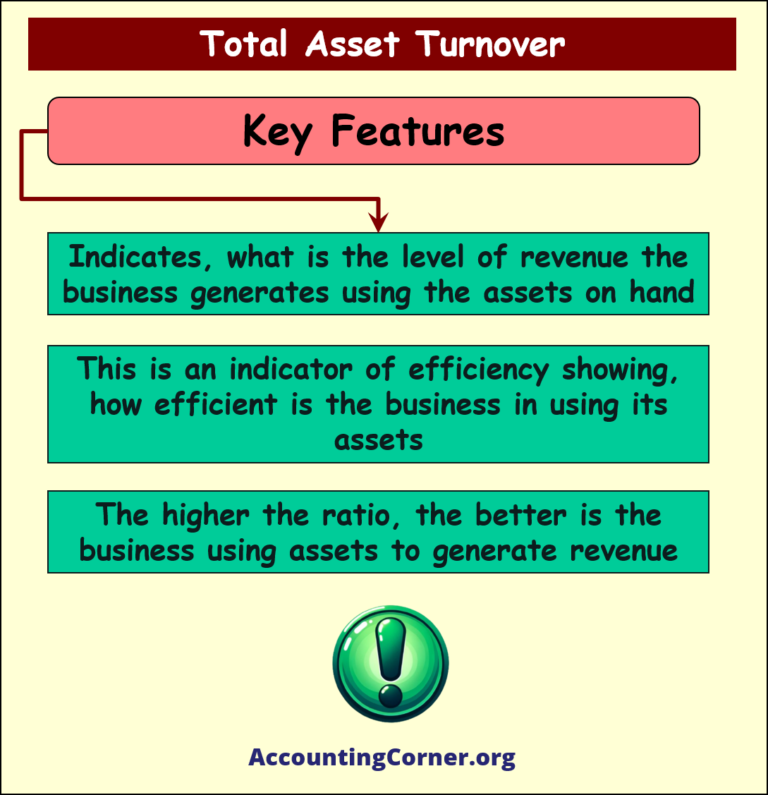

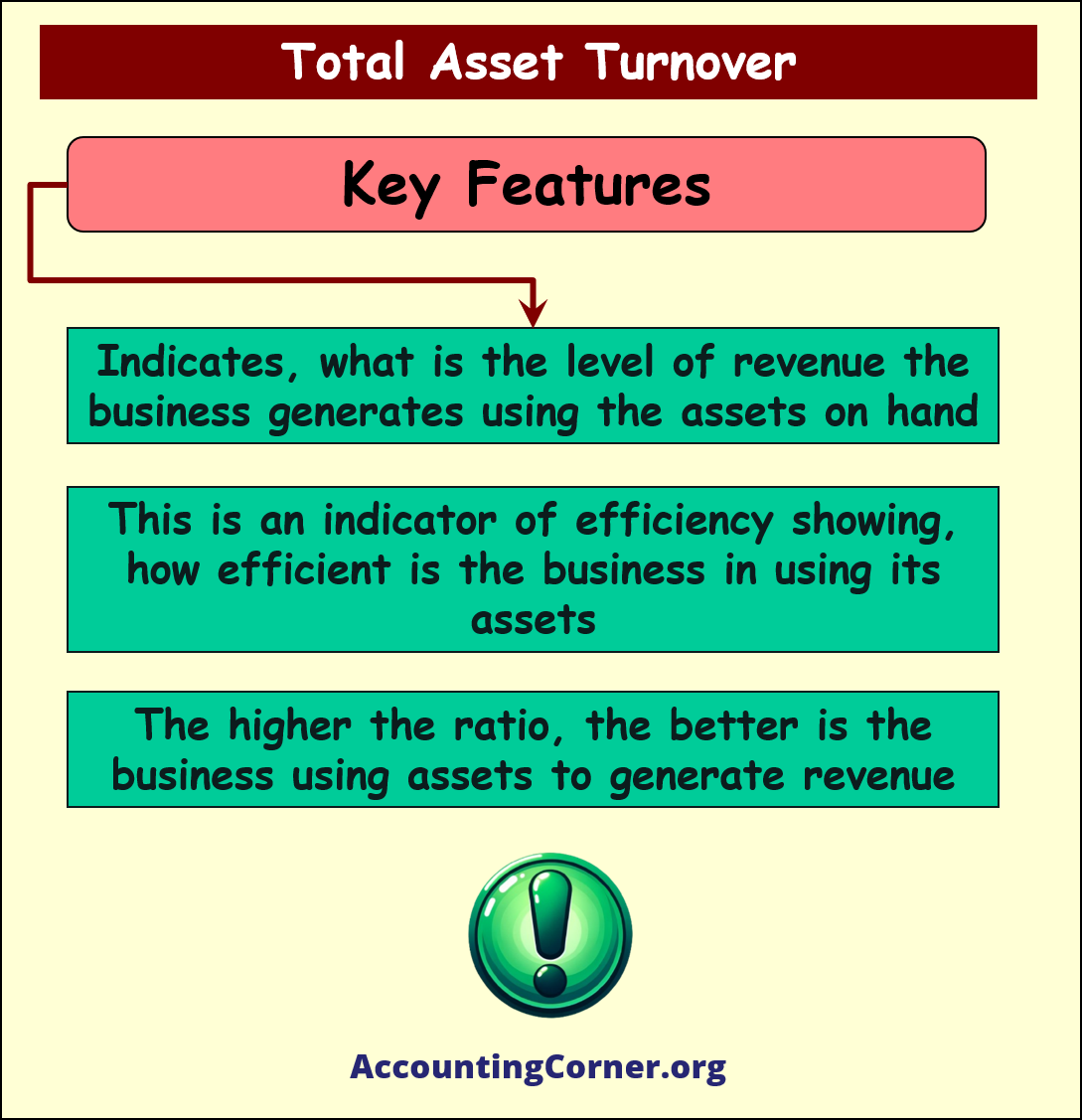

This ratio indicates what is the level of revenue the business generates using the assets on hand. This is an indicator of efficiency showing, how efficient is the business in using its assets.

This ratio indicates what is the level of revenue the business generates using the assets on hand. This is an indicator of efficiency showing, how efficient is the business in using its assets.

A higher ratio indicates that the company is using its assets more efficiently to generate sales. Conversely, a lower ratio might suggest that a company is not using its assets effectively.

A higher ratio indicates that the company is using its assets more efficiently to generate sales. Conversely, a lower ratio might suggest that a company is not using its assets effectively.

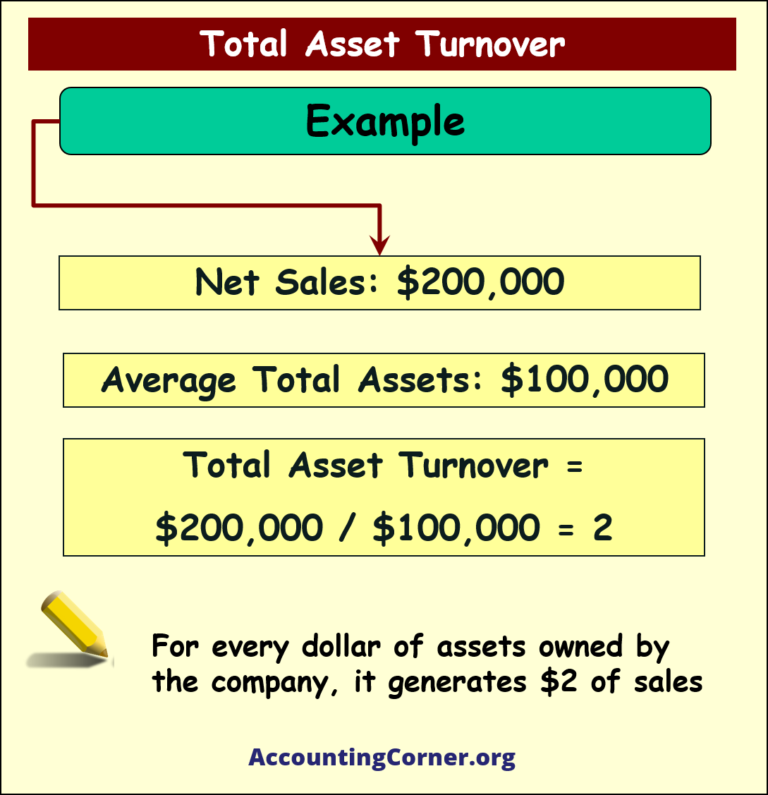

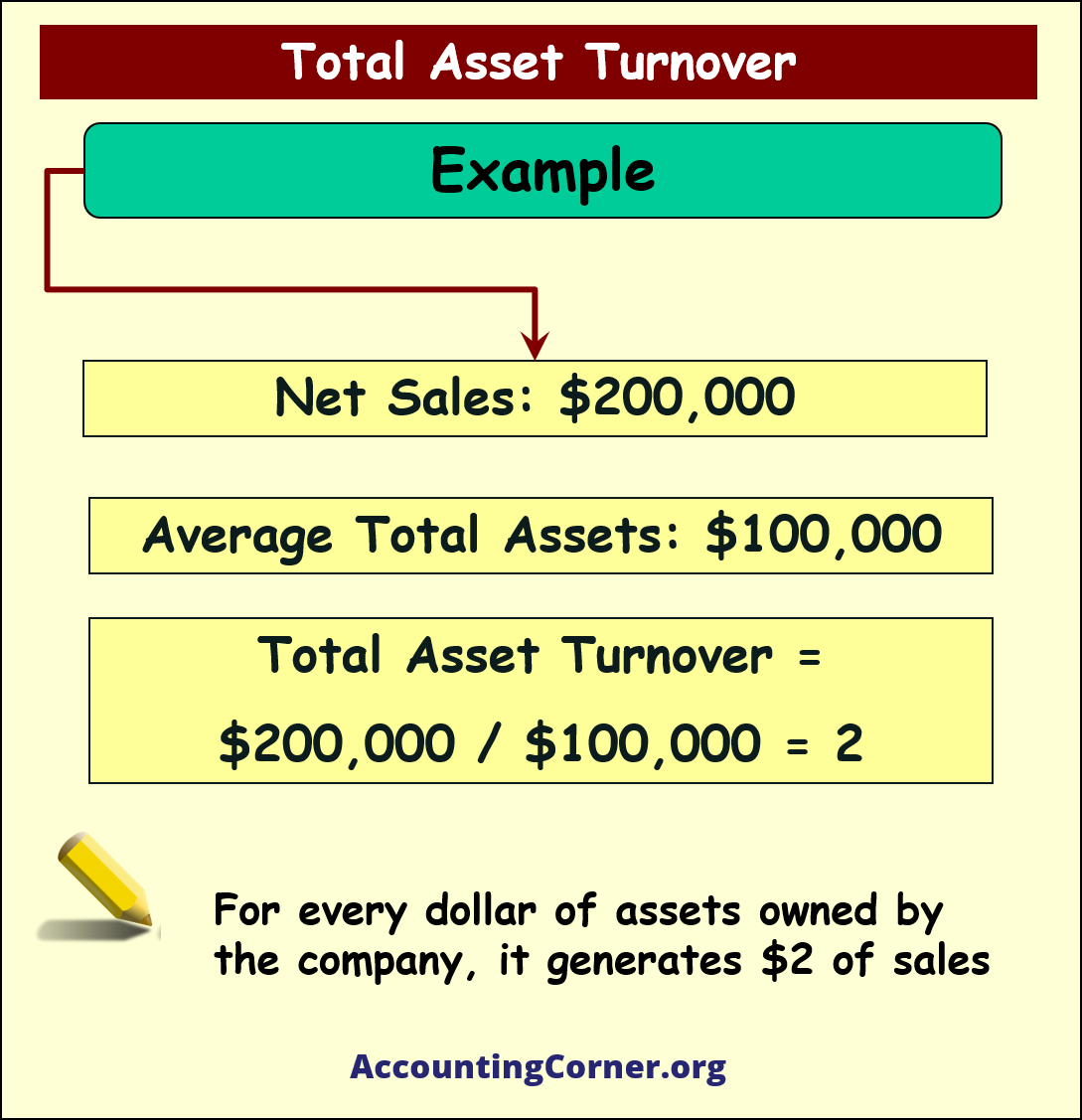

Total Assets Turnover Ratio – calculation example

For example:

- net sales of the company are $200,000

- average total assets of this company are $100,000

This means that for every dollar of assets owned by the company, it generates $2 of sales.

This means that for every dollar of assets owned by the company, it generates $2 of sales.

![]() This ratio as a stand alone is not indicative and it should be either compared across various periods of time in the same business or with the competitors operating in the same industry area.

This ratio as a stand alone is not indicative and it should be either compared across various periods of time in the same business or with the competitors operating in the same industry area.

Total Asset Turnover Ratio is important for comparing the performance of companies in capital-intensive sectors, like manufacturing, where investments in assets are significant. However, it’s less useful for comparing companies across different industries, as asset utilization can vary widely depending on the nature of the business.

Total Asset Turnover – Visuals

Total Asset Turnover – Video

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Total Asset Turnover Ratio to AccountingCorner.org home