Here you can find examples how the transaction impact the Accounting Equation. For this purpose there will be a hypothetical company analyzed, including business transactions impacting the activities of this company and exploring how these transactions impact the Accounting Equation and how this impact must be reflected.

Business Transaction No.1

The first transaction to start from is the establishment of the company Zeta and this transaction covers the $19,000 investment of the own capital by the shareholders and that investment covers the following:

- cash invested into bank account – $14,000

- petty cash is $5,000

The activities of the company Zeta is renting office space and selling different inventory. So let’s see how to record the 1st transaction and what is its impact on the Accounting Equation.

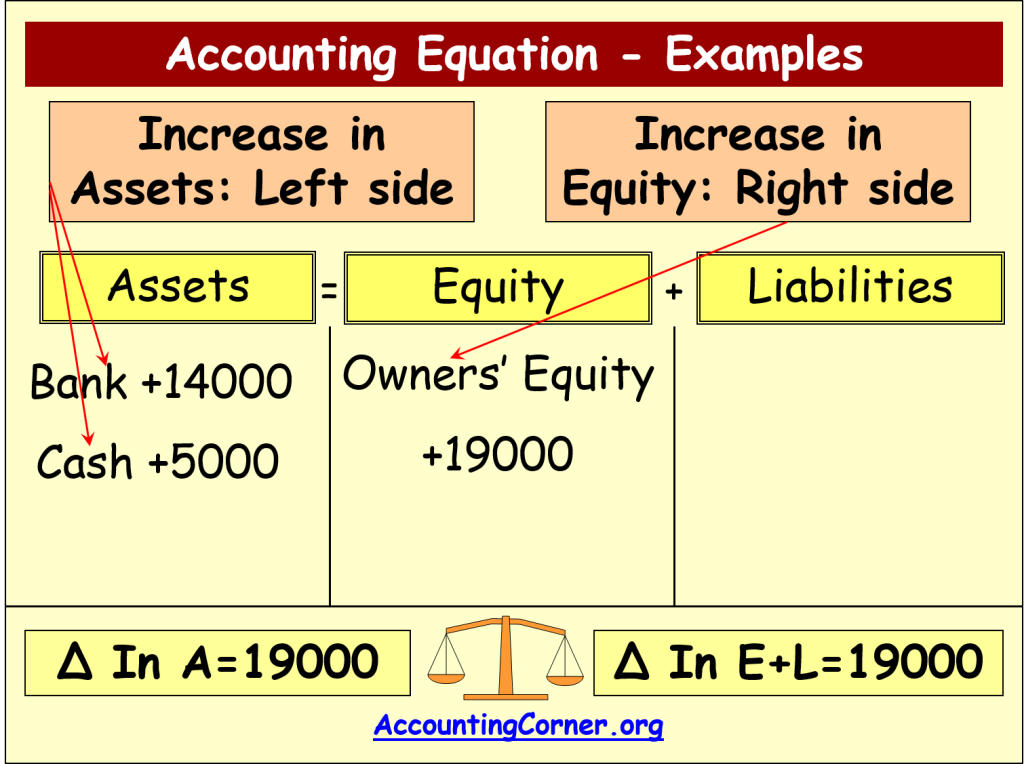

On the left (Asset) side of the equation we have increase in Assets, i.e. cash in bank by $14,000 and petty cash by $5,000. We need to separate petty cash and cash bank to reflect impact of the transaction on the different types of assets. This is done separately in order to provide information to the users of the financial data and to be able to earn to and to know what types of assets, what different types of assets business has.

This is the left side of the equation.

Since each transaction has two-fold impact on the equation, we need to consider what other parts of their accounting equation are impacted. There was an establishment of the company and owners invested financial means, there is an increase in Equity – right side of the Equation. Total amount invested by shareholders is $19,000, which is reflected on the right side as an increase in Owners’ Equity.

In order to reflect this transaction properly, there should be an equation between the impact on the left side and impact on the right side of the equation, i.e. Increase in Cash in Bank $14,000+Increase in Petty Cash $5,000=Increase in Owners’ Equity $19,000. There is an equation, so the transaction was reflected properly.

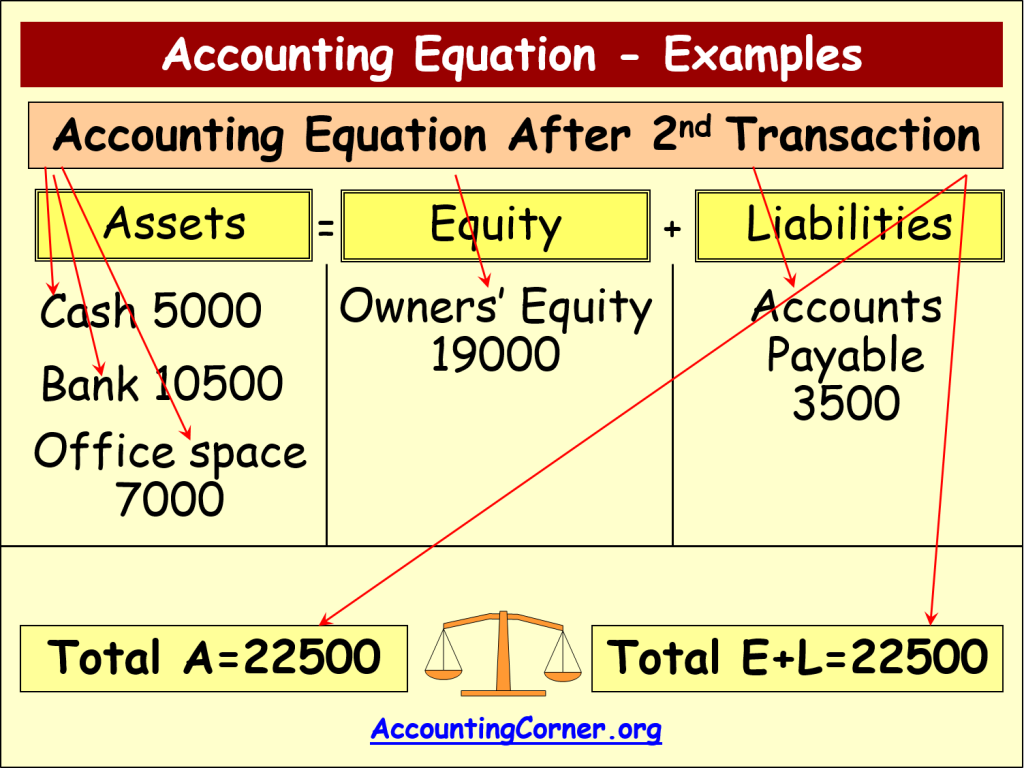

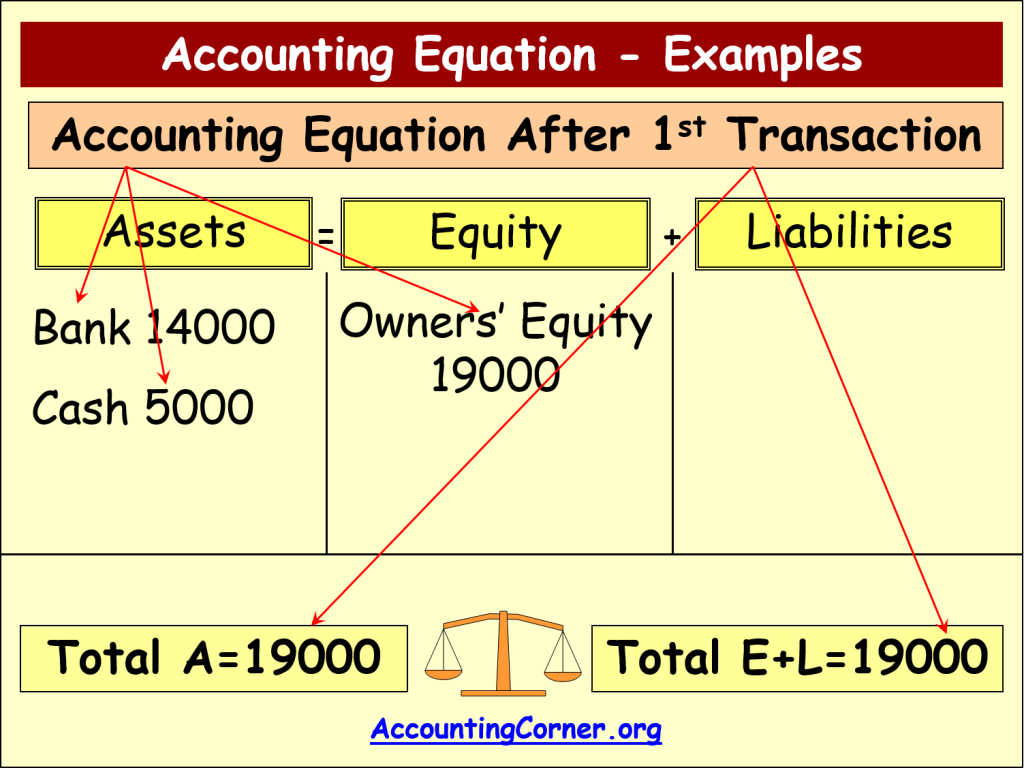

After the impact of this transaction on the accounting equation was recorded, we need to calculate the balance resulting after this business transaction. Total assets value is $19,000, total sum of Equity and Liabilities is $19,000.

There must be an equality. If there would be no equality, then this means that the transactions were recorded incorrectly. In such a case we would need to go back and check what kind of mistakes have been made and make necessary corrections.

Business Transaction No.2

Under the second transaction the company Zeta acquires office space, which will be rented out to the clients. The acquisition cost is $7,000. Part of the cost was paid by cash – $3,500, another part will be paid after some period of time, i.e. part of the office space was acquired on credit, i.e. $3,500.

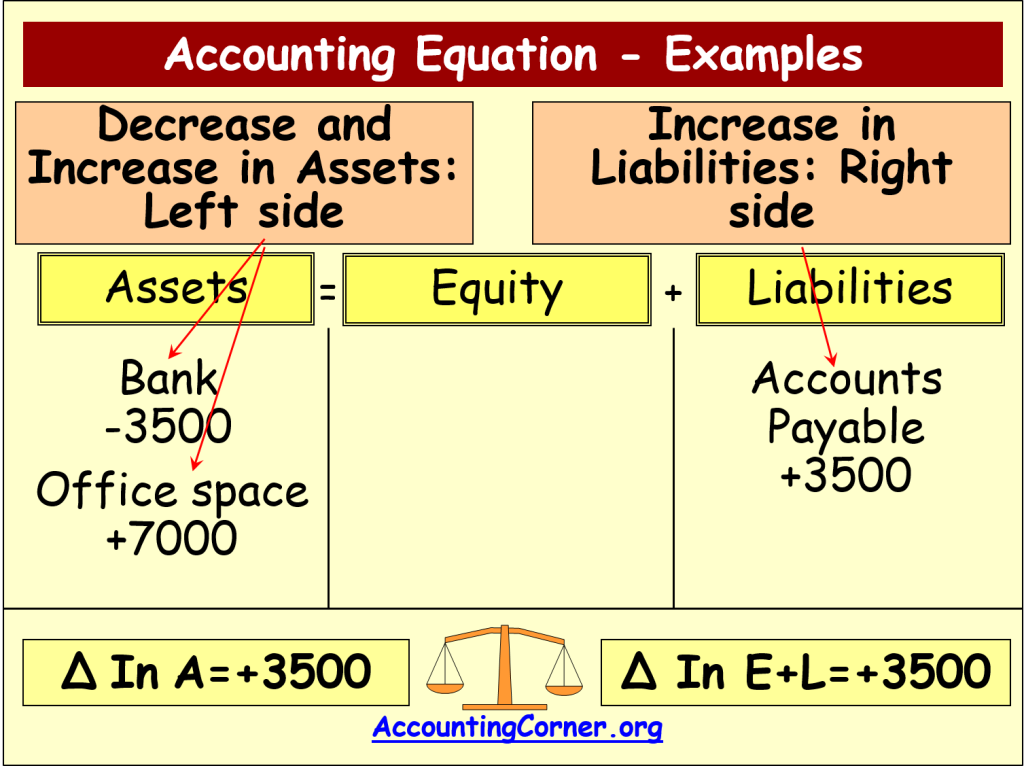

Let us explore how does this transaction impact the Accounting Equation? Since the assets were acquired, on the left side there is an increase in assets, i.e. Office Space – $7,000.

As the company has spent cash to cover part of the office space cost, there is a decrease in other asset category – Cash by $3,500, also reflected on the left side of the equation. There is an exchange of one type of the asset into another.

After this is done, still there is no balance between change in assets, equity and liabilities. The reason for this that only part of the business transaction was reflected, i.e. acquisition of office space and spending of cash.

As remaining part of the office space cost ($3,500) will be paid after some period of time, this part must be recorded as liability. On the right side of the equation there is an increase in liabilities, i.e. accounts payable category and it is $3,500 – the remaining part of the office space cost which was not paid by cash.

The next step is to add up total change in assets and total change in equity and liabilities in order to check whether we have recorded this transaction properly and whether there is an equality.

Total increase in assets amounts to $3,500, total increase in liabilities amounts to $3,500. There is an equality, therefore the transaction was recorded correctly.

The next step is to check how the accounting equation looks like after the second transaction was recorded. This calculation also must take into account the first transaction. Total value of Assets, Equity and Liabilities must include the impact of the 1st and 2nd transactions.