What is Voided Check?

![]() Voided Check is a common concept in banking and finance, particularly relevant for readers of a blog focusing on these topics. Here’s a comprehensive breakdown of this topic:

Voided Check is a common concept in banking and finance, particularly relevant for readers of a blog focusing on these topics. Here’s a comprehensive breakdown of this topic:

Definition of a Voided Check:

- A voided check is a check that has the word “VOID” written across it, which indicates that the check cannot be accepted for payment. However, the check still contains valuable information, such as the account holder’s name, account number, and the bank’s routing number, which can be used to set up electronic links to a bank account.

Importance of a Voided Check:

- Voided checks are commonly used to provide banking information without the risk of the check being used fraudulently. They are often requested by employers for setting up direct deposit of paychecks, or by financial institutions for setting up automatic payments or transfers.

- Since the check is marked as void, it provides a safe way to share account information without the fear of the check being cashed.

Practical Examples:

- For example, when starting a new job, an employer might ask for a voided check to set up direct deposit. The employee would provide a blank check, write “VOID” across it, and give it to the employer. This allows the employer to use the banking details to arrange for the employee’s salary to be deposited directly into their bank account.

- Similarly, for automatic mortgage or utility payments, a homeowner might need to provide a voided check to the mortgage company or utility provider to enable automatic monthly deductions from their account.

|

|

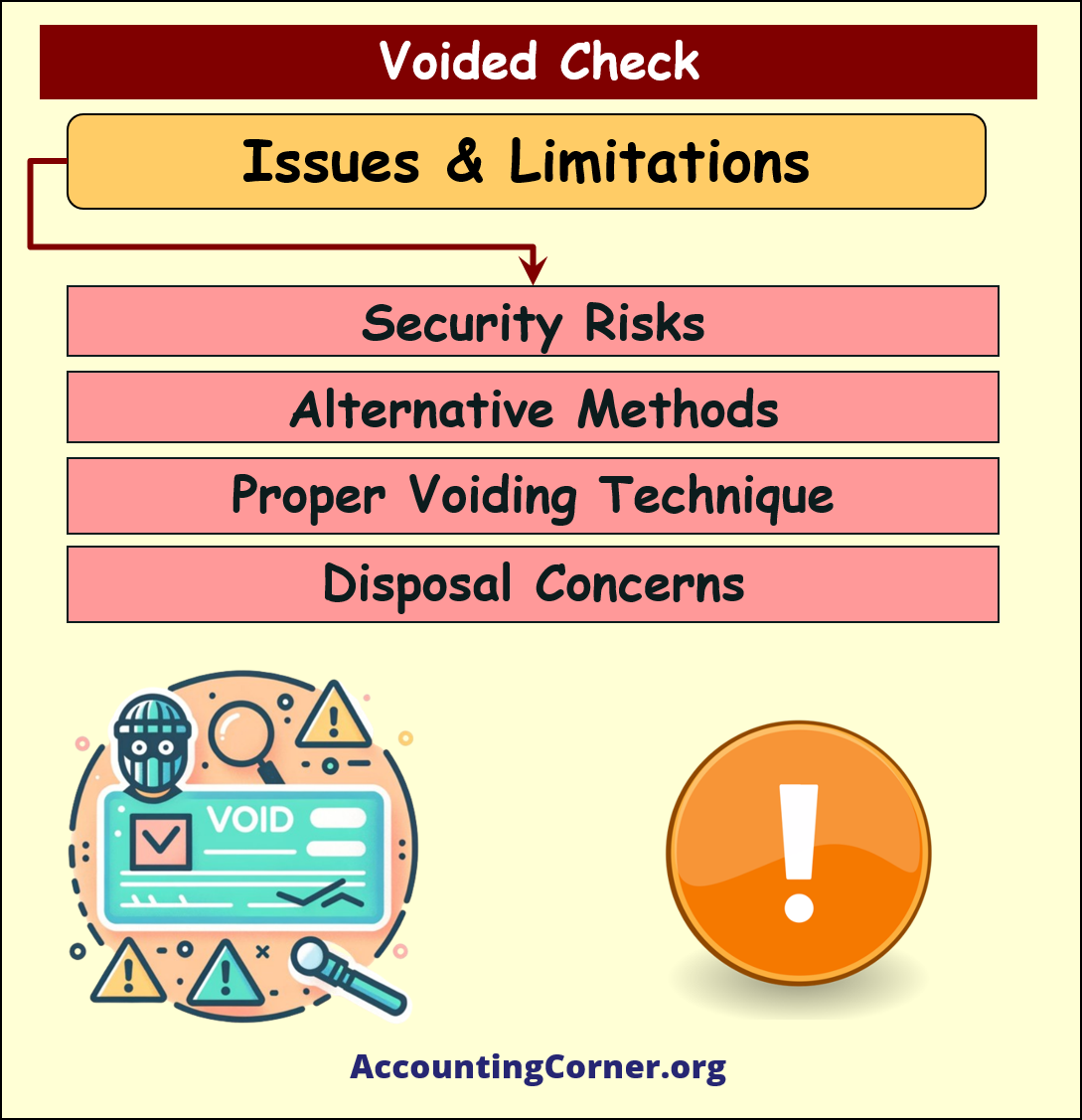

Issues and Concerns Related to Voided Checks:

- Security Risks: Even though a voided check cannot be used for payment, it still contains sensitive information. If this information falls into the wrong hands, it could be used for fraudulent activities.

- Alternative Methods: In the digital age, there are alternatives to providing a physical voided check, such as online forms or bank-issued direct deposit information forms, which might be more secure and convenient.

- Proper Voiding Technique: It’s important to ensure that “VOID” is written clearly and in a way that it cannot be erased or tampered with, to prevent any potential misuse.

- Disposal Concerns: Proper disposal of voided checks is crucial to prevent any potential misuse of the information on the check.

In summary, a voided check is a simple yet effective tool for safely providing bank account information for purposes such as setting up direct deposits or automatic payments. While it’s a relatively secure method, it’s important to be aware of the potential security risks and to handle and dispose of voided checks appropriately.

Voided Check – Visuals

Voided Check – Video Material

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from Voided Check to AccountingCorner.org home