Find here several of the basic accounting concepts – true and fair view, consistency concept, prudence concept. Also find here links to other financial accounting concepts:

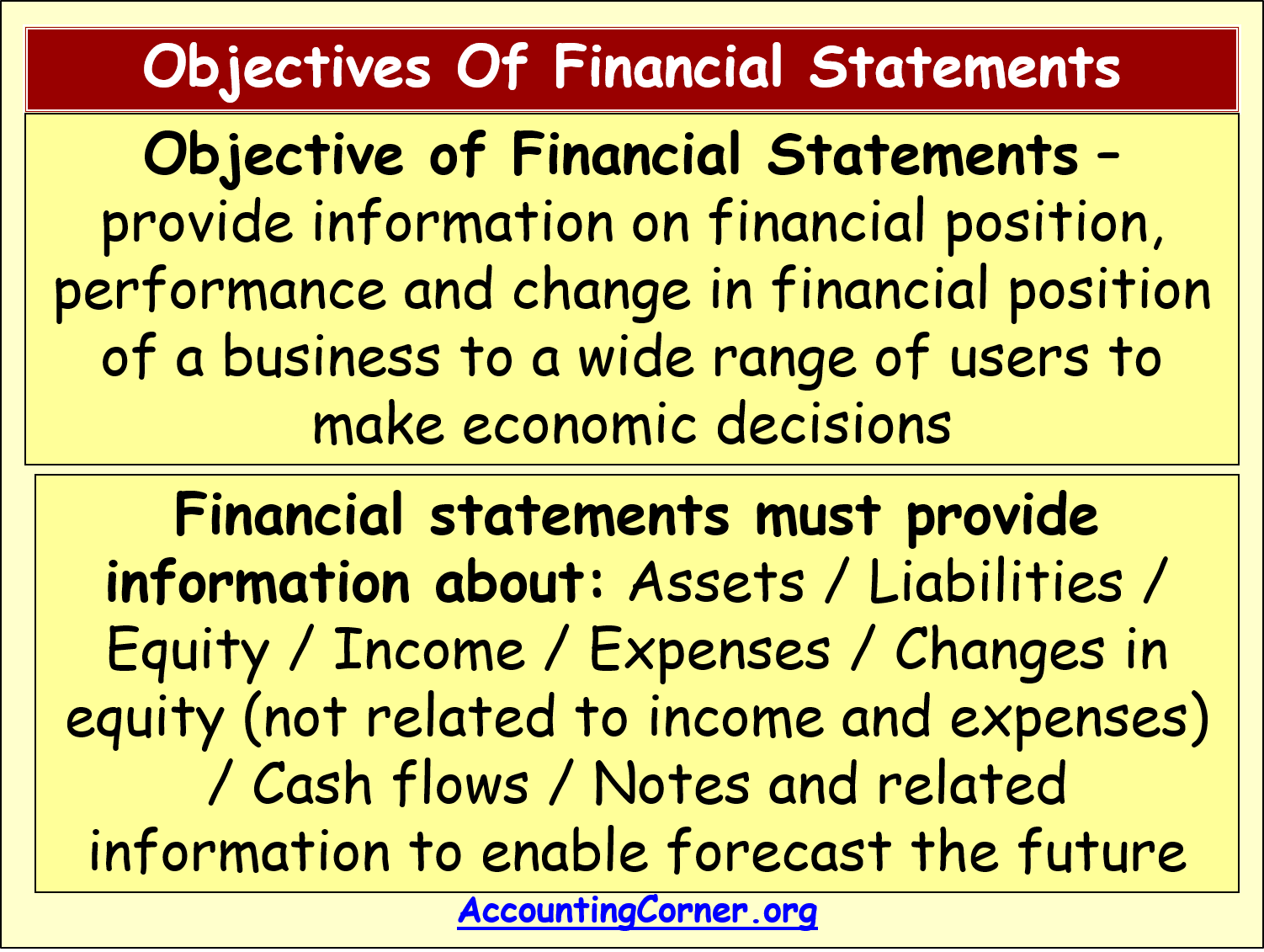

Objectives of Financial Statements

First of all let’s start from the objective of the financial statements. The main objective is to provide information on the financial position and performance of the business, and also give data on the change in that position during a particular period of time. Such information is provided to a wide range of users and such users make their economic decisions based on such financial data.

What kind of information should be included in the financial statements?

Below there is a list of the main parts of financial statements, therefore this information has to be provided and divided into the below categories:

- Assets, Liabilities, Equity – presented on the Balance Sheet

- Revenue and Expenses – presented on the Income Statement

- Changes in Equity, which is not related to Revenue or Expenses – presented on the Statement of Changes in Equity

- Cash Flows – presented on the Statement of Cash Flows

- Additional information provided in the form of notes, which includes other facts, which might be important for the users of the financial statements and which is not separately indicated in the Balance Sheet (check for this Balance Sheet Format), Cash Flow Statement, Income Statement (check for this Income Statement Format) or Statement on Changes of Equity.

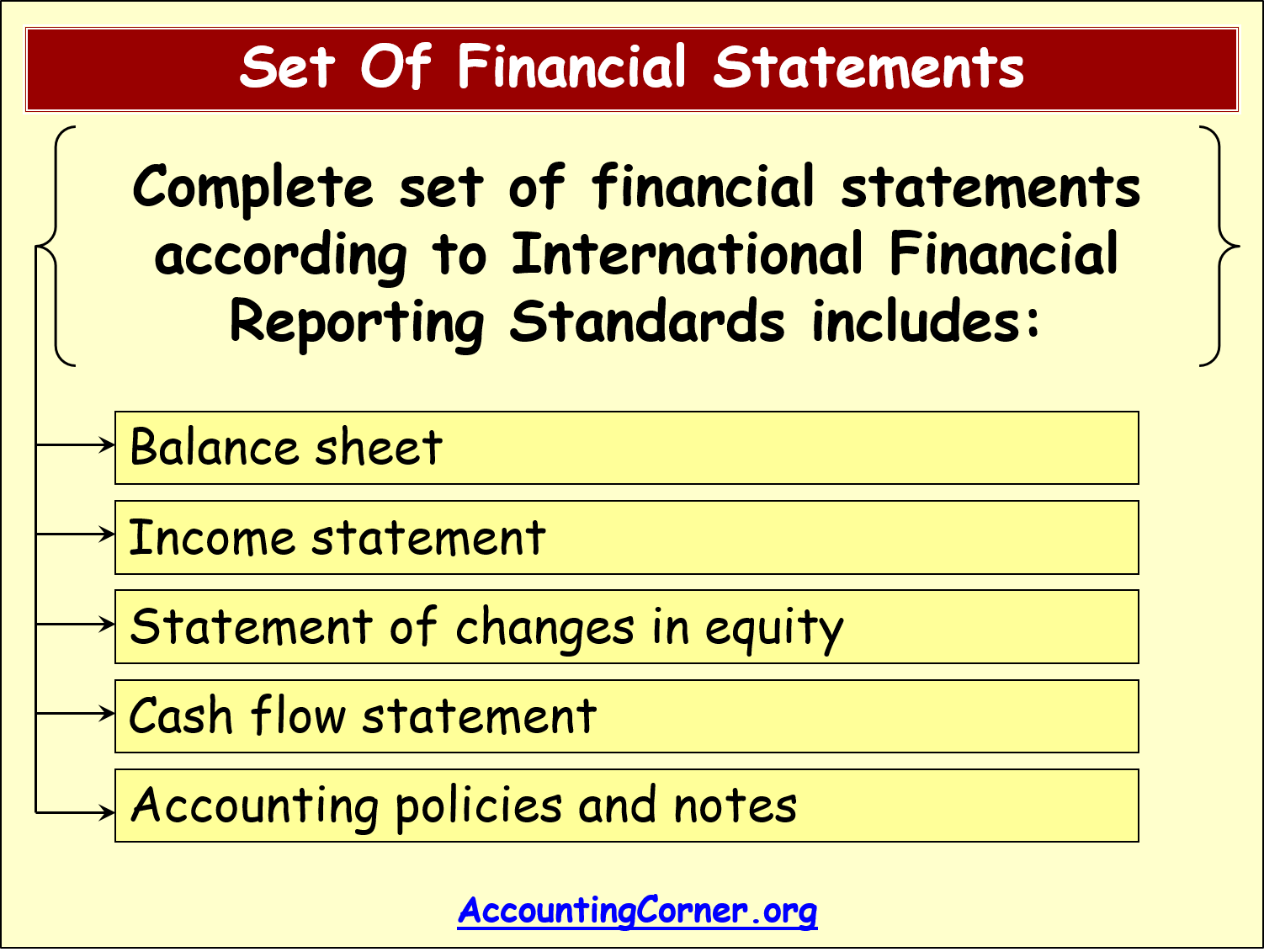

Complete set of the financial statements includes all the above items.

As the financial statements are prepared, their preparation is based on the certain basic assumptions or accounting concepts, which will be gradually covered and explored further on this page and in other articles.

These financial accounting concepts are widely accepted, i.e. these are the basic principles, based on which the financial statements are prepared.

True & Fair View

First one is true and fair presentation or true and fair view. Financial statements should present fairly financial position of the business and its performance, i.e. profit or loss for the period, and also cash flows for the period.

It is required that financial statements are compliant with the generally accepted accounting principles, which ensure fair presentation of the accounting data.

Consistency

One more important basic accounting concept is consistency. This concept means that presentation and classification of the items in the financial statement must be consistent, continuing under the same principles and rules from one period of time to another.

In case principles of classification are changed, there must be an explanation disclosing what has been changed, this change must be supported by proper facts and should be reasonable, explaining to the users of financial statements all the circumstances and impact on the financial statements.

Prudence

One more accounting concept is prudence. This concept means that while preparing financial statements accountants have to be cautious, they need to make estimates and have to be prudent in order not to overstate value of assets or understate the value of liabilities.

The Most Popular Accounting & Finance Topics:

- Balance Sheet

- Balance Sheet Example

- Classified Balance Sheet

- Balance Sheet Template

- Income Statement

- Income Statement Example

- Multi Step Income Statement

- Income Statement Format

- Common Size Income Statement

- Income Statement Template

- Cash Flow Statement

- Cash Flow Statement Example

- Cash Flow Statement Template

- Discounted Cash Flow

- Free Cash Flow

- Accounting Equation

- Accounting Cycle

- Accounting Principles

- Retained Earnings Statement

- Retained Earnings

- Retained Earnings Formula

- Financial Analysis

- Current Ratio Formula

- Acid Test Ratio Formula

- Cash Ratio Formula

- Debt to Income Ratio

- Debt to Equity Ratio

- Debt Ratio

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Mortgage Calculator

- Mortgage Rates

- Reverse Mortgage

- Mortgage Amortization Calculator

- Gross Revenue

- Semi Monthly Meaning

- Financial Statements

- Petty Cash

- General Ledger

- Allocation Definition

- Accounts Receivable

- Impairment

- Going Concern

- Trial Balance

- Accounts Payable

- Pro Forma Meaning

- FIFO

- LIFO

- Cost of Goods Sold

- How to void a check?

- Voided Check

- Depreciation

- Face Value

- Contribution Margin Ratio

- YTD Meaning

- Accrual Accounting

- What is Gross Income?

- Net Income

- What is accounting?

- Quick Ratio

- What is an invoice?

- Prudent Definition

- Prudence Definition

- Double Entry Accounting

- Gross Profit

- Gross Profit Formula

- What is an asset?

- Gross Margin Formula

- Gross Margin

- Disbursement

- Reconciliation Definition

- Deferred Revenue

- Leverage Ratio

- Collateral Definition

- Work in Progress

- EBIT Meaning

- FOB Meaning

- Return on Assets – ROA Formula

- Marginal Cost Formula

- Marginal Revenue Formula

- Proceeds

- In Transit Meaning

- Inherent Definition

- FOB Shipping Point

- WACC Formula

- What is a Guarantor?

- Tangible Meaning

- Profit and Loss Statement Template

- Revenue Vs Profit

- FTE Meaning

- Cash Book

- Accrued Income

- Bearer Bonds

- Credit Note Meaning

- EBITA meaning

- Fictitious Assets

- Preference Shares

- Wear and Tear Meaning

- Cancelled Cheque

- Cost Sheet Format

- Provision Definition

- EBITDA Meaning

- Covenant Definition

- FICA Meaning

- Ledger Definition

- Allowance for Doubtful Accounts

- T Account / T Accounts

- Contra Account

- NOPAT Formula

- Monetary Value

- Salvage Value

- Times Interest Earned Ratio

- Intermediate Accounting

- Mortgage Rate Chart

- Opportunity Cost

- Total Asset Turnover

- Sunk Cost

- Housing Interest Rates Chart

- Additional Paid In Capital

- Obsolescence

- What is Revenue?

- What Does Per Diem Mean?

- Unearned Revenue

- Accrued Expenses

- Earnings Per Share

- Consignee

- Accumulated Depreciation

- Leashold Improvements

- Operating Margin

- Notes Payable

- Current Assets

- Liabilities

- Controller Job Description

- Define Leverage

- Journal Entry

- Productivity Definition

- Capital Expenditures

- Check Register

- What is Liquidity?

- Variable Cost

- Variable Expenses

- Cash Receipts

- Gross Profit Ratio

- Net Sales

- Return on Sales

- Fixed Expenses

- Straight Line Depreciation

- Working Capital Ratio

- Fixed Cost

- Contingent Liabilities

- Marketable Securities

- Remittance Advice

- Extrapolation Definition

- Gross Sales

- Days Sales Oustanding

- Residual Value

- Accrued Interest

- Fixed Charge Coverage Ratio

- Prime Cost

- Perpetual Inventory System

- Vouching

Return from basic accounting concept to AccountingCorner.org